In this age of electronic devices, with screens dominating our lives The appeal of tangible printed products hasn't decreased. It doesn't matter if it's for educational reasons in creative or artistic projects, or simply adding the personal touch to your area, Interest On Home Loan Tax Rebate have become a valuable source. This article will take a dive into the world "Interest On Home Loan Tax Rebate," exploring the benefits of them, where they can be found, and the ways that they can benefit different aspects of your daily life.

Get Latest Interest On Home Loan Tax Rebate Below

Interest On Home Loan Tax Rebate

Interest On Home Loan Tax Rebate - Interest On Home Loan Tax Rebate, Interest On Housing Loan Tax Rebate, Interest On Home Loan Tax Deduction, Interest On Home Loan Tax Deduction Section, Interest On Home Loan Tax Deduction Malaysia, Interest On Home Loan Deduction Taxguru, Interest Paid On Home Loan Tax Deduction, Interest On Home Loan In Income Tax Return, Interest Paid On Housing Loan Tax Exemption Section, Interest On Housing Loan For Tax Exemption Under Construction

Web 4 janv 2023 nbsp 0183 32 Standard deduction rates are as follows Single taxpayers and married taxpayers who file separate returns 12 950 for tax year 2022 Married taxpayers who

Web 28 mars 2017 nbsp 0183 32 The interest portion of the EMI paid for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

Printables for free cover a broad collection of printable resources available online for download at no cost. They are available in a variety of designs, including worksheets coloring pages, templates and many more. The appealingness of Interest On Home Loan Tax Rebate is in their variety and accessibility.

More of Interest On Home Loan Tax Rebate

Lowest Interest Rates On Home Loans Under Rs 30 Lakh Here s What 15

Lowest Interest Rates On Home Loans Under Rs 30 Lakh Here s What 15

Web 5 janv 2023 nbsp 0183 32 The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750 000 of mortgage debt Homeowners who bought houses before December 16 2017 can deduct

Web If your taxable income in 2021 exceeds 68 507 69 398 in 2022 it s important to note that you can offset the deductible mortgage interest at a maximum rate of 43 in 2021

The Interest On Home Loan Tax Rebate have gained huge popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or expensive software.

-

Individualization The Customization feature lets you tailor print-ready templates to your specific requirements when it comes to designing invitations or arranging your schedule or even decorating your home.

-

Educational value: Downloads of educational content for free provide for students of all ages. This makes them a valuable instrument for parents and teachers.

-

Accessibility: Instant access to a myriad of designs as well as templates helps save time and effort.

Where to Find more Interest On Home Loan Tax Rebate

What Are Reuluations About Getting A Home Loan On A Forclosed Home

What Are Reuluations About Getting A Home Loan On A Forclosed Home

Web 5 sept 2023 nbsp 0183 32 Under Section 80EEA of the Income Tax Act in India first time homebuyers investing in affordable property with the help of a home loans get Rs 1 50 lakh income

Web Most homeowners can deduct all of their mortgage interest The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on

After we've peaked your curiosity about Interest On Home Loan Tax Rebate Let's see where you can locate these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of printables that are free for a variety of reasons.

- Explore categories such as interior decor, education, organizing, and crafts.

2. Educational Platforms

- Forums and educational websites often provide worksheets that can be printed for free along with flashcards, as well as other learning materials.

- It is ideal for teachers, parents and students looking for additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs or templates for download.

- These blogs cover a wide spectrum of interests, from DIY projects to party planning.

Maximizing Interest On Home Loan Tax Rebate

Here are some unique ways that you can make use of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes or even seasonal decorations to decorate your living areas.

2. Education

- Use free printable worksheets to enhance your learning at home also in the classes.

3. Event Planning

- Design invitations and banners and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable calendars, to-do lists, and meal planners.

Conclusion

Interest On Home Loan Tax Rebate are a treasure trove of fun and practical tools that cater to various needs and interests. Their accessibility and versatility make these printables a useful addition to both professional and personal lives. Explore the plethora of Interest On Home Loan Tax Rebate today to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free gratis?

- Yes, they are! You can download and print these items for free.

-

Can I use free printables in commercial projects?

- It's all dependent on the conditions of use. Always consult the author's guidelines prior to utilizing the templates for commercial projects.

-

Do you have any copyright concerns when using Interest On Home Loan Tax Rebate?

- Some printables could have limitations regarding usage. Make sure you read the conditions and terms of use provided by the creator.

-

How do I print Interest On Home Loan Tax Rebate?

- Print them at home with your printer or visit a local print shop to purchase premium prints.

-

What program will I need to access printables at no cost?

- The majority are printed in the PDF format, and is open with no cost software like Adobe Reader.

Latest Income Tax Exemptions FY 2017 18 AY 2018 19 Tax Deductions

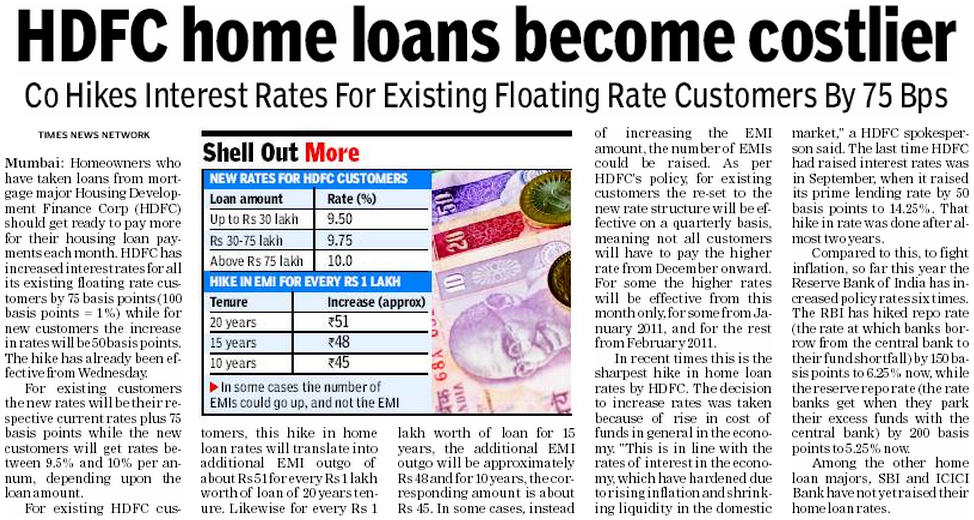

Housing Loan Interest Rates HDFC Home Loan Interest Rates Housing

Check more sample of Interest On Home Loan Tax Rebate below

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated

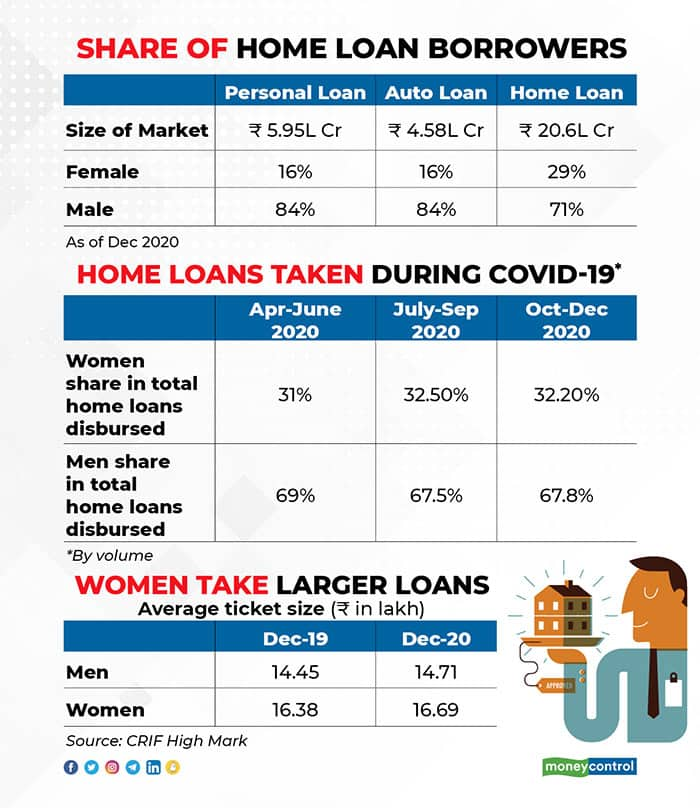

How Women Can Make The Most Of Lower Rates On Home Loans And Stamp Duties

Housing Loan Interest Rate Cumants

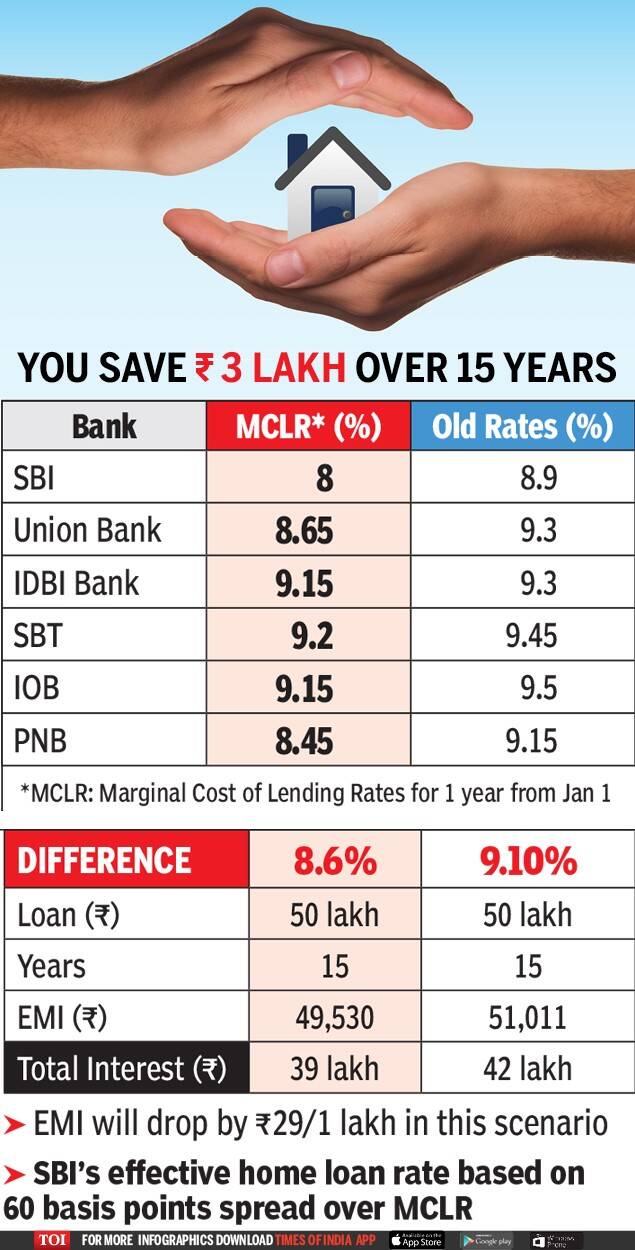

Home Loan To Become Cheapest In 6 Years As SBI Other Banks Slash Rates

Home Loan Interest Exemption In Income Tax Home Sweet Home

https://cleartax.in/s/home-loan-tax-benefit

Web 28 mars 2017 nbsp 0183 32 The interest portion of the EMI paid for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

https://cred.club/calculators/articles/how-to-calculate-home-loan-tax...

Web under Section 24 of the Income Tax Act you can claim a maximum tax rebate of up to 2 lakh on the interest payable on your home loan however note that these deductions

Web 28 mars 2017 nbsp 0183 32 The interest portion of the EMI paid for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

Web under Section 24 of the Income Tax Act you can claim a maximum tax rebate of up to 2 lakh on the interest payable on your home loan however note that these deductions

Housing Loan Interest Rate Cumants

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated

Home Loan To Become Cheapest In 6 Years As SBI Other Banks Slash Rates

Home Loan Interest Exemption In Income Tax Home Sweet Home

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

Income Tax Exemption Calculator For Interest Paid On Housing Loan With

Income Tax Exemption Calculator For Interest Paid On Housing Loan With

Where To Get A Car Loan