Today, with screens dominating our lives but the value of tangible printed objects isn't diminished. For educational purposes and creative work, or simply adding a personal touch to your space, Income Tax Rebate On Education Loan are now a vital source. For this piece, we'll dive in the world of "Income Tax Rebate On Education Loan," exploring what they are, where they are available, and how they can enhance various aspects of your life.

Get Latest Income Tax Rebate On Education Loan Below

Income Tax Rebate On Education Loan

Income Tax Rebate On Education Loan - Income Tax Rebate On Education Loan, Income Tax Deduction On Education Loan, Income Tax Exemption Education Loan Under Section 80e, Income Tax Credit Student Loan, Can I Get Tax Benefit On Education Loan, Is Education Loan Tax Deductible, Is Education Loan Interest Tax Deductible, Is Education Loan Taxable, Does Education Loan Comes Under 80c

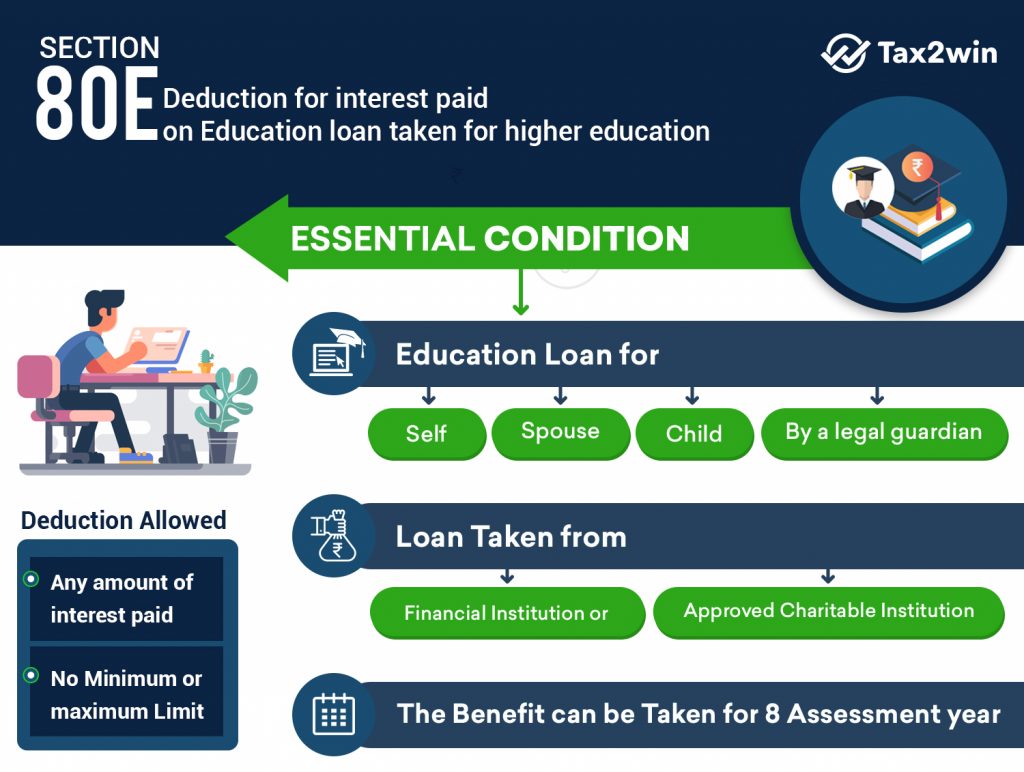

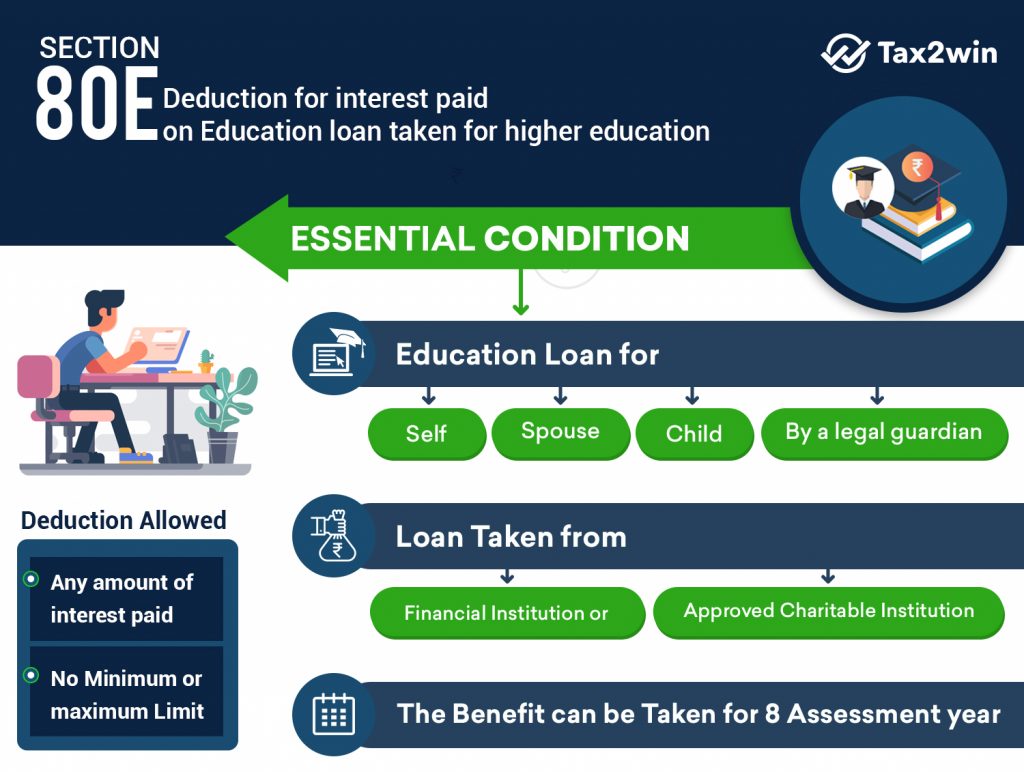

Web 31 mai 2023 nbsp 0183 32 Read about Sec 80E Deduction for ineterst paid on education loan for 8 years Read for eligibility no limit loan period purpose benefit and much more

Web 30 mars 2023 nbsp 0183 32 The Government of India also offers tax deductions of up to Rs 1 50 000 on the principal loan amount of an education loan under Section 80C of income tax law

Income Tax Rebate On Education Loan cover a large variety of printable, downloadable content that can be downloaded from the internet at no cost. These materials come in a variety of types, like worksheets, templates, coloring pages, and many more. The attraction of printables that are free is their flexibility and accessibility.

More of Income Tax Rebate On Education Loan

Section 80E Deduction For Interest On Education Loan Tax2win

Section 80E Deduction For Interest On Education Loan Tax2win

Web If you ve taken an Education Loan and are repaying the same you can always claim deduction under Section 80E of the Income Tax Act for the Repayment of Interest on Education Loan However this deduction is

Web 23 f 233 vr 2018 nbsp 0183 32 According to Section 80E of the Income Tax Act 1961 the interest paid on the education loan can be claimed as deduction This special deduction is also allowed

Print-friendly freebies have gained tremendous popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

Personalization Your HTML0 customization options allow you to customize printables to your specific needs whether it's making invitations and schedules, or even decorating your house.

-

Educational Impact: Downloads of educational content for free provide for students of all ages. This makes them an invaluable tool for teachers and parents.

-

Accessibility: Fast access a myriad of designs as well as templates can save you time and energy.

Where to Find more Income Tax Rebate On Education Loan

Income Tax Deduction On Education Loan 80E CAGMC

Income Tax Deduction On Education Loan 80E CAGMC

Web Total 1 06 776 Entire amount is available as deduction u s 80 E The repayment period for the student borrowed starts one year after the completion starts of the course or six

Web 16 f 233 vr 2021 nbsp 0183 32 16 February 2021 4 mins read Yes a loan for education is one of the easiest and quickest ways to finance higher studies You are eligible for tax benefits on

After we've peaked your interest in printables for free Let's find out where you can find these elusive gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection in Income Tax Rebate On Education Loan for different objectives.

- Explore categories like the home, decor, organizing, and crafts.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free for flashcards, lessons, and worksheets. tools.

- Perfect for teachers, parents and students looking for extra resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates, which are free.

- The blogs are a vast selection of subjects, everything from DIY projects to planning a party.

Maximizing Income Tax Rebate On Education Loan

Here are some innovative ways create the maximum value of printables that are free:

1. Home Decor

- Print and frame beautiful art, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Print out free worksheets and activities to aid in learning at your home also in the classes.

3. Event Planning

- Design invitations, banners, and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Keep track of your schedule with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Income Tax Rebate On Education Loan are a treasure trove of practical and innovative resources that can meet the needs of a variety of people and interest. Their access and versatility makes they a beneficial addition to any professional or personal life. Explore the many options that is Income Tax Rebate On Education Loan today, and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Income Tax Rebate On Education Loan truly absolutely free?

- Yes, they are! You can download and print these items for free.

-

Can I download free printables for commercial purposes?

- It's based on the usage guidelines. Always read the guidelines of the creator prior to printing printables for commercial projects.

-

Are there any copyright issues in printables that are free?

- Some printables could have limitations regarding their use. Be sure to check the terms and conditions offered by the author.

-

How can I print Income Tax Rebate On Education Loan?

- Print them at home using either a printer or go to any local print store for better quality prints.

-

What software will I need to access printables at no cost?

- Most printables come in the format of PDF, which is open with no cost software, such as Adobe Reader.

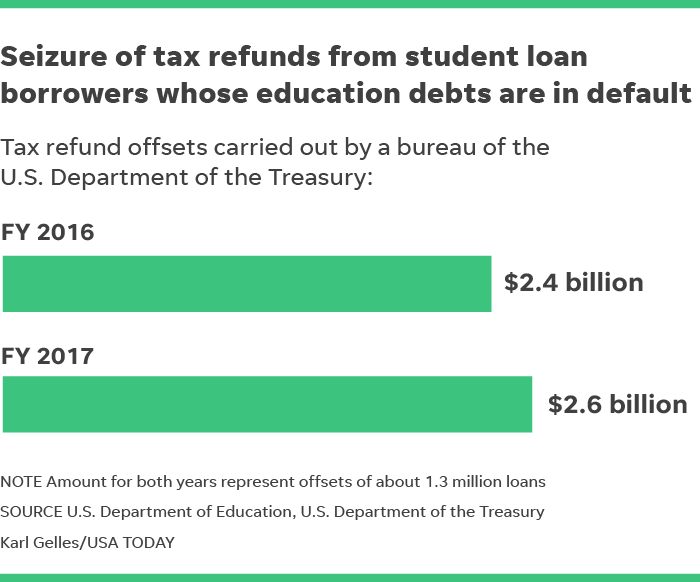

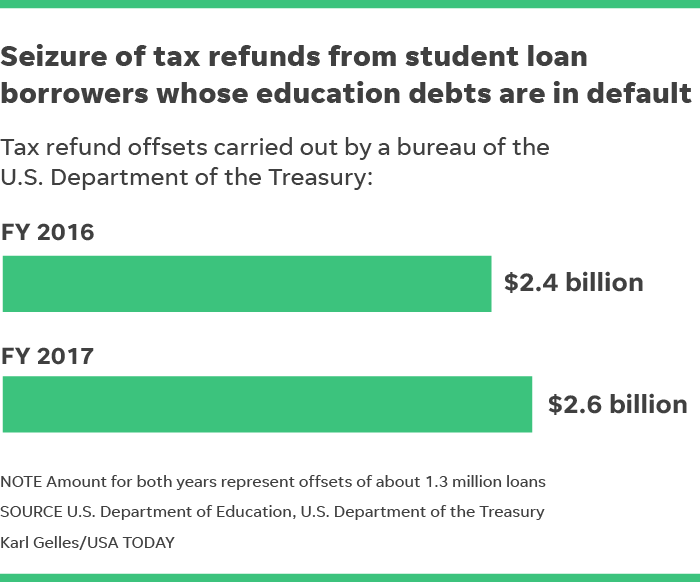

Paying Off Student Loans Don t Forget This 2500 Deduction Frugaling

DEDUCTION UNDER SECTION 80C TO 80U PDF

Check more sample of Income Tax Rebate On Education Loan below

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

Education Rebate Income Tested

Tax Rebate Under Section 87A Investor Guruji Tax Planning

Education Loan Tax Benefits How Education Loan Can Help Your Child

https://cleartax.in/s/tax-benefits-on-education-loan

Web 30 mars 2023 nbsp 0183 32 The Government of India also offers tax deductions of up to Rs 1 50 000 on the principal loan amount of an education loan under Section 80C of income tax law

https://www.etmoney.com/blog/education-loa…

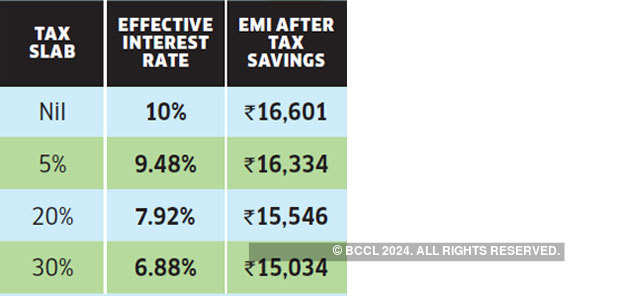

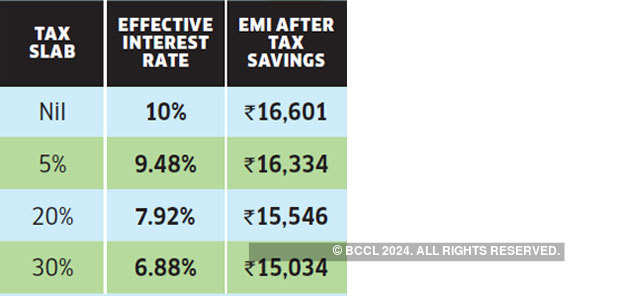

Web Once you avail of an education loan the interest paid which is a component of your EMI on the education loan is allowed as a deduction under Section 80E of the Income Tax Act 1961 This deduction is

Web 30 mars 2023 nbsp 0183 32 The Government of India also offers tax deductions of up to Rs 1 50 000 on the principal loan amount of an education loan under Section 80C of income tax law

Web Once you avail of an education loan the interest paid which is a component of your EMI on the education loan is allowed as a deduction under Section 80E of the Income Tax Act 1961 This deduction is

Tax Rebate Under Section 87A Investor Guruji Tax Planning

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

Education Loan Tax Benefits How Education Loan Can Help Your Child

Individual Income Tax Rebate

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

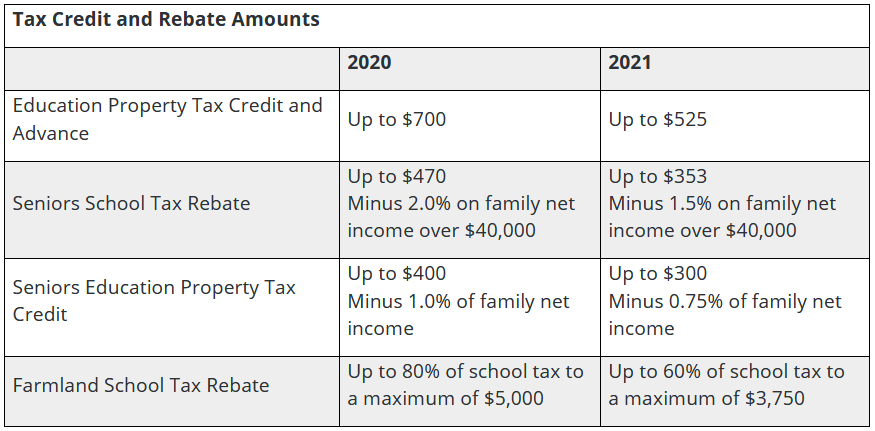

Provincial Education Property Tax Rebate Roll Out Rural Municipality