In the digital age, where screens dominate our lives yet the appeal of tangible printed objects hasn't waned. It doesn't matter if it's for educational reasons, creative projects, or simply adding the personal touch to your home, printables for free are a great source. With this guide, you'll dive deeper into "Income Tax Rebate Under Section 80g," exploring their purpose, where to find them and how they can enrich various aspects of your daily life.

Get Latest Income Tax Rebate Under Section 80g Below

Income Tax Rebate Under Section 80g

Income Tax Rebate Under Section 80g - Income Tax Rebate Under Section 80g, Income Tax Exemption Under Section 80ggc, Income Tax Deduction Under Section 80gg, Income Tax Exemption Under Section 80g(5)(vi), Income Tax Benefit Under Section 80g, Income Tax Exemption Under Section 80g(5), Income Tax Exemption Under Section 80gg, Income Tax Exemption On Donations Ngo Under Section 80g, Income Tax Exemption Section 80g, What Is Section 80g Of Income Tax

Verkko 15 helmik 2023 nbsp 0183 32 The new income tax slabs slabs are Rs 3 lakh 6 lakh with 5 tax rate Rs 6 lakh 9 lakh with 10 etc But why is it being said that there is no income tax upto Rs 7 lakh A tax rebate reduces your tax amount However the tax rebate is allowed only to resident individuals

Verkko 28 kes 228 k 2018 nbsp 0183 32 1 Deduction U s 80G is Allowable to all kind of Assessee 2 Deduction U s 80G on Donation to Foreign Trust 3 Deduction U s 80G on Donation to Political Parties 4 Only donation made to prescribed funds and institutions qualify for section 80G deduction 5 Maximum allowable deduction under section 80G 6

Income Tax Rebate Under Section 80g cover a large range of printable, free documents that can be downloaded online at no cost. They come in many formats, such as worksheets, templates, coloring pages, and more. The great thing about Income Tax Rebate Under Section 80g lies in their versatility as well as accessibility.

More of Income Tax Rebate Under Section 80g

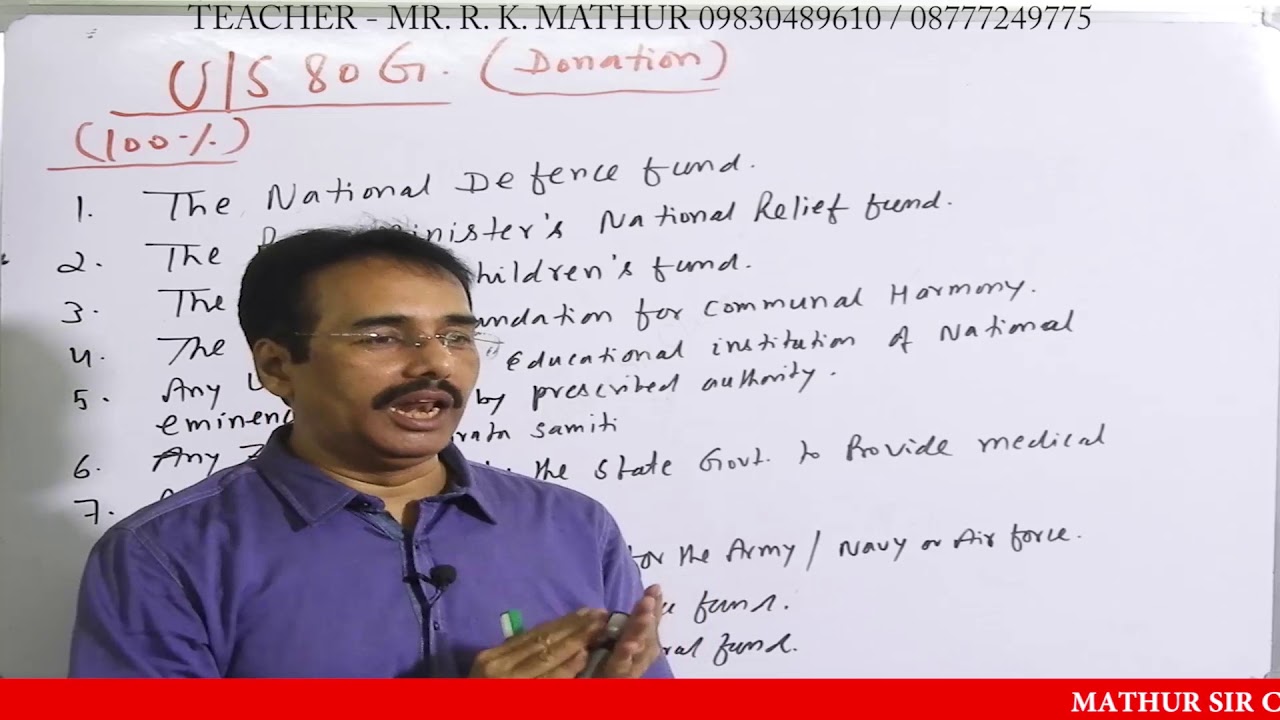

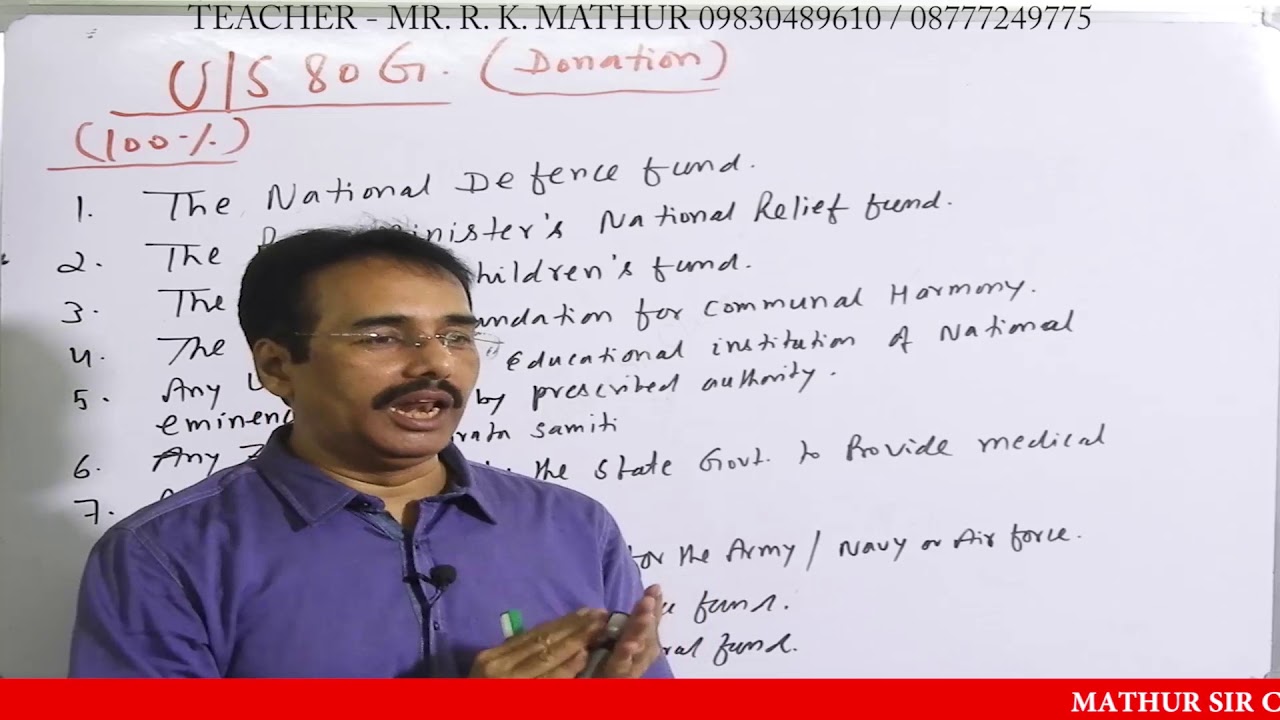

What Is Section 80G Tax Deductions On Your Donations Deduction U s

What Is Section 80G Tax Deductions On Your Donations Deduction U s

Verkko 23 marrask 2023 nbsp 0183 32 Section 80G of the Income Tax Act provides for a deduction for donations made to certain charitable institutions or funds The deduction is available to individuals as well as companies The deduction under section 80G can be claimed on the amount donated to eligible institutions or funds

Verkko 19 toukok 2023 nbsp 0183 32 Section 80G of the Income Tax Act 1961 is a beneficial provision that allows you to claim deductions for your donations to eligible charitable institutions By donating to these institutions you can support various social and environmental causes and save tax by reducing your taxable income

Income Tax Rebate Under Section 80g have gained immense popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

The ability to customize: We can customize the templates to meet your individual needs, whether it's designing invitations to organize your schedule or even decorating your house.

-

Educational Use: Downloads of educational content for free are designed to appeal to students of all ages. This makes them an essential tool for teachers and parents.

-

Accessibility: immediate access the vast array of design and templates helps save time and effort.

Where to Find more Income Tax Rebate Under Section 80g

Information On Section 80G Of Income Tax Act Ebizfiling

Information On Section 80G Of Income Tax Act Ebizfiling

Verkko SECTION 80G 2 B OF THE INCOME TAX ACT 1961 DEDUCTIONS DONATIONS TO RELIGIOUS CHARITABLE FUNDS ETC NOTIFIED PLACES OF WORSHIP Notification 61 11 10 2014 INCOME TAX ELEVENTH AMENDMENT RULES 2014 AMENDMENT IN RULES 2C 2CA 11AA FORM 10A FORM 56 AND FORM 56D

Verkko 13 kes 228 k 2023 nbsp 0183 32 Taxpayers can avail of tax saving benefits by donating money to eligible charitable institutions under Section 80G of the Act By making donations to these approved institutions and organizations taxpayers can claim deductions ranging from 50 to 100 of the donated amount

In the event that we've stirred your interest in Income Tax Rebate Under Section 80g Let's find out where you can discover these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of Income Tax Rebate Under Section 80g suitable for many purposes.

- Explore categories like decoration for your home, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing or flashcards as well as learning materials.

- Ideal for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates free of charge.

- The blogs covered cover a wide spectrum of interests, all the way from DIY projects to planning a party.

Maximizing Income Tax Rebate Under Section 80g

Here are some ideas of making the most of printables that are free:

1. Home Decor

- Print and frame stunning art, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Print out free worksheets and activities to enhance learning at home as well as in the class.

3. Event Planning

- Design invitations for banners, invitations as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized by using printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Income Tax Rebate Under Section 80g are an abundance of useful and creative resources that cater to various needs and pursuits. Their access and versatility makes them a wonderful addition to the professional and personal lives of both. Explore the vast collection that is Income Tax Rebate Under Section 80g today, and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free are they free?

- Yes, they are! You can print and download these tools for free.

-

Can I utilize free printing templates for commercial purposes?

- It depends on the specific usage guidelines. Make sure you read the guidelines for the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright concerns with printables that are free?

- Some printables may contain restrictions regarding usage. You should read the terms and conditions offered by the creator.

-

How do I print printables for free?

- Print them at home with any printer or head to a local print shop to purchase high-quality prints.

-

What program is required to open Income Tax Rebate Under Section 80g?

- The majority of printables are as PDF files, which can be opened using free programs like Adobe Reader.

Donate Under Section 80G Of Income Tax Receive Deduction

The 80G Certificate And Tax Exemption For Nonprofits Vakilsearch Blog

Check more sample of Income Tax Rebate Under Section 80g below

Income Tax Rebate Under Section 87A Eligibility Tax Deductions

Deduction Under Section 80G Section 80G Of Income Tax Act Deduction

Income Tax Rebate Under Section 87A

Income Tax Rebate Under Section 87a Working And Eligibility

Income Tax Rebate Under Section 87A

Section 87A Tax Rebate Under Section 87A Rebates Financial

https://taxguru.in/income-tax/all-about-deduction-under-section-80g-of...

Verkko 28 kes 228 k 2018 nbsp 0183 32 1 Deduction U s 80G is Allowable to all kind of Assessee 2 Deduction U s 80G on Donation to Foreign Trust 3 Deduction U s 80G on Donation to Political Parties 4 Only donation made to prescribed funds and institutions qualify for section 80G deduction 5 Maximum allowable deduction under section 80G 6

https://learn.quicko.com/section-80g-deduction-for-donation-to...

Verkko 9 helmik 2023 nbsp 0183 32 Section 80G of income tax act allows a deduction for any contribution made to certain relief funds and charitable institutions This deduction can be claimed by all types of taxpayers including NRIs i e individuals HUFs companies firms or any other person However not all donations are eligible for 80G Deduction

Verkko 28 kes 228 k 2018 nbsp 0183 32 1 Deduction U s 80G is Allowable to all kind of Assessee 2 Deduction U s 80G on Donation to Foreign Trust 3 Deduction U s 80G on Donation to Political Parties 4 Only donation made to prescribed funds and institutions qualify for section 80G deduction 5 Maximum allowable deduction under section 80G 6

Verkko 9 helmik 2023 nbsp 0183 32 Section 80G of income tax act allows a deduction for any contribution made to certain relief funds and charitable institutions This deduction can be claimed by all types of taxpayers including NRIs i e individuals HUFs companies firms or any other person However not all donations are eligible for 80G Deduction

Income Tax Rebate Under Section 87a Working And Eligibility

Deduction Under Section 80G Section 80G Of Income Tax Act Deduction

Income Tax Rebate Under Section 87A

Section 87A Tax Rebate Under Section 87A Rebates Financial

Income Tax Rebate Under Section 87A

Income Tax Rebate Under Section 87A All You Need To Know

Income Tax Rebate Under Section 87A All You Need To Know

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh