In a world where screens have become the dominant feature of our lives but the value of tangible printed objects hasn't waned. No matter whether it's for educational uses as well as creative projects or simply to add some personal flair to your area, Income Tax Rebate U S 10 13a are now an essential source. With this guide, you'll dive through the vast world of "Income Tax Rebate U S 10 13a," exploring what they are, how you can find them, and how they can enhance various aspects of your life.

Get Latest Income Tax Rebate U S 10 13a Below

Income Tax Rebate U S 10 13a

Income Tax Rebate U S 10 13a - Income Tax Deduction U/s 10(13a), Income Tax Rules U/s 10(13a), Hra Exemption U/s 10(13a) Limit, What Is Section 10 13a In Income Tax, What Is Hra Exemption U/s 10(13a), Income Tax Rules Section 10(13a)

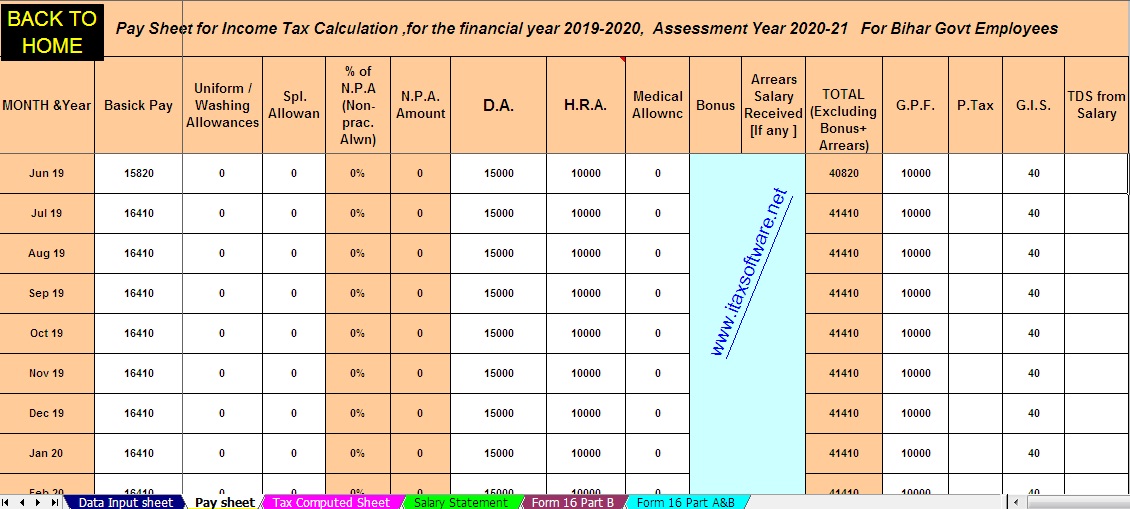

Web Standard Deduction of Rs 50 000 Entertainment Allowance Deduction in respect of this is available to a government employee to the extent of Rs 5 000 or 20 of his salary or

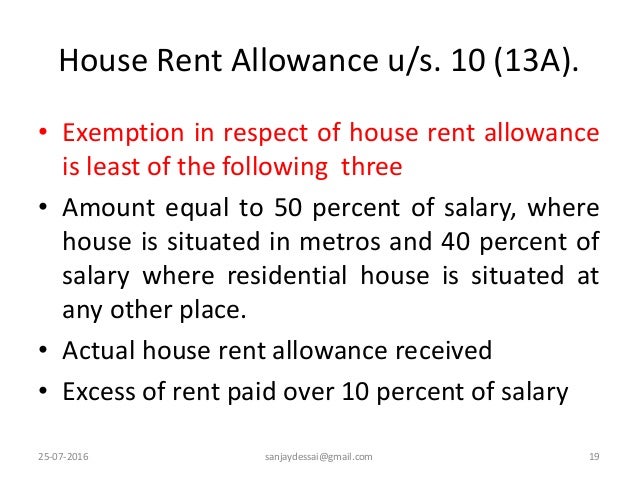

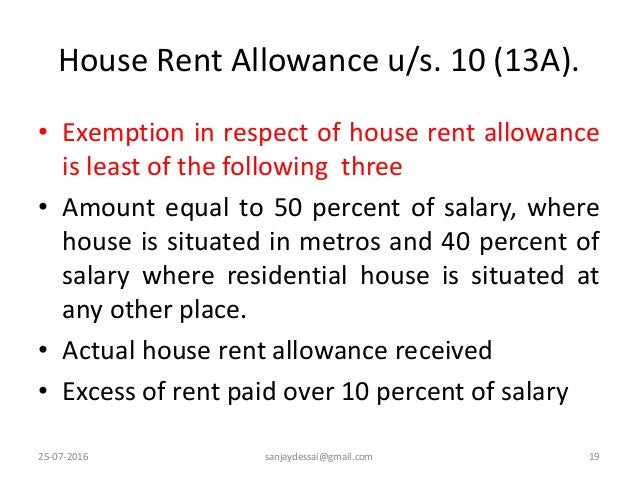

Web 4 avr 2017 nbsp 0183 32 House Rent Allowance HRA is a component of an employee s salary that may be subject to partial or full tax deductions

The Income Tax Rebate U S 10 13a are a huge range of printable, free content that can be downloaded from the internet at no cost. These printables come in different formats, such as worksheets, templates, coloring pages, and much more. The great thing about Income Tax Rebate U S 10 13a is in their variety and accessibility.

More of Income Tax Rebate U S 10 13a

Income Exempt Under Section 10 For Assessment Year 2016 17

Income Exempt Under Section 10 For Assessment Year 2016 17

Web 22 sept 2022 nbsp 0183 32 House rent allowance is eligible for HRA deduction under Section 10 13A of the Income Tax Act if an individual meets the following criteria The person claiming

Web HRA Exemption Calculation u s 10 13A The minimum of the following three amounts calculated would be exempted Actual HRA received from the employer Actual rent paid

Income Tax Rebate U S 10 13a have risen to immense popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Personalization You can tailor designs to suit your personal needs be it designing invitations to organize your schedule or even decorating your house.

-

Educational Impact: These Income Tax Rebate U S 10 13a cater to learners from all ages, making the perfect tool for parents and educators.

-

Convenience: Quick access to a myriad of designs as well as templates, which saves time as well as effort.

Where to Find more Income Tax Rebate U S 10 13a

Specific Conditions For Salary Individuals To Claim HRA U S 10 13A

Specific Conditions For Salary Individuals To Claim HRA U S 10 13A

Web 10 mars 2019 nbsp 0183 32 It is the allowance paid by the employer to the employee against travel with your family or alone LTA is 100 Tax exempted u s 10 5 and restricted only to the travel cost incurred by the employee The

Web HRA received is exempt u s 10 13A to the extent of the minimum of the following 3 amounts Actual House Rent allowance received by the employee in respect of the relevant period Excess of Rent paid for the

Now that we've piqued your interest in printables for free We'll take a look around to see where you can find these elusive treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection with Income Tax Rebate U S 10 13a for all reasons.

- Explore categories like furniture, education, organisation, as well as crafts.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets for flashcards, lessons, and worksheets. materials.

- Ideal for parents, teachers as well as students who require additional sources.

3. Creative Blogs

- Many bloggers share their creative designs with templates and designs for free.

- The blogs covered cover a wide array of topics, ranging including DIY projects to planning a party.

Maximizing Income Tax Rebate U S 10 13a

Here are some creative ways to make the most of Income Tax Rebate U S 10 13a:

1. Home Decor

- Print and frame gorgeous images, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Use printable worksheets from the internet to enhance your learning at home and in class.

3. Event Planning

- Designs invitations, banners and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Make sure you are organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Income Tax Rebate U S 10 13a are an abundance of practical and imaginative resources which cater to a wide range of needs and preferences. Their access and versatility makes them a valuable addition to both personal and professional life. Explore the wide world of printables for free today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly completely free?

- Yes, they are! You can download and print these tools for free.

-

Do I have the right to use free printables in commercial projects?

- It's based on specific terms of use. Make sure you read the guidelines for the creator before using printables for commercial projects.

-

Are there any copyright violations with Income Tax Rebate U S 10 13a?

- Some printables may have restrictions in their usage. Check the terms and regulations provided by the designer.

-

How can I print printables for free?

- You can print them at home using the printer, or go to an in-store print shop to get more high-quality prints.

-

What program is required to open printables at no cost?

- The majority are printed in PDF format. These is open with no cost programs like Adobe Reader.

Understanding Section 10 13A Of The Income Tax Act

House Rent Allowance Section 10 13A Income Tax Act YouTube

Check more sample of Income Tax Rebate U S 10 13a below

How HRA Tax Exemption Is Calculated U s 10 13A Calculation Guide

Income Tax Rebate U S 87A For The FY 2020 21 AY 2021 22 FY 2019

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

Income Tax Rebate Under Section 80 G Issued By Income Tax Department

Income Tax Rebate Under Section 87A

Income Tax Rebate Under Section 87A

https://cleartax.in/s/hra-house-rent-allowance

Web 4 avr 2017 nbsp 0183 32 House Rent Allowance HRA is a component of an employee s salary that may be subject to partial or full tax deductions

https://learn.quicko.com/house-rent-allowance-hra

Web 9 f 233 vr 2023 nbsp 0183 32 Actual House Rent Allowance INR 1 75 000 Actual Rent Paid 10 of Basic Salary INR 1 30 000 1 80 000 10 5 00 000 40 of the Basic Salary INR

Web 4 avr 2017 nbsp 0183 32 House Rent Allowance HRA is a component of an employee s salary that may be subject to partial or full tax deductions

Web 9 f 233 vr 2023 nbsp 0183 32 Actual House Rent Allowance INR 1 75 000 Actual Rent Paid 10 of Basic Salary INR 1 30 000 1 80 000 10 5 00 000 40 of the Basic Salary INR

Income Tax Rebate Under Section 80 G Issued By Income Tax Department

Income Tax Rebate U S 87A For The FY 2020 21 AY 2021 22 FY 2019

Income Tax Rebate Under Section 87A

Income Tax Rebate Under Section 87A

Income Tax Rebate U s 87A For The Financial Year 2023 24

.jpg)

87A Rebate Rebate U s 87A How To Get Income

.jpg)

87A Rebate Rebate U s 87A How To Get Income

Income Tax Rebate Under Section 87A PulseHRM