In the digital age, where screens rule our lives yet the appeal of tangible printed objects isn't diminished. If it's to aid in education for creative projects, simply adding an extra personal touch to your space, Hmrc Vat Due Dates 2022 have proven to be a valuable resource. Here, we'll take a dive deep into the realm of "Hmrc Vat Due Dates 2022," exploring what they are, where to find them, and how they can improve various aspects of your lives.

Get Latest Hmrc Vat Due Dates 2022 Below

Hmrc Vat Due Dates 2022

Hmrc Vat Due Dates 2022 - Hmrc Vat Due Dates 2022, Hmrc Vat Due Dates, Hmrc Vat Dates

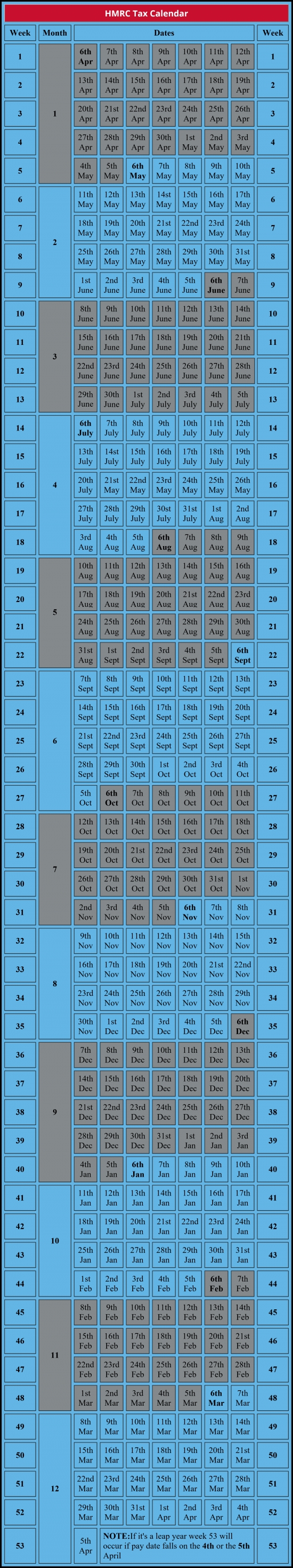

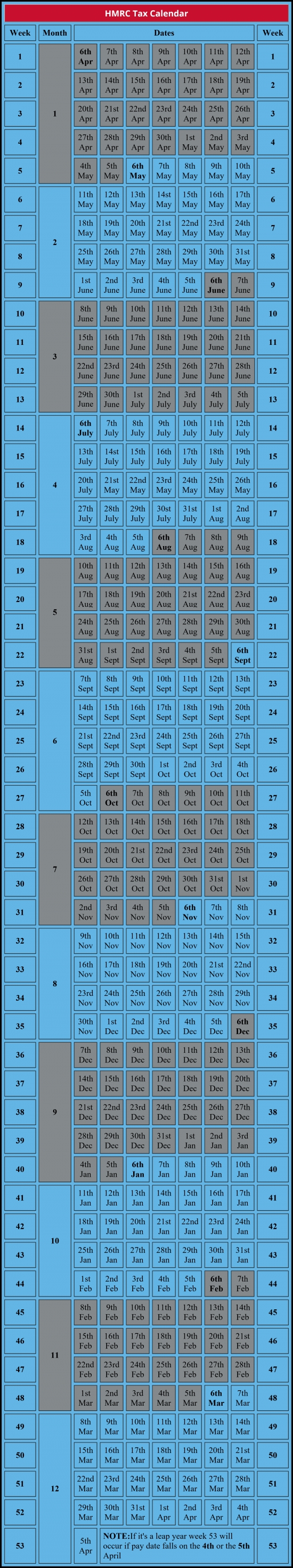

The FastPay guide to what key tax dates to look out for over the months of the new 2022 23 tax year VAT Deadlines 31 March All VAT submission deadlines deferred in the period to June

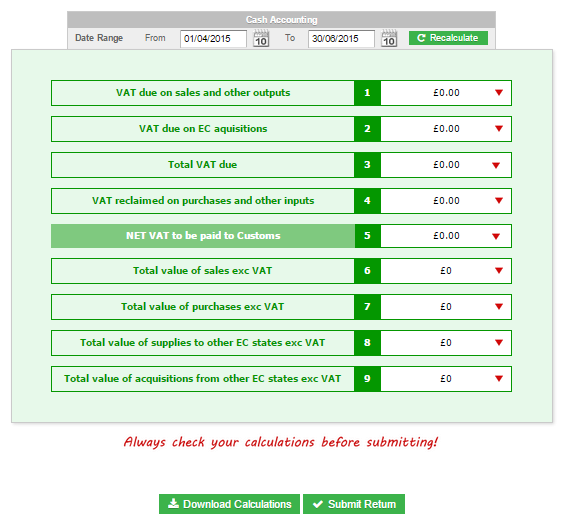

Deadlines The deadline for submitting your return online is usually one calendar month and 7 days after the end of an accounting period This is also the deadline for paying HMRC You

Hmrc Vat Due Dates 2022 provide a diverse assortment of printable materials that are accessible online for free cost. The resources are offered in a variety designs, including worksheets templates, coloring pages, and many more. The appeal of printables for free is in their variety and accessibility.

More of Hmrc Vat Due Dates 2022

VAT Due Dates In Europe

VAT Due Dates In Europe

For example for a VAT quarter ending 30 September 2023 the return and VAT owing will be due for submission and payment by 7 November 2023 It s important to note that the VAT

Deadline for non electronic payments of tax and NI due under PAYE settlement agreements PSAs for 2021 22 to reach HMRC Accounts Office T he due date is extended to 22 October 2022 for payments made

Print-friendly freebies have gained tremendous popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or expensive software.

-

Flexible: There is the possibility of tailoring the design to meet your needs such as designing invitations making your schedule, or even decorating your house.

-

Educational value: Downloads of educational content for free can be used by students of all ages. This makes them a valuable tool for parents and educators.

-

An easy way to access HTML0: You have instant access the vast array of design and templates will save you time and effort.

Where to Find more Hmrc Vat Due Dates 2022

MTD For VAT Key Dates For Your Business Xero UK

MTD For VAT Key Dates For Your Business Xero UK

HMRC has recently announced that those businesses with a taxable turnover of less than 85 000 per year will be able to use its online VAT account to file the VAT return due on 7 November 2022 Subsequent VAT

Quarterly monthly or yearly returns for VAT are required Quarterly VAT return dates are due for submission 1 month and 7 days after the end of a VAT quarter Annual VAT

We've now piqued your interest in printables for free Let's see where you can find these elusive gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of Hmrc Vat Due Dates 2022 suitable for many motives.

- Explore categories like decorations for the home, education and craft, and organization.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing Flashcards, worksheets, and other educational materials.

- Ideal for parents, teachers as well as students who require additional resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates free of charge.

- These blogs cover a wide range of topics, that includes DIY projects to planning a party.

Maximizing Hmrc Vat Due Dates 2022

Here are some inventive ways ensure you get the very most use of printables for free:

1. Home Decor

- Print and frame gorgeous art, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Use printable worksheets for free to enhance your learning at home or in the classroom.

3. Event Planning

- Designs invitations, banners and decorations for special occasions like birthdays and weddings.

4. Organization

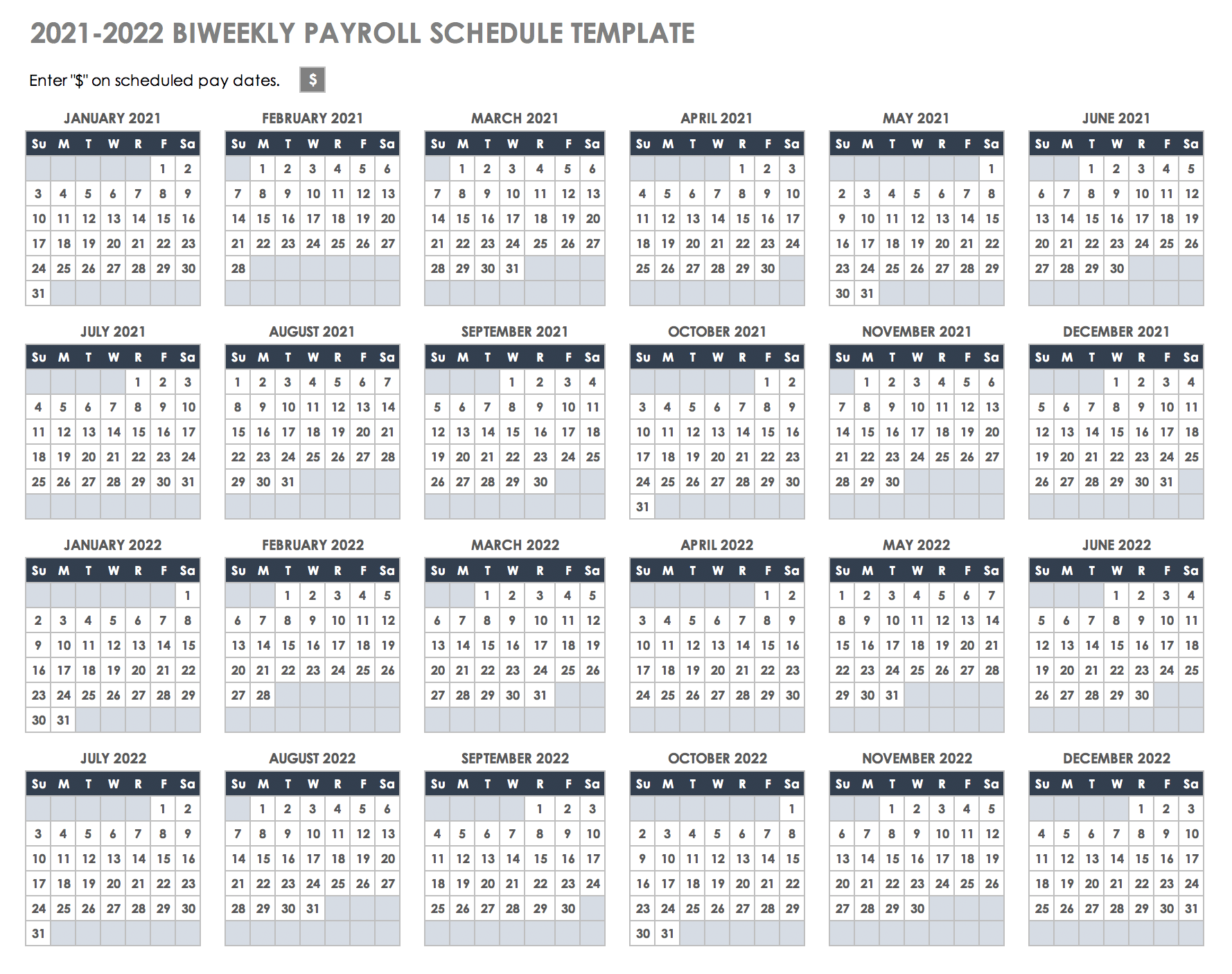

- Keep your calendars organized by printing printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Hmrc Vat Due Dates 2022 are an abundance of practical and innovative resources that can meet the needs of a variety of people and hobbies. Their availability and versatility make these printables a useful addition to both professional and personal lives. Explore the plethora of printables for free today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really absolutely free?

- Yes they are! You can print and download these materials for free.

-

Does it allow me to use free printables for commercial uses?

- It's contingent upon the specific conditions of use. Be sure to read the rules of the creator prior to using the printables in commercial projects.

-

Do you have any copyright problems with printables that are free?

- Some printables may come with restrictions regarding their use. Be sure to check the terms and conditions set forth by the designer.

-

How do I print Hmrc Vat Due Dates 2022?

- You can print them at home with printing equipment or visit an area print shop for higher quality prints.

-

What program do I need in order to open printables that are free?

- The majority of PDF documents are provided with PDF formats, which is open with no cost software like Adobe Reader.

How To Pay HMRC NJB Taxback

VAT Returns Guide VAT QuickFile

Check more sample of Hmrc Vat Due Dates 2022 below

What Are The VAT Return Due Dates Submission Penalties Deadlines

UK Payroll Tax Calendar 2022 2023 Shape Payroll

Form 20 F Due Date Form 20 F Pdf QFB66

Full List Of Cost Of Living Payment Dates For DWP And HMRC Claimants

Hmrc Paye Calendar 2019 2020

VAT Return Dates Payment Deadlines Goselfemployed co

https://www.gov.uk/submit-vat-return

Deadlines The deadline for submitting your return online is usually one calendar month and 7 days after the end of an accounting period This is also the deadline for paying HMRC You

https://goselfemployed.co/uk-vat-return-da…

For example a VAT return for the quarter from 1 April 2022 to 30 June 2022 would be due for filing and payment by 7 July 2022 When it

Deadlines The deadline for submitting your return online is usually one calendar month and 7 days after the end of an accounting period This is also the deadline for paying HMRC You

For example a VAT return for the quarter from 1 April 2022 to 30 June 2022 would be due for filing and payment by 7 July 2022 When it

Full List Of Cost Of Living Payment Dates For DWP And HMRC Claimants

UK Payroll Tax Calendar 2022 2023 Shape Payroll

Hmrc Paye Calendar 2019 2020

VAT Return Dates Payment Deadlines Goselfemployed co

Payroll Calendar Template 2022 Printable Calendar 2023

HMRC Apologies For VAT Registration Delays AccountingWEB

HMRC Apologies For VAT Registration Delays AccountingWEB

HMRC Collects Millions Of Additional VAT Due To Rising Fuel Prices