In this age of electronic devices, where screens rule our lives, the charm of tangible, printed materials hasn't diminished. For educational purposes in creative or artistic projects, or simply to add personal touches to your home, printables for free are now an essential source. In this article, we'll take a dive through the vast world of "Income Tax Rebate On Interest Paid On Housing Loan," exploring their purpose, where they are, and how they can improve various aspects of your lives.

Get Latest Income Tax Rebate On Interest Paid On Housing Loan Below

Income Tax Rebate On Interest Paid On Housing Loan

Income Tax Rebate On Interest Paid On Housing Loan - Income Tax Rebate On Interest Paid On Housing Loan, Income Tax Rebate On Interest Paid On Home Loan, Tax Relief On Interest Paid On Housing Loans, What Is Interest Rebate On Housing Loan, Tax Benefit On Interest Paid On Housing Loan, Is Interest On Housing Loan Exempt From Tax, Income Tax Rebate On Second Housing Loan Interest, Income Tax Benefit On Home Loan Interest

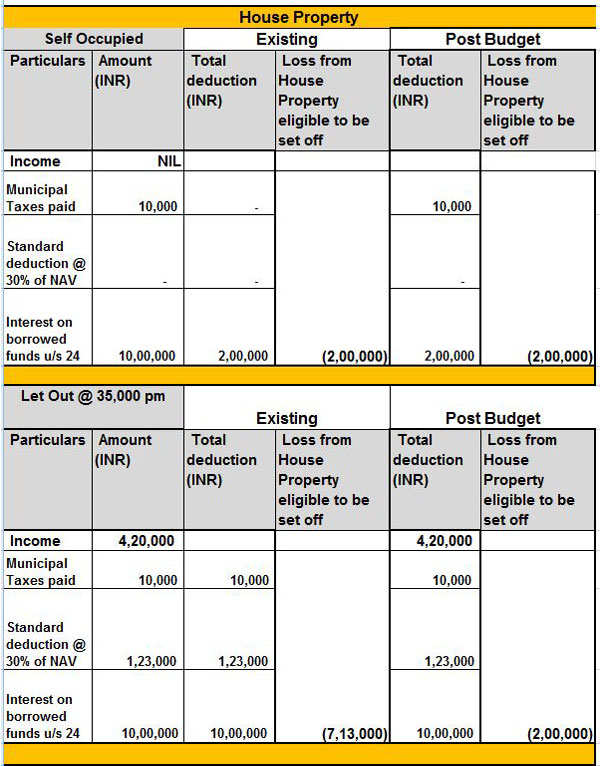

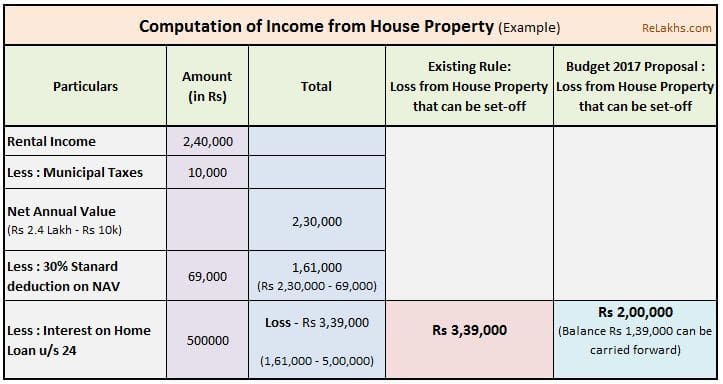

Web 24 ao 251 t 2023 nbsp 0183 32 Tax Deduction on Home Loan Interest Payment under Section 24 b As per Section 24 b of the Income Tax Act You can claim a tax deduction of up to Rs 2 lakh

Web 12 juin 2023 nbsp 0183 32 From the assessment year 2018 19 onwards the maximum deduction for interest paid on self occupied house property is Rs 2 lakh For let out property there is

Income Tax Rebate On Interest Paid On Housing Loan offer a wide assortment of printable materials available online at no cost. These resources come in various formats, such as worksheets, coloring pages, templates and much more. The beauty of Income Tax Rebate On Interest Paid On Housing Loan is their flexibility and accessibility.

More of Income Tax Rebate On Interest Paid On Housing Loan

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Web 31 mai 2022 nbsp 0183 32 2 Section 24 b Tax Deduction On Interest Paid You can enjoy home loan tax exemptions of up to Rs 2 lakh on the interest payment component This is useful during the initial repayments of your

Web 25 mars 2016 nbsp 0183 32 20 OF TOTAL Rs 56 741 74 Principle and Interest on Home Loan paid during the current financial year in which I got the possession of the second flat is as follows Financial Year Principle on

Printables for free have gained immense popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the need to buy physical copies or expensive software.

-

Flexible: We can customize the templates to meet your individual needs such as designing invitations and schedules, or decorating your home.

-

Educational Use: These Income Tax Rebate On Interest Paid On Housing Loan can be used by students of all ages, making them a great device for teachers and parents.

-

It's easy: Quick access to a plethora of designs and templates cuts down on time and efforts.

Where to Find more Income Tax Rebate On Interest Paid On Housing Loan

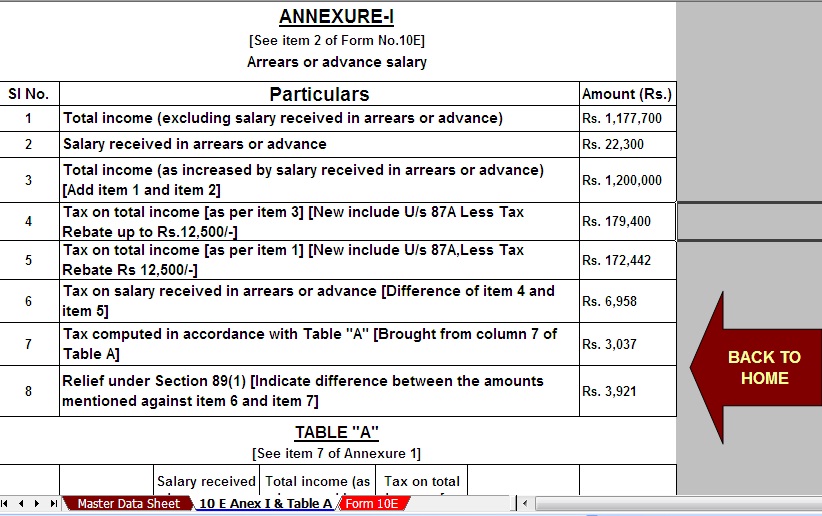

Income Tax Exemption Calculator For Interest Paid On Housing Loan With

Income Tax Exemption Calculator For Interest Paid On Housing Loan With

Web 28 janv 2014 nbsp 0183 32 The rebate is available from the financial year in which you have taken the possession of the property All the interest paid in that financial year can be claimed

Web 13 janv 2023 nbsp 0183 32 If you bought the house before December 16 2017 you can deduct the interest you paid during the year on the first 1 million of the mortgage 500 000 if married filing separately

We've now piqued your interest in Income Tax Rebate On Interest Paid On Housing Loan we'll explore the places you can find these elusive gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of printables that are free for a variety of goals.

- Explore categories like interior decor, education, organization, and crafts.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets, flashcards, and learning materials.

- Ideal for teachers, parents and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates for free.

- The blogs covered cover a wide range of topics, that includes DIY projects to planning a party.

Maximizing Income Tax Rebate On Interest Paid On Housing Loan

Here are some fresh ways ensure you get the very most of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes or decorations for the holidays to beautify your living spaces.

2. Education

- Use free printable worksheets to help reinforce your learning at home also in the classes.

3. Event Planning

- Design invitations, banners and decorations for special events like weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Income Tax Rebate On Interest Paid On Housing Loan are an abundance of fun and practical tools that cater to various needs and interests. Their accessibility and flexibility make they a beneficial addition to the professional and personal lives of both. Explore the endless world of Income Tax Rebate On Interest Paid On Housing Loan now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Income Tax Rebate On Interest Paid On Housing Loan really cost-free?

- Yes they are! You can print and download these files for free.

-

Can I use free printables for commercial uses?

- It is contingent on the specific conditions of use. Always review the terms of use for the creator before using printables for commercial projects.

-

Are there any copyright concerns when using Income Tax Rebate On Interest Paid On Housing Loan?

- Some printables may have restrictions on usage. Be sure to check the terms and condition of use as provided by the author.

-

How do I print Income Tax Rebate On Interest Paid On Housing Loan?

- You can print them at home using printing equipment or visit an in-store print shop to get more high-quality prints.

-

What program do I need in order to open printables for free?

- Most printables come in PDF format. These is open with no cost programs like Adobe Reader.

Home Loan Tax Benefit Calculator FrankiSoumya

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated

Check more sample of Income Tax Rebate On Interest Paid On Housing Loan below

Home Loan Tax Saving Claiming Home Loan Interest Tax Break On Rented

What Are Reuluations About Getting A Home Loan On A Forclosed Home

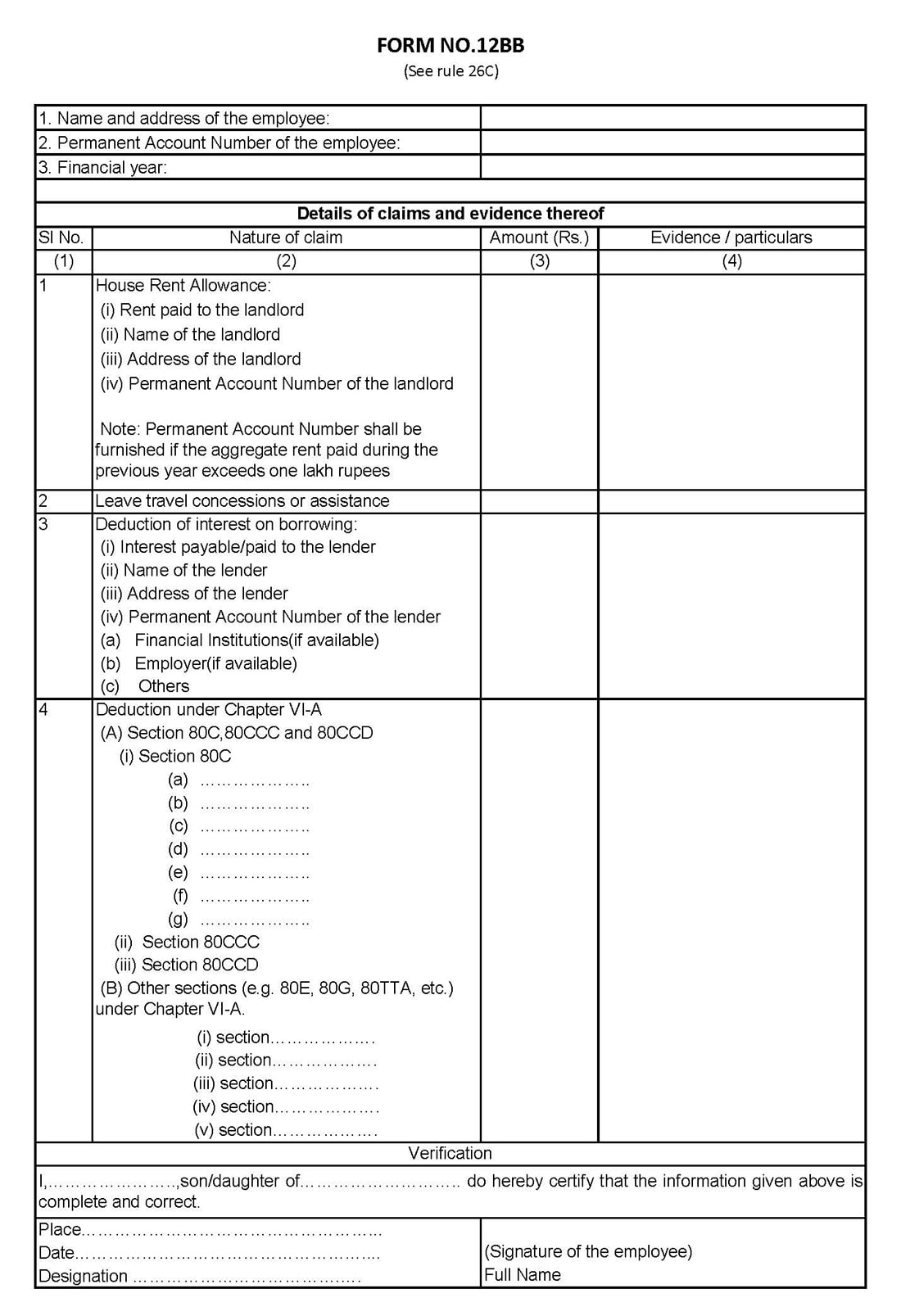

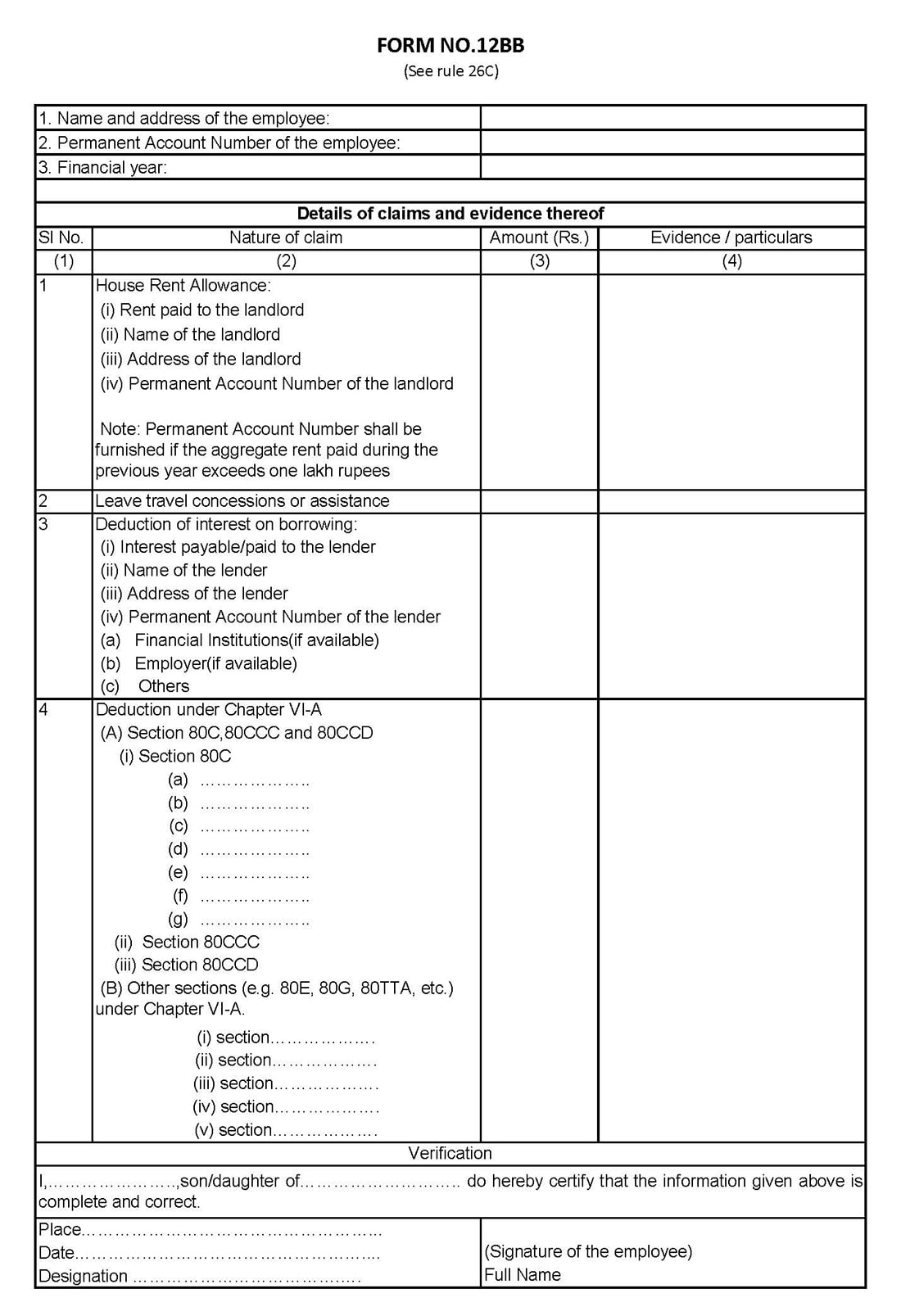

Form 12BB New Form To Claim Income Tax Benefits Rebate

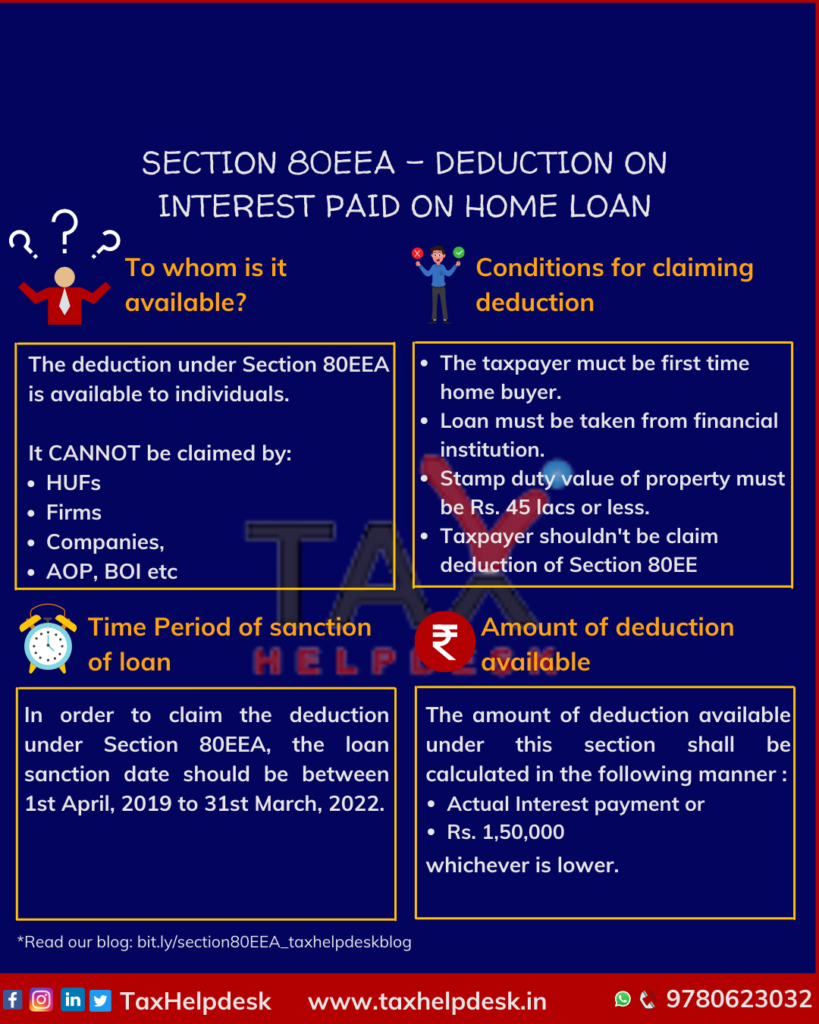

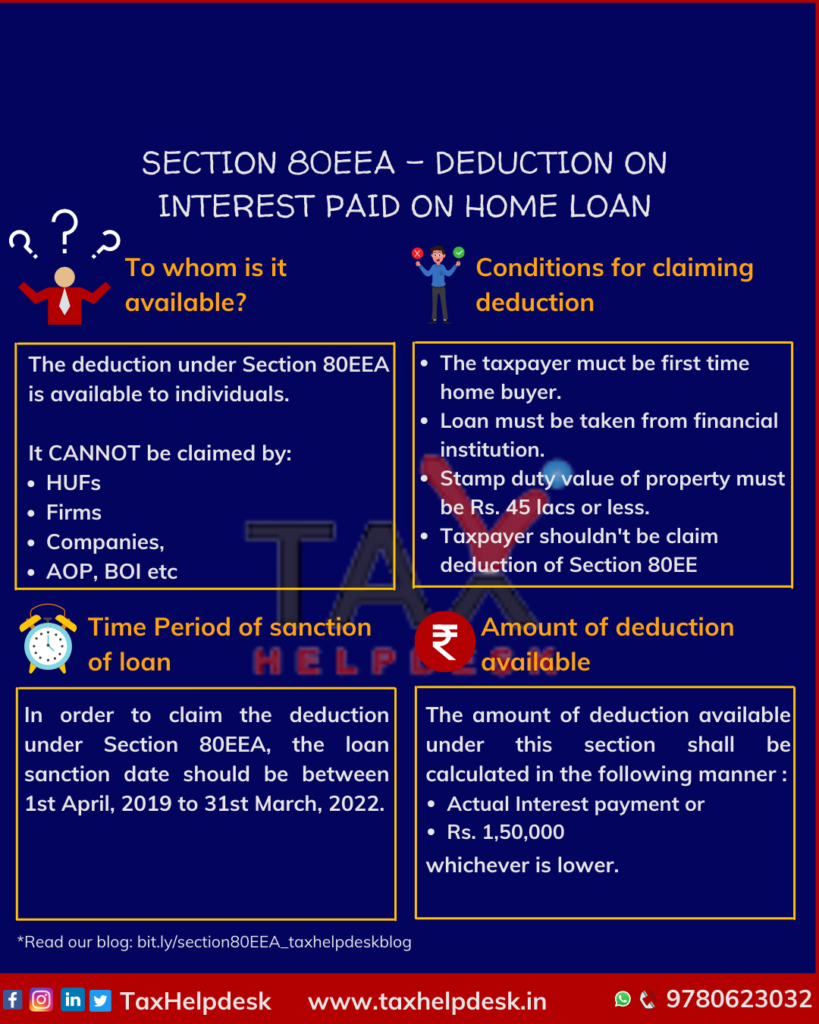

Section 80EEA Deduction On Interest Paid On Home Loan TaxHelpdesk

Home Loan Interest Tax Benefit 2019 20 Home Sweet Home Insurance

Home Loan Tax Benefit What Is The Income Tax Rebate On Home Loan

https://cleartax.in/s/home-loan-tax-benefits

Web 12 juin 2023 nbsp 0183 32 From the assessment year 2018 19 onwards the maximum deduction for interest paid on self occupied house property is Rs 2 lakh For let out property there is

https://www.iifl.com/blogs/have-you-calculated-income-tax-rebate-your...

Web The housing loan EMI consists of principal amount as Rs 1 50 000 deductible under section 80C and interest amount as Rs 2 000 00 deductible under section 24 of the

Web 12 juin 2023 nbsp 0183 32 From the assessment year 2018 19 onwards the maximum deduction for interest paid on self occupied house property is Rs 2 lakh For let out property there is

Web The housing loan EMI consists of principal amount as Rs 1 50 000 deductible under section 80C and interest amount as Rs 2 000 00 deductible under section 24 of the

Section 80EEA Deduction On Interest Paid On Home Loan TaxHelpdesk

What Are Reuluations About Getting A Home Loan On A Forclosed Home

Home Loan Interest Tax Benefit 2019 20 Home Sweet Home Insurance

Home Loan Tax Benefit What Is The Income Tax Rebate On Home Loan

Tax Rebate 2019 Malaysia Homebuyers To Get Income Tax Rebate On

How To Show Home Loan Interest For Self Occupied House In ITR 1 Tax

How To Show Home Loan Interest For Self Occupied House In ITR 1 Tax

Paying Off Student Loans Don t Forget This 2500 Deduction Frugaling