In the age of digital, where screens rule our lives and our lives are dominated by screens, the appeal of tangible printed objects hasn't waned. Whatever the reason, whether for education project ideas, artistic or just adding an individual touch to your home, printables for free are a great source. Through this post, we'll take a dive deep into the realm of "How To Declare Education Loan For Tax Exemption," exploring the benefits of them, where they can be found, and how they can be used to enhance different aspects of your life.

Get Latest How To Declare Education Loan For Tax Exemption Below

How To Declare Education Loan For Tax Exemption

How To Declare Education Loan For Tax Exemption - How To Declare Education Loan For Tax Exemption, How Do I Declare My Education Loan For Tax Exemption, Can Education Loan Be Used For Tax Exemption, Education Loan Tax Exemption Limit

Kindly guide on whether the interest paid on the educational loan taken for the purpose of daughter s education can be claimed as tax deduction in my tax return

Education loan interest is tax deductible under section 80E for individuals taking loans for higher studies limited to interest payments only Loan must be from recognized institutions No cap on deduction amount available

The How To Declare Education Loan For Tax Exemption are a huge range of downloadable, printable material that is available online at no cost. These materials come in a variety of designs, including worksheets coloring pages, templates and much more. One of the advantages of How To Declare Education Loan For Tax Exemption lies in their versatility as well as accessibility.

More of How To Declare Education Loan For Tax Exemption

Tax Exempt Donation Letter Sample Form Fill Out And Sign Printable

Tax Exempt Donation Letter Sample Form Fill Out And Sign Printable

Declaring that you have made interest payments towards the education loan when you file your annual TDS is the only step to claim this education loan income tax exemption under Section

Section 80E of the Income tax act allows you to claim a deduction for the education loan taken from any financial institution or approved charitable institution Under this section you can only take a tax deduction for the

Printables for free have gained immense popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies or expensive software.

-

customization: Your HTML0 customization options allow you to customize designs to suit your personal needs whether you're designing invitations to organize your schedule or decorating your home.

-

Educational Use: Education-related printables at no charge offer a wide range of educational content for learners of all ages. This makes these printables a powerful tool for parents and educators.

-

Accessibility: instant access many designs and templates saves time and effort.

Where to Find more How To Declare Education Loan For Tax Exemption

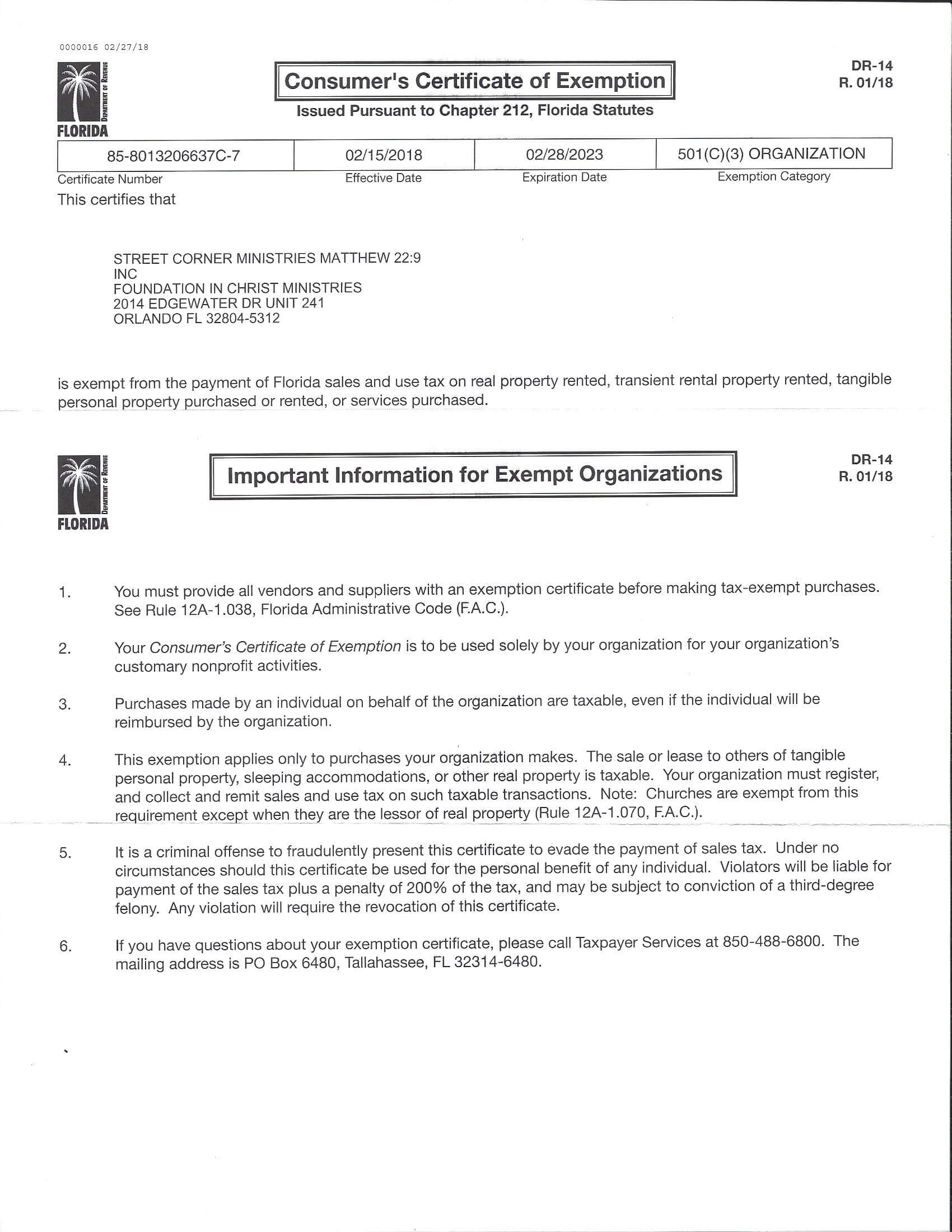

Florida Sales Tax Exemption Certificate Foundation In Christ Ministries

Florida Sales Tax Exemption Certificate Foundation In Christ Ministries

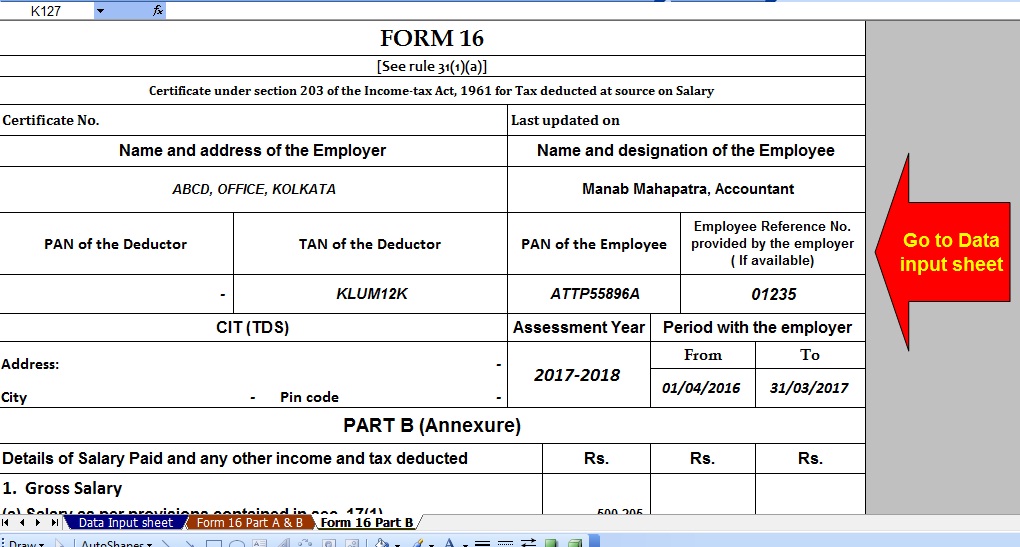

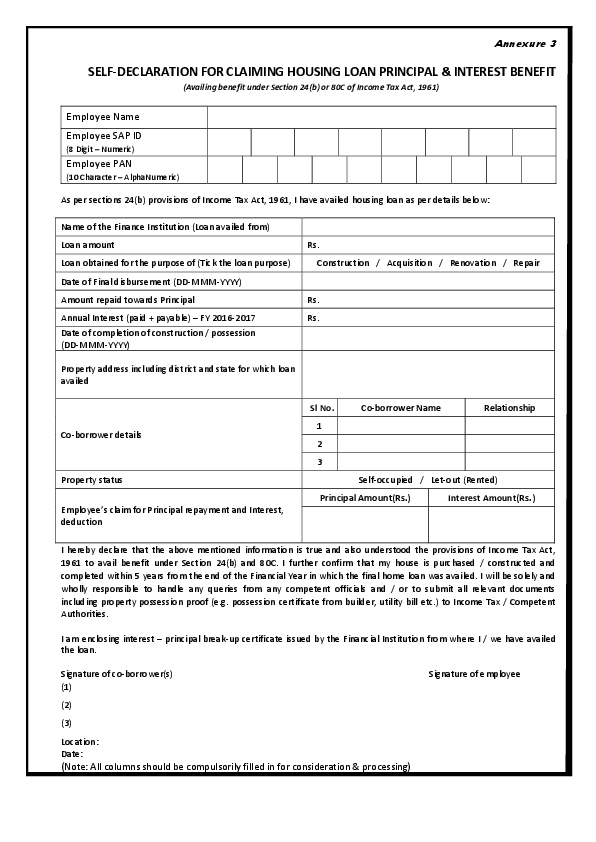

As per the Income Tax Act a taxpayer is allowed to claim deduction under Chapter VI A for the Repayment of Education Loan Section 80E and for the Repayment of Home Loan

For tax free educational assistance received in 2023 reduce the qualified educational expenses for each academic period by the amount of tax free educational assistance allocable to that academic period

If we've already piqued your interest in printables for free Let's take a look at where you can discover these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety in How To Declare Education Loan For Tax Exemption for different purposes.

- Explore categories such as interior decor, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free Flashcards, worksheets, and other educational materials.

- The perfect resource for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for free.

- The blogs are a vast array of topics, ranging starting from DIY projects to party planning.

Maximizing How To Declare Education Loan For Tax Exemption

Here are some new ways to make the most use of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes or other seasonal decorations to fill your living spaces.

2. Education

- Print out free worksheets and activities for teaching at-home (or in the learning environment).

3. Event Planning

- Design invitations, banners and decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

How To Declare Education Loan For Tax Exemption are an abundance of creative and practical resources that can meet the needs of a variety of people and hobbies. Their accessibility and versatility make them a great addition to your professional and personal life. Explore the vast array of How To Declare Education Loan For Tax Exemption and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are How To Declare Education Loan For Tax Exemption really for free?

- Yes, they are! You can download and print these resources at no cost.

-

Can I download free templates for commercial use?

- It's all dependent on the conditions of use. Be sure to read the rules of the creator before using any printables on commercial projects.

-

Do you have any copyright problems with printables that are free?

- Some printables may contain restrictions in use. Make sure you read the terms and conditions set forth by the creator.

-

How can I print printables for free?

- You can print them at home using a printer or visit a print shop in your area for better quality prints.

-

What program do I require to open printables that are free?

- The majority of PDF documents are provided in PDF format. They is open with no cost software such as Adobe Reader.

Sbi Education Loan Form Filling Sample Pdf Fill Out Sign Online DocHub

Tax Exemption Certificate SACHET Pakistan

Check more sample of How To Declare Education Loan For Tax Exemption below

Tax Help Fusion

Joint Home Loan Declaration Form For Income Tax Savings And Non

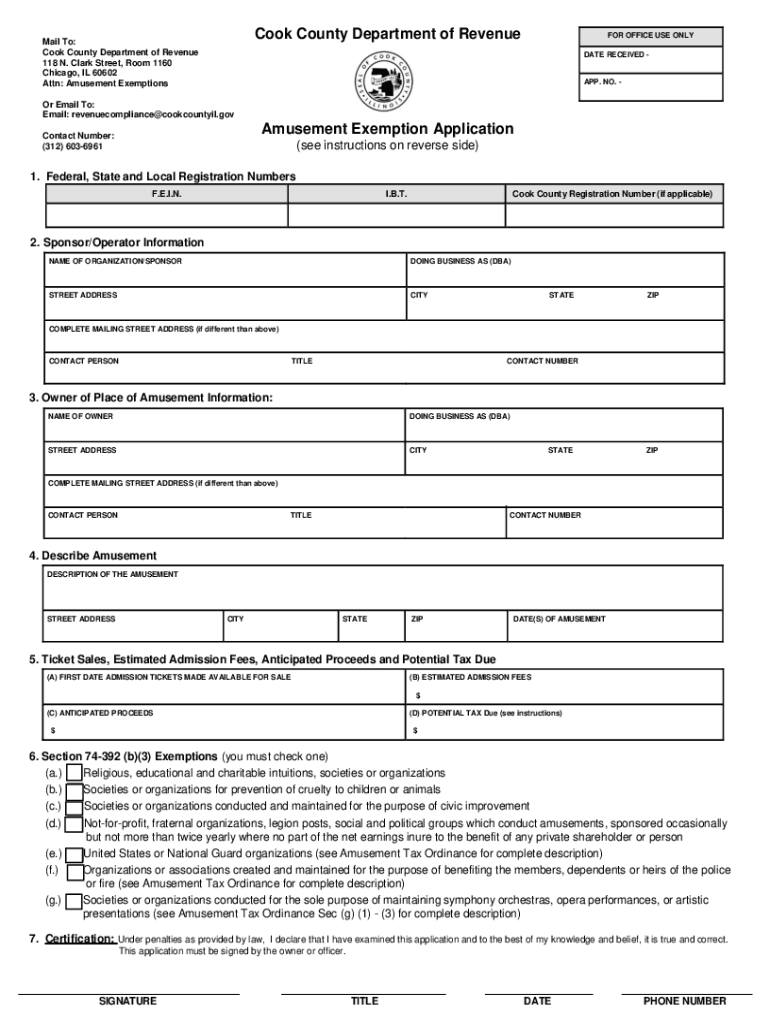

Cook County Amusement Tax Form Fill Out And Sign Printable PDF

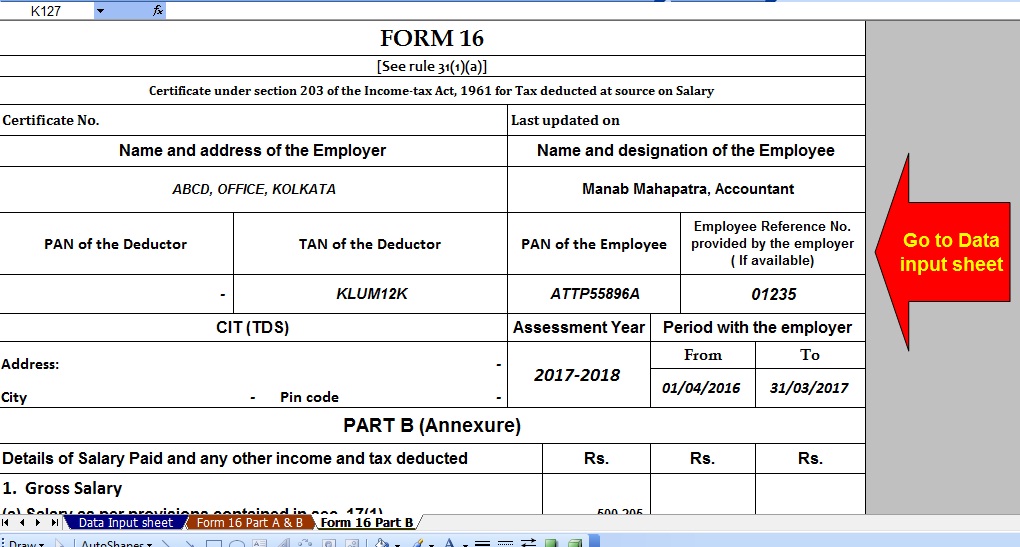

Section 80E Save Income Tax With Education Loan Lenvica HRMS

Home Loan Interest Home Loan Interest Exemption Section

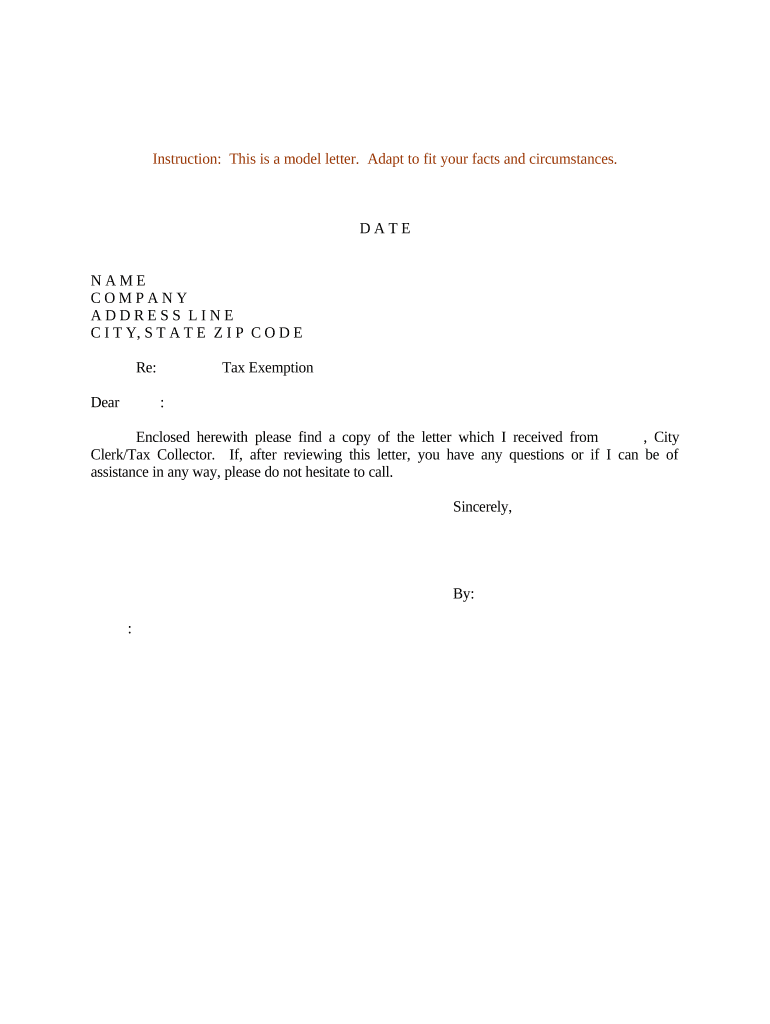

Application Letter For Tax Exemption PDF

https://cleartax.in

Education loan interest is tax deductible under section 80E for individuals taking loans for higher studies limited to interest payments only Loan must be from recognized institutions No cap on deduction amount available

https://money.usnews.com › ...

There are a few documents you ll need before you can claim the student loan interest deduction on your federal taxes Form 1040 or 1040 SR This is your federal tax

Education loan interest is tax deductible under section 80E for individuals taking loans for higher studies limited to interest payments only Loan must be from recognized institutions No cap on deduction amount available

There are a few documents you ll need before you can claim the student loan interest deduction on your federal taxes Form 1040 or 1040 SR This is your federal tax

Section 80E Save Income Tax With Education Loan Lenvica HRMS

Joint Home Loan Declaration Form For Income Tax Savings And Non

Home Loan Interest Home Loan Interest Exemption Section

Application Letter For Tax Exemption PDF

How To Show Home Loan In Income Tax Declaration 11 Explore Top

Home Loan Tax Exemption Check Tax Benefits On Home Loan

Home Loan Tax Exemption Check Tax Benefits On Home Loan

Sample Letter Tax Exemption Form Fill Out And Sign Printable PDF