In this age of technology, where screens dominate our lives, the charm of tangible, printed materials hasn't diminished. If it's to aid in education such as creative projects or just adding an individual touch to your home, printables for free are a great resource. Here, we'll take a dive through the vast world of "Income Tax Rebate On Donation To Political Parties," exploring what they are, how they are available, and how they can add value to various aspects of your lives.

Get Latest Income Tax Rebate On Donation To Political Parties Below

Income Tax Rebate On Donation To Political Parties

Income Tax Rebate On Donation To Political Parties - Income Tax Rebate On Donation To Political Parties, Income Tax Deduction For Donation To Political Parties, Income Tax Exemption For Contribution To Political Parties, Tax Rebate On Donation To Political Party, Is Donation To Political Party Tax Deductible In India, Tax Benefit On Donation To Political Party, Are Donations To Political Parties Tax Deductible

Web 12 avr 2023 nbsp 0183 32 Section 80GGC of the Income Tax Act provides tax deductions for contributions made to political parties The amount of deduction that can be claimed depends on the mode of payment If the

Web 17 juil 2019 nbsp 0183 32 Under Section 80GGC any amount contributed to an electoral trust or a registered political party as per Section 29A of the Representation of the People Act

Income Tax Rebate On Donation To Political Parties cover a large range of printable, free material that is available online at no cost. They are available in numerous styles, from worksheets to coloring pages, templates and more. The value of Income Tax Rebate On Donation To Political Parties lies in their versatility and accessibility.

More of Income Tax Rebate On Donation To Political Parties

Donation To Political Parties Claim Tax Deduction Under Section 80GGC

Donation To Political Parties Claim Tax Deduction Under Section 80GGC

Web 28 f 233 vr 2023 nbsp 0183 32 80GGC Chapter VI A Income Tax Tax Benefits Last updated on February 28th 2023 Political donations are a way for individuals to express their support for a

Web Treasurer of political party any person authorised by political party in this behalf has furnished a report of donations received in excess of Rs 20 000 to Election Commission

Printables for free have gained immense popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or costly software.

-

Customization: It is possible to tailor designs to suit your personal needs in designing invitations for your guests, organizing your schedule or even decorating your home.

-

Educational Use: The free educational worksheets provide for students of all ages, making these printables a powerful source for educators and parents.

-

Accessibility: The instant accessibility to numerous designs and templates, which saves time as well as effort.

Where to Find more Income Tax Rebate On Donation To Political Parties

How To Download BJP Donation Receipt Get Your BJP Donation Receipt In

How To Download BJP Donation Receipt Get Your BJP Donation Receipt In

Web 17 d 233 c 2020 nbsp 0183 32 Lorsque les dons sont effectu 233 s au profit d un parti ou d un groupement politique ils ne donnent droit 224 r 233 duction d imp 244 t que dans la limite de 7 500 euros par

Web 10 avr 2023 nbsp 0183 32 In the last 2 weeks of March 2023 the Income Tax department has issued several notices to taxpayers who have claimed deduction under section 80GGB and 80GGC of the Income Tax Act

Now that we've piqued your curiosity about Income Tax Rebate On Donation To Political Parties we'll explore the places the hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection with Income Tax Rebate On Donation To Political Parties for all applications.

- Explore categories such as decoration for your home, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free or flashcards as well as learning materials.

- Ideal for teachers, parents and students in need of additional resources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for no cost.

- These blogs cover a wide range of topics, that includes DIY projects to planning a party.

Maximizing Income Tax Rebate On Donation To Political Parties

Here are some creative ways create the maximum value use of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes or seasonal decorations to adorn your living areas.

2. Education

- Use printable worksheets from the internet to build your knowledge at home and in class.

3. Event Planning

- Invitations, banners and decorations for special events such as weddings or birthdays.

4. Organization

- Be organized by using printable calendars, to-do lists, and meal planners.

Conclusion

Income Tax Rebate On Donation To Political Parties are a treasure trove with useful and creative ideas for a variety of needs and passions. Their access and versatility makes they a beneficial addition to any professional or personal life. Explore the many options of Income Tax Rebate On Donation To Political Parties to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Income Tax Rebate On Donation To Political Parties truly for free?

- Yes you can! You can print and download these documents for free.

-

Can I use free printables for commercial use?

- It is contingent on the specific usage guidelines. Be sure to read the rules of the creator before utilizing their templates for commercial projects.

-

Do you have any copyright concerns when using Income Tax Rebate On Donation To Political Parties?

- Certain printables might have limitations on use. Be sure to read the terms of service and conditions provided by the author.

-

How can I print printables for free?

- You can print them at home with an printer, or go to an in-store print shop to get more high-quality prints.

-

What software do I need to open printables that are free?

- The majority are printed in the format PDF. This can be opened with free programs like Adobe Reader.

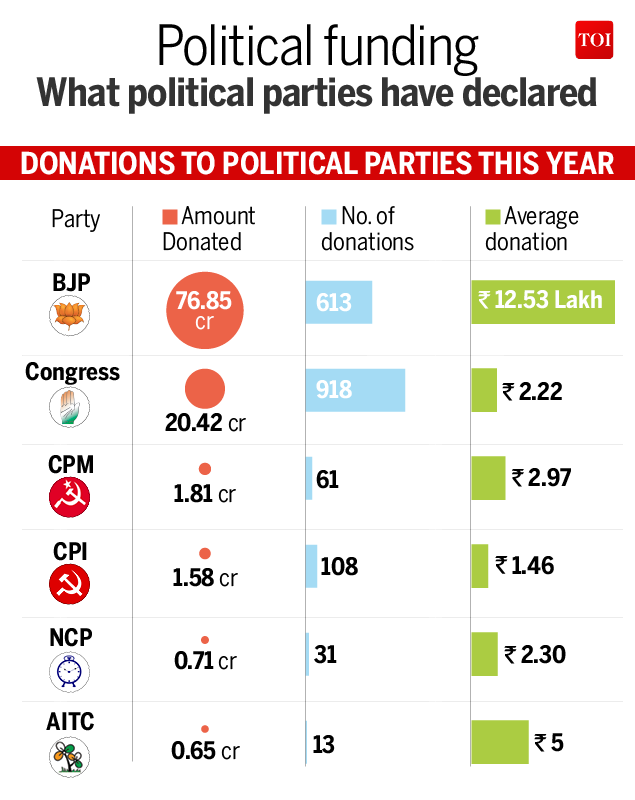

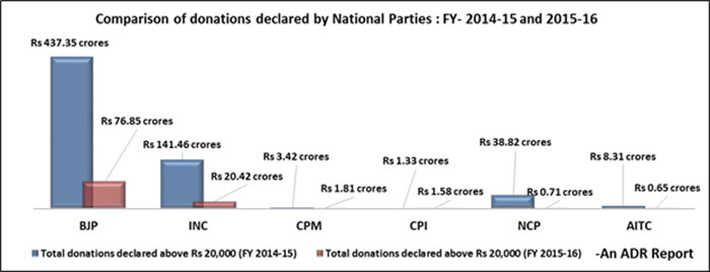

Infographic Political Parties Got Just Rs 102 02 Crore In Donations In

Donations To BJP Far More Than To Other Parties ADR Governance Now

Check more sample of Income Tax Rebate On Donation To Political Parties below

How To Get Maximum Tax Rebate On Donation In USA

Deduction For Donation To Political Party Section 80GGC YouTube

Report On Income And Donations Received By Political Parties

Political Party Contributions

BJP Top Recipient Of Donations To Political Parties In Fiscal 2015 Mint

Donation To Political Party IncomeTax Planning Goes Wrong shorts

https://tax2win.in/guide/section-80ggc

Web 17 juil 2019 nbsp 0183 32 Under Section 80GGC any amount contributed to an electoral trust or a registered political party as per Section 29A of the Representation of the People Act

https://cleartax.in/s/section-80ggc-of-income-tax-act

Web 19 d 233 c 2022 nbsp 0183 32 What is Section 80GGC Section 80GGC provides for tax deductions with respect to donations made by taxpayers towards political parties or any electoral

Web 17 juil 2019 nbsp 0183 32 Under Section 80GGC any amount contributed to an electoral trust or a registered political party as per Section 29A of the Representation of the People Act

Web 19 d 233 c 2022 nbsp 0183 32 What is Section 80GGC Section 80GGC provides for tax deductions with respect to donations made by taxpayers towards political parties or any electoral

Political Party Contributions

Deduction For Donation To Political Party Section 80GGC YouTube

BJP Top Recipient Of Donations To Political Parties In Fiscal 2015 Mint

Donation To Political Party IncomeTax Planning Goes Wrong shorts

Tax Exemption Under Section 80g How To Claim Tax Exemption Under 80g

Tax Rebate Digital Tax Filing Taxes Tax Services

Tax Rebate Digital Tax Filing Taxes Tax Services

Deduction For Donations Given To Political Parties FinancePost