In this day and age with screens dominating our lives yet the appeal of tangible printed materials hasn't faded away. Whether it's for educational purposes, creative projects, or simply to add some personal flair to your home, printables for free have proven to be a valuable source. With this guide, you'll dive through the vast world of "Income Tax Rebate On Interest Earned," exploring the different types of printables, where they are available, and how they can enhance various aspects of your daily life.

Get Latest Income Tax Rebate On Interest Earned Below

Income Tax Rebate On Interest Earned

Income Tax Rebate On Interest Earned - Income Tax Rebate On Interest Earned, Income Tax (tax Relief On Interest Payments) (guernsey) Ordinance 2007, Income Tax Rebate On Bank Interest, What Is The Income Tax On Interest Earned, How Much Tax Is On Interest Income, What Is Tax Free Interest Income

Web Deduction can be claimed only up to Rs 10 000 on the interest earned on the savings bank account However tax will have to be paid on any amount over and above Rs 10 000

Web 13 mai 2017 nbsp 0183 32 Section 80TTA of the Income Tax Act 1961 provides a deduction of up to Rs 10 000 on the income earned from interest on savings made in a bank co operative

Printables for free include a vast array of printable documents that can be downloaded online at no cost. They are available in numerous types, like worksheets, templates, coloring pages, and much more. The value of Income Tax Rebate On Interest Earned is in their versatility and accessibility.

More of Income Tax Rebate On Interest Earned

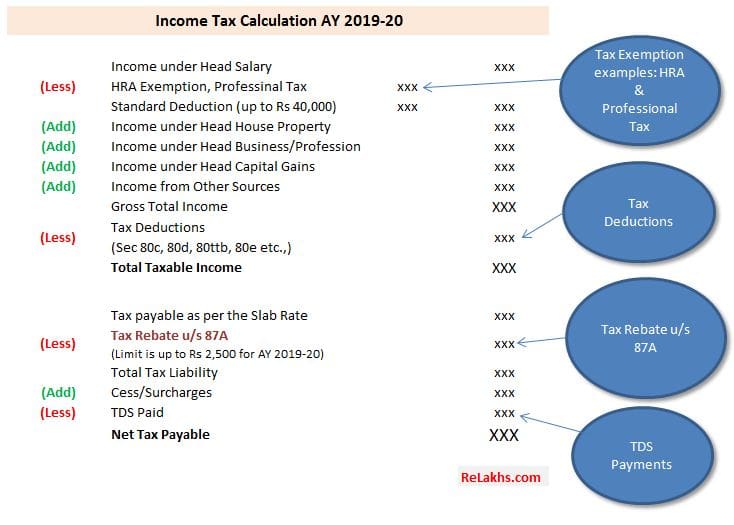

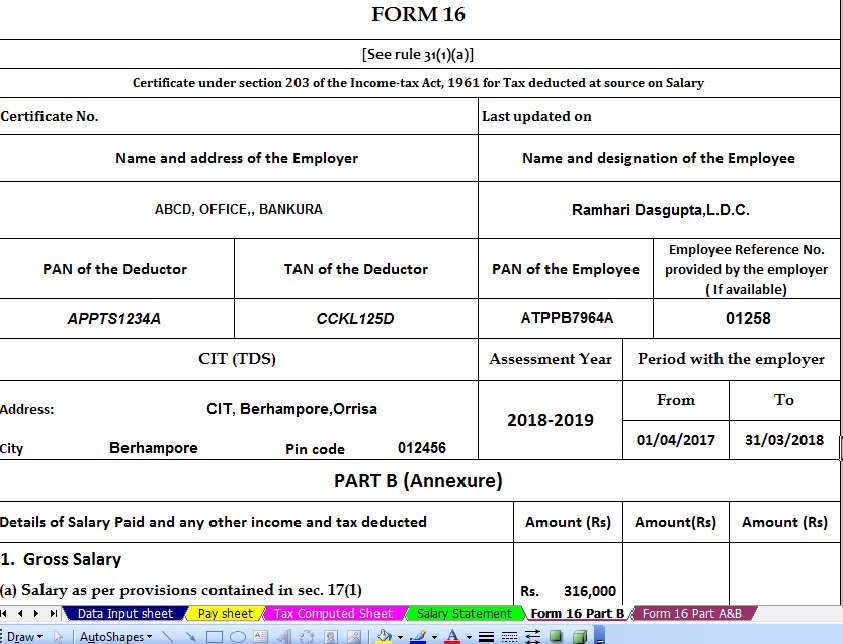

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Web 22 f 233 vr 2023 nbsp 0183 32 Interest Exemptions Interest from a South African source earned by any natural person is exempt per annum up to an amount of 22 February 2023 No

Web 8 avr 2021 nbsp 0183 32 Interest earned from bank fixed deposits is fully taxable for individuals while senior citizens can claim a deduction of up to 50 000 against the interest earned on savings and fixed deposit

Income Tax Rebate On Interest Earned have gained a lot of popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or costly software.

-

customization: The Customization feature lets you tailor printables to your specific needs in designing invitations or arranging your schedule or decorating your home.

-

Educational Benefits: Educational printables that can be downloaded for free offer a wide range of educational content for learners of all ages. This makes them a valuable instrument for parents and teachers.

-

The convenience of You have instant access many designs and templates, which saves time as well as effort.

Where to Find more Income Tax Rebate On Interest Earned

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Web 11 nov 2019 nbsp 0183 32 Section 80TTA of Income Tax Act offers deduction on interest income earned from savings bank deposit of up to Rs 10 000 for FY 2023 24 AY 2024 25

Web 8 sept 2023 nbsp 0183 32 According to Section 80TTB of the Income Tax Act senior citizens can avail of a deduction of up to Rs 50 000 on the interest on deposits which includes fixed

We've now piqued your interest in Income Tax Rebate On Interest Earned Let's take a look at where the hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection of Income Tax Rebate On Interest Earned for various objectives.

- Explore categories such as furniture, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free with flashcards and other teaching materials.

- The perfect resource for parents, teachers or students in search of additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates for free.

- The blogs covered cover a wide spectrum of interests, including DIY projects to planning a party.

Maximizing Income Tax Rebate On Interest Earned

Here are some inventive ways for you to get the best of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Use these printable worksheets free of charge to build your knowledge at home also in the classes.

3. Event Planning

- Make invitations, banners as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable planners along with lists of tasks, and meal planners.

Conclusion

Income Tax Rebate On Interest Earned are an abundance of practical and innovative resources that can meet the needs of a variety of people and interests. Their accessibility and versatility make them a wonderful addition to your professional and personal life. Explore the plethora of printables for free today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really for free?

- Yes they are! You can download and print these tools for free.

-

Can I make use of free printouts for commercial usage?

- It's dependent on the particular conditions of use. Always consult the author's guidelines before utilizing their templates for commercial projects.

-

Are there any copyright rights issues with printables that are free?

- Some printables could have limitations in use. You should read the terms and conditions set forth by the designer.

-

How do I print printables for free?

- You can print them at home using printing equipment or visit a local print shop for premium prints.

-

What software will I need to access printables that are free?

- The majority of PDF documents are provided in PDF format. They can be opened using free software such as Adobe Reader.

Interest Earned On Savings What Is It And How To Calculate It

Deferred Tax And Temporary Differences The Footnotes Analyst

Check more sample of Income Tax Rebate On Interest Earned below

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

2007 Tax Rebate Tax Deduction Rebates

Interim Budget 2019 20 The Talk Of The Town Trade Brains

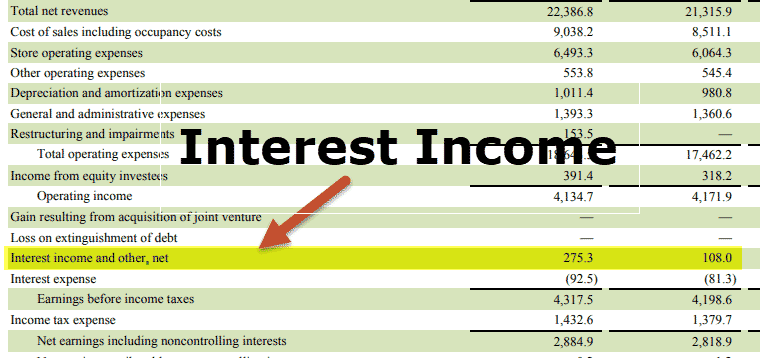

Solved From The Income Statement Other Income expense In Chegg

Budget 2019 Income Tax Rebate Hiked For Income Up To Rs 5 Lakh Here

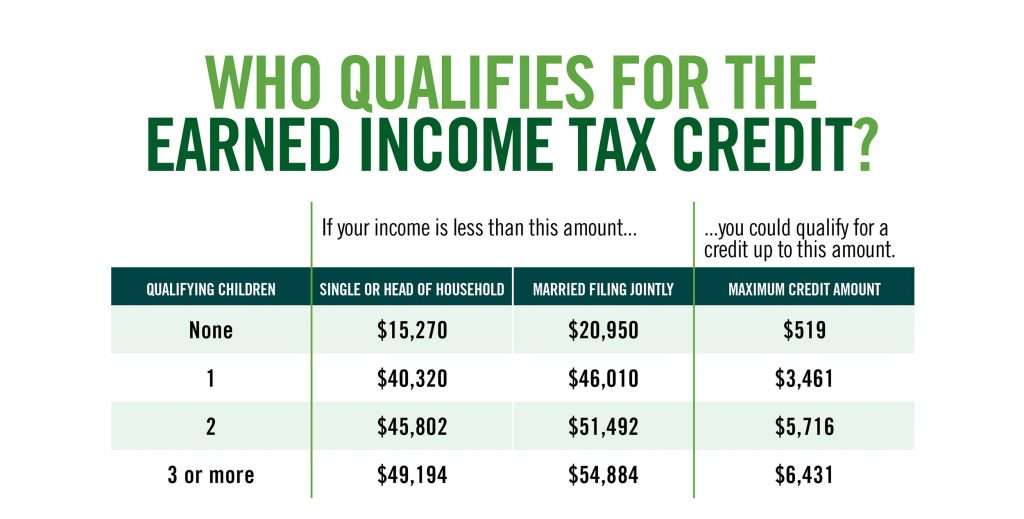

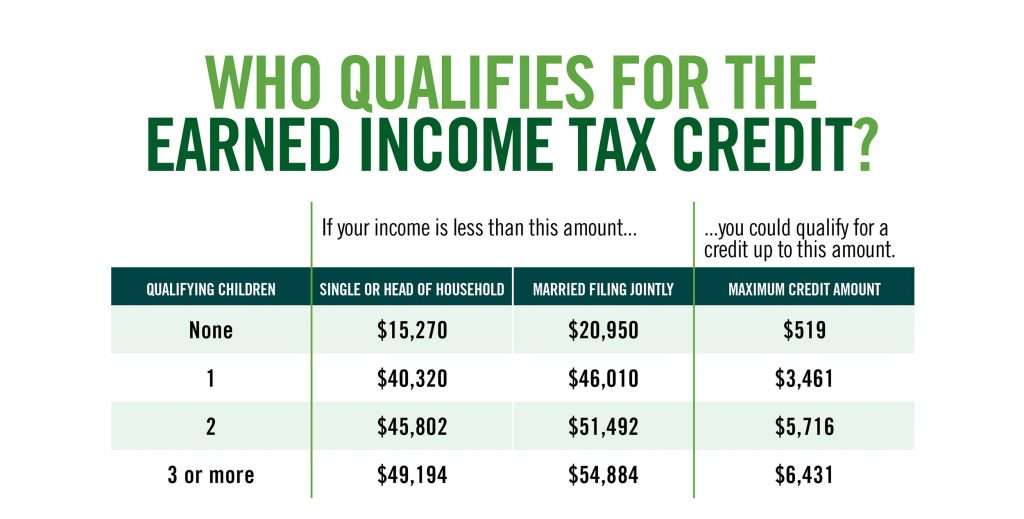

How Much Earned Income To File Taxes TaxesTalk

https://cleartax.in/s/claiming-deduction-on-interest-under-section-80tta

Web 13 mai 2017 nbsp 0183 32 Section 80TTA of the Income Tax Act 1961 provides a deduction of up to Rs 10 000 on the income earned from interest on savings made in a bank co operative

https://www.idfcfirstbank.com/finfirst-blogs/finance/is-tax-refund...

Web However under Section 244A of the Income Tax Act the IT department must pay an interest of 0 5 of the refund amount per month or part thereof This means your

Web 13 mai 2017 nbsp 0183 32 Section 80TTA of the Income Tax Act 1961 provides a deduction of up to Rs 10 000 on the income earned from interest on savings made in a bank co operative

Web However under Section 244A of the Income Tax Act the IT department must pay an interest of 0 5 of the refund amount per month or part thereof This means your

Solved From The Income Statement Other Income expense In Chegg

2007 Tax Rebate Tax Deduction Rebates

Budget 2019 Income Tax Rebate Hiked For Income Up To Rs 5 Lakh Here

How Much Earned Income To File Taxes TaxesTalk

How Is Interest Income From Your Investments Taxed Personal Finance Plan

Retirement Income Tax Rebate Calculator Greater Good SA

Retirement Income Tax Rebate Calculator Greater Good SA

Income Tax Rebate Rs 2500 U s 87A Tdstaxindia