In the digital age, where screens rule our lives yet the appeal of tangible printed materials hasn't faded away. Be it for educational use and creative work, or simply adding an extra personal touch to your space, Income Tax Rebate And Exemption have proven to be a valuable source. We'll take a dive into the world "Income Tax Rebate And Exemption," exploring their purpose, where to find them, and how they can be used to enhance different aspects of your life.

Get Latest Income Tax Rebate And Exemption Below

Income Tax Rebate And Exemption

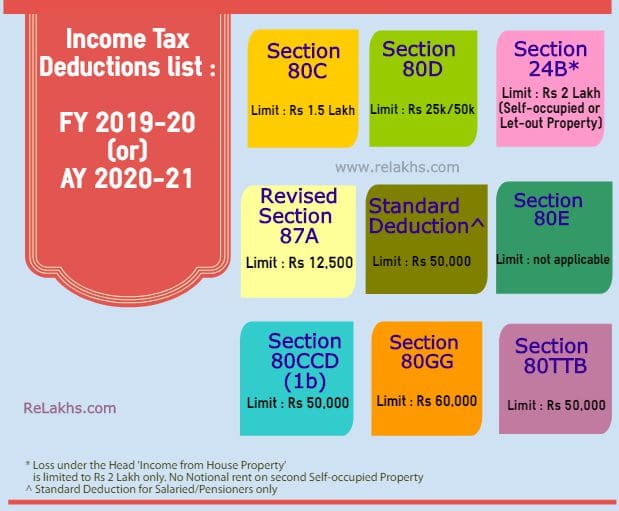

Income Tax Rebate And Exemption - Income Tax Rebate And Exemption, Income Tax Deductions And Exemptions, Income Tax Deductions And Exemptions Pdf, Income Tax Deduction And Exemption List, Income Tax Rebate And Relief, Income Tax Deductions And Exemptions For Fy 2022-23, Us Income Tax Deductions And Exemptions, Massachusetts Income Tax Deductions And Exemptions, Income Tax (allowances Deductions And Exemptions) Rules 1992, Income Tax Slabs Deductions And Exemptions Ay 2020-21

Web Exemptions and deductions both reduce the taxable income and are allowed concession before the taxes are paid while rebates reduce the tax and are offered after taxes are filed Exemption The word exempt

Web Income tax rebate is like the final bargain that you can claim from your taxable income after you have claimed exemptions and deductions Tax rebate under Section 87A of the Income Tax Act is the final reduction

Printables for free include a vast variety of printable, downloadable materials online, at no cost. These resources come in various styles, from worksheets to coloring pages, templates and much more. The value of Income Tax Rebate And Exemption is their versatility and accessibility.

More of Income Tax Rebate And Exemption

Difference Between Income Tax Slabs 2019 20 And 2020 21 Gservants

Difference Between Income Tax Slabs 2019 20 And 2020 21 Gservants

Web 24 f 233 vr 2023 nbsp 0183 32 Difference between tax exemption tax deduction and rebate One can claim income tax deductions and tax exemptions from their income However one can claim

Web 10 f 233 vr 2023 nbsp 0183 32 Tax exemptions are to be claimed only from a specific source of income and not from the total income For example exemptions under the salary head are not

The Income Tax Rebate And Exemption have gained huge popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or expensive software.

-

Flexible: It is possible to tailor printables to your specific needs such as designing invitations or arranging your schedule or even decorating your house.

-

Educational Impact: These Income Tax Rebate And Exemption offer a wide range of educational content for learners of all ages, which makes them a useful aid for parents as well as educators.

-

Convenience: Access to an array of designs and templates, which saves time as well as effort.

Where to Find more Income Tax Rebate And Exemption

Major Exemptions Deductions Availed By Taxpayers In India

Major Exemptions Deductions Availed By Taxpayers In India

Web 1 f 233 vr 2023 nbsp 0183 32 Income tax exemption as the word exemption suggests simply means that no tax needs to be paid Presently the government exempts income of up to Rs 2 5 Lakh per annum It basically means

Web Corporate Income Tax Rate Rebates amp Tax Exemption Schemes On this page Corporate Income Tax Rate Corporate Income Tax Rebates Corporate Income Tax Rate Your

Now that we've piqued your curiosity about Income Tax Rebate And Exemption Let's look into where you can get these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of Income Tax Rebate And Exemption to suit a variety of objectives.

- Explore categories like home decor, education, the arts, and more.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing Flashcards, worksheets, and other educational materials.

- It is ideal for teachers, parents, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for no cost.

- These blogs cover a broad variety of topics, all the way from DIY projects to planning a party.

Maximizing Income Tax Rebate And Exemption

Here are some creative ways ensure you get the very most of printables for free:

1. Home Decor

- Print and frame beautiful images, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Utilize free printable worksheets for reinforcement of learning at home or in the classroom.

3. Event Planning

- Designs invitations, banners as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized with printable planners or to-do lists. meal planners.

Conclusion

Income Tax Rebate And Exemption are an abundance of useful and creative resources that meet a variety of needs and preferences. Their accessibility and flexibility make them an essential part of both personal and professional life. Explore the vast array of Income Tax Rebate And Exemption to unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really free?

- Yes you can! You can download and print these free resources for no cost.

-

Can I use the free printables to make commercial products?

- It's based on the terms of use. Be sure to read the rules of the creator before using any printables on commercial projects.

-

Do you have any copyright issues when you download Income Tax Rebate And Exemption?

- Certain printables might have limitations on usage. Make sure you read the terms and condition of use as provided by the creator.

-

How do I print Income Tax Rebate And Exemption?

- Print them at home using the printer, or go to the local print shops for top quality prints.

-

What software will I need to access printables free of charge?

- Many printables are offered in PDF format, which can be opened with free software, such as Adobe Reader.

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

2022 Deductions List Name List 2022

Check more sample of Income Tax Rebate And Exemption below

What Is Difference Between Tax Rebate And Tax Exemption Quora

Tax Rebate For Individual Deductions For Individuals reliefs

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

Tax Rebate U s 87A Income Tax Exemption Guide Deduction Sections For

How To Choose Between The New And Old Income Tax Regimes Chandan

First Time Home Buyer Tax Questions

https://www.etmoney.com/blog/difference-bet…

Web Income tax rebate is like the final bargain that you can claim from your taxable income after you have claimed exemptions and deductions Tax rebate under Section 87A of the Income Tax Act is the final reduction

https://www.tomorrowmakers.com/tax-plannin…

Web 1 f 233 vr 2023 nbsp 0183 32 How much tax deduction can you get in the current financial year Do you need clarification on the difference between a tax rebate and a tax exemption Are pension gratuity LTA HRA and tax exempted

Web Income tax rebate is like the final bargain that you can claim from your taxable income after you have claimed exemptions and deductions Tax rebate under Section 87A of the Income Tax Act is the final reduction

Web 1 f 233 vr 2023 nbsp 0183 32 How much tax deduction can you get in the current financial year Do you need clarification on the difference between a tax rebate and a tax exemption Are pension gratuity LTA HRA and tax exempted

Tax Rebate U s 87A Income Tax Exemption Guide Deduction Sections For

Tax Rebate For Individual Deductions For Individuals reliefs

How To Choose Between The New And Old Income Tax Regimes Chandan

First Time Home Buyer Tax Questions

Income Tax Slab For Women Exemption And Rebates

Comparison Of New Income Tax Regime With Old Tax Regime The Economic

Comparison Of New Income Tax Regime With Old Tax Regime The Economic

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog