In this age of electronic devices, when screens dominate our lives however, the attraction of tangible, printed materials hasn't diminished. It doesn't matter if it's for educational reasons such as creative projects or simply adding an element of personalization to your space, Impact Of Tax Credits On Wages have proven to be a valuable source. In this article, we'll dive into the sphere of "Impact Of Tax Credits On Wages," exploring the different types of printables, where to locate them, and how they can improve various aspects of your lives.

Get Latest Impact Of Tax Credits On Wages Below

Impact Of Tax Credits On Wages

Impact Of Tax Credits On Wages -

We find a significant firm level incidence of the tax credit on wages that unfolds gradually over time More particularly a 1 percentage point increase in the tax

Spring 2019 1 Motivation This paper analyzes the impact of the Earned Income Tax Credit EITC pay ments on labour market behaviors wages and the tax incidence

Printables for free include a vast assortment of printable material that is available online at no cost. These resources come in many styles, from worksheets to templates, coloring pages and more. The benefit of Impact Of Tax Credits On Wages is their versatility and accessibility.

More of Impact Of Tax Credits On Wages

Employee Retention Credit Owner Wages Count Towards Refund

Employee Retention Credit Owner Wages Count Towards Refund

In addition to directly raising incomes the EITC has sharply changed work incentives currently increasing the after tax wage by up to 45 for

The EITC a refundable tax credit available to low income families who have income from work dramatically reduces child poverty encourages single mothers to participate in the formal economy and

Impact Of Tax Credits On Wages have garnered immense popularity for several compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies or costly software.

-

customization: Your HTML0 customization options allow you to customize the design to meet your needs whether it's making invitations making your schedule, or decorating your home.

-

Educational Value Printables for education that are free cater to learners of all ages, which makes these printables a powerful tool for parents and teachers.

-

Simple: immediate access many designs and templates helps save time and effort.

Where to Find more Impact Of Tax Credits On Wages

Understanding Employee Tax Credits Exploring Wages That Qualify

Understanding Employee Tax Credits Exploring Wages That Qualify

The authors estimate the effects of the interactions between the Earned Income Tax Credit EITC and minimum wages on labor market outcomes

We nd evidence that 1 through the salience mechanism the rm cuts the wage of claimant workers relative to similarly skilled nonclaimants by 30 percent of the tax

We hope we've stimulated your curiosity about Impact Of Tax Credits On Wages We'll take a look around to see where you can locate these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection and Impact Of Tax Credits On Wages for a variety objectives.

- Explore categories like interior decor, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets Flashcards, worksheets, and other educational materials.

- Perfect for teachers, parents as well as students who require additional sources.

3. Creative Blogs

- Many bloggers share their creative designs with templates and designs for free.

- These blogs cover a broad range of topics, including DIY projects to party planning.

Maximizing Impact Of Tax Credits On Wages

Here are some creative ways how you could make the most use of Impact Of Tax Credits On Wages:

1. Home Decor

- Print and frame stunning artwork, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Print worksheets that are free for reinforcement of learning at home (or in the learning environment).

3. Event Planning

- Create invitations, banners, and other decorations for special occasions such as weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Impact Of Tax Credits On Wages are an abundance of practical and innovative resources that cater to various needs and needs and. Their access and versatility makes them a valuable addition to both professional and personal lives. Explore the wide world of Impact Of Tax Credits On Wages and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Impact Of Tax Credits On Wages truly are they free?

- Yes you can! You can download and print these resources at no cost.

-

Can I use free printables for commercial uses?

- It's all dependent on the conditions of use. Always verify the guidelines of the creator prior to printing printables for commercial projects.

-

Are there any copyright issues with Impact Of Tax Credits On Wages?

- Some printables could have limitations regarding usage. Be sure to check the conditions and terms of use provided by the creator.

-

How can I print Impact Of Tax Credits On Wages?

- You can print them at home using any printer or head to the local print shop for better quality prints.

-

What program do I require to view printables free of charge?

- A majority of printed materials are in the format of PDF, which is open with no cost software, such as Adobe Reader.

What Are Refundable Tax Credits YouTube

Government Accused Of Covering Up Negative Impact Of Tax Credit Cuts

Check more sample of Impact Of Tax Credits On Wages below

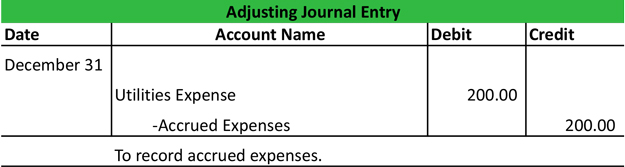

5 Types Of Adjusting Entries Rrandonextoleman

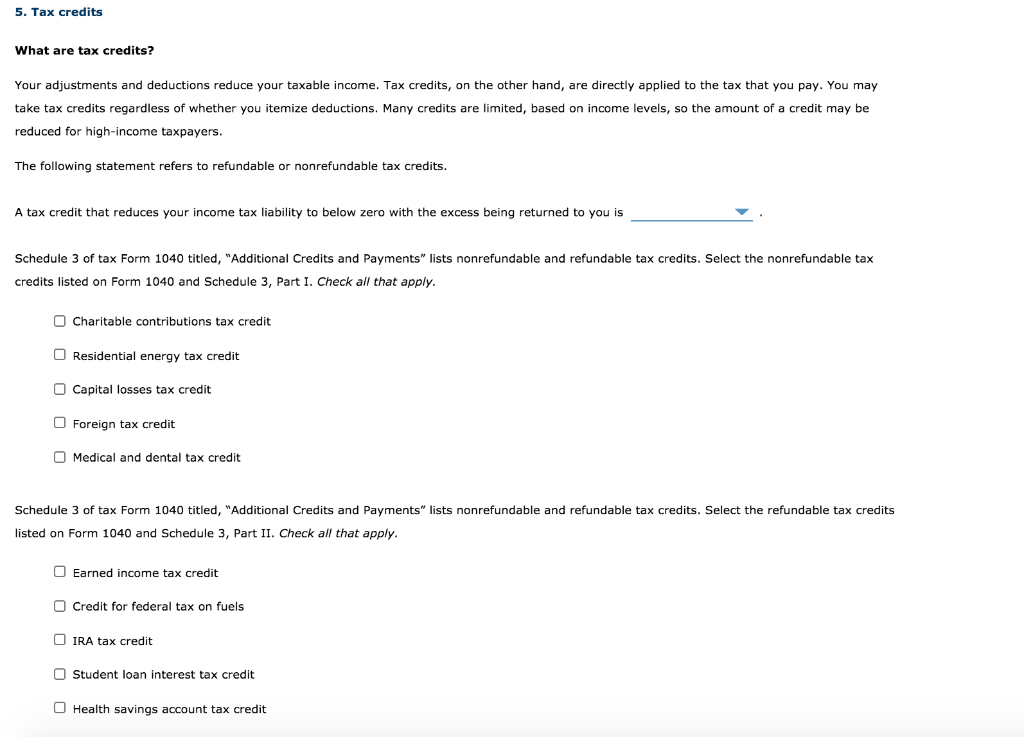

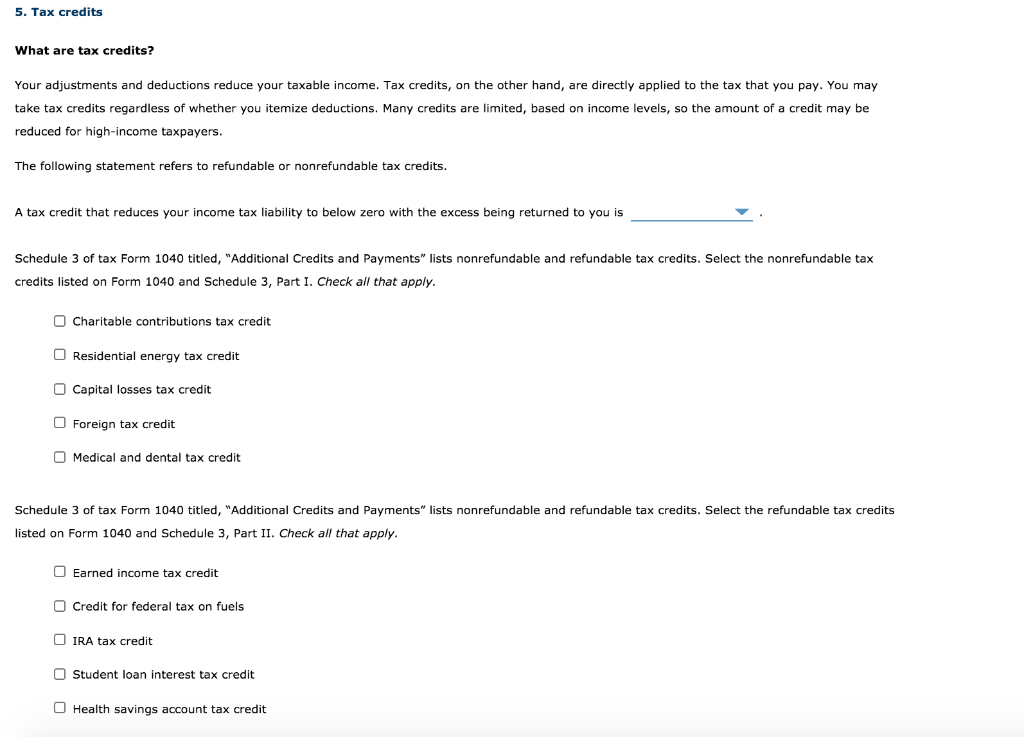

Solved 5 Tax Credits What Are Tax Credits Your Adjustments Chegg

What Is Tax Credit For Health Insurance Benefits Types And Impact

CMS Questioned On Easing Impact Of Tax Credits On Consumers Modern

The Following Is The Post closing Trial Balance For The Whitlow

Employee Retention Credit Deadline 2022 Employee Retention Credit

![]()

https://www.economicpolicyresearch.org/images/docs/...

Spring 2019 1 Motivation This paper analyzes the impact of the Earned Income Tax Credit EITC pay ments on labour market behaviors wages and the tax incidence

https://www.economicpolicyresearch.org/images/docs/...

Effects of the EITC particularly for groups like older low wage workers who face slower wage growth as a result of the policy but do not receive the same level of

Spring 2019 1 Motivation This paper analyzes the impact of the Earned Income Tax Credit EITC pay ments on labour market behaviors wages and the tax incidence

Effects of the EITC particularly for groups like older low wage workers who face slower wage growth as a result of the policy but do not receive the same level of

CMS Questioned On Easing Impact Of Tax Credits On Consumers Modern

Solved 5 Tax Credits What Are Tax Credits Your Adjustments Chegg

The Following Is The Post closing Trial Balance For The Whitlow

Employee Retention Credit Deadline 2022 Employee Retention Credit

Hardware Company s Payroll For N 2017 Is Summarized Below Unemployment

Offset Rising Minimum Wages With WOTC Capital Review Group

Offset Rising Minimum Wages With WOTC Capital Review Group

How To Enhance Employee Retention Through Tax Credits Clean Slate Tax