In this age of technology, where screens have become the dominant feature of our lives it's no wonder that the appeal of tangible printed items hasn't gone away. Whatever the reason, whether for education such as creative projects or just adding an individual touch to your area, International Student Tax Return No Income are now a vital source. For this piece, we'll take a dive deeper into "International Student Tax Return No Income," exploring their purpose, where you can find them, and how they can improve various aspects of your lives.

Get Latest International Student Tax Return No Income Below

International Student Tax Return No Income

International Student Tax Return No Income - International Student Tax Return No Income, What Happens If You Don't File Taxes International Student, What Happens If An International Student Does Not File Taxes, Can You File Taxes As A Student With No Income, Can International Students Apply For Tax Return, Do International Students Pay Taxes

You might get a refund Some international students will qualify for a refund due to tax treaties and a lack of serious income if they ve earned income in the US Protect taxation of your worldwide income You fulfill your visa

If you are a foreign student or trainee Finland does usually not impose tax on income you receive from other countries The reason for this is the provisions of international tax treaties

International Student Tax Return No Income offer a wide collection of printable materials available online at no cost. They are available in numerous types, like worksheets, coloring pages, templates and many more. The benefit of International Student Tax Return No Income is in their variety and accessibility.

More of International Student Tax Return No Income

International Student Tax Information

International Student Tax Information

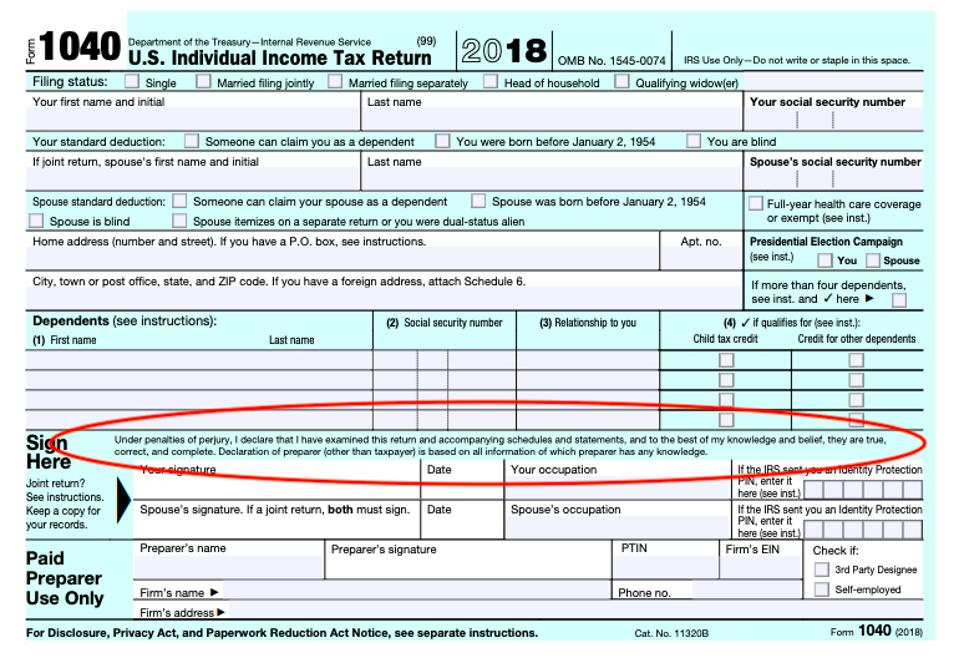

Below are instructions to fill out and submit Form 8843 and supporting documents to the U S Internal Revenue Service IRS Any spouses and dependents in F 2 or J 2 status must also file Form 8843 If you are not filing Form 8843 for the

Yes F 1 international students must pay tax on their US sourced income For example if you receive wages salary tips investment income prizes awards and taxable portions of scholarships and grants you will be

International Student Tax Return No Income have risen to immense popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

The ability to customize: You can tailor printables to fit your particular needs when it comes to designing invitations and schedules, or even decorating your house.

-

Educational Benefits: Printables for education that are free provide for students of all ages, which makes them a great device for teachers and parents.

-

An easy way to access HTML0: Instant access to the vast array of design and templates helps save time and effort.

Where to Find more International Student Tax Return No Income

F 1 International Student Tax Return Filing A Complete Guide

F 1 International Student Tax Return Filing A Complete Guide

Understand withholding and refunds Be aware of potential tax withholding and international students tax return Check filing obligations Even with no income filing might be

NO income in 2023 Do I Need a Social Security Number or Individual Taxpayer Identification Number to File Form 8843 The general answer is no Nonresident international students

Now that we've ignited your interest in printables for free, let's explore where you can discover these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of International Student Tax Return No Income designed for a variety uses.

- Explore categories like decoration for your home, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free, flashcards, and learning tools.

- Perfect for teachers, parents and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers offer their unique designs as well as templates for free.

- The blogs covered cover a wide selection of subjects, that range from DIY projects to party planning.

Maximizing International Student Tax Return No Income

Here are some fresh ways in order to maximize the use use of printables for free:

1. Home Decor

- Print and frame stunning images, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Use these printable worksheets free of charge to build your knowledge at home and in class.

3. Event Planning

- Designs invitations, banners and decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

International Student Tax Return No Income are an abundance of practical and innovative resources which cater to a wide range of needs and needs and. Their availability and versatility make them a valuable addition to every aspect of your life, both professional and personal. Explore the many options of International Student Tax Return No Income to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really for free?

- Yes they are! You can print and download the resources for free.

-

Are there any free printables for commercial uses?

- It's based on specific usage guidelines. Always review the terms of use for the creator prior to using the printables in commercial projects.

-

Are there any copyright issues in printables that are free?

- Some printables may have restrictions in use. Be sure to read these terms and conditions as set out by the author.

-

How can I print printables for free?

- Print them at home with any printer or head to an area print shop for premium prints.

-

What program do I need to run printables that are free?

- Most printables come in PDF format. They can be opened with free software, such as Adobe Reader.

F 1 International Student Tax Return Filing A Complete Guide

Canada Tax Filing canada Tax File canada International

Check more sample of International Student Tax Return No Income below

International Student Tax Return Australia 2023 6 Mistakes To Avoid

International Student Tax Return

International Student Tax Return Tax Refund Tax Deductions Tax

5 Reasons To Consider Studying In A US Community College

When Can I Expect My International Student Tax Refund

Derrick Scarpaci LinkedIn

https://www.vero.fi/en/individuals/tax-cards-and...

If you are a foreign student or trainee Finland does usually not impose tax on income you receive from other countries The reason for this is the provisions of international tax treaties

https://internationaloffice.berkeley.edu/…

Who earned NO income in 2023 You must file Tax Form 8843 by June 17 2024 All international students scholars and their dependents present in the U S under F 1 F 2 J 1 or J 2 nonimmigrant status who are

If you are a foreign student or trainee Finland does usually not impose tax on income you receive from other countries The reason for this is the provisions of international tax treaties

Who earned NO income in 2023 You must file Tax Form 8843 by June 17 2024 All international students scholars and their dependents present in the U S under F 1 F 2 J 1 or J 2 nonimmigrant status who are

5 Reasons To Consider Studying In A US Community College

International Student Tax Return

When Can I Expect My International Student Tax Refund

Derrick Scarpaci LinkedIn

F 1 International Student Tax Return Filing A Full Guide 2023

International Student Tax Return Do I Need To File Taxes As An

International Student Tax Return Do I Need To File Taxes As An

New Mexico Printable Irs Tax Forms Printable Forms Free Online