In a world in which screens are the norm yet the appeal of tangible printed objects isn't diminished. Whatever the reason, whether for education such as creative projects or just adding personal touches to your area, Income Tax Deductions For Salaried Employees Pdf are a great resource. This article will dive into the sphere of "Income Tax Deductions For Salaried Employees Pdf," exploring the different types of printables, where you can find them, and the ways that they can benefit different aspects of your life.

Get Latest Income Tax Deductions For Salaried Employees Pdf Below

Income Tax Deductions For Salaried Employees Pdf

Income Tax Deductions For Salaried Employees Pdf - Income Tax Deductions For Salaried Employees Pdf, Income Tax Deduction Rules For Salaried Employees Pdf, Income Tax Deductions For Salaried Employees, Income Tax Deductions For Salaried Employees Calculator, Income Tax Benefits For Salaried Employees, Income Tax Deductions For Salaried Employees Slab

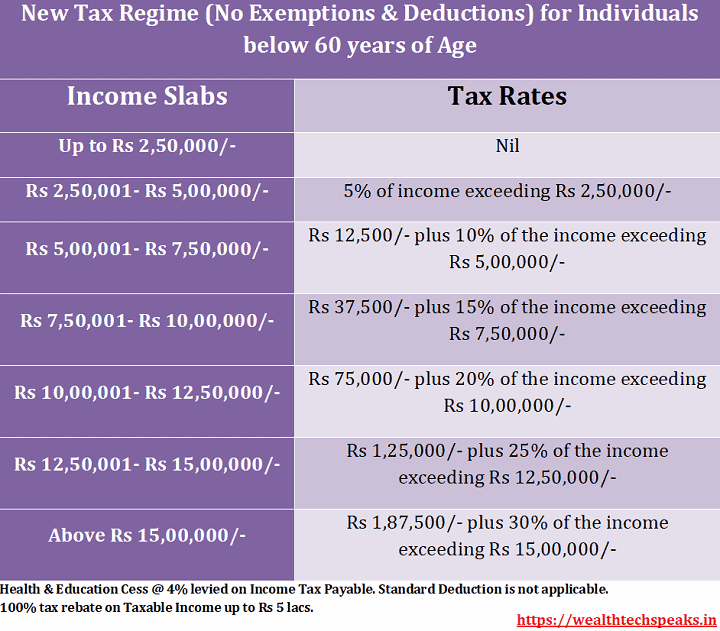

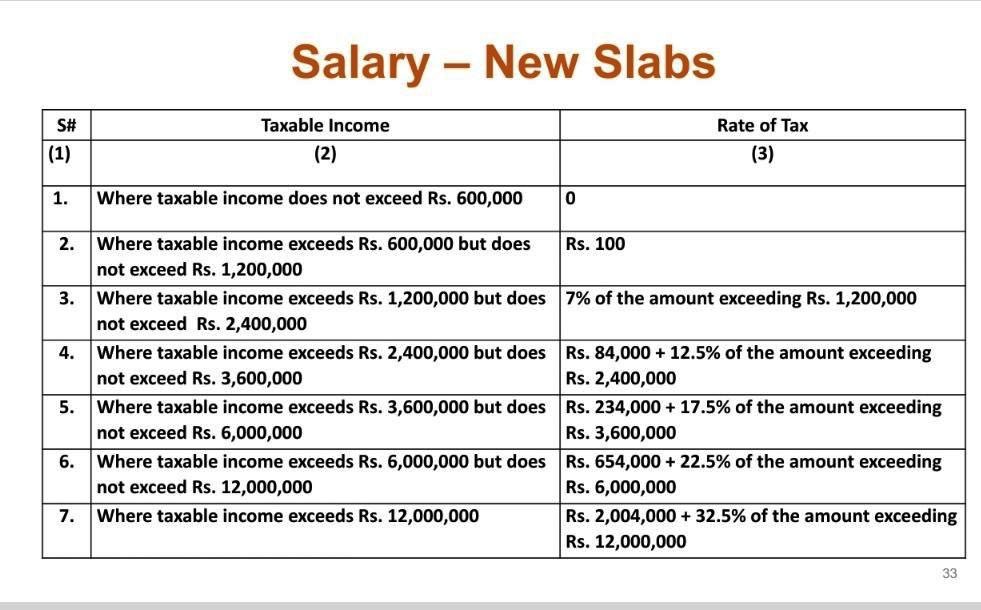

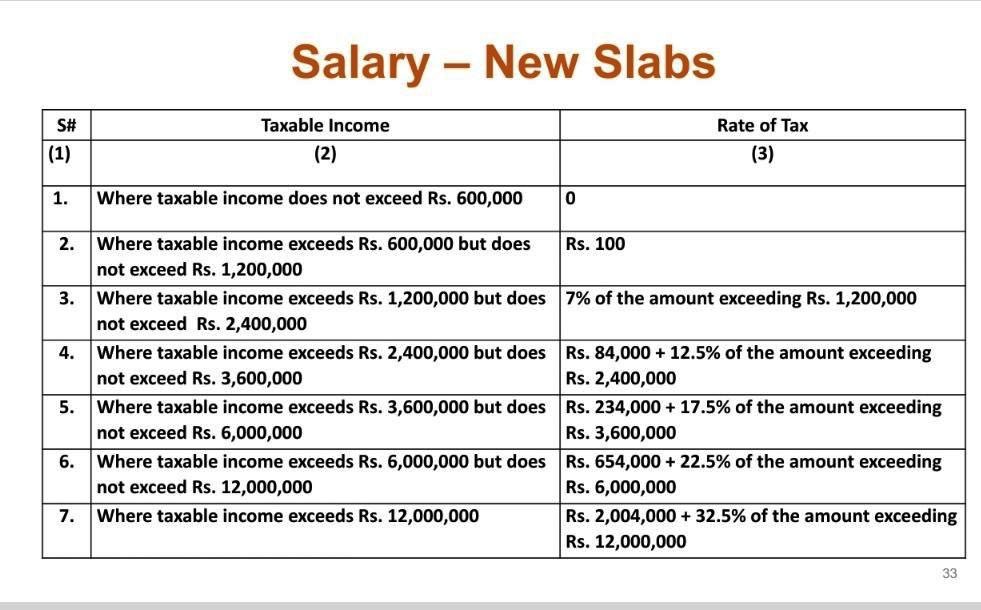

Salaried taxpayers earn income from salary Taxes are determined by employers and deducted at source Employees can structure their salary with tax exempt components New tax regime removes many exemptions Employees can claim various tax benefits and deductions by providing proofs Employers offer standard deductions and

Salaried employees have significant income tax deduction opportunities Major deductions include HRA standard deduction LTA books and periodicals and gratuity Other savings avenues include section 80C for investments section 80D for medical expenses section 24 for home loan interest and section 80E for education loan

Income Tax Deductions For Salaried Employees Pdf cover a large selection of printable and downloadable documents that can be downloaded online at no cost. They come in many types, such as worksheets templates, coloring pages, and much more. The appeal of printables for free is their versatility and accessibility.

More of Income Tax Deductions For Salaried Employees Pdf

Income Tax Deductions For Salaried Employees Blog By Tickertape

Income Tax Deductions For Salaried Employees Blog By Tickertape

Form 10E User Manual 1 Overview The total Income Tax liability is calculated on the total income earned during a particular Financial Year However if the income for the particular Financial Year includes an advance or arrear payment in the nature of salary the Income Tax Act allows relief u s 89 for the additional burden of the tax

How to Calculate Income Tax on Salary Generally tax is calculated by multiplying the applicable tax rate with the taxable income Though it seems simple it consists of several steps including calculating gross salary calculating deductions and exemptions calculating tax payable deducting tax already paid etc

The Income Tax Deductions For Salaried Employees Pdf have gained huge popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or expensive software.

-

Modifications: It is possible to tailor designs to suit your personal needs in designing invitations or arranging your schedule or even decorating your house.

-

Educational Worth: Free educational printables provide for students from all ages, making them a vital instrument for parents and teachers.

-

An easy way to access HTML0: The instant accessibility to a variety of designs and templates cuts down on time and efforts.

Where to Find more Income Tax Deductions For Salaried Employees Pdf

Standard Deduction For Salary Ay 2021 22 Standard Deduction 2021

Standard Deduction For Salary Ay 2021 22 Standard Deduction 2021

Format of Declaration to be taken from Salaried Employee by Employer to deduct TDS in Old or New IT Slab Rates The Finance Act 2020 has introduced new section 115BAC as per this provision the assessee has an option whether to pay tax as per new slab rates or the old slab rates including employees for Financial Year 2020 21

Understand how to calculate income tax on your salary with this detailed guide Includes step by step instructions and examples to help you accurately determine your tax liability

We've now piqued your interest in Income Tax Deductions For Salaried Employees Pdf Let's take a look at where you can locate these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of Income Tax Deductions For Salaried Employees Pdf suitable for many motives.

- Explore categories such as decoration for your home, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing for flashcards, lessons, and worksheets. tools.

- Ideal for teachers, parents as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs as well as templates for free.

- These blogs cover a broad spectrum of interests, all the way from DIY projects to planning a party.

Maximizing Income Tax Deductions For Salaried Employees Pdf

Here are some new ways that you can make use use of printables for free:

1. Home Decor

- Print and frame stunning art, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Use free printable worksheets to reinforce learning at home also in the classes.

3. Event Planning

- Design invitations for banners, invitations as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Income Tax Deductions For Salaried Employees Pdf are an abundance of innovative and useful resources for a variety of needs and preferences. Their availability and versatility make them an essential part of your professional and personal life. Explore the vast collection of Income Tax Deductions For Salaried Employees Pdf to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually gratis?

- Yes you can! You can print and download these files for free.

-

Can I download free printouts for commercial usage?

- It's contingent upon the specific terms of use. Always check the creator's guidelines before using their printables for commercial projects.

-

Do you have any copyright concerns when using Income Tax Deductions For Salaried Employees Pdf?

- Certain printables may be subject to restrictions on use. Be sure to check the conditions and terms of use provided by the designer.

-

How do I print printables for free?

- Print them at home with any printer or head to any local print store for top quality prints.

-

What software do I need to open printables that are free?

- A majority of printed materials are in PDF format. They is open with no cost software such as Adobe Reader.

Top Beneficial Income Tax Deductions For Salaried Individuals For F Y

How To File Income Tax Return Online For Salaried Employees 2022 2023

Check more sample of Income Tax Deductions For Salaried Employees Pdf below

Online Salary Tax Calculator MckenzyJoani

Income Tax Calculator For Salaried INVOMERT

Income Tax Slabs Rates Financial Year 2022 23 WealthTech Speaks

Income Tax Slabs Year 2022 23 Info Ghar Educational News

Standard Deduction 2020 Self Employed Standard Deduction 2021

Top 10 Income Tax Deductions For Salaried Individuals

https://cleartax.in/s/income-tax-allowances-and-deductions

Salaried employees have significant income tax deduction opportunities Major deductions include HRA standard deduction LTA books and periodicals and gratuity Other savings avenues include section 80C for investments section 80D for medical expenses section 24 for home loan interest and section 80E for education loan

https://moneyexcel.com/download-income-tax...

An Income Tax Calculator is a Microsoft Excel based utility designed to estimate the tax liability of salaried individuals based on their income It makes the complicated tax calculation process easier giving users precise numbers quickly

Salaried employees have significant income tax deduction opportunities Major deductions include HRA standard deduction LTA books and periodicals and gratuity Other savings avenues include section 80C for investments section 80D for medical expenses section 24 for home loan interest and section 80E for education loan

An Income Tax Calculator is a Microsoft Excel based utility designed to estimate the tax liability of salaried individuals based on their income It makes the complicated tax calculation process easier giving users precise numbers quickly

Income Tax Slabs Year 2022 23 Info Ghar Educational News

Income Tax Calculator For Salaried INVOMERT

Standard Deduction 2020 Self Employed Standard Deduction 2021

Top 10 Income Tax Deductions For Salaried Individuals

Income Tax Deductions For Ay 2023 24

List Of Allowances Perquisites Deductions Available To Salaried Persons

List Of Allowances Perquisites Deductions Available To Salaried Persons

Section Wise Income Tax Deductions For AY 2022 23 FY 2021 22