In this age of technology, when screens dominate our lives however, the attraction of tangible printed materials hasn't faded away. For educational purposes as well as creative projects or just adding an element of personalization to your space, Income Tax Rebate On Home Loan For Second House are now an essential resource. We'll take a dive deep into the realm of "Income Tax Rebate On Home Loan For Second House," exploring what they are, where to find them and the ways that they can benefit different aspects of your life.

Get Latest Income Tax Rebate On Home Loan For Second House Below

Income Tax Rebate On Home Loan For Second House

Income Tax Rebate On Home Loan For Second House - Income Tax Rebate On Home Loan For Second House, Income Tax Rebate On Second House Property, Can I Claim Tax Benefit On The Second House, Income Tax Rebate On Second Housing Loan Interest, Housing Loan Tax Benefit For Second House, Income Tax Benefit On 2nd Home Loan

Web 21 mars 2021 nbsp 0183 32 Whether you have one home loan or more the deduction allowable under Section 80 C for repayment of home loan is restricted to Rs 1 50 lakh together with various other eligible items

Web Tax Benefits on Second Home Loan The Government made a significant amendment to the financial budget for FY 2019 20 in which taxpayers have been allowed to declare two houses as self occupied As a result

Income Tax Rebate On Home Loan For Second House provide a diverse selection of printable and downloadable documents that can be downloaded online at no cost. They come in many types, like worksheets, coloring pages, templates and many more. The great thing about Income Tax Rebate On Home Loan For Second House is their flexibility and accessibility.

More of Income Tax Rebate On Home Loan For Second House

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Web Although you are allowed to claim Rs 2 lakhs for your self occupied property as well as full interest for let out or deemed to have been let properties there is a restriction of Rs 2 lakhs on the amount of the

Web There are two possibilities here Both residences are self occupied According to the most recent budget provisions the second property cannot be considered rent As a result

Income Tax Rebate On Home Loan For Second House have gained immense popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the requirement of buying physical copies or expensive software.

-

customization They can make printed materials to meet your requirements, whether it's designing invitations, organizing your schedule, or even decorating your home.

-

Educational value: Downloads of educational content for free cater to learners of all ages. This makes them an essential instrument for parents and teachers.

-

Convenience: Instant access to a myriad of designs as well as templates is time-saving and saves effort.

Where to Find more Income Tax Rebate On Home Loan For Second House

Income Tax Rebate On Home Loan Fy 2019 20 A design system

Income Tax Rebate On Home Loan Fy 2019 20 A design system

Web Income Tax benefit on Second Home Loan As discussed above the second house is considered as let out whether it is actually rented out or not You have to add rental

Web 20 mai 2016 nbsp 0183 32 E g if you have taken second home loan and it has Rs 2 5 Lakhs as interest and Rs 1 Lakh as principal amount you can claim this Rs 2 5 Lakhs as an income tax

Since we've got your interest in Income Tax Rebate On Home Loan For Second House Let's look into where you can locate these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of printables that are free for a variety of motives.

- Explore categories like decoration for your home, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free as well as flashcards and other learning tools.

- Perfect for teachers, parents as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates at no cost.

- These blogs cover a broad range of interests, that includes DIY projects to planning a party.

Maximizing Income Tax Rebate On Home Loan For Second House

Here are some inventive ways of making the most of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Use free printable worksheets to aid in learning at your home, or even in the classroom.

3. Event Planning

- Invitations, banners and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Get organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Income Tax Rebate On Home Loan For Second House are a treasure trove of useful and creative resources catering to different needs and needs and. Their accessibility and versatility make them a fantastic addition to any professional or personal life. Explore the endless world of Income Tax Rebate On Home Loan For Second House now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really gratis?

- Yes they are! You can print and download these resources at no cost.

-

Can I use the free printables to make commercial products?

- It is contingent on the specific conditions of use. Make sure you read the guidelines for the creator before using their printables for commercial projects.

-

Are there any copyright issues when you download printables that are free?

- Certain printables could be restricted concerning their use. Be sure to check the terms and conditions offered by the creator.

-

How do I print Income Tax Rebate On Home Loan For Second House?

- Print them at home using any printer or head to a local print shop to purchase the highest quality prints.

-

What program do I require to open Income Tax Rebate On Home Loan For Second House?

- A majority of printed materials are as PDF files, which can be opened with free software, such as Adobe Reader.

Latest Income Tax Rebate On Home Loan 2023

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

Check more sample of Income Tax Rebate On Home Loan For Second House below

Home Loan Tax Benefits Section 24 80EE 80C 10 Less Known Facts

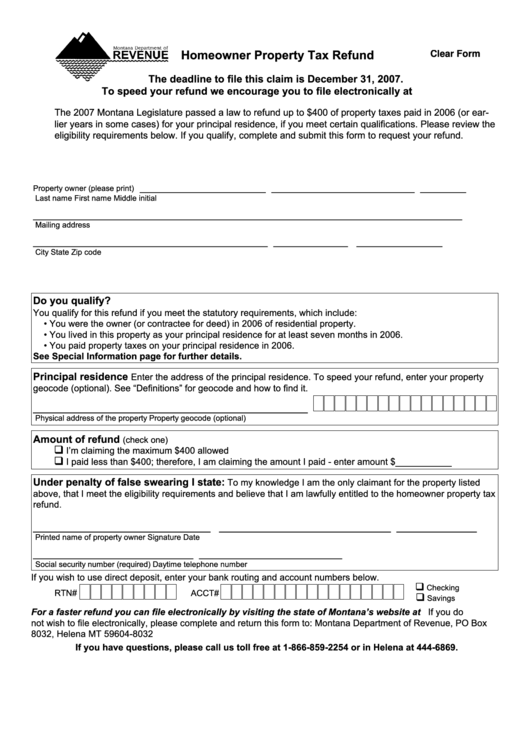

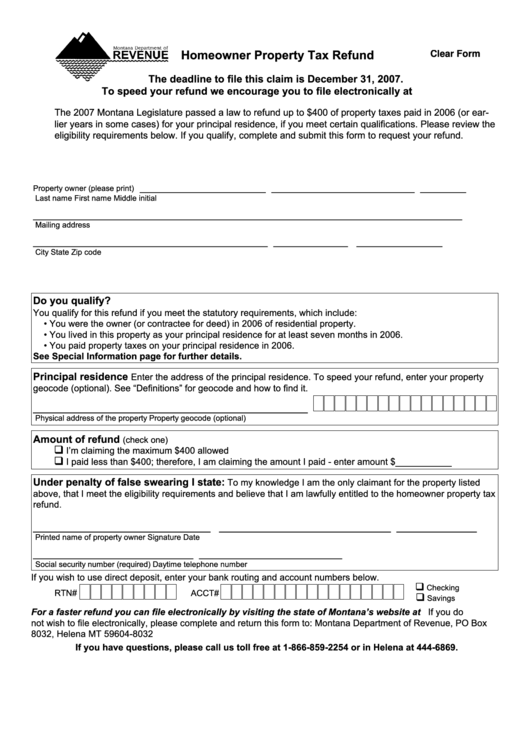

Fillable Homeowner Property Tax Refund Form Montana Department Of

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

DEDUCTION UNDER SECTION 80C TO 80U PDF

Danpirellodesign Income Tax Rebate On Home Loan And Hra

https://www.icicibank.com/blogs/home-loan/t…

Web Tax Benefits on Second Home Loan The Government made a significant amendment to the financial budget for FY 2019 20 in which taxpayers have been allowed to declare two houses as self occupied As a result

https://navi.com/blog/second-home-loan

Web 24 janv 2022 nbsp 0183 32 Under Section 24 of IT Act one can avail income tax benefit on interest payment of the second home loan In that case a deduction of up to Rs 2 lakh will be available for taxpayers Note that as

Web Tax Benefits on Second Home Loan The Government made a significant amendment to the financial budget for FY 2019 20 in which taxpayers have been allowed to declare two houses as self occupied As a result

Web 24 janv 2022 nbsp 0183 32 Under Section 24 of IT Act one can avail income tax benefit on interest payment of the second home loan In that case a deduction of up to Rs 2 lakh will be available for taxpayers Note that as

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

Fillable Homeowner Property Tax Refund Form Montana Department Of

DEDUCTION UNDER SECTION 80C TO 80U PDF

Danpirellodesign Income Tax Rebate On Home Loan And Hra

INCOME TAX REBATE ON HOME LOAN

Know The Tax Amount You Can Save On Your Home Loan Under Section 24 And

Know The Tax Amount You Can Save On Your Home Loan Under Section 24 And

Income Tax Deductions For FY 2018 19 And AY 2019 20 Sid Associates