In this age of technology, where screens have become the dominant feature of our lives and our lives are dominated by screens, the appeal of tangible printed items hasn't gone away. In the case of educational materials and creative work, or just adding an extra personal touch to your space, How Much For Tax Credit have proven to be a valuable source. With this guide, you'll take a dive into the sphere of "How Much For Tax Credit," exploring the different types of printables, where to find them, and how they can enrich various aspects of your lives.

Get Latest How Much For Tax Credit Below

How Much For Tax Credit

How Much For Tax Credit - How Much For Tax Credit, How Much For Tax Relief, How Much For Tax Deductions, How Much For Child Tax Credit 2023, How Much For Child Tax Credit, How Much For Disability Tax Credit, How Much For Child Tax Credit 2021, How Much Income For Tax Credit, How Much For Working Tax Credits, How Much Savings For Tax Credits

The earned income tax credit is a refundable credit for low to middle income workers For the 2024 tax year the tax credit ranges from a max of 632 to 7 830 depending on tax filing

A tax credit is a dollar for dollar reduction of a taxpayer s bill This can reduce the tax they owe or in some cases increase their refund

How Much For Tax Credit encompass a wide collection of printable materials that are accessible online for free cost. These materials come in a variety of formats, such as worksheets, templates, coloring pages and much more. The benefit of How Much For Tax Credit is in their variety and accessibility.

More of How Much For Tax Credit

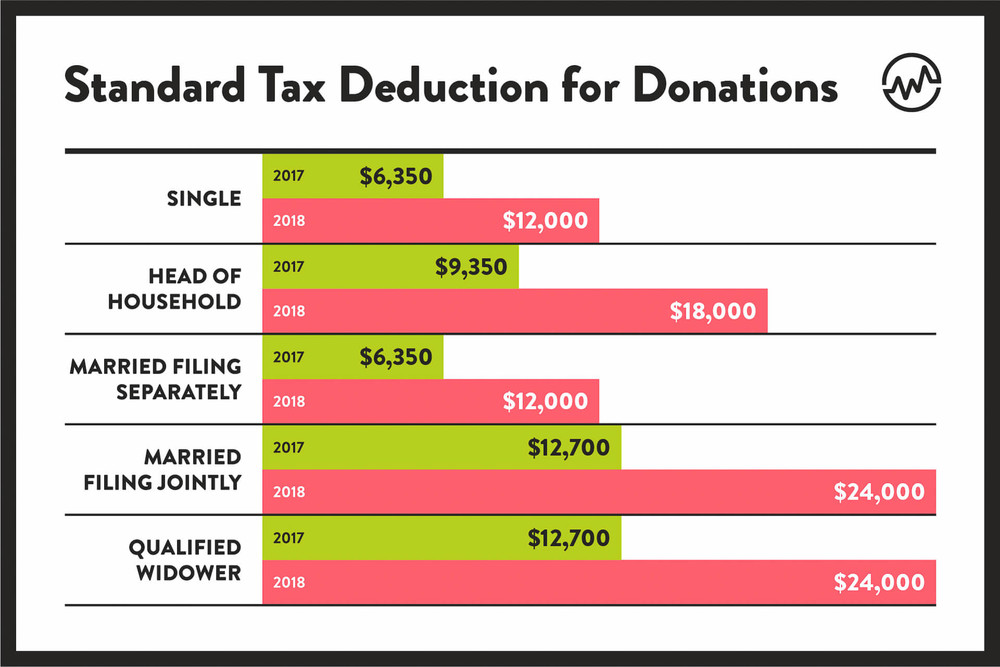

How Much Do You Need To Donate For Tax Deduction

How Much Do You Need To Donate For Tax Deduction

The child tax credit is limited to 2 000 for every dependent you have who s under age 17 1 600 being refundable for the 2023 tax year That increases to 1 700 for the 2024 tax year

The new child tax credit will provide 3 000 for children ages 6 to 17 and 3 600 for those under age 6 Here s how to calculate how much you ll get

How Much For Tax Credit have gained immense popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or expensive software.

-

The ability to customize: The Customization feature lets you tailor designs to suit your personal needs such as designing invitations and schedules, or even decorating your house.

-

Educational Benefits: Educational printables that can be downloaded for free provide for students of all ages. This makes these printables a powerful tool for parents and educators.

-

It's easy: instant access a variety of designs and templates will save you time and effort.

Where to Find more How Much For Tax Credit

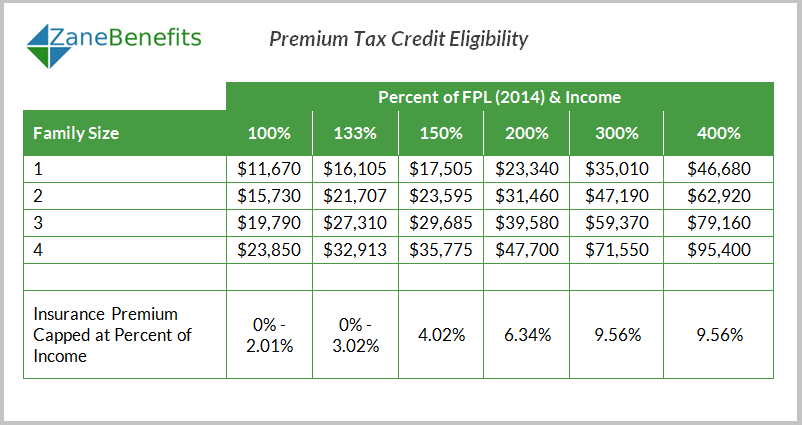

Premium Tax Credit Charts 2015

Premium Tax Credit Charts 2015

Enacted in 1997 the credit currently provides up to 2 000 per child to about 40 million families every year The American Rescue Plan made historic expansions to the Child Tax Credit CTC

For the 2023 tax year you can get a maximum tax credit of 2 000 for each qualifying child under age 17 although there is an income limit of 400 000 for married couples and 200 000 for individuals 1

If we've already piqued your curiosity about How Much For Tax Credit We'll take a look around to see where you can find these elusive gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection in How Much For Tax Credit for different uses.

- Explore categories like the home, decor, management, and craft.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets, flashcards, and learning tools.

- Perfect for teachers, parents, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates free of charge.

- The blogs are a vast variety of topics, starting from DIY projects to planning a party.

Maximizing How Much For Tax Credit

Here are some inventive ways to make the most use of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes or seasonal decorations that will adorn your living spaces.

2. Education

- Print out free worksheets and activities to enhance learning at home as well as in the class.

3. Event Planning

- Design invitations, banners and decorations for special occasions like birthdays and weddings.

4. Organization

- Be organized by using printable calendars, to-do lists, and meal planners.

Conclusion

How Much For Tax Credit are a treasure trove of practical and innovative resources designed to meet a range of needs and preferences. Their accessibility and flexibility make these printables a useful addition to both professional and personal lives. Explore the many options of How Much For Tax Credit now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really for free?

- Yes you can! You can print and download these resources at no cost.

-

Are there any free printables in commercial projects?

- It's all dependent on the usage guidelines. Always verify the guidelines provided by the creator before using their printables for commercial projects.

-

Are there any copyright issues when you download printables that are free?

- Some printables may have restrictions in their usage. Check the conditions and terms of use provided by the creator.

-

How can I print printables for free?

- You can print them at home using a printer or visit a local print shop to purchase premium prints.

-

What software do I need to open printables at no cost?

- The majority are printed in the format PDF. This is open with no cost software, such as Adobe Reader.

Federal Income Tax Brackets 2021 Vs 2022 Orangerilo

4 Courier Service Horror Stories The E Commerce World Will Never Unsee

Check more sample of How Much For Tax Credit below

So Much For tax The Rich 9GAG

Payslip Explained Planday

Income Tax Estimator 2020 LlinosJenny

What Metal Roofs Qualify For Tax Credit What Metal Roofs Qualify For

Hendrickson Mozena Time For Tax Credit Reform Correct Success

Ultimate Guide To Buy Tax Lien Properties With Tax Lien Code

https://www.nerdwallet.com/article/taxes/wh…

A tax credit is a dollar for dollar reduction of a taxpayer s bill This can reduce the tax they owe or in some cases increase their refund

https://www.irs.gov/newsroom/tax-credits-for...

A tax credit is a dollar for dollar amount taxpayers claim on their tax return to reduce the income tax they owe Eligible taxpayers can use them to reduce their tax bill

A tax credit is a dollar for dollar reduction of a taxpayer s bill This can reduce the tax they owe or in some cases increase their refund

A tax credit is a dollar for dollar amount taxpayers claim on their tax return to reduce the income tax they owe Eligible taxpayers can use them to reduce their tax bill

What Metal Roofs Qualify For Tax Credit What Metal Roofs Qualify For

Payslip Explained Planday

Hendrickson Mozena Time For Tax Credit Reform Correct Success

Ultimate Guide To Buy Tax Lien Properties With Tax Lien Code

The 2018 Electric Vehicle Tax Credit OsVehicle

How To Know If You Are Paying Too Much For Property Taxes National

How To Know If You Are Paying Too Much For Property Taxes National

Jimbaran Beach 2019 What To Know Before You Go with Photos