In the age of digital, when screens dominate our lives yet the appeal of tangible, printed materials hasn't diminished. It doesn't matter if it's for educational reasons or creative projects, or simply to add personal touches to your area, Income Tax Deduction U S 10 13a are a great resource. For this piece, we'll dive into the sphere of "Income Tax Deduction U S 10 13a," exploring their purpose, where they are available, and ways they can help you improve many aspects of your lives.

What Are Income Tax Deduction U S 10 13a?

The Income Tax Deduction U S 10 13a are a huge range of downloadable, printable items that are available online at no cost. They come in many forms, including worksheets, templates, coloring pages and much more. The beauty of Income Tax Deduction U S 10 13a is their versatility and accessibility.

Income Tax Deduction U S 10 13a

Income Tax Deduction U S 10 13a

Income Tax Deduction U S 10 13a - Income Tax Deduction U/s 10(13a), Hra Deduction U/s 10(13a) Of Income Tax Act 1961, Income Tax Rules U/s 10(13a), Income Tax Rules Section 10(13a), What Is Section 10 13a In Income Tax, What Is Section 10(13a) Of Income Tax Act

[desc-5]

[desc-1]

Farm House Is Part Of Agricultural Land And Eligible For Deduction U s

Farm House Is Part Of Agricultural Land And Eligible For Deduction U s

[desc-4]

[desc-6]

Standard Deduction For Salary Ay 2021 22 Standard Deduction 2021

Standard Deduction For Salary Ay 2021 22 Standard Deduction 2021

[desc-9]

[desc-7]

Automated Income Tax Arrears Relief Calculator U s 89 1 With Form 10E

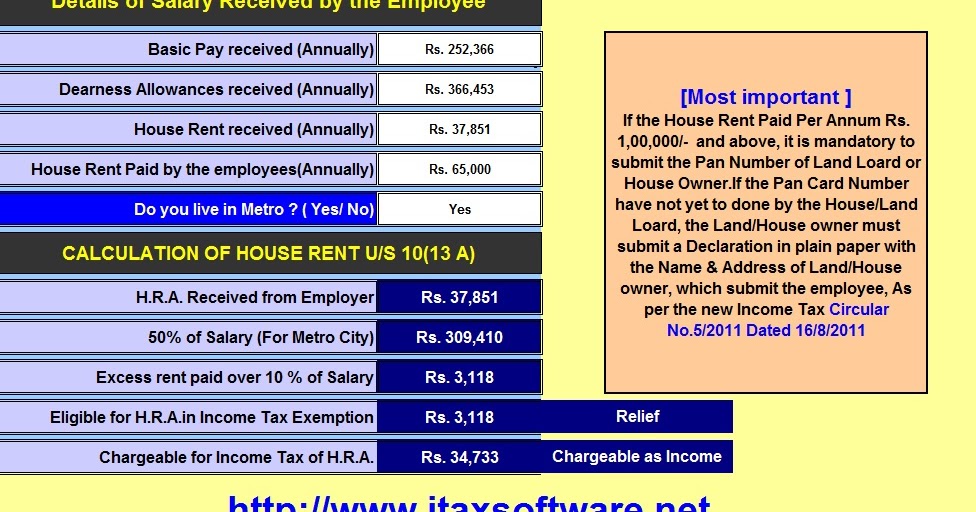

Error Exemption Of HRA U s 10 13a Shall Not Be More Than Minimum Of

SEBI Notifies Norms For Alternative Investment Fund Under SEBI

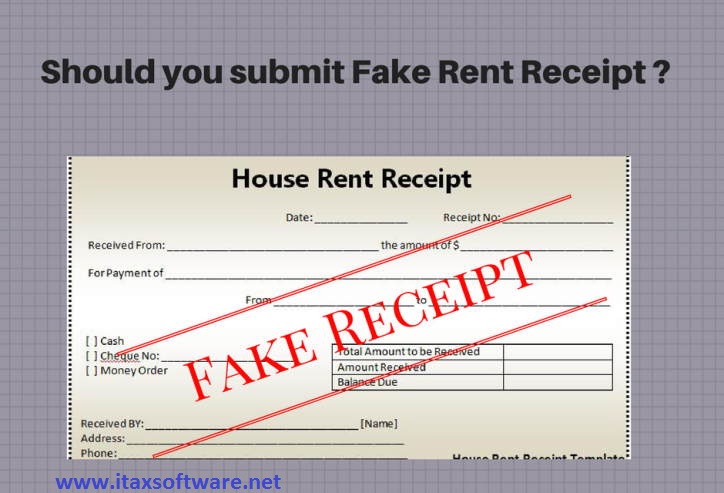

Be Aware Before Submit Fake Rent Receipts At Your Office To Claim HRA

TDS Certificate Form16 Form 16A

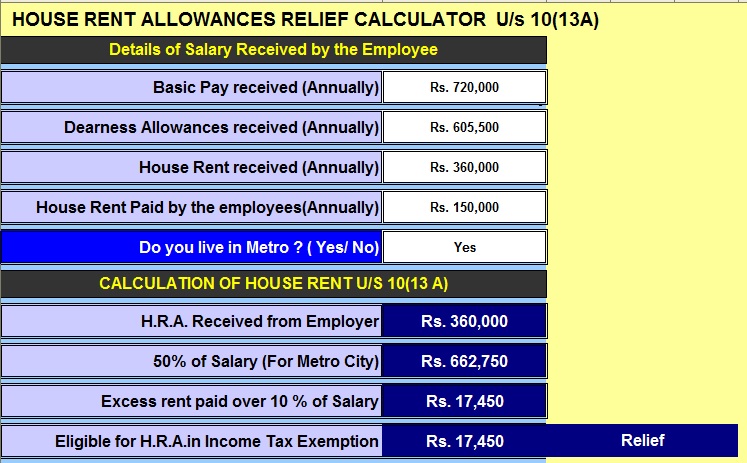

Specific Conditions For Salary Individuals To Claim HRA U S 10 13A

Specific Conditions For Salary Individuals To Claim HRA U S 10 13A

Rent Paid To Wife Eligible For HRA Deduction U s 10 13A Of Income Tax