In this age of technology, where screens rule our lives and our lives are dominated by screens, the appeal of tangible printed material hasn't diminished. If it's to aid in education such as creative projects or simply adding some personal flair to your area, Income Tax Rebate On Sb Interest have proven to be a valuable resource. This article will take a dive into the world "Income Tax Rebate On Sb Interest," exploring what they are, how to get them, as well as ways they can help you improve many aspects of your daily life.

Get Latest Income Tax Rebate On Sb Interest Below

Income Tax Rebate On Sb Interest

Income Tax Rebate On Sb Interest - Income Tax Rebate On Sb Interest, Income Tax Rebate On Saving Account Interest, Income Tax Rebate On Bank Interest, Income Tax Rebate On Interest Income For Senior Citizens, Does Bank Deduct Tds On Sb Interest, Is Interest Income Tax Deductible

Web 17 ao 251 t 2018 nbsp 0183 32 As per this section interest income from savings bank accounts and fixed deposits is exempt from income tax to the extent of Rs 50 000 per financial year To be eligible for tax benefit under Section

Web 6 mars 2023 nbsp 0183 32 How to calculate income tax on savings bank interest Savings account interest is taxable at your slab rate in case the interest amount exceeds Rs 10 000 in a financial year Interest earned up to

Income Tax Rebate On Sb Interest cover a large array of printable content that can be downloaded from the internet at no cost. These printables come in different designs, including worksheets coloring pages, templates and more. The attraction of printables that are free lies in their versatility and accessibility.

More of Income Tax Rebate On Sb Interest

Individual Income Tax Rebate

Individual Income Tax Rebate

Web 22 juil 2019 nbsp 0183 32 Any amount that is credited as interest on the savings bank is income for the taxpayer and needs to be disclosed under his her Income tax return under the head

Web 26 juil 2022 nbsp 0183 32 If you opt for the old existing income tax regime while filing ITR for FY 2021 22 AY 2022 23 then you can claim a tax deduction of up to Rs 10 000 on savings

Printables that are free have gained enormous popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

customization: They can make printed materials to meet your requirements whether it's making invitations as well as organizing your calendar, or decorating your home.

-

Educational Use: Free educational printables can be used by students of all ages, making them a useful instrument for parents and teachers.

-

Simple: immediate access the vast array of design and templates reduces time and effort.

Where to Find more Income Tax Rebate On Sb Interest

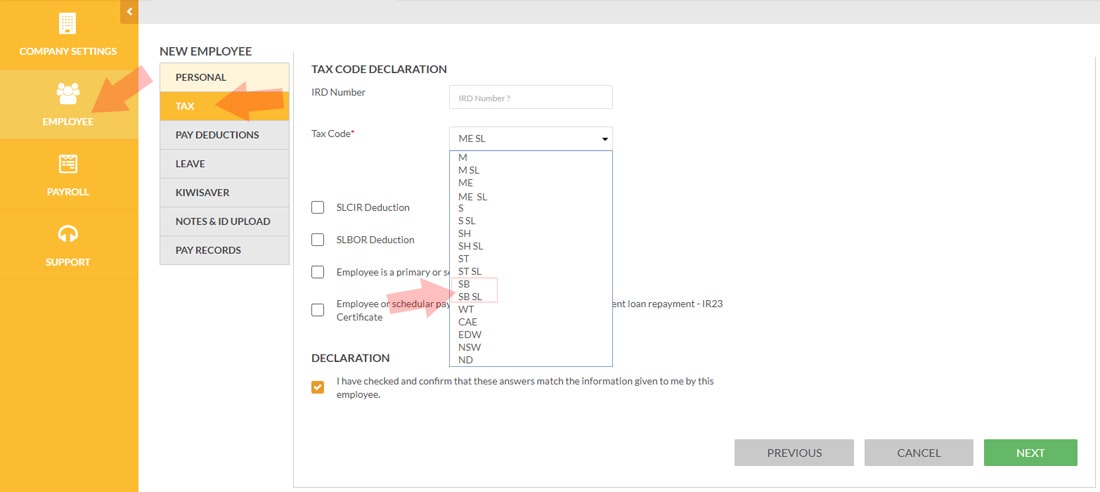

Secondary Tax Codes SB SB SL Your Payroll NZ

Secondary Tax Codes SB SB SL Your Payroll NZ

Web 24 f 233 vr 2022 nbsp 0183 32 Rs 23000 for the period of 1st July to 31st December 2021 Rs 12 000 x 3 6 Rs 6 000 for the period of 1st April 2020 to 31st March 2021 Therefore total interest

Web 14 f 233 vr 2023 nbsp 0183 32 Section 80TTA of the Income Tax Act was introduced in order to allow a deduction of up to INR 10 000 on such interest Who can claim 80TTA deduction

Since we've got your interest in Income Tax Rebate On Sb Interest Let's find out where they are hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection of Income Tax Rebate On Sb Interest to suit a variety of reasons.

- Explore categories such as interior decor, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free with flashcards and other teaching materials.

- Great for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers share their creative designs or templates for download.

- These blogs cover a wide range of interests, that includes DIY projects to planning a party.

Maximizing Income Tax Rebate On Sb Interest

Here are some creative ways of making the most of Income Tax Rebate On Sb Interest:

1. Home Decor

- Print and frame stunning images, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Use free printable worksheets to help reinforce your learning at home or in the classroom.

3. Event Planning

- Designs invitations, banners as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Keep your calendars organized by printing printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Income Tax Rebate On Sb Interest are an abundance of practical and innovative resources that can meet the needs of a variety of people and preferences. Their availability and versatility make them a wonderful addition to both professional and personal lives. Explore the endless world of Income Tax Rebate On Sb Interest right now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really gratis?

- Yes, they are! You can download and print these materials for free.

-

Can I utilize free printouts for commercial usage?

- It's contingent upon the specific usage guidelines. Always verify the guidelines provided by the creator prior to using the printables in commercial projects.

-

Are there any copyright issues in printables that are free?

- Certain printables could be restricted regarding their use. Be sure to read the conditions and terms of use provided by the author.

-

How do I print Income Tax Rebate On Sb Interest?

- You can print them at home with your printer or visit any local print store for more high-quality prints.

-

What program do I require to view Income Tax Rebate On Sb Interest?

- The majority of PDF documents are provided in PDF format, which can be opened using free software, such as Adobe Reader.

Solved Janice Morgan Age 24 Is Single And Has No Dependents She Is

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

Check more sample of Income Tax Rebate On Sb Interest below

Georgia Income Tax Rebate 2023 Printable Rebate Form

Income Tax Rebate On Investment In Insurance Premium 2020 Tariq Mahmood

How To Search Income Tax Rebate On Women YouTube

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

Retirement Income Tax Rebate Calculator Greater Good SA

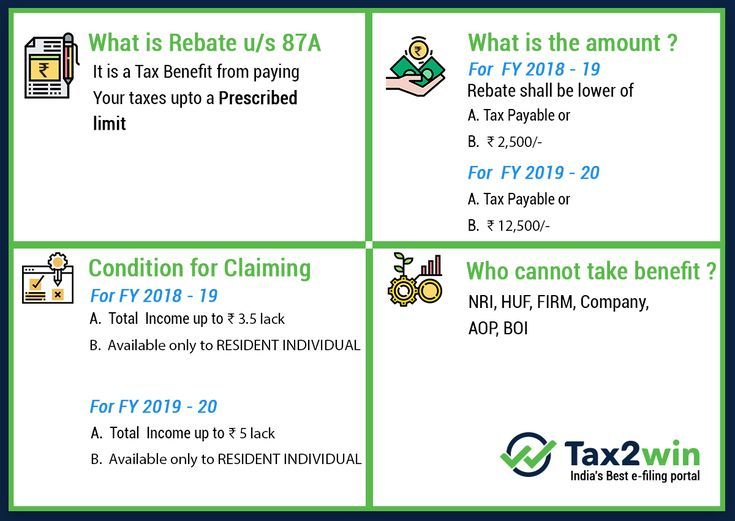

Income Tax Rebate Under Section 87A

https://www.paisabazaar.com/tax/income-ta…

Web 6 mars 2023 nbsp 0183 32 How to calculate income tax on savings bank interest Savings account interest is taxable at your slab rate in case the interest amount exceeds Rs 10 000 in a financial year Interest earned up to

https://tax2win.in/guide/section-80tta

Web 17 juil 2019 nbsp 0183 32 Section 80TTA of the Income Tax Act 1961 deals with the tax deductions granted on interest on saving banks This deduction is

Web 6 mars 2023 nbsp 0183 32 How to calculate income tax on savings bank interest Savings account interest is taxable at your slab rate in case the interest amount exceeds Rs 10 000 in a financial year Interest earned up to

Web 17 juil 2019 nbsp 0183 32 Section 80TTA of the Income Tax Act 1961 deals with the tax deductions granted on interest on saving banks This deduction is

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

Income Tax Rebate On Investment In Insurance Premium 2020 Tariq Mahmood

Retirement Income Tax Rebate Calculator Greater Good SA

Income Tax Rebate Under Section 87A

Section 87A Tax Rebate Under Section 87A Rebates Financial

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated