Today, where screens dominate our lives, the charm of tangible printed materials isn't diminishing. If it's to aid in education in creative or artistic projects, or just adding an extra personal touch to your area, Income Tax Return For Housing Loan have become an invaluable resource. With this guide, you'll dive through the vast world of "Income Tax Return For Housing Loan," exploring what they are, where to locate them, and how they can improve various aspects of your life.

Get Latest Income Tax Return For Housing Loan Below

Income Tax Return For Housing Loan

Income Tax Return For Housing Loan - Income Tax Return For Housing Loan, Income Tax Rebate For Housing Loan, Income Tax Declaration For House Loan, Income Tax Return Housing Loan Interest, Income Tax Return On Home Loan, Income Tax Filing House Loan Interest, Income Tax Rebate On Housing Loan Interest 2021-22, Income Tax Rebate On Housing Loan Interest 2022-23, Income Tax Rebate On Housing Loan Principal And Interest, Income Tax Rebate On Housing Loan Interest In India

The Income Tax Act of India provides tax benefits on both these components under different sections Let s understand this with an example Suppose

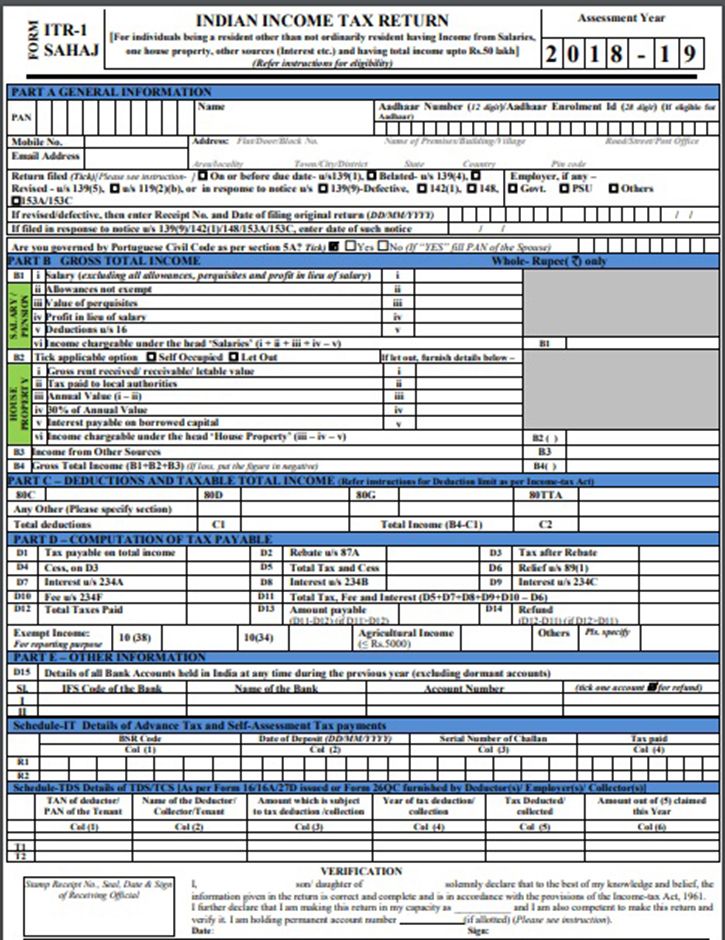

Updated on Mar 18th 2024 8 min read Acquiring a home loan can provide opportunities to save on taxes in accordance with the regulations of the Income tax Act 1961 The

Income Tax Return For Housing Loan provide a diverse range of printable, free materials available online at no cost. These printables come in different kinds, including worksheets templates, coloring pages and much more. The attraction of printables that are free is their versatility and accessibility.

More of Income Tax Return For Housing Loan

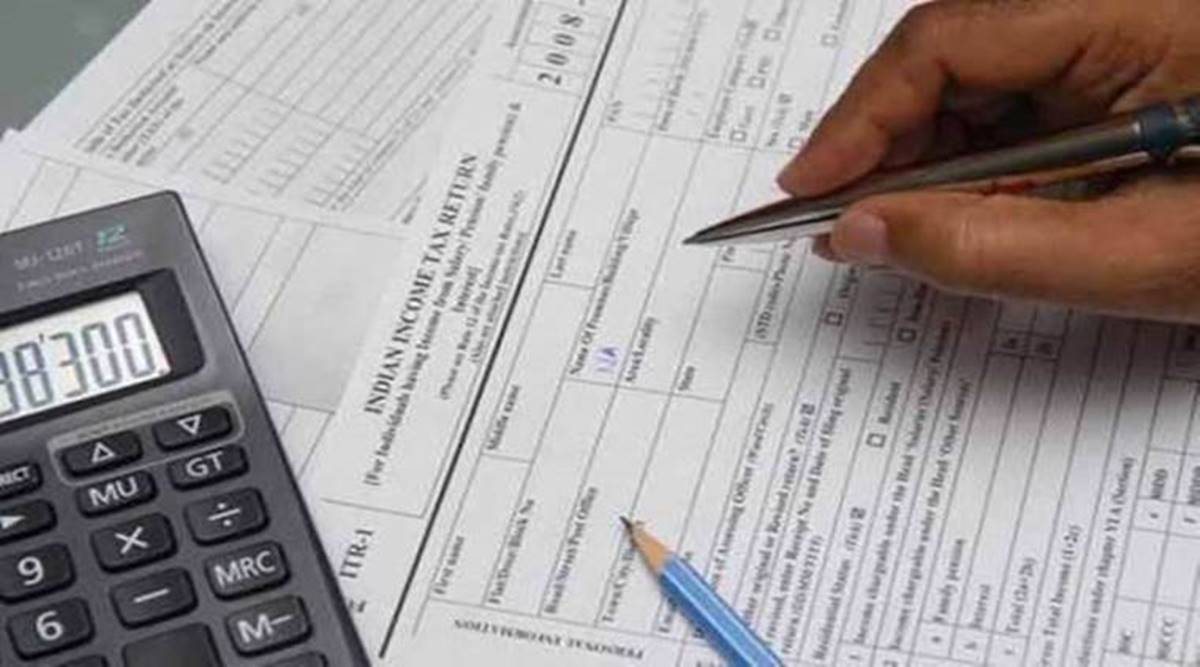

Know The Last Date To File Income Tax Return For FY 2021 22 AY 2022 23

Know The Last Date To File Income Tax Return For FY 2021 22 AY 2022 23

Deduction Amount You can claim a deduction of up to 2 lakhs every financial year on the interest paid towards your home loan Eligibility Criteria The

Published April 22 2020 by Better When you apply for a mortgage your lender is likely to ask you to provide financial documentation which may include 1 to 2 years worth of tax

Printables that are free have gained enormous popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies or costly software.

-

Modifications: You can tailor print-ready templates to your specific requirements when it comes to designing invitations, organizing your schedule, or decorating your home.

-

Educational value: Free educational printables cater to learners of all ages, which makes these printables a powerful source for educators and parents.

-

Simple: Access to the vast array of design and templates will save you time and effort.

Where to Find more Income Tax Return For Housing Loan

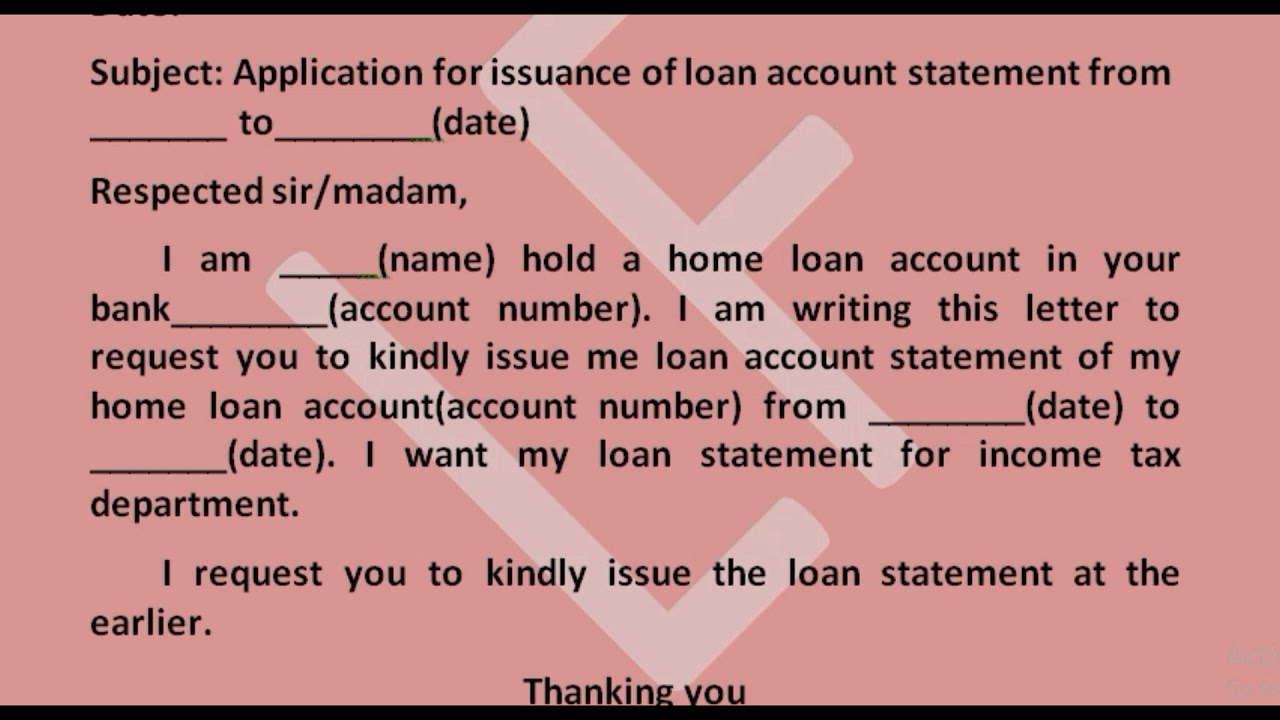

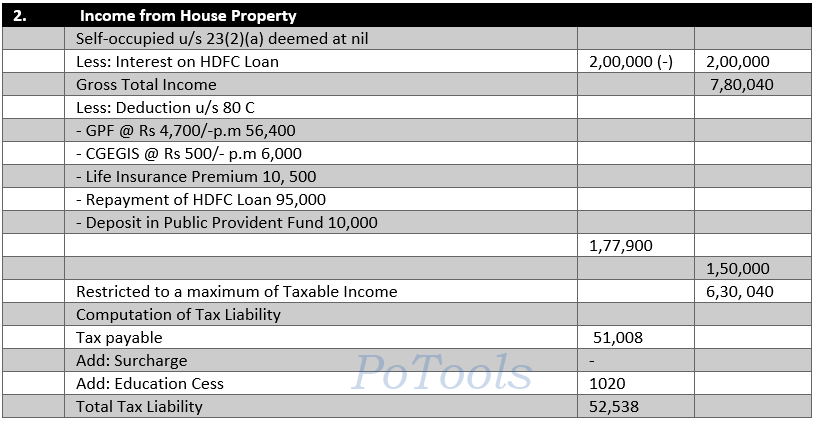

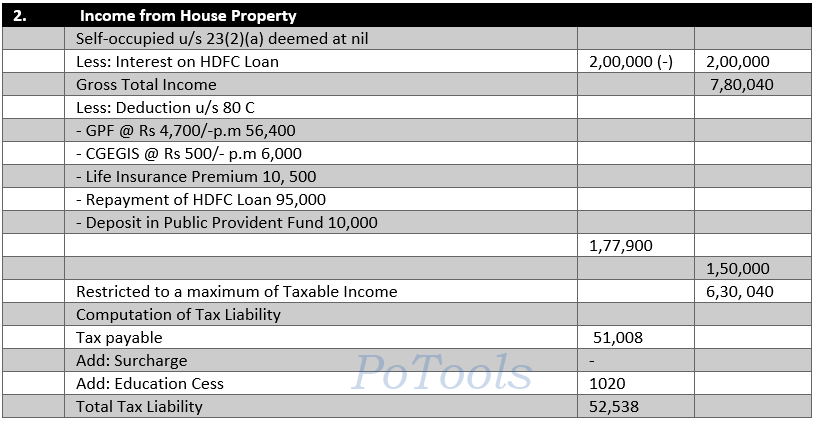

How To Fill Housing Loan Interest And Principal In Income Tax Return

How To Fill Housing Loan Interest And Principal In Income Tax Return

In addition to your basic KYC documents like your proof of address and identity and property documents like chain of documents and title deeds of the land

A home loan provides a number of benefits upon repayment through tax deductions under the Income Tax Act of 1961 A home loan repayment consists of two

Now that we've ignited your interest in printables for free and other printables, let's discover where you can find these treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection in Income Tax Return For Housing Loan for different purposes.

- Explore categories like furniture, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free with flashcards and other teaching tools.

- The perfect resource for parents, teachers, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates free of charge.

- The blogs covered cover a wide spectrum of interests, starting from DIY projects to planning a party.

Maximizing Income Tax Return For Housing Loan

Here are some creative ways of making the most use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes as well as seasonal decorations, to embellish your living spaces.

2. Education

- Print free worksheets to enhance learning at home either in the schoolroom or at home.

3. Event Planning

- Make invitations, banners and decorations for special events such as weddings or birthdays.

4. Organization

- Stay organized with printable planners with to-do lists, planners, and meal planners.

Conclusion

Income Tax Return For Housing Loan are an abundance of practical and imaginative resources that cater to various needs and desires. Their availability and versatility make them a fantastic addition to each day life. Explore the vast collection of printables for free today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly free?

- Yes, they are! You can print and download these materials for free.

-

Can I use free printing templates for commercial purposes?

- It's based on the rules of usage. Always verify the guidelines provided by the creator prior to printing printables for commercial projects.

-

Do you have any copyright concerns with Income Tax Return For Housing Loan?

- Certain printables could be restricted on use. Always read the conditions and terms of use provided by the creator.

-

How can I print printables for free?

- Print them at home with printing equipment or visit a local print shop to purchase high-quality prints.

-

What program do I need to open Income Tax Return For Housing Loan?

- A majority of printed materials are in PDF format. These is open with no cost programs like Adobe Reader.

Joint Home Loan Declaration Form For Income Tax Savings And Non

Joint Home Loan Declaration Form For Income Tax Savings And Non

Check more sample of Income Tax Return For Housing Loan below

8 Point Check List While Applying For Housing Loan Mint2Save Finance

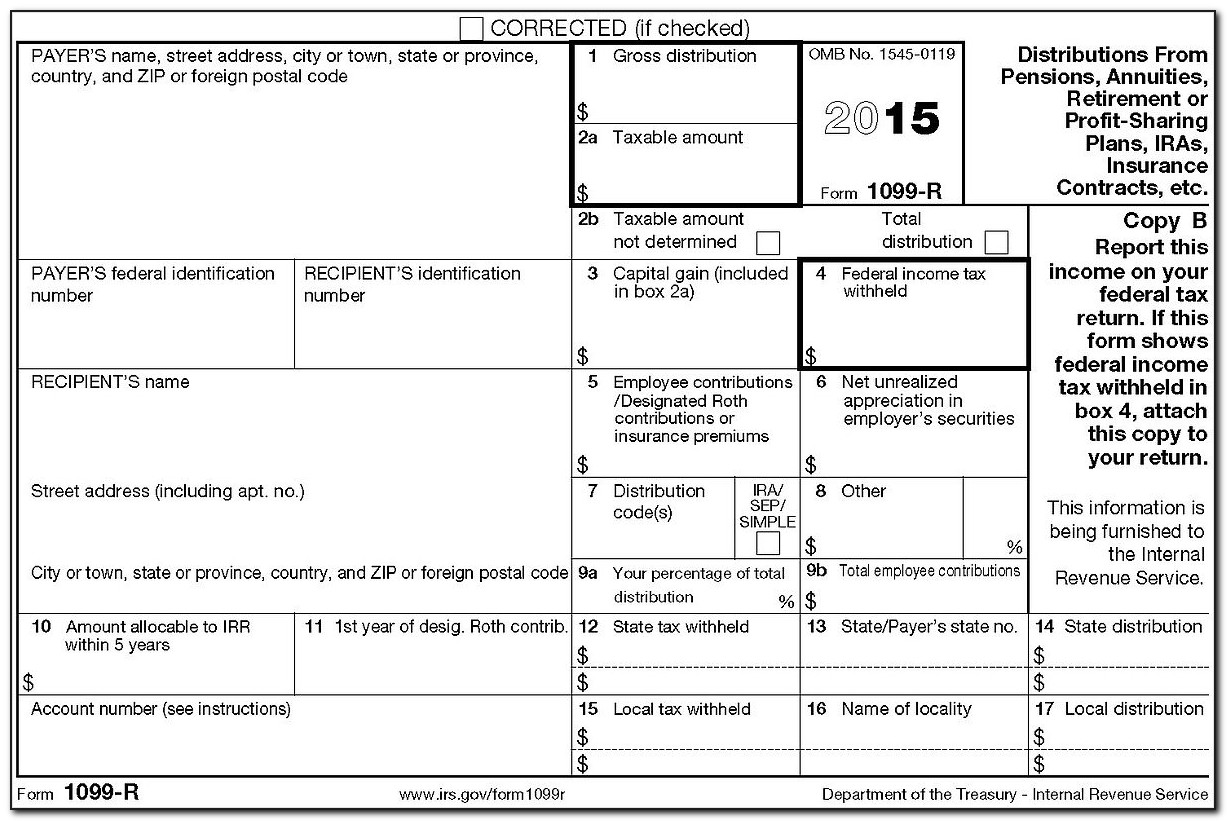

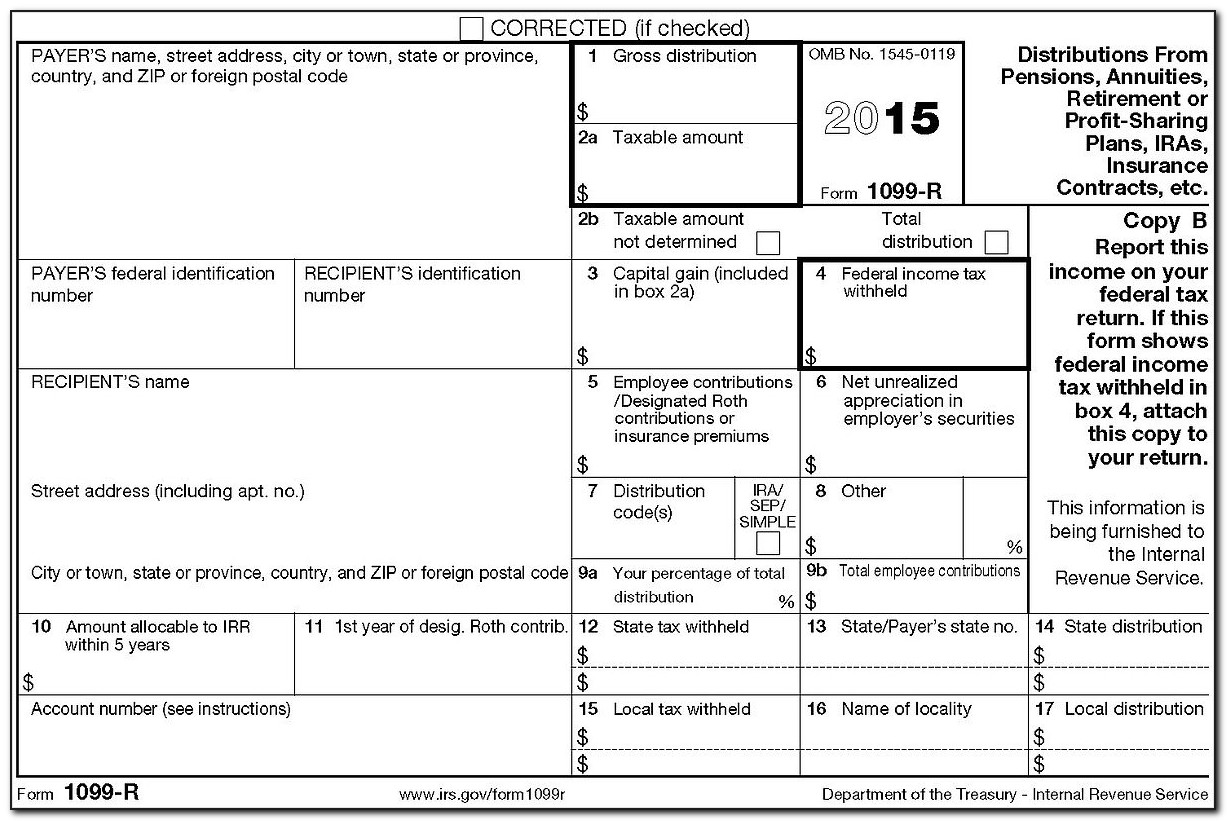

Form 1099 Income Tax Return Form Resume Examples aZDY4rRk79

Income Tax Return

Debit Card Withdrawal From ATMs Made Free Of Charges Amid Coronavirus

Relation Between Loan Amount And Tax Deduction

Income Tax Calculation For Interest On Housing Loan And Deduction U s

https://cleartax.in/s/home-loan-tax-benefits

Updated on Mar 18th 2024 8 min read Acquiring a home loan can provide opportunities to save on taxes in accordance with the regulations of the Income tax Act 1961 The

https://www.kotak.com/en/stories-in-focus/loans/...

ITR is necessary as It is an indicator of your financial stability Through an ITR the lender is able to determine your financial capability You are required to submit ITR for the last

Updated on Mar 18th 2024 8 min read Acquiring a home loan can provide opportunities to save on taxes in accordance with the regulations of the Income tax Act 1961 The

ITR is necessary as It is an indicator of your financial stability Through an ITR the lender is able to determine your financial capability You are required to submit ITR for the last

Debit Card Withdrawal From ATMs Made Free Of Charges Amid Coronavirus

Form 1099 Income Tax Return Form Resume Examples aZDY4rRk79

Relation Between Loan Amount And Tax Deduction

Income Tax Calculation For Interest On Housing Loan And Deduction U s

5 Things That Can Affect Your Housing Loan Benchmark Colorado

ITR Filing Online 2019 20 Last Date How To File Income Tax Return For

ITR Filing Online 2019 20 Last Date How To File Income Tax Return For

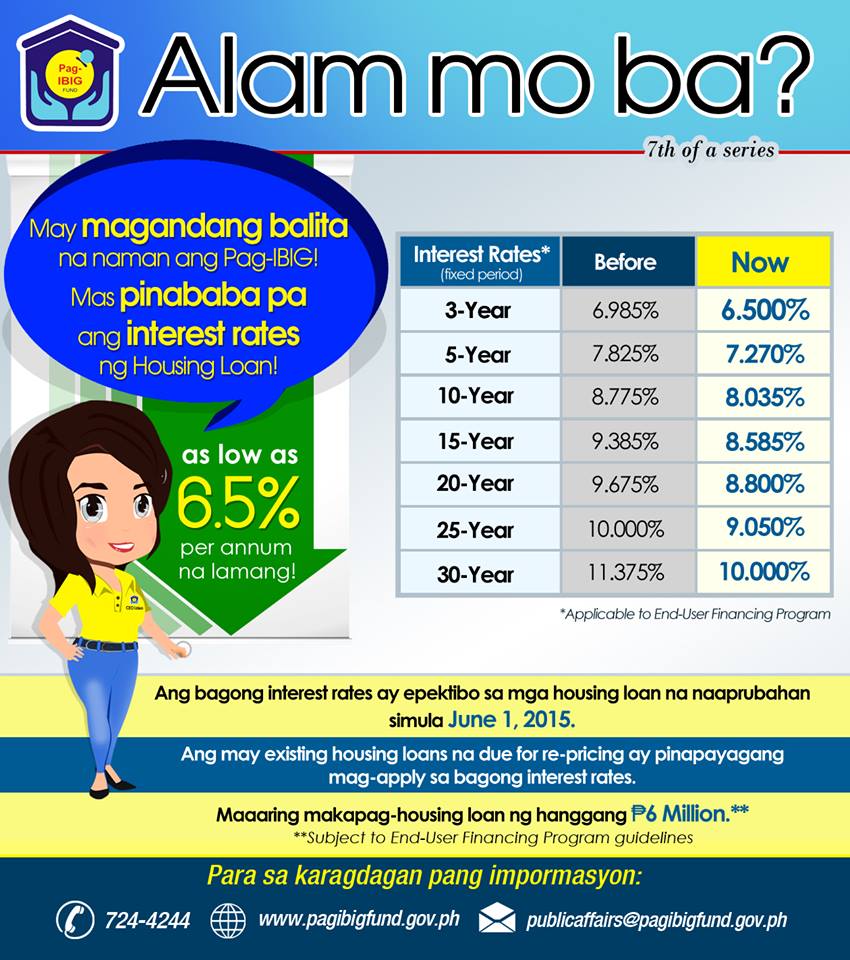

Affordable Property Listing Of The Philippines PAG IBIG HOUSING LOAN