Today, in which screens are the norm yet the appeal of tangible printed materials hasn't faded away. It doesn't matter if it's for educational reasons for creative projects, just adding personal touches to your area, Income Tax Rebate On House Loan Interest are now an essential source. Here, we'll dive into the world of "Income Tax Rebate On House Loan Interest," exploring the different types of printables, where they can be found, and what they can do to improve different aspects of your lives.

Get Latest Income Tax Rebate On House Loan Interest Below

Income Tax Rebate On House Loan Interest

Income Tax Rebate On House Loan Interest - Income Tax Rebate On Housing Loan Interest 2021-22, Income Tax Rebate On Housing Loan Interest 2022-23, Income Tax Rebate On Housing Loan Interest, Income Tax Rebate On Housing Loan Interest In India, Income Tax Benefit On Housing Loan Interest And Principal, Income Tax Rebate On House Building Loan Interest, Income Tax Rebate On Second Housing Loan Interest, Income Tax Exemption On Second Housing Loan Interest, Income Tax Return Housing Loan Interest, Income Tax Exemption For Housing Loan Interest 2022-23

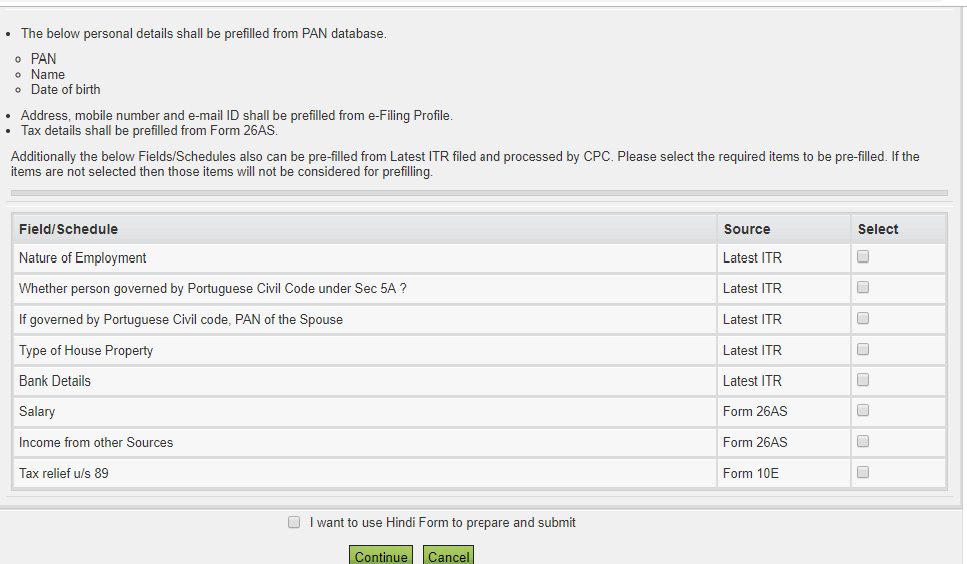

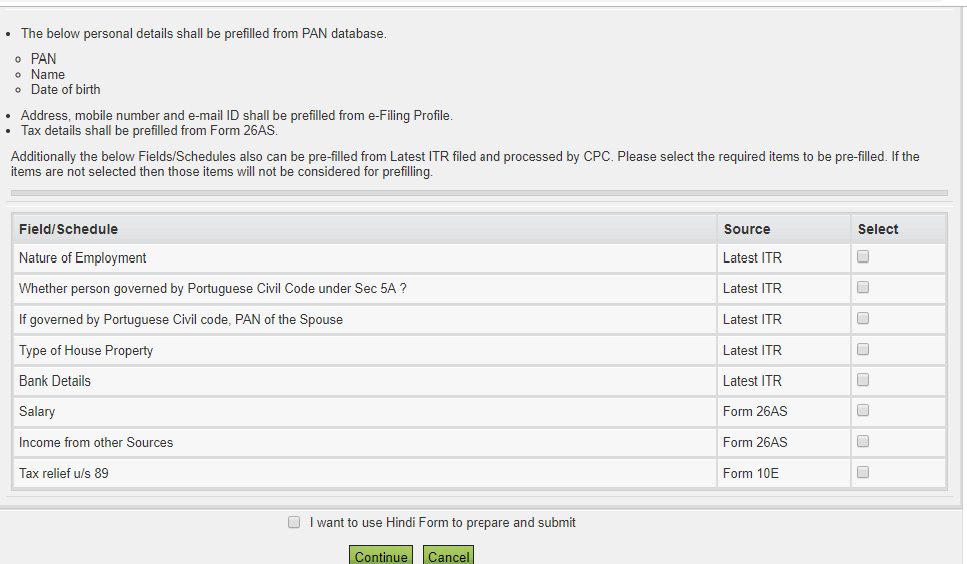

Web 31 mai 2022 nbsp 0183 32 You can claim tax benefits on a home loan when filing your income tax returns ITR or when submitting the home loan interest certificate to your employer The process to claim housing loan tax

Web 4 avr 2017 nbsp 0183 32 Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution You can claim a

Printables for free cover a broad collection of printable materials that are accessible online for free cost. These materials come in a variety of types, such as worksheets templates, coloring pages and more. One of the advantages of Income Tax Rebate On House Loan Interest is in their variety and accessibility.

More of Income Tax Rebate On House Loan Interest

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Web Under Section 24 of the Income Tax Act an individual can claim a tax deduction of the interest payment on the housing loan up to a maximum amount of Rs 2 00 000 You

Web 13 janv 2023 nbsp 0183 32 Homeowners who bought houses before December 16 2017 can deduct interest on the first 1 million of the mortgage Claiming the mortgage interest deduction requires itemizing on your tax return

Income Tax Rebate On House Loan Interest have risen to immense appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or expensive software.

-

Flexible: It is possible to tailor the design to meet your needs such as designing invitations making your schedule, or even decorating your house.

-

Educational Benefits: Educational printables that can be downloaded for free provide for students from all ages, making them a great tool for parents and teachers.

-

Affordability: immediate access numerous designs and templates can save you time and energy.

Where to Find more Income Tax Rebate On House Loan Interest

Home Loan Tax Benefit Calculator FrankiSoumya

Home Loan Tax Benefit Calculator FrankiSoumya

Web Under Sections 80C and 24 both the borrowers are eligible for up to Rs 2 lakh tax rebate on interest payment each and up to Rs 1 5 lakh benefit on the principal repayment each

Web Most homeowners can deduct all of their mortgage interest The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on

We've now piqued your interest in Income Tax Rebate On House Loan Interest and other printables, let's discover where you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of Income Tax Rebate On House Loan Interest suitable for many motives.

- Explore categories such as decoration for your home, education, crafting, and organization.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets, flashcards, and learning tools.

- Perfect for teachers, parents or students in search of additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates, which are free.

- These blogs cover a broad range of topics, including DIY projects to party planning.

Maximizing Income Tax Rebate On House Loan Interest

Here are some innovative ways ensure you get the very most of printables for free:

1. Home Decor

- Print and frame gorgeous images, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Use printable worksheets from the internet for teaching at-home, or even in the classroom.

3. Event Planning

- Design invitations and banners and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Make sure you are organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Income Tax Rebate On House Loan Interest are a treasure trove of innovative and useful resources that satisfy a wide range of requirements and pursuits. Their access and versatility makes they a beneficial addition to the professional and personal lives of both. Explore the many options of printables for free today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly completely free?

- Yes, they are! You can download and print these free resources for no cost.

-

Can I utilize free printables to make commercial products?

- It depends on the specific rules of usage. Always check the creator's guidelines before using their printables for commercial projects.

-

Do you have any copyright violations with printables that are free?

- Some printables may have restrictions on their use. Be sure to check the terms and conditions set forth by the designer.

-

How do I print printables for free?

- Print them at home using any printer or head to an in-store print shop to get higher quality prints.

-

What software do I need to run printables for free?

- Most PDF-based printables are available as PDF files, which can be opened using free software like Adobe Reader.

Income Tax Deductions List FY 2020 21 Save Tax For AY 2021 22

Income Tax Exemption Calculator For Interest Paid On Housing Loan With

Check more sample of Income Tax Rebate On House Loan Interest below

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

Rising Home Loan Interests Have Begun To Impact Homebuyers

DEDUCTION UNDER SECTION 80C TO 80U PDF

Home Loan Interest Rates 2019 Mortgage Rule Change To Lower Home

Home Loan Interest In Itr 4 Home Sweet Home Modern Livingroom

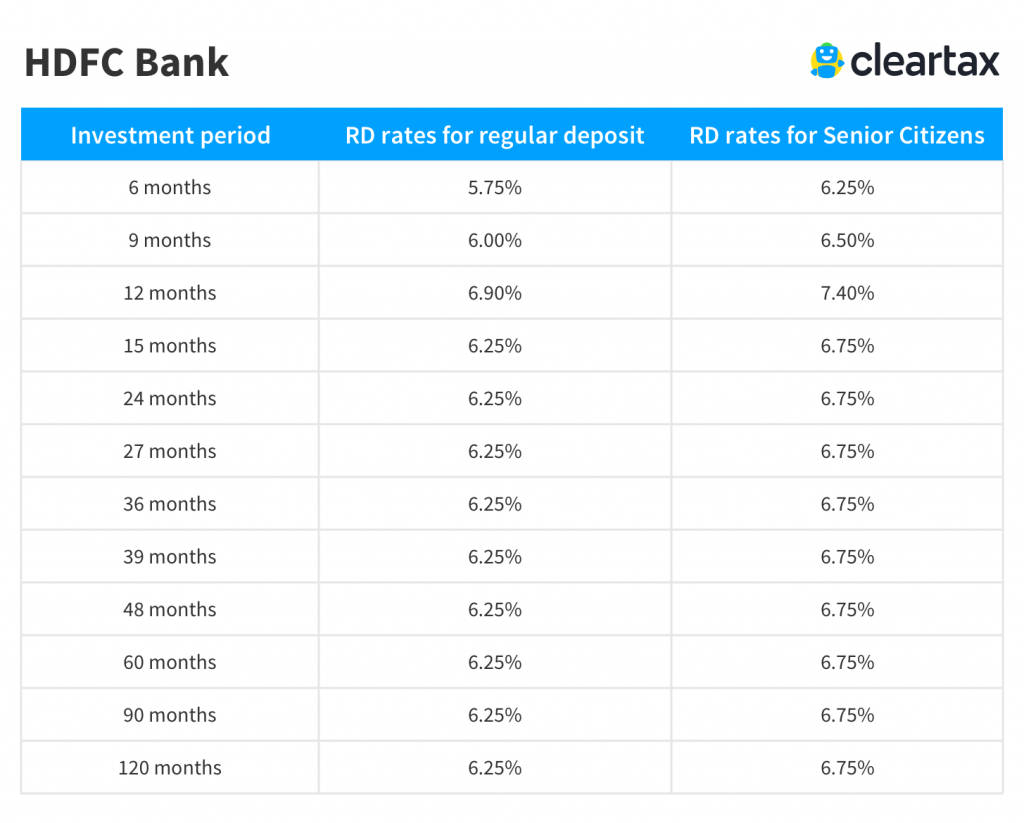

Housing Loan Interest Rates HDFC Home Loan Interest Rates Housing

https://cleartax.in/s/section-80ee-income-tax-deduction-for-interest...

Web 4 avr 2017 nbsp 0183 32 Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution You can claim a

https://cred.club/calculators/articles/how-to-calculate-home-loan-tax-benefits

Web under Section 24 of the Income Tax Act you can claim a maximum tax rebate of up to 2 lakh on the interest payable on your home loan however note that these deductions

Web 4 avr 2017 nbsp 0183 32 Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution You can claim a

Web under Section 24 of the Income Tax Act you can claim a maximum tax rebate of up to 2 lakh on the interest payable on your home loan however note that these deductions

Home Loan Interest Rates 2019 Mortgage Rule Change To Lower Home

Rising Home Loan Interests Have Begun To Impact Homebuyers

Home Loan Interest In Itr 4 Home Sweet Home Modern Livingroom

Housing Loan Interest Rates HDFC Home Loan Interest Rates Housing

FY 22 23 New Income Tax Return E filing Exemptions Deductions E

Exemption Of Up To 2 Lacks In Tax From These Schemes The Viral News

Exemption Of Up To 2 Lacks In Tax From These Schemes The Viral News

Best Home Loan Interest Rates In India For Nri Home Sweet Home