In a world where screens have become the dominant feature of our lives The appeal of tangible printed objects hasn't waned. Be it for educational use and creative work, or simply to add personal touches to your area, Hra Exemption In Income Tax With Example are a great source. In this article, we'll dive deep into the realm of "Hra Exemption In Income Tax With Example," exploring the benefits of them, where to get them, as well as the ways that they can benefit different aspects of your lives.

Get Latest Hra Exemption In Income Tax With Example Below

Hra Exemption In Income Tax With Example

Hra Exemption In Income Tax With Example - Hra Exemption In Income Tax With Example, How Is Hra Exemption Calculated With Example, What Is Hra Exemption In Income Tax, How To Calculate Hra Exemption For Income Tax With Example, Does Hra Exemption Comes Under 80c

The rent agreement should clearly mention your name the landlord s name the rent amount and the duration Learn about House Rent Allowance in detail including what is HRA Tax Exemptions and benefits of availing HRA Also know How to Calculate and Claim HRA

How does HRA become tax exempt Subject to certain conditions a fixed portion of HRA is exempt from taxes according to the Income Tax Act of 1961 This exemption is regulated by Section 10 13A of the Income Tax Act Who is eligible for HRA exemption Any salaried individual can claim an exemption for HRA

Printables for free cover a broad assortment of printable, downloadable documents that can be downloaded online at no cost. They come in many types, like worksheets, coloring pages, templates and more. The attraction of printables that are free is in their variety and accessibility.

More of Hra Exemption In Income Tax With Example

How To Claim HRA Allowance House Rent Allowance Exemption

How To Claim HRA Allowance House Rent Allowance Exemption

The exemption on HRA is covered under Section 10 13A of the Income Tax Act and Rule 2A of the Income Tax Rules It is to be noted that the entire HRA is not deductible HRA is an allowance and is subject to income tax

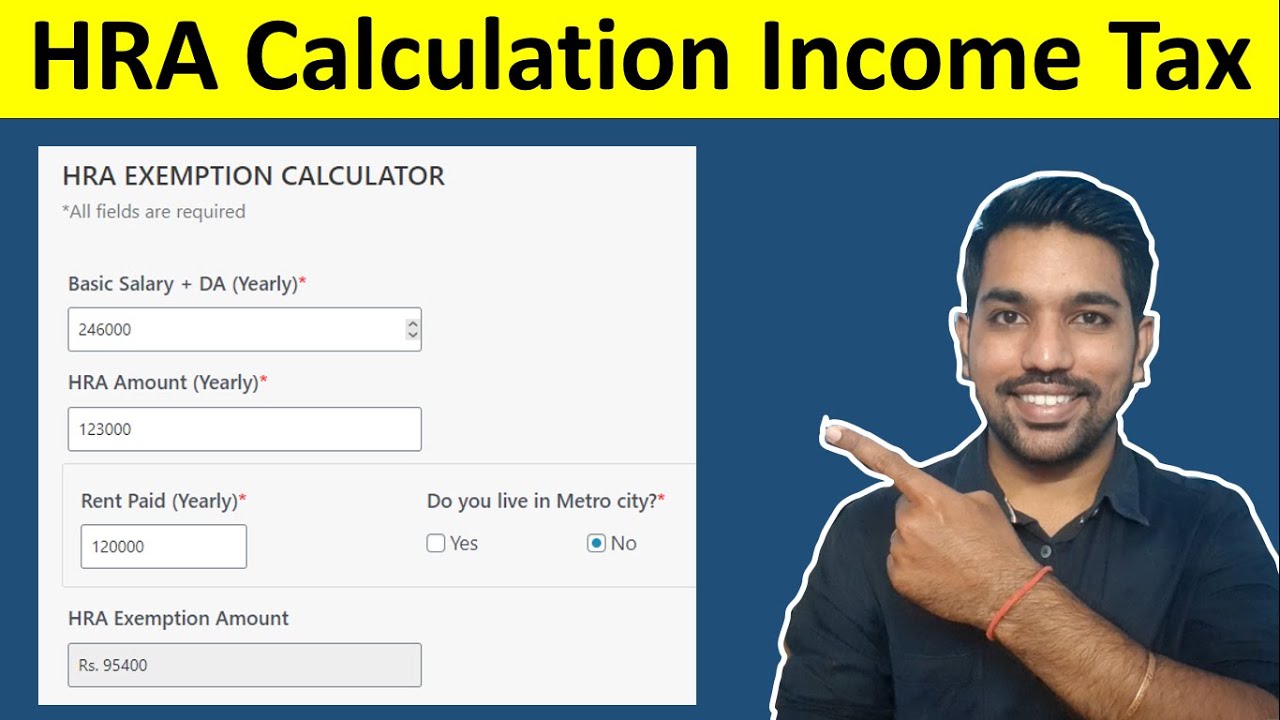

In this example the entire HRA received from the employer Rs 1 00 000 is exempt from income tax This is because the calculated amounts based on 50 of basic salary and DA Rs 1 62 000 and rent paid minus 10 Rs 1 65 600 are higher than the actual HRA received

The Hra Exemption In Income Tax With Example have gained huge popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the need to purchase physical copies or costly software.

-

Flexible: This allows you to modify printing templates to your own specific requirements, whether it's designing invitations to organize your schedule or even decorating your home.

-

Education Value Downloads of educational content for free cater to learners of all ages, which makes them a great resource for educators and parents.

-

Accessibility: Instant access to a myriad of designs as well as templates is time-saving and saves effort.

Where to Find more Hra Exemption In Income Tax With Example

How HRA Exemption Is Calculated Excel Examples FinCalC Blog

How HRA Exemption Is Calculated Excel Examples FinCalC Blog

Step 1 Enter your basic salary and HRA you get as per your salary slip Step 2 Enter the actual rent paid and specify whether you live in a metro city or not from the drop down The HRA calculation for income tax makes it easy for the employees to save tax

No HRA is an allowance and is exempt from Salary Income u s 10 13A of the Income Tax Act Can HRA exemption be claimed if living parents A taxpayer can go for a rental agreement with anyone except their spouse and claim HRA

After we've peaked your curiosity about Hra Exemption In Income Tax With Example Let's take a look at where you can find these elusive gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of printables that are free for a variety of uses.

- Explore categories like decorating your home, education, crafting, and organization.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free including flashcards, learning tools.

- This is a great resource for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates, which are free.

- These blogs cover a broad selection of subjects, that range from DIY projects to party planning.

Maximizing Hra Exemption In Income Tax With Example

Here are some inventive ways that you can make use of printables that are free:

1. Home Decor

- Print and frame gorgeous art, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Use printable worksheets from the internet to enhance learning at home either in the schoolroom or at home.

3. Event Planning

- Invitations, banners and decorations for special occasions such as weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars or to-do lists. meal planners.

Conclusion

Hra Exemption In Income Tax With Example are an abundance of fun and practical tools which cater to a wide range of needs and pursuits. Their accessibility and flexibility make them an invaluable addition to any professional or personal life. Explore the vast world of printables for free today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really cost-free?

- Yes, they are! You can download and print these files for free.

-

Can I utilize free templates for commercial use?

- It's based on specific rules of usage. Always consult the author's guidelines before using printables for commercial projects.

-

Are there any copyright rights issues with printables that are free?

- Some printables could have limitations on use. Be sure to read these terms and conditions as set out by the designer.

-

How can I print Hra Exemption In Income Tax With Example?

- Print them at home with your printer or visit the local print shops for premium prints.

-

What software must I use to open printables at no cost?

- The majority of PDF documents are provided as PDF files, which is open with no cost software, such as Adobe Reader.

HRA Calculation In Income Tax House Rent Allowance Calculator

House Rent Allowance What Is HRA HRA Exemptions Deductions Tax2win

Check more sample of Hra Exemption In Income Tax With Example below

Income Tax Savings HRA

HRA What Is House Rent Allowance HRA Exemption Deduction Taxwink

How To Claim HRA While Filing Your Income Tax Return ITR SAG Infotech

HRA Exemption In Income Tax Section 80GG Section 10 13A YouTube

Pin Auf NEWS You Can USE

HRA Exemption Rules HRA Deduction HRA Calculation HRA Tax Saving

https://jupiter.money/blog/how-to-calculate-hra-in-salary

How does HRA become tax exempt Subject to certain conditions a fixed portion of HRA is exempt from taxes according to the Income Tax Act of 1961 This exemption is regulated by Section 10 13A of the Income Tax Act Who is eligible for HRA exemption Any salaried individual can claim an exemption for HRA

https://taxguru.in/income-tax/house-rent-allowance...

HRA is covered under Section 10 13A of Income Tax Act 1961 Salaried Employees who live in a Rented house can claim HRA to lower their taxes partially or wholly The decision of how much HRA needs to be paid is made by employer

How does HRA become tax exempt Subject to certain conditions a fixed portion of HRA is exempt from taxes according to the Income Tax Act of 1961 This exemption is regulated by Section 10 13A of the Income Tax Act Who is eligible for HRA exemption Any salaried individual can claim an exemption for HRA

HRA is covered under Section 10 13A of Income Tax Act 1961 Salaried Employees who live in a Rented house can claim HRA to lower their taxes partially or wholly The decision of how much HRA needs to be paid is made by employer

HRA Exemption In Income Tax Section 80GG Section 10 13A YouTube

HRA What Is House Rent Allowance HRA Exemption Deduction Taxwink

Pin Auf NEWS You Can USE

HRA Exemption Rules HRA Deduction HRA Calculation HRA Tax Saving

HRA Exemption Calculator For Income Tax Benefits Calculation And

How To Calculate HRA House Rent Allowance Exemption U s 10 13A As

How To Calculate HRA House Rent Allowance Exemption U s 10 13A As

ITR Filing 2023 How To Claim Exemption On HRA In Tax Return