In the age of digital, in which screens are the norm and our lives are dominated by screens, the appeal of tangible printed items hasn't gone away. If it's to aid in education as well as creative projects or simply to add some personal flair to your space, Income Tax 80d Deduction Limit are now a vital resource. Here, we'll take a dive deep into the realm of "Income Tax 80d Deduction Limit," exploring what they are, how to get them, as well as how they can add value to various aspects of your lives.

Get Latest Income Tax 80d Deduction Limit Below

Income Tax 80d Deduction Limit

Income Tax 80d Deduction Limit -

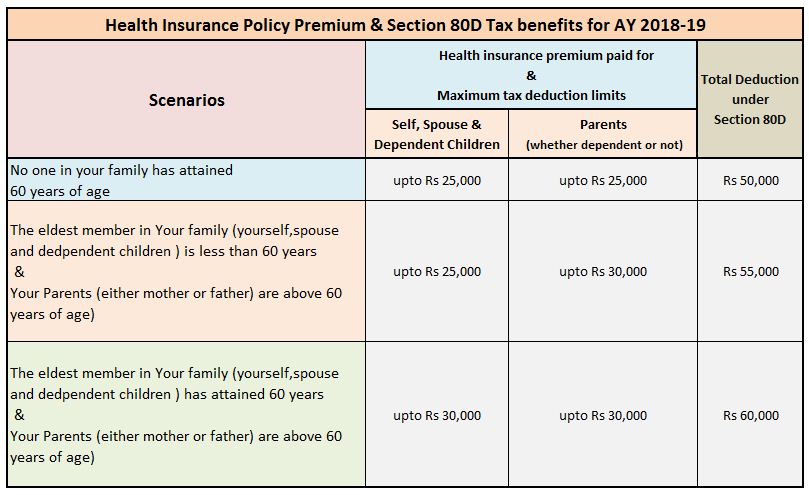

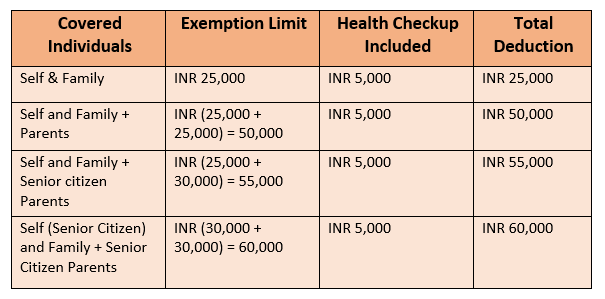

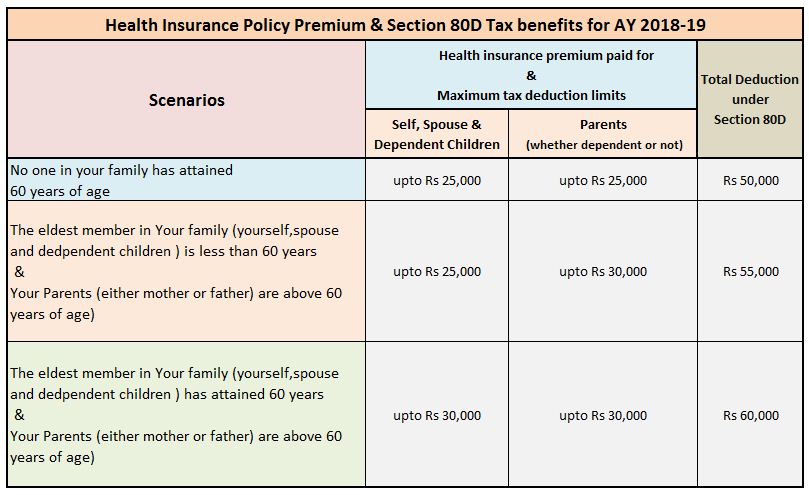

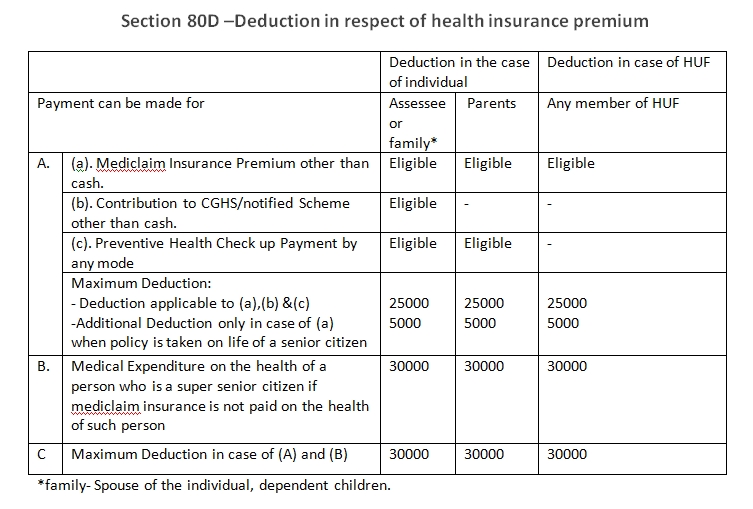

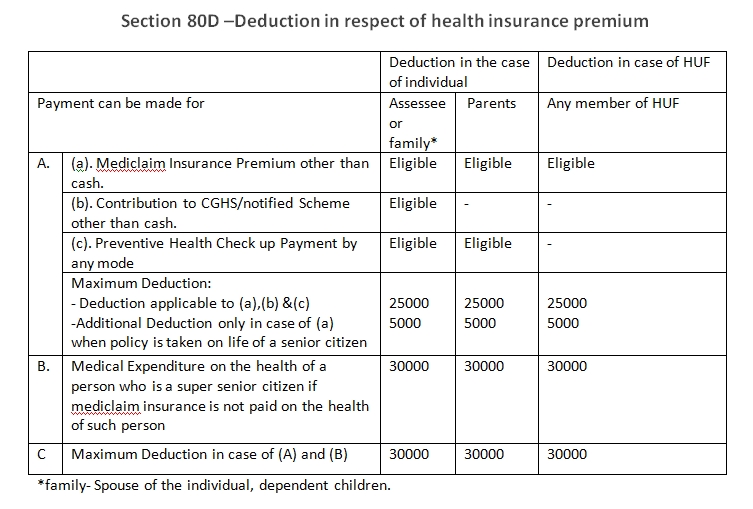

Deduction under section 80D of the Income Tax Act is available in addition to the deduction of INR 1 50 Lakhs available collectively under section 80C section 80CCC and

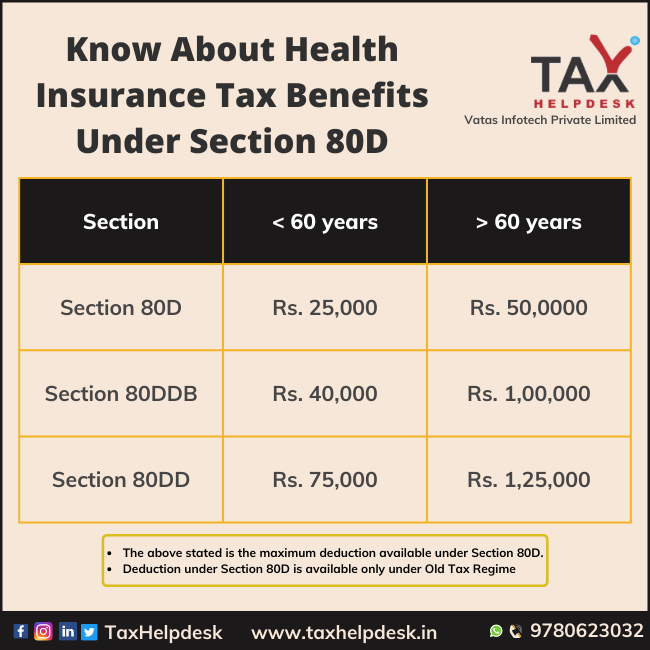

Under Section 80DDB the maximum deduction is Rs 1 lakh per dependent Explore Section 80D of the Income Tax Act to understand deductions available for medical and health insurance premiums Learn about eligibility

Income Tax 80d Deduction Limit include a broad variety of printable, downloadable documents that can be downloaded online at no cost. These resources come in many forms, including worksheets, coloring pages, templates and more. One of the advantages of Income Tax 80d Deduction Limit is in their versatility and accessibility.

More of Income Tax 80d Deduction Limit

Section 80D Of Income Tax 80D Deduction For Medical Insurance Mediclaim

Section 80D Of Income Tax 80D Deduction For Medical Insurance Mediclaim

Schedule 80D in income tax return allows deductions for health insurance premiums and medical expenses for self spouse children parents with limits Filling out accurately

Section 80D of the Income Tax Act of 1961 allows taxpayers to claim deductions for the premiums paid on health or medical insurance policies The section is implemented to urge people to

The Income Tax 80d Deduction Limit have gained huge popularity for several compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

Modifications: This allows you to modify the design to meet your needs when it comes to designing invitations for your guests, organizing your schedule or even decorating your house.

-

Education Value Printing educational materials for no cost can be used by students of all ages, which makes them a great aid for parents as well as educators.

-

Convenience: immediate access an array of designs and templates is time-saving and saves effort.

Where to Find more Income Tax 80d Deduction Limit

Section 80D Deduction In Respect Of Health Or Medical Insurance

Section 80D Deduction In Respect Of Health Or Medical Insurance

The maximum deduction limit in this case is INR 50 000 per financial year Conditions for Claiming Deductions To claim deductions under Section 80D taxpayers need

Section 80D of the Income Tax Act allows a deduction to an Individual including non resident individuals or HUF for the amount paid towards medical insurance premiums medical expenditures and preventive health

We've now piqued your interest in printables for free We'll take a look around to see where you can discover these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety with Income Tax 80d Deduction Limit for all reasons.

- Explore categories such as furniture, education, organizational, and arts and crafts.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing Flashcards, worksheets, and other educational tools.

- Perfect for teachers, parents and students looking for extra resources.

3. Creative Blogs

- Many bloggers post their original designs with templates and designs for free.

- These blogs cover a broad spectrum of interests, starting from DIY projects to party planning.

Maximizing Income Tax 80d Deduction Limit

Here are some inventive ways create the maximum value use of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Print worksheets that are free to reinforce learning at home also in the classes.

3. Event Planning

- Design invitations for banners, invitations as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Income Tax 80d Deduction Limit are an abundance of fun and practical tools that satisfy a wide range of requirements and passions. Their access and versatility makes these printables a useful addition to any professional or personal life. Explore the vast world of Income Tax 80d Deduction Limit to unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are Income Tax 80d Deduction Limit truly cost-free?

- Yes, they are! You can print and download these items for free.

-

Can I download free printables to make commercial products?

- It's based on specific rules of usage. Always read the guidelines of the creator before using their printables for commercial projects.

-

Are there any copyright rights issues with Income Tax 80d Deduction Limit?

- Some printables may come with restrictions on use. Be sure to review the terms of service and conditions provided by the creator.

-

How do I print printables for free?

- Print them at home with printing equipment or visit a local print shop to purchase premium prints.

-

What software do I require to open printables for free?

- Many printables are offered in PDF format. They can be opened with free software like Adobe Reader.

IndiaNivesh Section 80 Deductions Income Tax Deductions Under

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

Check more sample of Income Tax 80d Deduction Limit below

80D DEDUCTION FOR AY2020 21 HEALTH INSURANCE DEDUCTION 80D INCOME TAX

Health Insurance Sec 80D Tax Deduction FY 2020 21 AY 2021 22

Preventive Check Up 80d Wkcn

Deduction U s 80C 80CCC 80CCD 80D Income Tax 80c

Section 80d Preventive Health Check Up Tax Deduction The Gray Tower

Deduction Of Health Insurance Premium Medical Expenses U s 80D Of

https://tax2win.in/guide/section-80d-ded…

Under Section 80DDB the maximum deduction is Rs 1 lakh per dependent Explore Section 80D of the Income Tax Act to understand deductions available for medical and health insurance premiums Learn about eligibility

https://www.etmoney.com/learn/income …

What is the limit of deduction under section 80D of Income Tax You can claim a deduction of up to Rs 25 000 for medical insurance premiums for yourself your spouse and your children If you are paying your parents

Under Section 80DDB the maximum deduction is Rs 1 lakh per dependent Explore Section 80D of the Income Tax Act to understand deductions available for medical and health insurance premiums Learn about eligibility

What is the limit of deduction under section 80D of Income Tax You can claim a deduction of up to Rs 25 000 for medical insurance premiums for yourself your spouse and your children If you are paying your parents

Deduction U s 80C 80CCC 80CCD 80D Income Tax 80c

Health Insurance Sec 80D Tax Deduction FY 2020 21 AY 2021 22

Section 80d Preventive Health Check Up Tax Deduction The Gray Tower

Deduction Of Health Insurance Premium Medical Expenses U s 80D Of

Section 80D Deduction For Medical Insurance Health Checkups 2019

Section 80d Preventive Health Check Up Tax Deduction The Gray Tower

Section 80d Preventive Health Check Up Tax Deduction The Gray Tower

Section 80D Deduction Eligibility And Limit September 2023 TNIE