In the digital age, when screens dominate our lives but the value of tangible printed material hasn't diminished. In the case of educational materials in creative or artistic projects, or simply adding some personal flair to your area, How Far Back Can You Claim Fuel Tax Credits have become an invaluable resource. In this article, we'll take a dive into the sphere of "How Far Back Can You Claim Fuel Tax Credits," exploring their purpose, where to find them and ways they can help you improve many aspects of your life.

Get Latest How Far Back Can You Claim Fuel Tax Credits Below

How Far Back Can You Claim Fuel Tax Credits

How Far Back Can You Claim Fuel Tax Credits - How Far Back Can You Claim Fuel Tax Credits, How Far Back Can I Claim Fuel Tax Credits, How Do You Claim Fuel Tax Credits, Can You Backdate Fuel Tax Credits, When Can You Claim Fuel Tax Credits, How Far Back Can You Claim Mileage From Hmrc, How To Claim Fuel Tax Credits

You can claim the credits by lodging individual activity statements for each period in which the fuel was acquired and this can be done retroactively The time limit mentioned on the page is 4 years so you are still within the timeframe that allows you to claim these credits

The amount depends on when you acquire the fuel what fuel you use and the activity you use it in Fuel tax credits rates also change regularly so it s important to check the rates each time you do your business activity statement BAS

Printables for free cover a broad collection of printable materials online, at no cost. These resources come in many types, like worksheets, coloring pages, templates and much more. The appealingness of How Far Back Can You Claim Fuel Tax Credits is in their variety and accessibility.

More of How Far Back Can You Claim Fuel Tax Credits

Fuel Tax Credits Banlaw

Fuel Tax Credits Banlaw

When you first register for fuel tax credits you will need to know the date you want your fuel tax credit registration to start you can only claim fuel tax credits if you are registered for GST at the time you acquired the fuel acquired the fuel within the last four years

Public Law 117 169 136 Stat 1818 August 16 2022 commonly known as the Inflation Reduction Act retroactively reinstated and extended the following fuel tax credits through December 31 2024 Alternative fuel credit Alternative fuel mixture credit Second generation biofuel producer credit

How Far Back Can You Claim Fuel Tax Credits have risen to immense popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies or expensive software.

-

customization: There is the possibility of tailoring printables to your specific needs whether it's making invitations to organize your schedule or decorating your home.

-

Educational Value: These How Far Back Can You Claim Fuel Tax Credits provide for students from all ages, making them a valuable tool for teachers and parents.

-

An easy way to access HTML0: The instant accessibility to a myriad of designs as well as templates saves time and effort.

Where to Find more How Far Back Can You Claim Fuel Tax Credits

Fuel Tax Credit Rate Changes Affecting Your March 22 BAS Beam Bookkeeping

Fuel Tax Credit Rate Changes Affecting Your March 22 BAS Beam Bookkeeping

You can claim tax relief on the money you ve spent on fuel and electricity for business trips in your company car Keep records to show the actual cost of the fuel

You buy goods in the reporting period September 1 to 30 2022 for which you can claim an ITC The fiscal year that includes the September 2022 return ends on December 31 2022 You can claim the ITC on any later return for a reporting period that ends by December 31 2024 and is filed by January 31 2025

We hope we've stimulated your curiosity about How Far Back Can You Claim Fuel Tax Credits and other printables, let's discover where you can discover these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of How Far Back Can You Claim Fuel Tax Credits for various purposes.

- Explore categories like furniture, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing, flashcards, and learning tools.

- Ideal for parents, teachers as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers share their imaginative designs or templates for download.

- These blogs cover a broad selection of subjects, that includes DIY projects to party planning.

Maximizing How Far Back Can You Claim Fuel Tax Credits

Here are some innovative ways of making the most use of printables that are free:

1. Home Decor

- Print and frame stunning art, quotes, or festive decorations to decorate your living areas.

2. Education

- Print worksheets that are free to help reinforce your learning at home or in the classroom.

3. Event Planning

- Design invitations, banners and decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized by using printable calendars, to-do lists, and meal planners.

Conclusion

How Far Back Can You Claim Fuel Tax Credits are a treasure trove of innovative and useful resources that cater to various needs and interest. Their accessibility and versatility make they a beneficial addition to every aspect of your life, both professional and personal. Explore the vast array of How Far Back Can You Claim Fuel Tax Credits today to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really cost-free?

- Yes, they are! You can print and download these resources at no cost.

-

Can I use the free printables in commercial projects?

- It's dependent on the particular usage guidelines. Always verify the guidelines of the creator prior to using the printables in commercial projects.

-

Do you have any copyright issues in How Far Back Can You Claim Fuel Tax Credits?

- Certain printables could be restricted in use. Make sure to read the terms and conditions provided by the creator.

-

How can I print printables for free?

- You can print them at home with either a printer or go to a local print shop for more high-quality prints.

-

What software do I need in order to open How Far Back Can You Claim Fuel Tax Credits?

- A majority of printed materials are in the format PDF. This is open with no cost software like Adobe Reader.

How Far Back Can You Get A Refund For Back Taxes Geaux Tax Resolutions

365 Day 365 How Far Back Can You Remember Like Your V Flickr

Check more sample of How Far Back Can You Claim Fuel Tax Credits below

Fuel Tax Credits Banlaw

STM Accounting Group Fuel Tax Credit Changes

Fuel Tax Credit Changes HTA

Fuel Tax Credit Changes

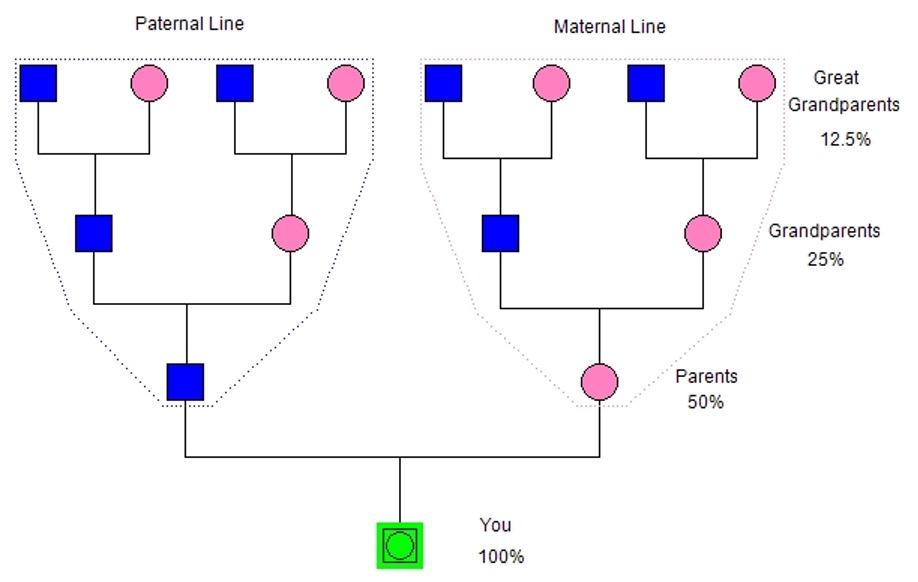

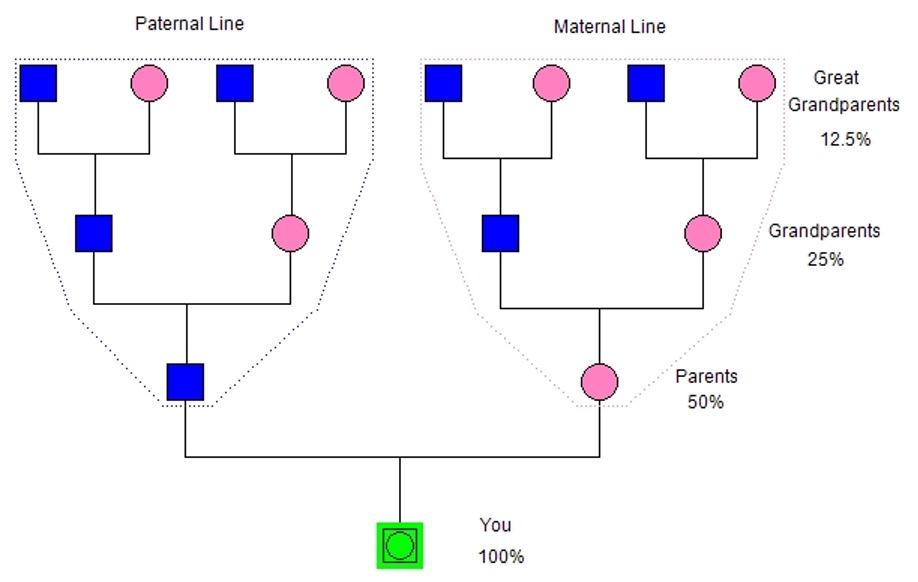

How Far Back Can You Go With DNA

How Far Back Can You Claim VAT On Expenses In UK Intertax Tax

https://www.ato.gov.au/.../fuel-schemes/fuel-tax-credits-business

The amount depends on when you acquire the fuel what fuel you use and the activity you use it in Fuel tax credits rates also change regularly so it s important to check the rates each time you do your business activity statement BAS

https://business.gov.au/finance/taxation/claim-fuel-tax-credits

If your business uses fuel you may be able to claim credits for the fuel tax included in the price of the fuel Find out if you re eligible for fuel tax credits and how to make a claim

The amount depends on when you acquire the fuel what fuel you use and the activity you use it in Fuel tax credits rates also change regularly so it s important to check the rates each time you do your business activity statement BAS

If your business uses fuel you may be able to claim credits for the fuel tax included in the price of the fuel Find out if you re eligible for fuel tax credits and how to make a claim

Fuel Tax Credit Changes

STM Accounting Group Fuel Tax Credit Changes

How Far Back Can You Go With DNA

How Far Back Can You Claim VAT On Expenses In UK Intertax Tax

How Far Back Can You Amend A Corporate Tax Return YouTube

864 How Far Back Can You Go For Your Educational Records For Your

864 How Far Back Can You Go For Your Educational Records For Your

How Far Back Can You Get Audited