In the age of digital, when screens dominate our lives however, the attraction of tangible printed materials isn't diminishing. If it's to aid in education project ideas, artistic or simply adding an element of personalization to your space, Illinois Real Estate Transfer Tax Exemptions are now a useful source. With this guide, you'll take a dive into the world of "Illinois Real Estate Transfer Tax Exemptions," exploring what they are, how to locate them, and how they can improve various aspects of your life.

Get Latest Illinois Real Estate Transfer Tax Exemptions Below

Illinois Real Estate Transfer Tax Exemptions

Illinois Real Estate Transfer Tax Exemptions - Illinois Real Estate Transfer Tax Exemptions, Il Real Estate Transfer Tax Exemptions, Illinois Real Property Transfer Tax Exemptions, Illinois Real Estate Transfer Tax Law, Who Pays Real Estate Transfer Tax In Illinois, Exemptions From Property Transfer Tax Include

Assuming you are in a community which has a transfer tax you can pay as little as 50 per transaction or as much as 10 per 1 000 of a real estate transaction HOW DOES A COMMUNITY IMPOSE A TRANSFER TAX Since 1997 communities in

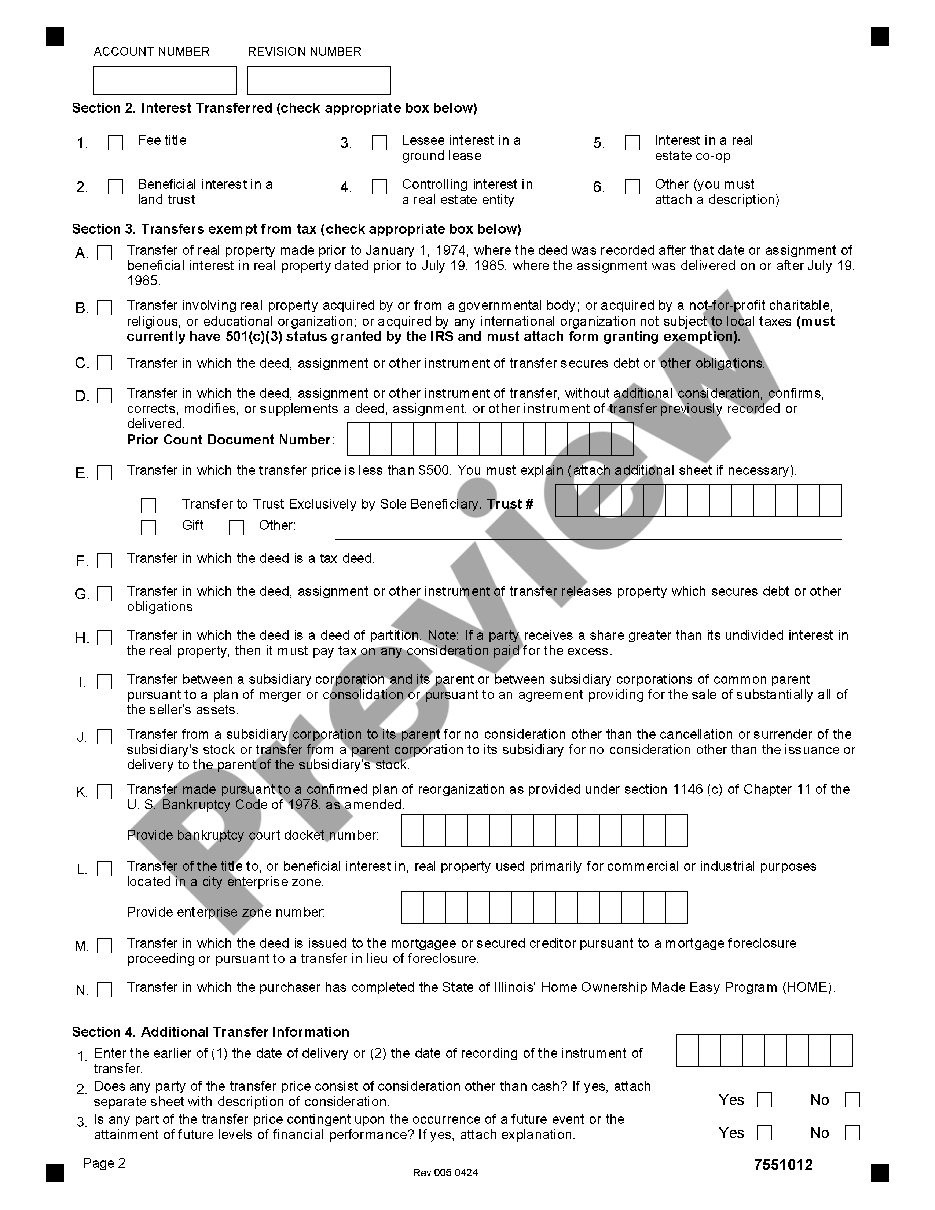

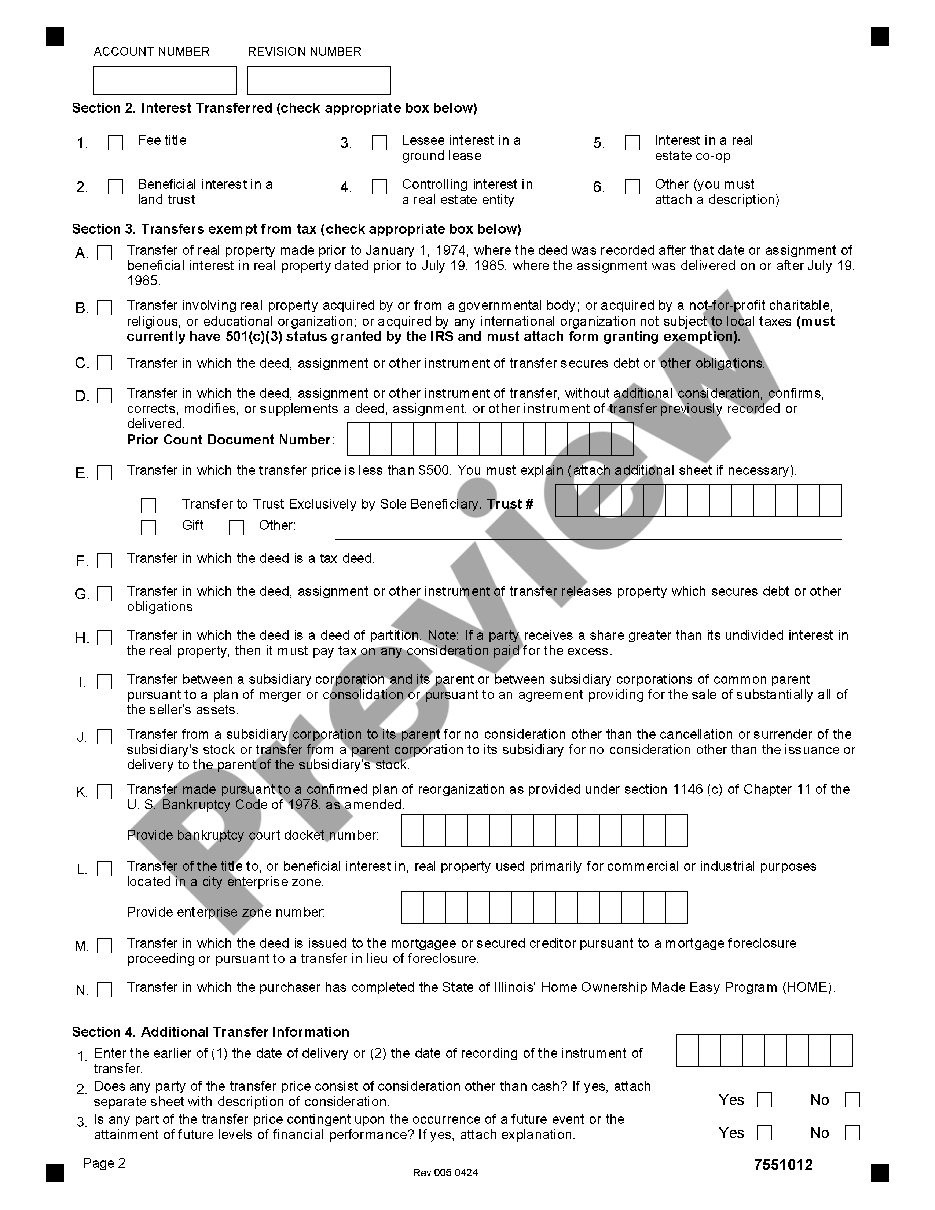

The following deeds or trust documents shall be exempt from the provisions of this Article except as provided in this Section a Deeds representing real estate transfers made before January 1 1968 but recorded after that date and trust documents executed before January 1 1986 but recorded after that date

The Illinois Real Estate Transfer Tax Exemptions are a huge collection of printable documents that can be downloaded online at no cost. These resources come in various types, like worksheets, templates, coloring pages and much more. One of the advantages of Illinois Real Estate Transfer Tax Exemptions lies in their versatility and accessibility.

More of Illinois Real Estate Transfer Tax Exemptions

Illinois District Court Finds That Fannie Mae Freddie Mac And FHFA

Illinois District Court Finds That Fannie Mae Freddie Mac And FHFA

MyDec at MyTax Illinois allows users to search for Illinois Real Estate Transfer Declarations Forms PTAX 203 PTAX 203 A PTAX 203 B as well as Cook County and City of Chicago Real Estate Transfer Declarations if applicable without logging in to a MyDec account

Exemptions The following deeds or trust documents shall be exempt from the provisions of this Article except as provided in this Section a Deeds representing real estate transfers made before January 1 1968 but recorded after that date and trust documents executed before January 1 1986 but recorded after that date

Printables for free have gained immense popularity for several compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

Personalization There is the possibility of tailoring the design to meet your needs whether you're designing invitations making your schedule, or decorating your home.

-

Education Value Educational printables that can be downloaded for free provide for students from all ages, making them an invaluable resource for educators and parents.

-

An easy way to access HTML0: Fast access various designs and templates reduces time and effort.

Where to Find more Illinois Real Estate Transfer Tax Exemptions

GUIDE TO PHILADELPHIA REAL ESTATE TRANSFER TAX EXEMPTIONS Top

GUIDE TO PHILADELPHIA REAL ESTATE TRANSFER TAX EXEMPTIONS Top

Party A s real estate is valued at 50 000 Party B s real estate is valued at 55 000 The transfer is exempt from the tax except for the money difference or money s worth paid from one party to the other under 35 ILCS 200 31 45 k

Illinois s current transfer tax rate is 0 50 per 500 So for a house worth 265 824 the median home price in the state the transfer tax due will be 399 On top of that certain counties impose an additional 25 cents for every 500

In the event that we've stirred your interest in printables for free We'll take a look around to see where you can find these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection with Illinois Real Estate Transfer Tax Exemptions for all objectives.

- Explore categories like decorations for the home, education and organizational, and arts and crafts.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free for flashcards, lessons, and worksheets. tools.

- The perfect resource for parents, teachers as well as students who require additional resources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for no cost.

- The blogs covered cover a wide range of topics, everything from DIY projects to planning a party.

Maximizing Illinois Real Estate Transfer Tax Exemptions

Here are some ideas that you can make use of Illinois Real Estate Transfer Tax Exemptions:

1. Home Decor

- Print and frame gorgeous images, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Print worksheets that are free to enhance learning at home (or in the learning environment).

3. Event Planning

- Designs invitations, banners and decorations for special events such as weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Illinois Real Estate Transfer Tax Exemptions are an abundance filled with creative and practical information that can meet the needs of a variety of people and needs and. Their accessibility and flexibility make them a valuable addition to both professional and personal lives. Explore the world of Illinois Real Estate Transfer Tax Exemptions today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Illinois Real Estate Transfer Tax Exemptions really absolutely free?

- Yes they are! You can download and print the resources for free.

-

Can I download free printables for commercial purposes?

- It's dependent on the particular conditions of use. Always consult the author's guidelines before using their printables for commercial projects.

-

Are there any copyright issues in printables that are free?

- Certain printables may be subject to restrictions on usage. Always read the terms and regulations provided by the author.

-

How do I print printables for free?

- Print them at home with a printer or visit the local print shop for premium prints.

-

What program do I need to open printables that are free?

- The majority of printables are in the format PDF. This is open with no cost software like Adobe Reader.

Property Transfer Tax Exemptions BC Buying Vancouver Real Estate YouTube

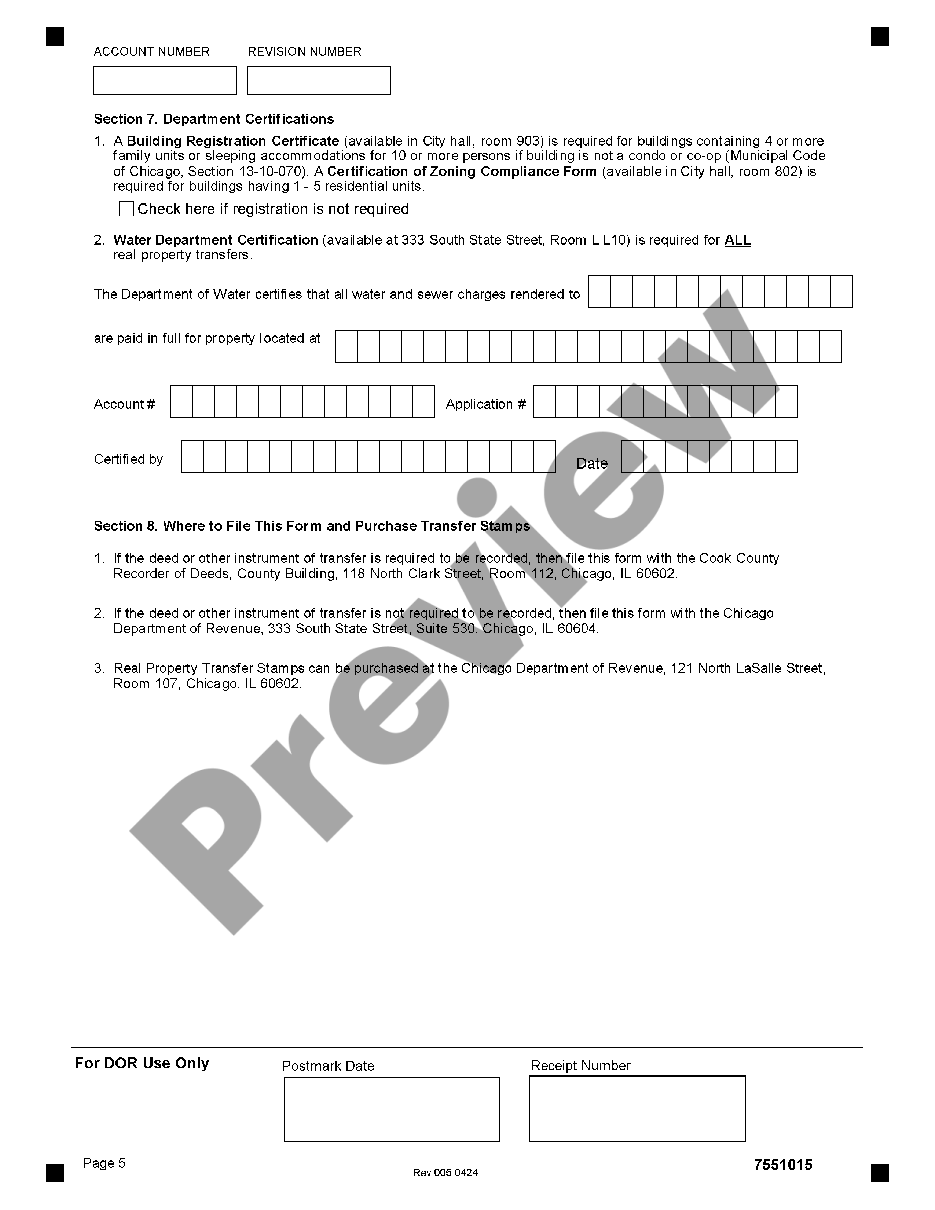

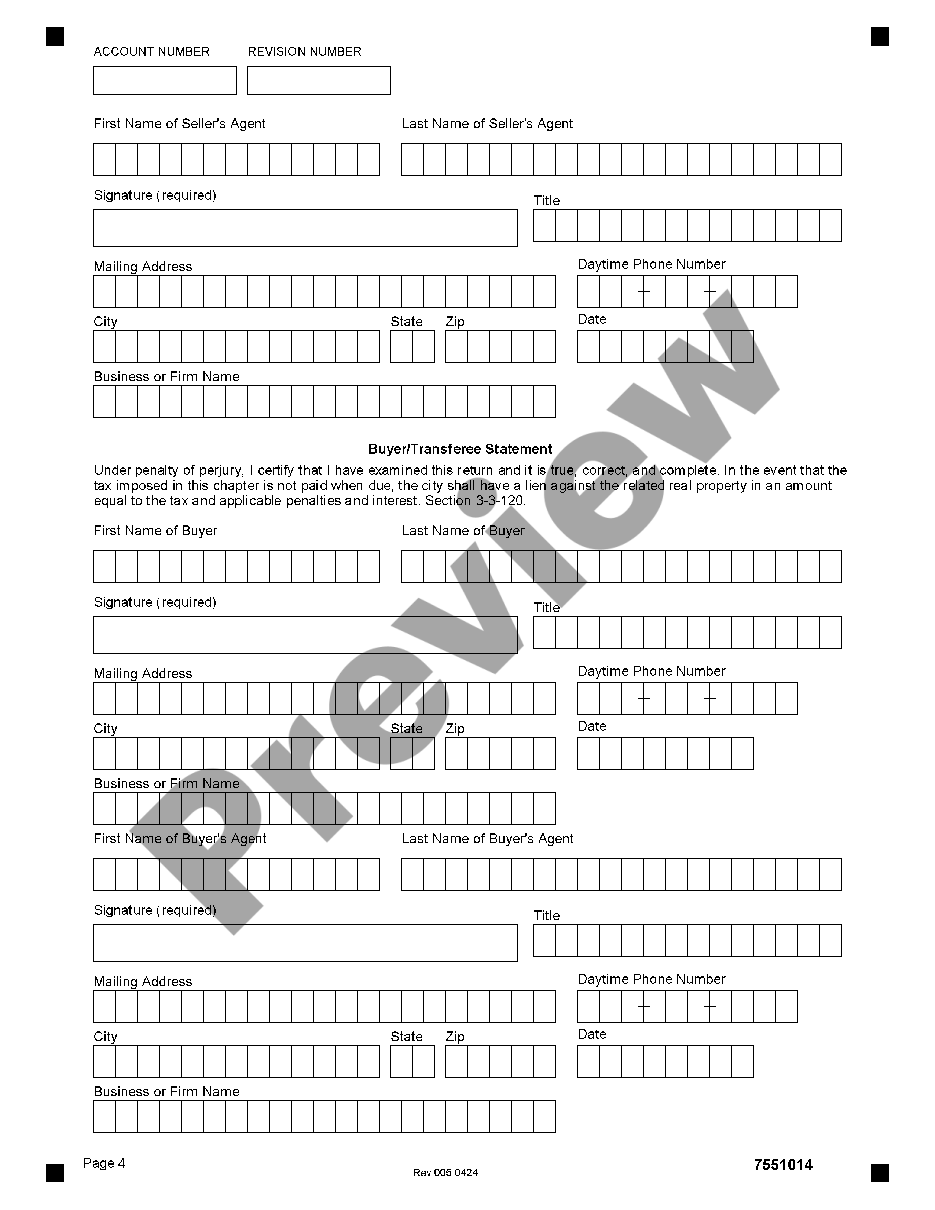

Joliet City Of Chicago Illinois Real Estate Transfer Tax Declaration

Check more sample of Illinois Real Estate Transfer Tax Exemptions below

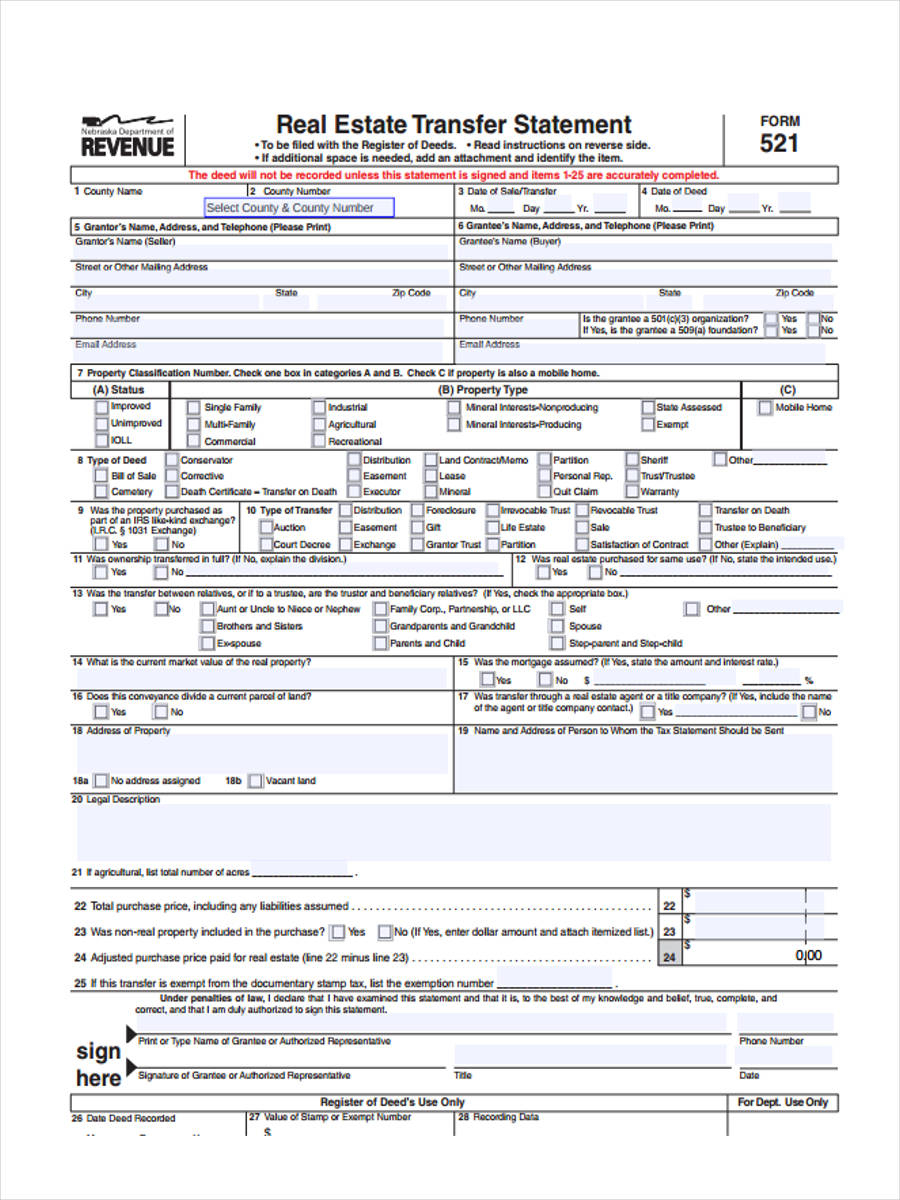

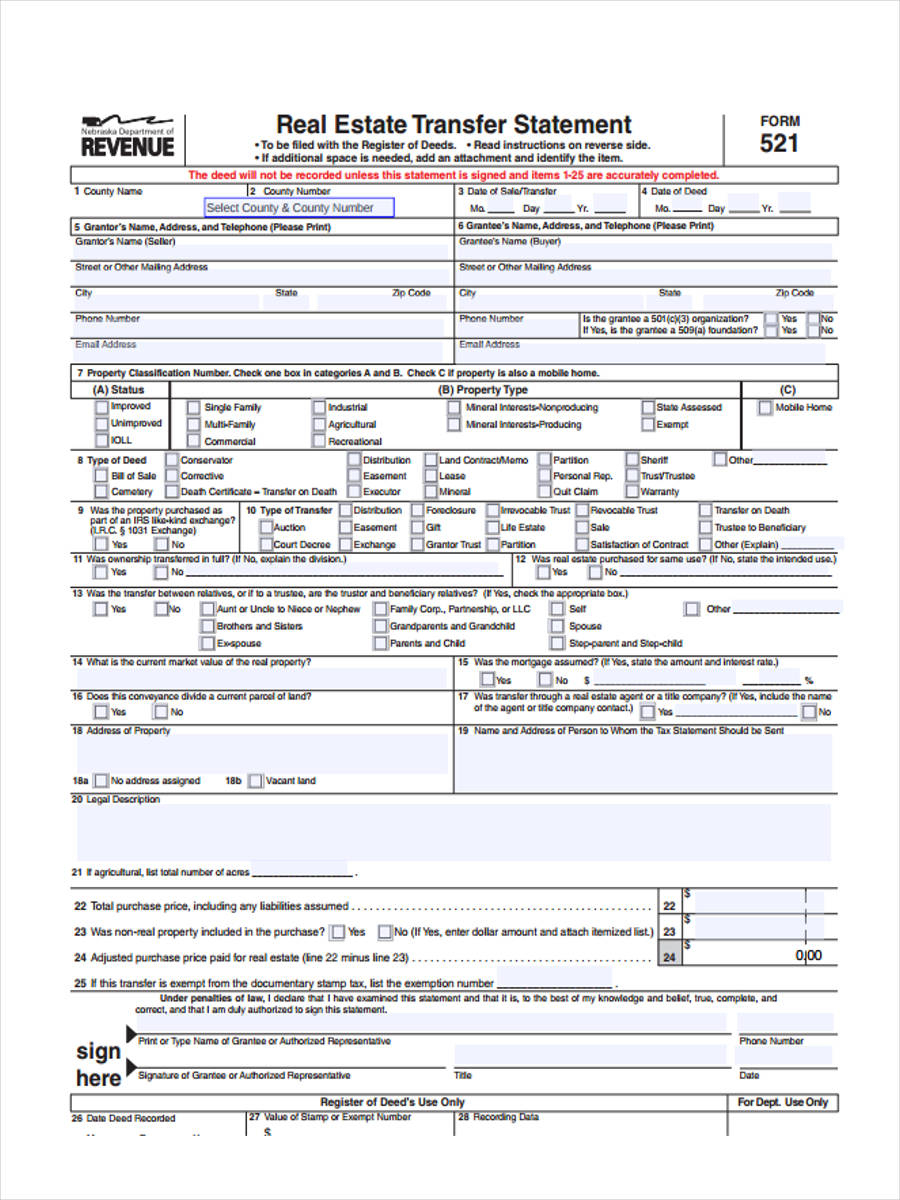

Form Ptax 203 B Illinois Real Estate Transfer Declaration CountyForms

Understanding Tennessee s Transfer Tax And Exemptions

Illinois Transfer Of Stock Form TransferForm

Illinois Transfer Of Stock Form TransferForm

Rashad Matson

PFM Study Boston Real Estate Transfer Tax pdf DocDroid

https://casetext.com/statute/illinois-compiled...

The following deeds or trust documents shall be exempt from the provisions of this Article except as provided in this Section a Deeds representing real estate transfers made before January 1 1968 but recorded after that date and trust documents executed before January 1 1986 but recorded after that date

https://tax.illinois.gov/research/taxinformation/property/rett.html

MyDec at MyTax Illinois used by individuals title companies and settlement agencies to submit approve or reject Real Property Transfer Tax Declarations replaces the EZDec system

The following deeds or trust documents shall be exempt from the provisions of this Article except as provided in this Section a Deeds representing real estate transfers made before January 1 1968 but recorded after that date and trust documents executed before January 1 1986 but recorded after that date

MyDec at MyTax Illinois used by individuals title companies and settlement agencies to submit approve or reject Real Property Transfer Tax Declarations replaces the EZDec system

Illinois Transfer Of Stock Form TransferForm

Understanding Tennessee s Transfer Tax And Exemptions

Rashad Matson

PFM Study Boston Real Estate Transfer Tax pdf DocDroid

TP 584 Combined Real Estate Transfer Tax Return Credit Line Mortgage

Cook City Of Chicago Illinois Real Estate Transfer Tax Declaration

Cook City Of Chicago Illinois Real Estate Transfer Tax Declaration

Cook City Of Chicago Illinois Real Estate Transfer Tax Declaration