In the digital age, where screens rule our lives yet the appeal of tangible printed materials hasn't faded away. Whatever the reason, whether for education, creative projects, or simply adding personal touches to your space, Income Tax Rebate Other Than 80c are now a useful resource. This article will dive to the depths of "Income Tax Rebate Other Than 80c," exploring what they are, where to locate them, and how they can add value to various aspects of your lives.

Get Latest Income Tax Rebate Other Than 80c Below

Income Tax Rebate Other Than 80c

Income Tax Rebate Other Than 80c - Income Tax Rebate Other Than 80c, Income Tax Saving Other Than 80c, Investment Options For Tax Benefit Other Than 80c, What Is 80c In Itr, What Are All Comes Under 80c, What Is 80c In Income Tax, What Comes Under 80c In Income Tax

Web 9 d 233 c 2021 nbsp 0183 32 December 9 2021 18 15 IST Many taxpayers exhaust the limit of Rs 1 5 lakh under Section 80C and yet want to bring save more tax The last date to save tax for the

Web 26 d 233 c 2022 nbsp 0183 32 Best 10 Tax Saving Investment Options Other Than 80C 1 Tax saving with NPS under Section 80CCD 1B Taxpayers can save additional tax by investing up to

Income Tax Rebate Other Than 80c cover a large assortment of printable, downloadable content that can be downloaded from the internet at no cost. They are available in numerous kinds, including worksheets templates, coloring pages and much more. The attraction of printables that are free is their versatility and accessibility.

More of Income Tax Rebate Other Than 80c

Tax Savings Options Other Than Sec 80C For FY 2017 18 BasuNivesh

Tax Savings Options Other Than Sec 80C For FY 2017 18 BasuNivesh

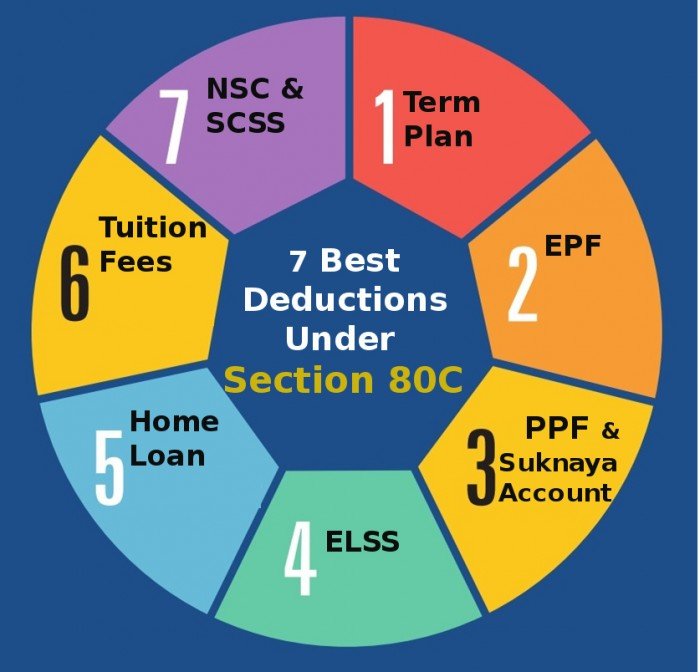

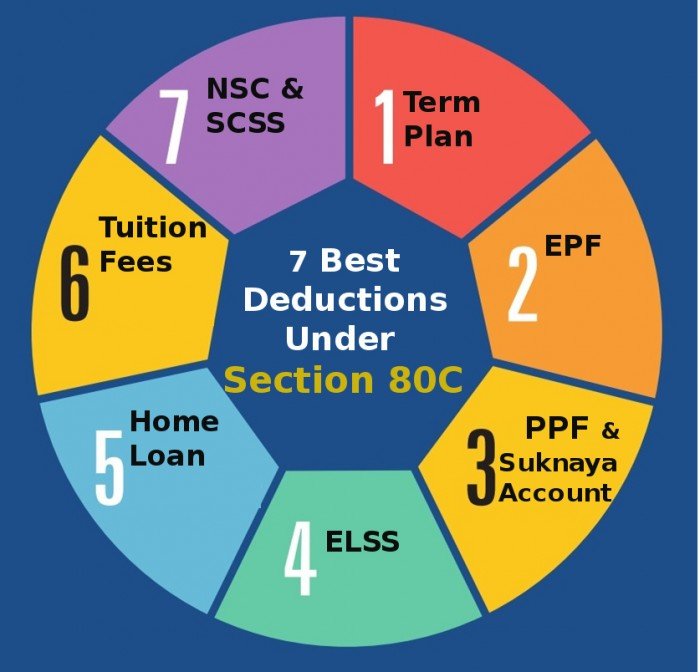

Web 3 ao 251 t 2018 nbsp 0183 32 You can save up to Rs 46 800 tax deductions of up to Rs 1 50 000 a year in taxes by investing in ELSS which is covered under Section 80C of the Income Tax Act

Web All About Tax Saving Investments Other Than 80C Section 80C is the most well known provision of the Income Tax Act of 1961 under which a rebate of up to Rs 1 5 Lakh is

Income Tax Rebate Other Than 80c have risen to immense recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

Individualization You can tailor printing templates to your own specific requirements for invitations, whether that's creating them or arranging your schedule or even decorating your house.

-

Educational Value: These Income Tax Rebate Other Than 80c provide for students of all ages, which makes them a useful device for teachers and parents.

-

It's easy: instant access a variety of designs and templates saves time and effort.

Where to Find more Income Tax Rebate Other Than 80c

Save Tax Other Than 80C Tips And Tricks To Save Tax Legally

Save Tax Other Than 80C Tips And Tricks To Save Tax Legally

Web 11 janv 2023 nbsp 0183 32 These deductions against the tax could be claimed under four sections of the income tax act namely Section 80C Section 24 Section 80EE and Section 80EEA In this article we will discuss at

Web Maximum rebate for a Mediclaim policy for an individual and spouse and kids is Rs 25 000 An additional rebate of up to Rs 25 000 for the premium paid for parents Mediclaim

In the event that we've stirred your interest in printables for free, let's explore where you can discover these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection and Income Tax Rebate Other Than 80c for a variety needs.

- Explore categories such as decorating your home, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums often provide worksheets that can be printed for free as well as flashcards and other learning tools.

- Perfect for teachers, parents and students looking for additional resources.

3. Creative Blogs

- Many bloggers provide their inventive designs as well as templates for free.

- The blogs covered cover a wide variety of topics, that includes DIY projects to planning a party.

Maximizing Income Tax Rebate Other Than 80c

Here are some innovative ways to make the most use of Income Tax Rebate Other Than 80c:

1. Home Decor

- Print and frame beautiful art, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Use printable worksheets from the internet for reinforcement of learning at home also in the classes.

3. Event Planning

- Designs invitations, banners and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Get organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Income Tax Rebate Other Than 80c are a treasure trove of innovative and useful resources designed to meet a range of needs and pursuits. Their accessibility and flexibility make them an essential part of both personal and professional life. Explore the plethora of Income Tax Rebate Other Than 80c right now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really absolutely free?

- Yes they are! You can print and download these tools for free.

-

Can I use the free printables for commercial purposes?

- It's based on specific terms of use. Make sure you read the guidelines for the creator prior to printing printables for commercial projects.

-

Are there any copyright problems with printables that are free?

- Certain printables could be restricted on usage. Make sure to read these terms and conditions as set out by the author.

-

How do I print Income Tax Rebate Other Than 80c?

- You can print them at home using either a printer or go to a local print shop to purchase high-quality prints.

-

What software will I need to access Income Tax Rebate Other Than 80c?

- The majority of printables are with PDF formats, which can be opened with free software, such as Adobe Reader.

80C TO 80U DEDUCTIONS LIST PDF

Budget 2014 Impact On Money Taxes And Savings

Check more sample of Income Tax Rebate Other Than 80c below

12 Ways To Save Taxes Other Than 80C Omozing

Income Tax Calculator Top 5 Tax Saving Tips Other Than Section 80C Benefit

What Are The Tax Saving Options Other Than 80 C 80C

Tax Saving Options Other Than 80C Investments YouTube

Reduce Your Tax Liability Beyond Section 80C Jupiter

Why Is 80C The Best Tax Saving Instrument

https://www.etmoney.com/learn/saving-schemes/beyond-section-80c-10...

Web 26 d 233 c 2022 nbsp 0183 32 Best 10 Tax Saving Investment Options Other Than 80C 1 Tax saving with NPS under Section 80CCD 1B Taxpayers can save additional tax by investing up to

https://www.financialexpress.com/money/income-tax/14-tax-saving...

Web 21 mars 2020 nbsp 0183 32 14 tax saving investment options beyond Section 80C limit Most people are aware of claiming tax deduction of Rs 1 5 lakh under Section 80C of the Income Tax

Web 26 d 233 c 2022 nbsp 0183 32 Best 10 Tax Saving Investment Options Other Than 80C 1 Tax saving with NPS under Section 80CCD 1B Taxpayers can save additional tax by investing up to

Web 21 mars 2020 nbsp 0183 32 14 tax saving investment options beyond Section 80C limit Most people are aware of claiming tax deduction of Rs 1 5 lakh under Section 80C of the Income Tax

Tax Saving Options Other Than 80C Investments YouTube

Income Tax Calculator Top 5 Tax Saving Tips Other Than Section 80C Benefit

Reduce Your Tax Liability Beyond Section 80C Jupiter

Why Is 80C The Best Tax Saving Instrument

Post Office TD Time Diposit Investment 2021 Income Tax Rebate 80c

HOW TO SAVE TAX UNDER SECTION 80 C WHAT COMES UNDER SECTION 80C FULL

HOW TO SAVE TAX UNDER SECTION 80 C WHAT COMES UNDER SECTION 80C FULL

80ccc Pension Plan Investor Guruji