In this day and age where screens rule our lives, the charm of tangible printed materials isn't diminishing. Whether it's for educational purposes as well as creative projects or just adding an element of personalization to your space, House Rent Tax Exemption India are now an essential resource. The following article is a dive into the world of "House Rent Tax Exemption India," exploring their purpose, where they can be found, and the ways that they can benefit different aspects of your lives.

Get Latest House Rent Tax Exemption India Below

House Rent Tax Exemption India

House Rent Tax Exemption India - House Rent Tax Exemption India, House Rent Tax In India, House Rent Receipt Format Pdf Download For Income Tax Exemption India, Is House Rent Taxable In India, Is House Rent Exempted From Tax, House Rent Tax Exemption Limit, How Much Tax Exemption On House Rent

Verkko 6 jouluk 2022 nbsp 0183 32 Rental incomes from properties that belong to political properties are entirely tax exempt in India as per Section 13A of ITA The annual value of a property the owner uses as his her

Verkko 5 toukok 2020 nbsp 0183 32 CONDITIONS FOR CLAIMING HRA EXEMPTION Salaried Individual only can claim HRA Self employed cannot claim HRA However Self Employed can also claim deduction of Rent paid

House Rent Tax Exemption India cover a large variety of printable, downloadable content that can be downloaded from the internet at no cost. These materials come in a variety of forms, including worksheets, coloring pages, templates and many more. One of the advantages of House Rent Tax Exemption India is their flexibility and accessibility.

More of House Rent Tax Exemption India

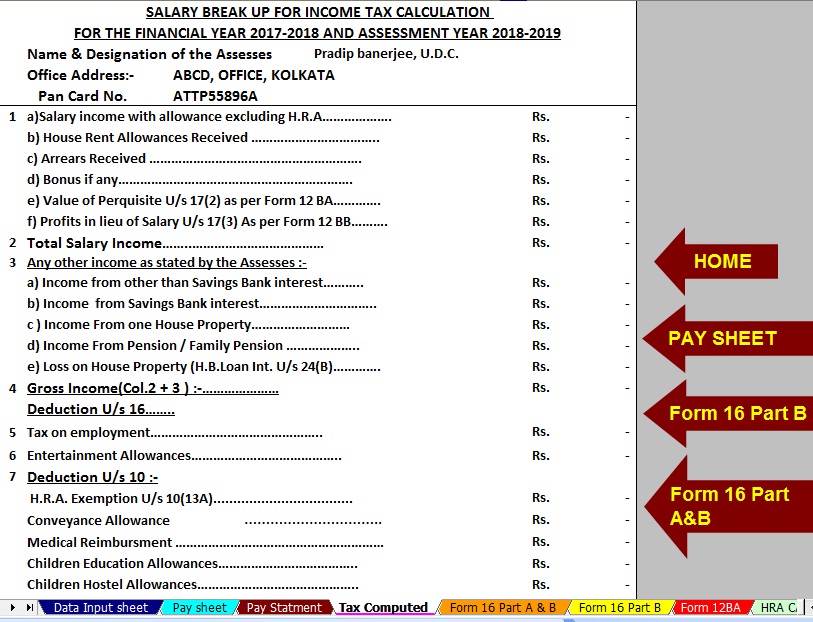

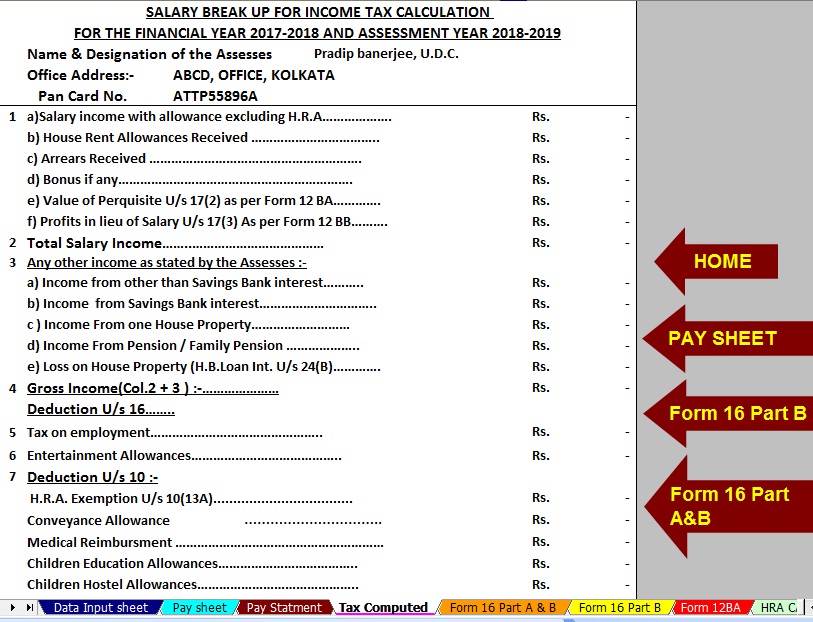

CALCULATION OF HOUSE RENT ALLOWANCE Allowance Kids Education Excel

CALCULATION OF HOUSE RENT ALLOWANCE Allowance Kids Education Excel

Verkko 31 tammik 2020 nbsp 0183 32 HRA tax exemption depends on four components Salary Basic salary DA HRA component of the salary Rent paid

Verkko 17 helmik 2021 nbsp 0183 32 50 of salary Basic DA 50 30000 12 2000 12 192 000 HRA exemption applies to the lowest value of 1 2 or 3 In the example above the entire

House Rent Tax Exemption India have gained immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

Customization: This allows you to modify printables to fit your particular needs for invitations, whether that's creating them for your guests, organizing your schedule or even decorating your home.

-

Educational Benefits: The free educational worksheets provide for students of all ages, which makes them a vital tool for parents and teachers.

-

The convenience of Fast access a myriad of designs as well as templates, which saves time as well as effort.

Where to Find more House Rent Tax Exemption India

House Rent Allowance HRA Tax Exemption HRA Calculation Rules

House Rent Allowance HRA Tax Exemption HRA Calculation Rules

Verkko 26 hein 228 k 2023 nbsp 0183 32 1 Actual HRA Received This is the total HRA received by the employee from their employer 2 Rent Paid Minus 10 of Basic Salary The

Verkko 31 hein 228 k 2023 nbsp 0183 32 Eligibility for claiming deduction under Section 80GG A taxpayer must fulfil the following conditions to claim a deduction under Section 80GG You have not

Now that we've piqued your interest in House Rent Tax Exemption India, let's explore where you can discover these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of House Rent Tax Exemption India to suit a variety of reasons.

- Explore categories like furniture, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets with flashcards and other teaching tools.

- It is ideal for teachers, parents and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates at no cost.

- The blogs covered cover a wide selection of subjects, that includes DIY projects to planning a party.

Maximizing House Rent Tax Exemption India

Here are some ideas how you could make the most of printables for free:

1. Home Decor

- Print and frame beautiful images, quotes, or festive decorations to decorate your living areas.

2. Education

- Use free printable worksheets for teaching at-home for the classroom.

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Make sure you are organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

House Rent Tax Exemption India are an abundance with useful and creative ideas that meet a variety of needs and pursuits. Their access and versatility makes them an invaluable addition to each day life. Explore the plethora of House Rent Tax Exemption India and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really for free?

- Yes, they are! You can download and print the resources for free.

-

Do I have the right to use free printables for commercial use?

- It's dependent on the particular conditions of use. Always verify the guidelines provided by the creator before using their printables for commercial projects.

-

Do you have any copyright concerns when using printables that are free?

- Certain printables may be subject to restrictions in use. Be sure to check the terms and conditions provided by the creator.

-

How can I print House Rent Tax Exemption India?

- You can print them at home with any printer or head to a local print shop for high-quality prints.

-

What program do I require to view printables free of charge?

- The majority of PDF documents are provided in the format PDF. This can be opened using free software such as Adobe Reader.

HRA Exemption Calculator In Excel House Rent Allowance Calculation

HRA House Rent Allowance Tax Exemption Rules Overview And Blog By

Check more sample of House Rent Tax Exemption India below

House Rent Allowance HRA Exemption Rules Tax Deductions Tax2win

How HRA Exemption Is Calculated Excel Examples FinCalC Blog

Documents Required For HRA Exemption In India Tax Saving India

Automatic House Rent Exemption Calculator U s 10 13A Tdstaxindia

HRA Exemption India Rent Calculator Save Tax Pay To Wife Or Parent

House Rent Allowance HRA Exemption Section 10 13A Income Tax CA Club

https://taxguru.in/income-tax/house-rent-allo…

Verkko 5 toukok 2020 nbsp 0183 32 CONDITIONS FOR CLAIMING HRA EXEMPTION Salaried Individual only can claim HRA Self employed cannot claim HRA However Self Employed can also claim deduction of Rent paid

https://www.acko.com/income-tax/house-ren…

Verkko 3 hein 228 k 2023 nbsp 0183 32 Salaried people residing in rental housing are eligible to claim the HRA tax exemption HRA exemption is calculated based on multiple things like the actual rent paid the base pay or salary of the

Verkko 5 toukok 2020 nbsp 0183 32 CONDITIONS FOR CLAIMING HRA EXEMPTION Salaried Individual only can claim HRA Self employed cannot claim HRA However Self Employed can also claim deduction of Rent paid

Verkko 3 hein 228 k 2023 nbsp 0183 32 Salaried people residing in rental housing are eligible to claim the HRA tax exemption HRA exemption is calculated based on multiple things like the actual rent paid the base pay or salary of the

Automatic House Rent Exemption Calculator U s 10 13A Tdstaxindia

How HRA Exemption Is Calculated Excel Examples FinCalC Blog

HRA Exemption India Rent Calculator Save Tax Pay To Wife Or Parent

House Rent Allowance HRA Exemption Section 10 13A Income Tax CA Club

Wesley 4 1 YouTube

House Rent Allowance HRA Tax Exemption HRA Calculation Rules

House Rent Allowance HRA Tax Exemption HRA Calculation Rules

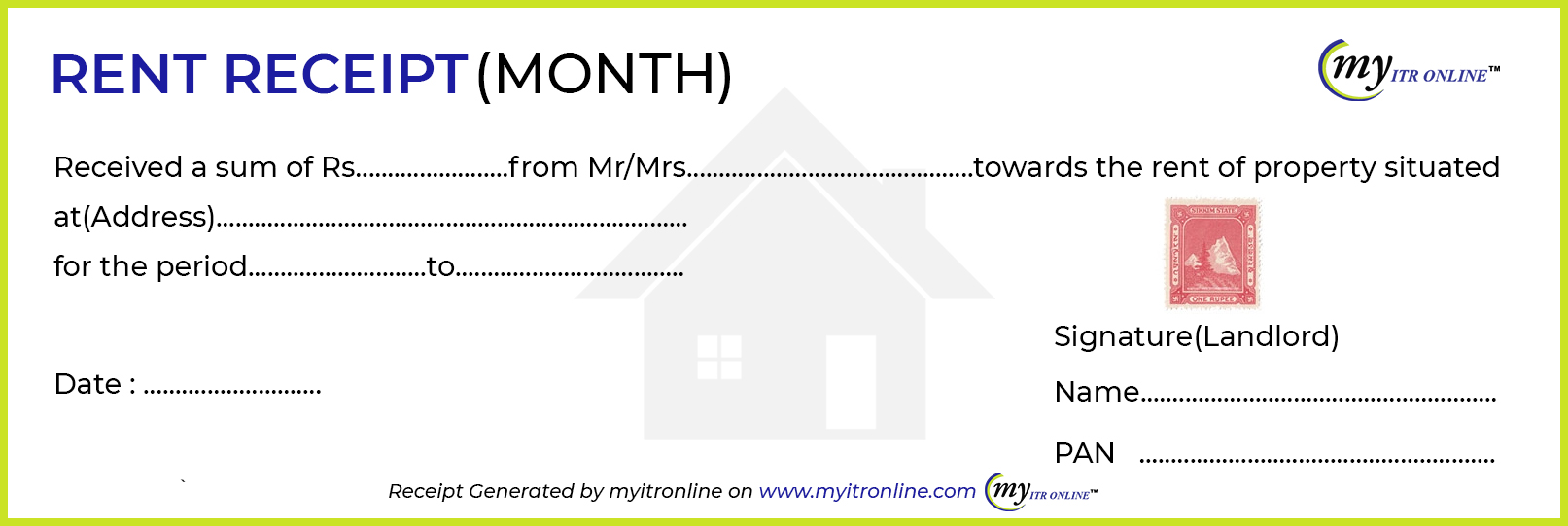

Free Rent Receipt Generator Online House Rent Receipt Generator With