In this age of technology, where screens rule our lives, the charm of tangible printed objects isn't diminished. Be it for educational use such as creative projects or simply to add some personal flair to your home, printables for free have become an invaluable source. The following article is a dive in the world of "Income Tax Rebate Interest On House Building Loan," exploring what they are, how they are available, and how they can be used to enhance different aspects of your life.

Get Latest Income Tax Rebate Interest On House Building Loan Below

Income Tax Rebate Interest On House Building Loan

Income Tax Rebate Interest On House Building Loan - Income Tax Rebate+interest On House Building Loan, What Is Interest Rebate On Housing Loan, How Much Interest Rebate On Home Loan, Income Tax Relief On House Building Loan, Can You Claim Interest On Home Loan, Maximum Rebate On Home Loan Interest

Web Income tax rebate on home loan Tax deductions Homebuyers in India may deduct up to Rs 1 5 lakhs in principal payments under Section 80C and up to Rs 2 million in interest

Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

Printables for free include a vast range of downloadable, printable items that are available online at no cost. These resources come in various designs, including worksheets templates, coloring pages and much more. The benefit of Income Tax Rebate Interest On House Building Loan is their versatility and accessibility.

More of Income Tax Rebate Interest On House Building Loan

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated

Web 4 ao 251 t 2021 nbsp 0183 32 This means that you get to claim an additional deduction of Rs 44 000 in Prior Period Interest during the next 5 financial years i e 2023 24 2024 25 2025 26 2026

Web under Section 24 of the Income Tax Act you can claim a maximum tax rebate of up to 2 lakh on the interest payable on your home loan however note that these deductions

Income Tax Rebate Interest On House Building Loan have risen to immense recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

customization: You can tailor print-ready templates to your specific requirements whether you're designing invitations or arranging your schedule or even decorating your house.

-

Educational Worth: These Income Tax Rebate Interest On House Building Loan can be used by students from all ages, making them an essential aid for parents as well as educators.

-

Simple: immediate access an array of designs and templates cuts down on time and efforts.

Where to Find more Income Tax Rebate Interest On House Building Loan

Home Loan Interest Exemption In Income Tax Home Sweet Home

Home Loan Interest Exemption In Income Tax Home Sweet Home

Web 31 mai 2022 nbsp 0183 32 You can claim tax benefits on a home loan when filing your income tax returns ITR or when submitting the home loan interest certificate to your employer The process to claim housing loan tax

Web 11 janv 2023 nbsp 0183 32 On purchase of property with home loans borrowers enjoy a variety of deductions on their income tax liability These deductions against the tax could be claimed under four sections of the income tax

Now that we've piqued your interest in printables for free Let's find out where the hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of printables that are free for a variety of purposes.

- Explore categories like decorating your home, education, craft, and organization.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free or flashcards as well as learning tools.

- Ideal for teachers, parents and students looking for extra resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates for free.

- These blogs cover a broad array of topics, ranging that range from DIY projects to party planning.

Maximizing Income Tax Rebate Interest On House Building Loan

Here are some ways in order to maximize the use use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or festive decorations to decorate your living spaces.

2. Education

- Utilize free printable worksheets to reinforce learning at home for the classroom.

3. Event Planning

- Designs invitations, banners and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable calendars as well as to-do lists and meal planners.

Conclusion

Income Tax Rebate Interest On House Building Loan are an abundance of practical and innovative resources that meet a variety of needs and desires. Their accessibility and flexibility make they a beneficial addition to every aspect of your life, both professional and personal. Explore the vast collection of Income Tax Rebate Interest On House Building Loan right now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really are they free?

- Yes you can! You can download and print these materials for free.

-

Are there any free printing templates for commercial purposes?

- It's based on specific terms of use. Always verify the guidelines of the creator before utilizing printables for commercial projects.

-

Do you have any copyright issues in Income Tax Rebate Interest On House Building Loan?

- Certain printables could be restricted regarding their use. Check the terms and conditions offered by the creator.

-

How do I print printables for free?

- Print them at home using your printer or visit the local print shop for premium prints.

-

What program will I need to access printables that are free?

- The majority are printed in the PDF format, and can be opened with free software, such as Adobe Reader.

What Are Reuluations About Getting A Home Loan On A Forclosed Home

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

Check more sample of Income Tax Rebate Interest On House Building Loan below

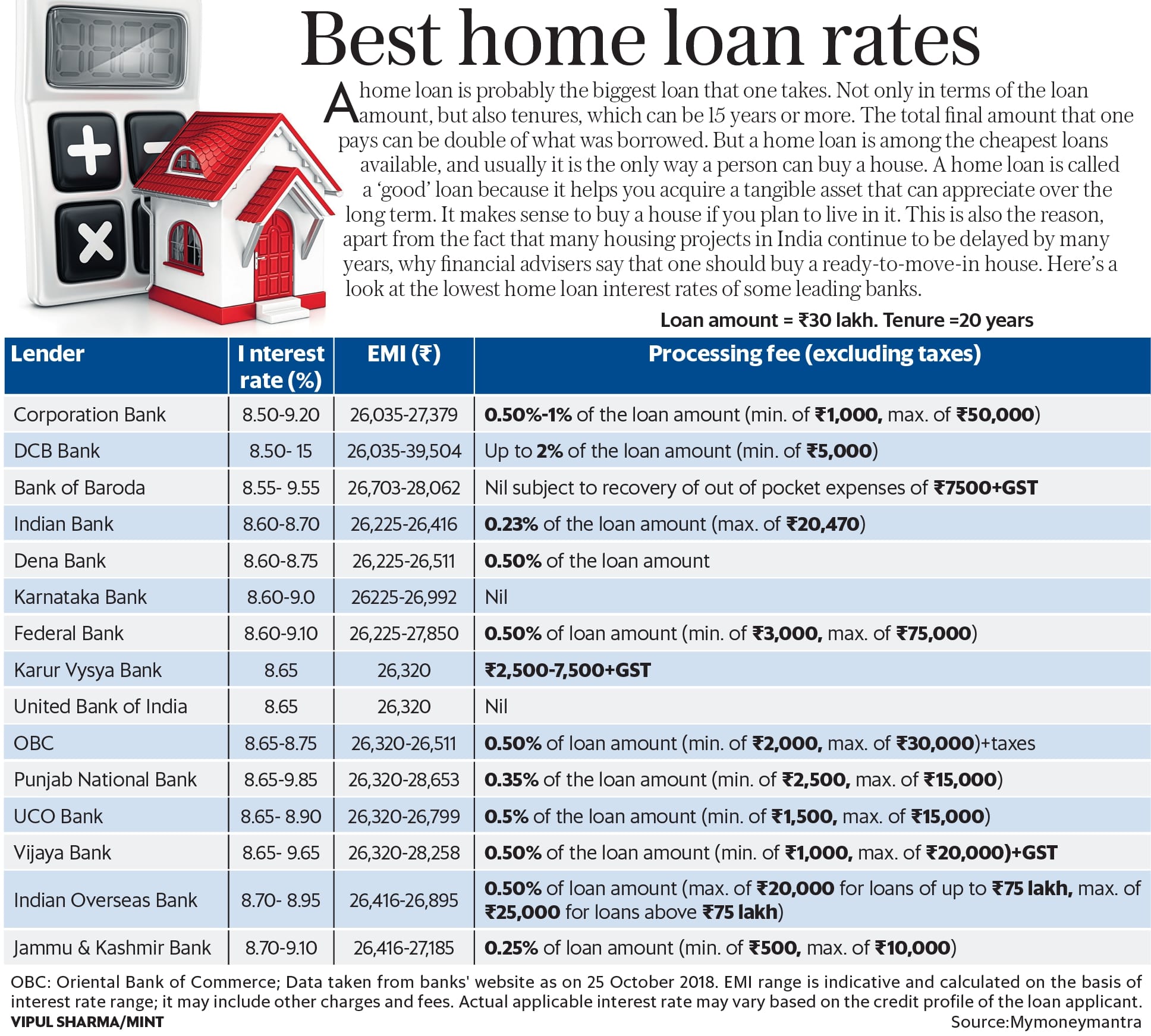

The Best Home Loan Rates Being Offered Right Now Livemint

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

Home Loan Tax Benefits Section 24 80EE 80C 10 Less Known Facts

House Loan Limit In Income Tax Home Sweet Home

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

Form 12BB New Form To Claim Income Tax Benefits Rebate

https://cleartax.in/s/home-loan-tax-benefits

Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

https://money.stackexchange.com/questions/27738

Web 28 janv 2014 nbsp 0183 32 3 Answers Sorted by 1 The rebate is available from the financial year in which you have taken the possession of the property All the interest paid in that

Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

Web 28 janv 2014 nbsp 0183 32 3 Answers Sorted by 1 The rebate is available from the financial year in which you have taken the possession of the property All the interest paid in that

House Loan Limit In Income Tax Home Sweet Home

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

Form 12BB New Form To Claim Income Tax Benefits Rebate

Latest Income Tax Rebate On Home Loan 2023

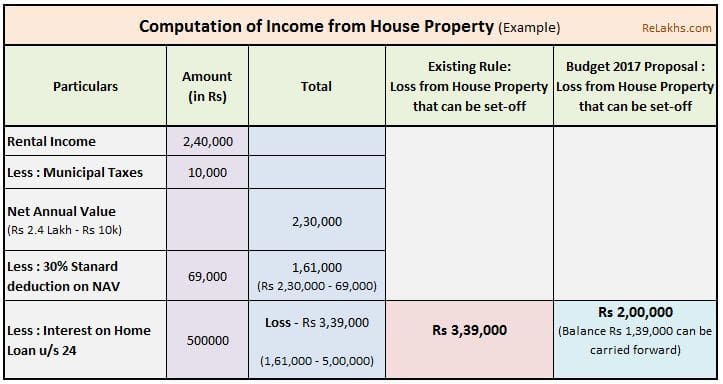

Home Loan Tax Saving Claiming Home Loan Interest Tax Break On Rented

Home Loan Tax Saving Claiming Home Loan Interest Tax Break On Rented

How To Claim Interest On Home Loan Deduction While Efiling ITR