In the age of digital, when screens dominate our lives yet the appeal of tangible printed materials isn't diminishing. For educational purposes such as creative projects or simply to add a personal touch to your space, Income Tax Rebate On Two Housing Loan are now a useful resource. In this article, we'll take a dive deeper into "Income Tax Rebate On Two Housing Loan," exploring the benefits of them, where they are, and how they can add value to various aspects of your life.

Get Latest Income Tax Rebate On Two Housing Loan Below

Income Tax Rebate On Two Housing Loan

Income Tax Rebate On Two Housing Loan - Income Tax Rebate On Second Housing Loan Interest, Income Tax Exemption On Second Housing Loan Interest, Income Tax Exemption For Second Housing Loan, Income Tax Benefit For 2nd Housing Loan, Income Tax Rebate On Home Loan Rules, Income Tax Rebate On Second House Property, Income Tax Rebate On House Rent

Web 21 mars 2021 nbsp 0183 32 Whether you have one home loan or more the deduction allowable under Section 80 C for repayment of home loan is restricted to Rs 1 50 lakh together with various other eligible items Balwant

Web Tax Benefits on Second Home Loan The Government made a significant amendment to the financial budget for FY 2019 20 in which taxpayers have been allowed to declare two houses as self occupied As a result

Income Tax Rebate On Two Housing Loan offer a wide selection of printable and downloadable material that is available online at no cost. These resources come in various forms, including worksheets, coloring pages, templates and more. One of the advantages of Income Tax Rebate On Two Housing Loan lies in their versatility and accessibility.

More of Income Tax Rebate On Two Housing Loan

Income Tax Deductions List FY 2020 21 Save Tax For AY 2021 22

Income Tax Deductions List FY 2020 21 Save Tax For AY 2021 22

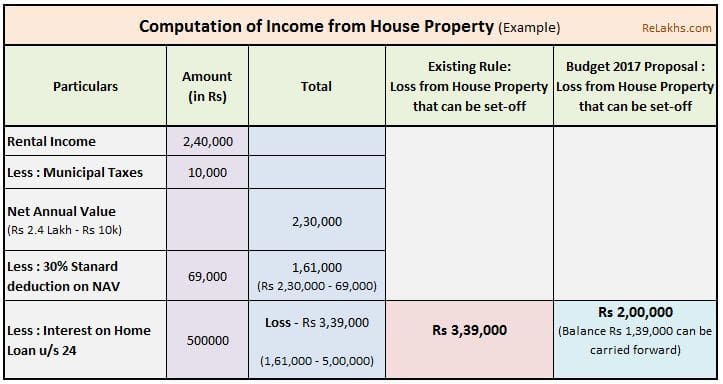

Web 24 janv 2022 nbsp 0183 32 For maintenance purposes and general upkeeps the owner of that let out property can claim a tax rebate of 30 Under Section 24 of IT Act one can avail income tax benefit on interest payment of the

Web The income tax laws allow you to have two residential houses as self occupied So if you own and occupy upto two houses the maximum deduction with respect to interest payment is restricted to Rs 2 lakhs per

Printables for free have gained immense popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the need to buy physical copies or expensive software.

-

Personalization The Customization feature lets you tailor the design to meet your needs, whether it's designing invitations and schedules, or decorating your home.

-

Educational Use: Free educational printables offer a wide range of educational content for learners of all ages. This makes them a useful aid for parents as well as educators.

-

Easy to use: Quick access to various designs and templates cuts down on time and efforts.

Where to Find more Income Tax Rebate On Two Housing Loan

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Web You can deduct a typical 30 percent interest on a home loan and municipal taxes from that You can deduct up to Rs 2 lakhs from your other sources of income Home Loan

Web 11 janv 2023 nbsp 0183 32 Yes you claim deductions on two home loans within the specific limit under Section 24 Rs 2 lakhs per annum if the properties are self occupied Only for your first home you can claim benefits under

After we've peaked your interest in Income Tax Rebate On Two Housing Loan We'll take a look around to see where you can find these treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection of Income Tax Rebate On Two Housing Loan suitable for many uses.

- Explore categories such as home decor, education, craft, and organization.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free, flashcards, and learning tools.

- Ideal for teachers, parents and students looking for extra sources.

3. Creative Blogs

- Many bloggers post their original designs with templates and designs for free.

- These blogs cover a broad range of interests, that includes DIY projects to planning a party.

Maximizing Income Tax Rebate On Two Housing Loan

Here are some fresh ways of making the most use of printables that are free:

1. Home Decor

- Print and frame gorgeous art, quotes, or festive decorations to decorate your living areas.

2. Education

- Use free printable worksheets to build your knowledge at home (or in the learning environment).

3. Event Planning

- Design invitations and banners and decorations for special occasions like birthdays and weddings.

4. Organization

- Keep track of your schedule with printable calendars or to-do lists. meal planners.

Conclusion

Income Tax Rebate On Two Housing Loan are an abundance with useful and creative ideas that satisfy a wide range of requirements and hobbies. Their availability and versatility make them a wonderful addition to both personal and professional life. Explore the vast array of Income Tax Rebate On Two Housing Loan today to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really cost-free?

- Yes you can! You can print and download these materials for free.

-

Are there any free templates for commercial use?

- It's determined by the specific conditions of use. Always verify the guidelines of the creator before using any printables on commercial projects.

-

Are there any copyright violations with printables that are free?

- Some printables may have restrictions in use. Be sure to read the terms and regulations provided by the author.

-

How do I print printables for free?

- You can print them at home with your printer or visit any local print store for superior prints.

-

What program do I need to open Income Tax Rebate On Two Housing Loan?

- The majority of PDF documents are provided with PDF formats, which is open with no cost software, such as Adobe Reader.

What Are Reuluations About Getting A Home Loan On A Forclosed Home

Home Loan Tax Benefit Calculator FrankiSoumya

Check more sample of Income Tax Rebate On Two Housing Loan below

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

DEDUCTION UNDER SECTION 80C TO 80U PDF

Exemption Of Up To 2 Lacks In Tax From These Schemes The Viral News

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

Joint Home Loan Declaration Form For Income Tax Savings And Non

https://www.icicibank.com/blogs/home-loan/ta…

Web Tax Benefits on Second Home Loan The Government made a significant amendment to the financial budget for FY 2019 20 in which taxpayers have been allowed to declare two houses as self occupied As a result

https://taxguru.in/income-tax/income-tax-benefits-deductions-second...

Web 9 janv 2021 nbsp 0183 32 09 Jan 2021 39 636 Views 41 comments From FY 19 20 onwards in the Finance Act 2019 government has allowed a major relief u s 23 and 24 of the Income

Web Tax Benefits on Second Home Loan The Government made a significant amendment to the financial budget for FY 2019 20 in which taxpayers have been allowed to declare two houses as self occupied As a result

Web 9 janv 2021 nbsp 0183 32 09 Jan 2021 39 636 Views 41 comments From FY 19 20 onwards in the Finance Act 2019 government has allowed a major relief u s 23 and 24 of the Income

Exemption Of Up To 2 Lacks In Tax From These Schemes The Viral News

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

Joint Home Loan Declaration Form For Income Tax Savings And Non

Illinois Tax Rebate Tracker Rebate2022

Property Tax Rebate Application Printable Pdf Download

Property Tax Rebate Application Printable Pdf Download

Home Loan Tax Benefits In India Important Facts