In the age of digital, where screens have become the dominant feature of our lives but the value of tangible printed materials hasn't faded away. It doesn't matter if it's for educational reasons, creative projects, or just adding personal touches to your space, Hra Exemption In Income Tax Under Section have proven to be a valuable resource. Through this post, we'll dive into the sphere of "Hra Exemption In Income Tax Under Section," exploring the benefits of them, where to get them, as well as how they can add value to various aspects of your lives.

Get Latest Hra Exemption In Income Tax Under Section Below

Hra Exemption In Income Tax Under Section

Hra Exemption In Income Tax Under Section - Hra Exemption In Income Tax Under Section, Hra Exemption In Income Tax Section, Does Hra Exemption Comes Under 80c, What Is Hra Exemption In Income Tax, How Much Hra Is Exempted From Income Tax

Section 80GG of the Income Tax Act in India allows individuals who pay rent but don t receive House Rent Allowance HRA to claim deductions for that rent on their taxes This benefit applies to both salaried individuals and self employed persons

However if you live in a rented accommodation you can claim a tax exemption either partially or wholly under Section 10 13A of the Income Tax Act This is popularly known as HRA exemption If you don t live in a rented accommodation this allowance is fully taxable

The Hra Exemption In Income Tax Under Section are a huge assortment of printable materials that are accessible online for free cost. These resources come in many styles, from worksheets to templates, coloring pages, and many more. The attraction of printables that are free is their flexibility and accessibility.

More of Hra Exemption In Income Tax Under Section

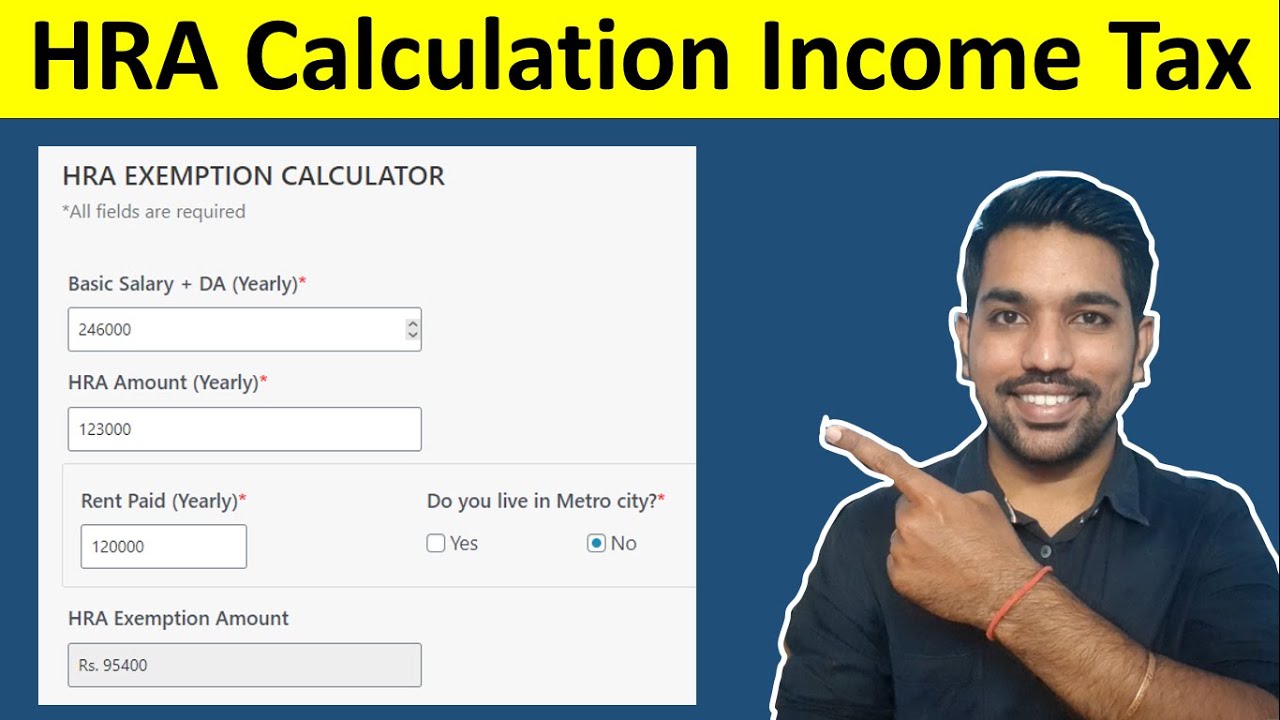

How HRA Exemption Is Calculated Excel Examples FinCalC Blog

How HRA Exemption Is Calculated Excel Examples FinCalC Blog

Under Section 10 13A of the Income Tax Act the following types of expenses are covered under House Rent Allowance HRA for exemption from income tax Rent paid The actual rent paid by the taxpayer for

According to Section 10 13A of the Income Tax Act 1961 salaried individuals in India can claim an exemption on their House Rent Allowance HRA This exemption is calculated by taking the

The Hra Exemption In Income Tax Under Section have gained huge popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or expensive software.

-

The ability to customize: You can tailor print-ready templates to your specific requirements for invitations, whether that's creating them as well as organizing your calendar, or decorating your home.

-

Educational Impact: Free educational printables offer a wide range of educational content for learners of all ages, making them a vital tool for parents and teachers.

-

Convenience: instant access a myriad of designs as well as templates will save you time and effort.

Where to Find more Hra Exemption In Income Tax Under Section

How To Show HRA Not Accounted By The Employer In ITR

How To Show HRA Not Accounted By The Employer In ITR

A portion of HRA is excluded from taxation under Section 10 13A of the Income Tax Act of 1961 subject to some provisions Until calculating taxable income the sum of HRA exemption is deducted from the overall income which allows an individual to

Is House Rent Allowance deductible under section 80C No HRA is an allowance and is exempt from Salary Income u s 10 13A of the Income Tax Act

After we've peaked your interest in printables for free, let's explore where you can find these gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection and Hra Exemption In Income Tax Under Section for a variety objectives.

- Explore categories like the home, decor, craft, and organization.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free including flashcards, learning materials.

- The perfect resource for parents, teachers and students looking for extra resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates, which are free.

- These blogs cover a broad array of topics, ranging starting from DIY projects to party planning.

Maximizing Hra Exemption In Income Tax Under Section

Here are some ways for you to get the best use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Print out free worksheets and activities to reinforce learning at home and in class.

3. Event Planning

- Design invitations, banners, and decorations for special occasions such as weddings or birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars checklists for tasks, as well as meal planners.

Conclusion

Hra Exemption In Income Tax Under Section are a treasure trove filled with creative and practical information which cater to a wide range of needs and hobbies. Their access and versatility makes them an invaluable addition to both professional and personal life. Explore the vast world of Hra Exemption In Income Tax Under Section to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Hra Exemption In Income Tax Under Section really cost-free?

- Yes they are! You can print and download these documents for free.

-

Can I use free printables for commercial purposes?

- It's contingent upon the specific terms of use. Always consult the author's guidelines prior to printing printables for commercial projects.

-

Do you have any copyright issues when you download Hra Exemption In Income Tax Under Section?

- Some printables may contain restrictions regarding their use. Check the terms and conditions offered by the author.

-

How do I print printables for free?

- You can print them at home with any printer or head to the local print shops for superior prints.

-

What software must I use to open printables for free?

- Most printables come with PDF formats, which can be opened using free software like Adobe Reader.

HRA Calculation In Income Tax House Rent Allowance Calculator

Income Tax Savings HRA

Check more sample of Hra Exemption In Income Tax Under Section below

Pin Auf NEWS You Can USE

House Rent Allowance What Is HRA HRA Exemptions Deductions Tax2win

HRA Exemption In Income Tax Section 80GG Section 10 13A YouTube

HRA Exemption Rules HRA Deduction HRA Calculation HRA Tax Saving

What Is Previous Year In Income Tax Under Section 3

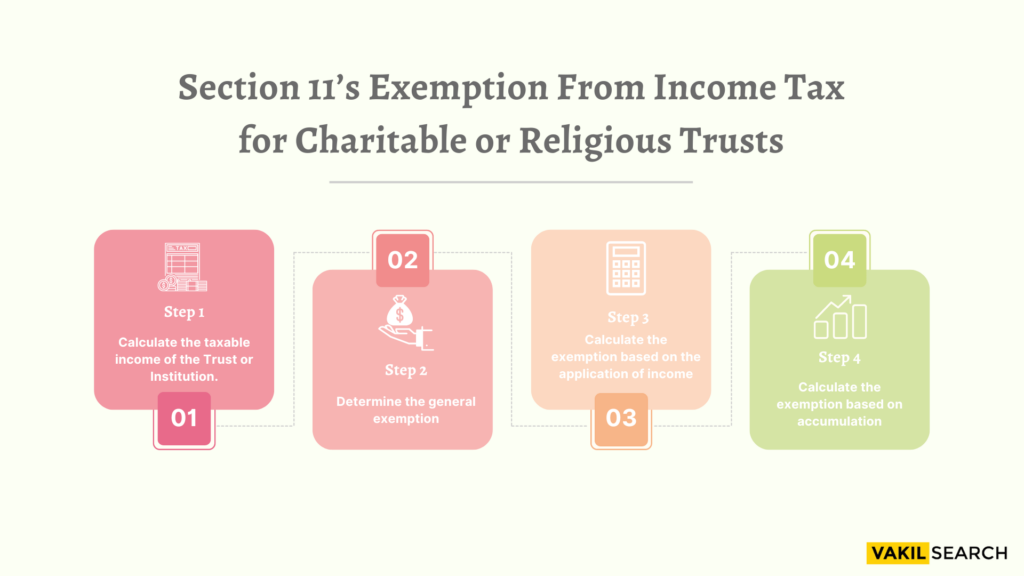

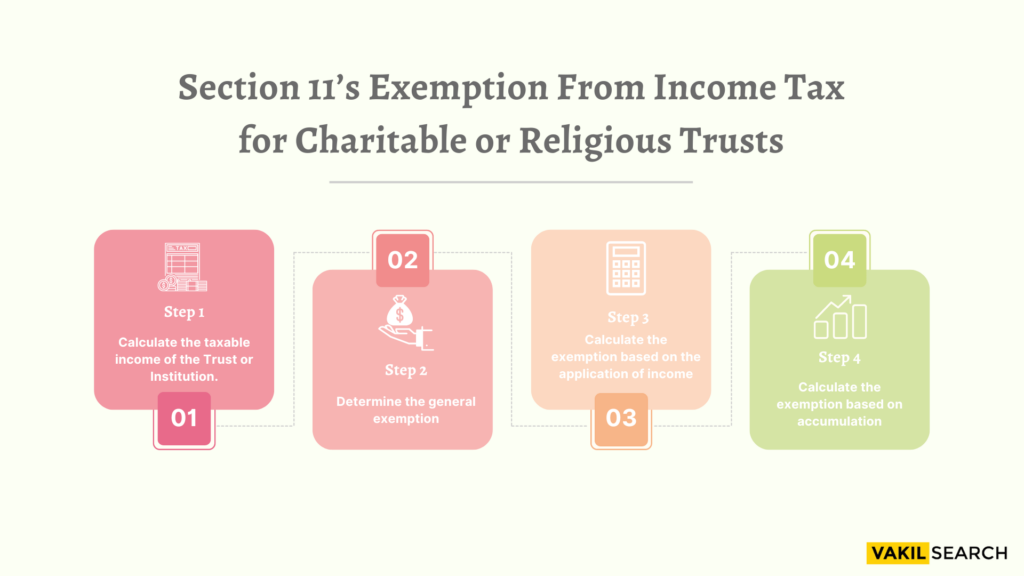

Section 11 Income Tax Act Exemptions For Charitable Trusts

https://cleartax.in/s/hra-house-rent-allowance

However if you live in a rented accommodation you can claim a tax exemption either partially or wholly under Section 10 13A of the Income Tax Act This is popularly known as HRA exemption If you don t live in a rented accommodation this allowance is fully taxable

https://economictimes.indiatimes.com/wealth/tax/...

Subject to specific conditions a portion of the HRA is exempted from taxation under Section 10 13A of the Income tax Act 1961 The amount of HRA tax exemption is deducted from the total salary before calculating the

However if you live in a rented accommodation you can claim a tax exemption either partially or wholly under Section 10 13A of the Income Tax Act This is popularly known as HRA exemption If you don t live in a rented accommodation this allowance is fully taxable

Subject to specific conditions a portion of the HRA is exempted from taxation under Section 10 13A of the Income tax Act 1961 The amount of HRA tax exemption is deducted from the total salary before calculating the

HRA Exemption Rules HRA Deduction HRA Calculation HRA Tax Saving

House Rent Allowance What Is HRA HRA Exemptions Deductions Tax2win

What Is Previous Year In Income Tax Under Section 3

Section 11 Income Tax Act Exemptions For Charitable Trusts

HRA Exemption Calculator For Income Tax Benefits Calculation And

HRA Exemption Rules HRA Deduction HRA Calculation HRA Tax Saving

HRA Exemption Rules HRA Deduction HRA Calculation HRA Tax Saving

How To Claim HRA While Filing Your Income Tax Return ITR SAG Infotech