In this age of technology, with screens dominating our lives but the value of tangible printed objects isn't diminished. For educational purposes, creative projects, or just adding the personal touch to your home, printables for free have proven to be a valuable source. Through this post, we'll take a dive into the world of "Irs Tax Credit Air Conditioner," exploring the different types of printables, where to locate them, and how they can add value to various aspects of your daily life.

Get Latest Irs Tax Credit Air Conditioner Below

Irs Tax Credit Air Conditioner

Irs Tax Credit Air Conditioner - Irs Tax Credit Air Conditioner, Irs Tax Credit For New Air Conditioner, Irs Air Conditioner Tax Credit 2023, Irs Air Conditioner Tax Credit 2022, Does My Air Conditioner Qualify For Tax Credit, Can I Claim A Tax Credit For A New Air Conditioner, What Ac Units Qualify For Tax Credit, How Do I Know If My Air Conditioner Qualifies For A Tax Credit

Credits Deductions Frequently asked questions about energy efficient home improvements and residential clean energy property credits Energy Efficient Home Improvement Credit Qualifying Expenditures and Credit Amount Updated FAQs were released to the public in Fact Sheet 2024 15 PDF April 17 2024 Q1

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

Printables for free include a vast collection of printable documents that can be downloaded online at no cost. These resources come in many designs, including worksheets templates, coloring pages and more. The attraction of printables that are free is in their versatility and accessibility.

More of Irs Tax Credit Air Conditioner

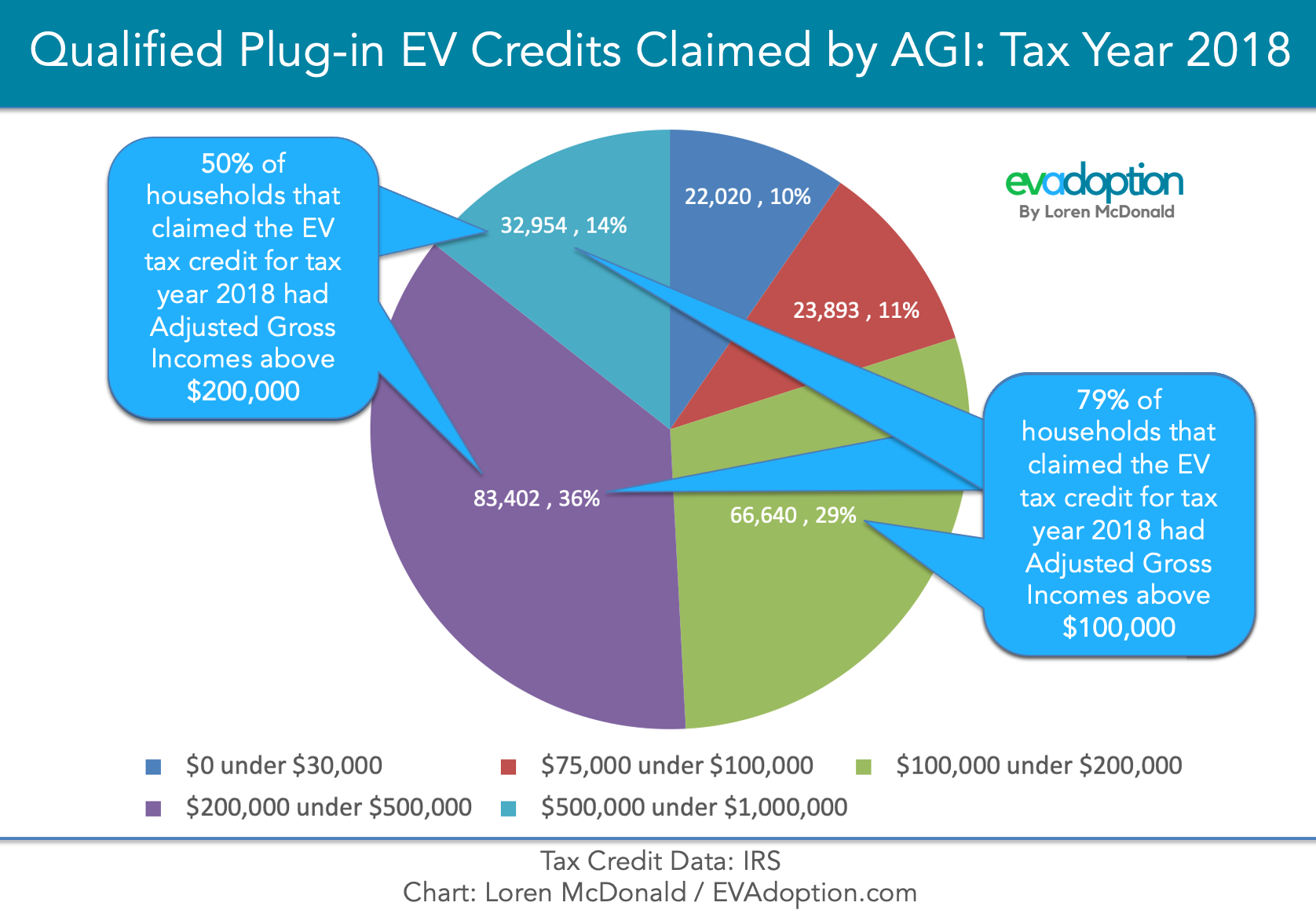

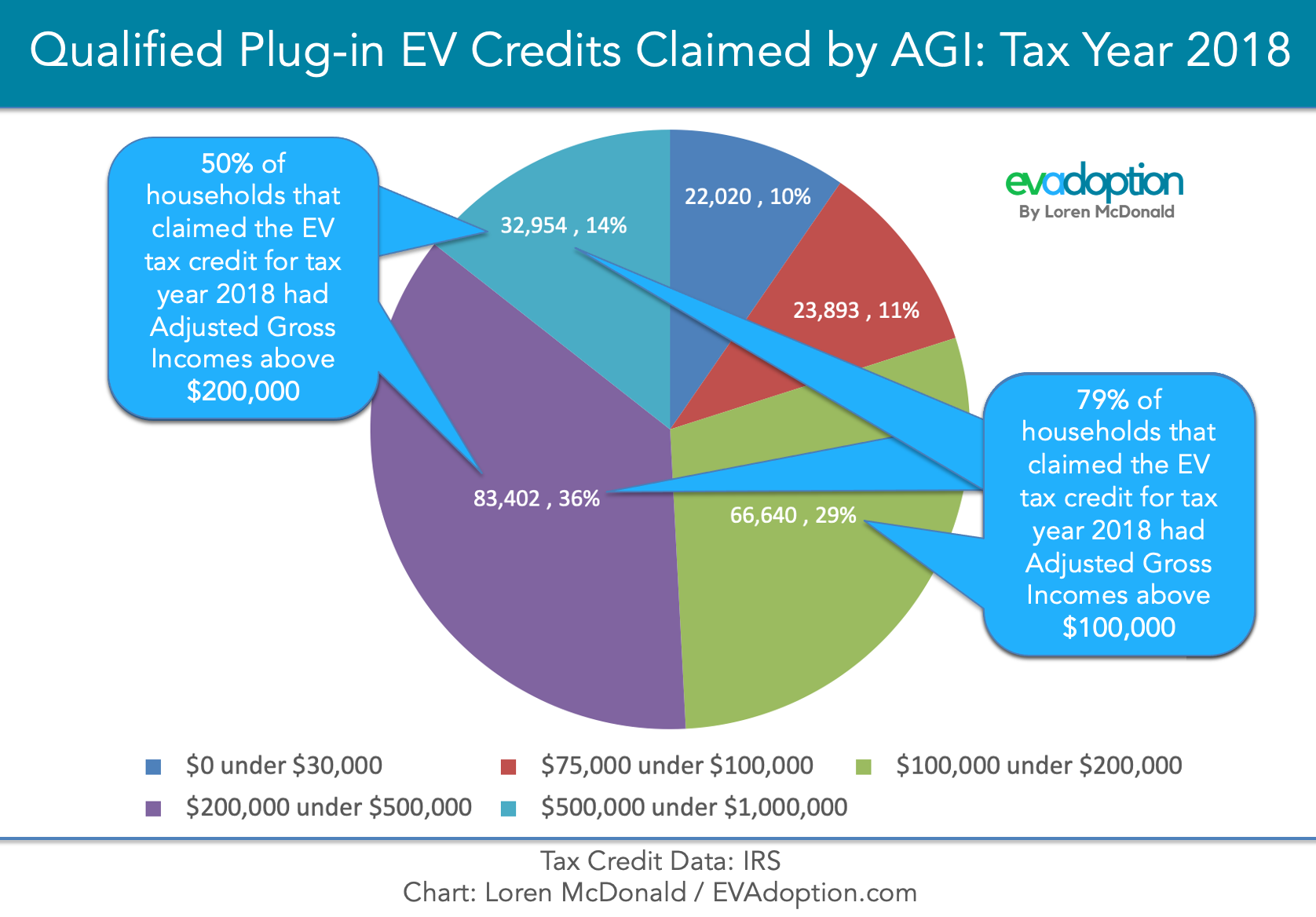

IRS Tax credit by Household AGI 2018 updated FINAL2 EVAdoption

IRS Tax credit by Household AGI 2018 updated FINAL2 EVAdoption

Exterior doors windows and skylights insulation materials or systems and air sealing materials or systems the home must be located in the United States and must be owned and used by the taxpayer as the taxpayer s principal residence 1

Central air conditioners Natural gas propane or oil water heaters Natural gas propane or oil furnaces and hot water boilers Heat pumps water heaters biomass stoves and boilers Home energy audits of a main home The maximum credit that can be claimed each year is

The Irs Tax Credit Air Conditioner have gained huge popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or costly software.

-

customization: They can make designs to suit your personal needs whether you're designing invitations as well as organizing your calendar, or even decorating your house.

-

Educational Worth: Educational printables that can be downloaded for free offer a wide range of educational content for learners of all ages. This makes them a useful device for teachers and parents.

-

Affordability: Instant access to many designs and templates saves time and effort.

Where to Find more Irs Tax Credit Air Conditioner

Irs Form 5695 Instructions 2023 Printable Forms Free Online

Irs Form 5695 Instructions 2023 Printable Forms Free Online

Central air conditioning 300 for air conditioners recognized as ENERGY STAR Most Efficient Air source heat pumps 300 for ENERGY STAR certified heat pumps Natural gas propane or oil furnace 150 for ENERGY STAR certified gas furnaces except those certified for U S South only

Eficient air conditioners Eficient heating equipment Eficient water heating equipment Other Energy Eficiency Upgrades Electric panel or circuit upgrades for new electric equipment N A 300 150 N A Updated Tax Credit Available for 2023 2032 Tax Years 30 of cost up to 2 000 per year 30 of cost up to 600

Now that we've ignited your interest in Irs Tax Credit Air Conditioner and other printables, let's discover where you can find these gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection of Irs Tax Credit Air Conditioner for various needs.

- Explore categories like decoration for your home, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free along with flashcards, as well as other learning tools.

- Perfect for teachers, parents and students looking for extra resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates for free.

- These blogs cover a wide range of topics, everything from DIY projects to party planning.

Maximizing Irs Tax Credit Air Conditioner

Here are some inventive ways how you could make the most of printables for free:

1. Home Decor

- Print and frame stunning art, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Use these printable worksheets free of charge to enhance learning at home (or in the learning environment).

3. Event Planning

- Make invitations, banners as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized with printable calendars, to-do lists, and meal planners.

Conclusion

Irs Tax Credit Air Conditioner are an abundance of useful and creative resources designed to meet a range of needs and preferences. Their availability and versatility make them a valuable addition to each day life. Explore the wide world of Irs Tax Credit Air Conditioner today to unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually gratis?

- Yes they are! You can download and print these items for free.

-

Do I have the right to use free templates for commercial use?

- It's dependent on the particular terms of use. Be sure to read the rules of the creator prior to printing printables for commercial projects.

-

Do you have any copyright violations with Irs Tax Credit Air Conditioner?

- Some printables may come with restrictions in their usage. Make sure to read the terms of service and conditions provided by the author.

-

How do I print printables for free?

- Print them at home with the printer, or go to an area print shop for the highest quality prints.

-

What program do I need in order to open Irs Tax Credit Air Conditioner?

- Most PDF-based printables are available in the format PDF. This can be opened using free programs like Adobe Reader.

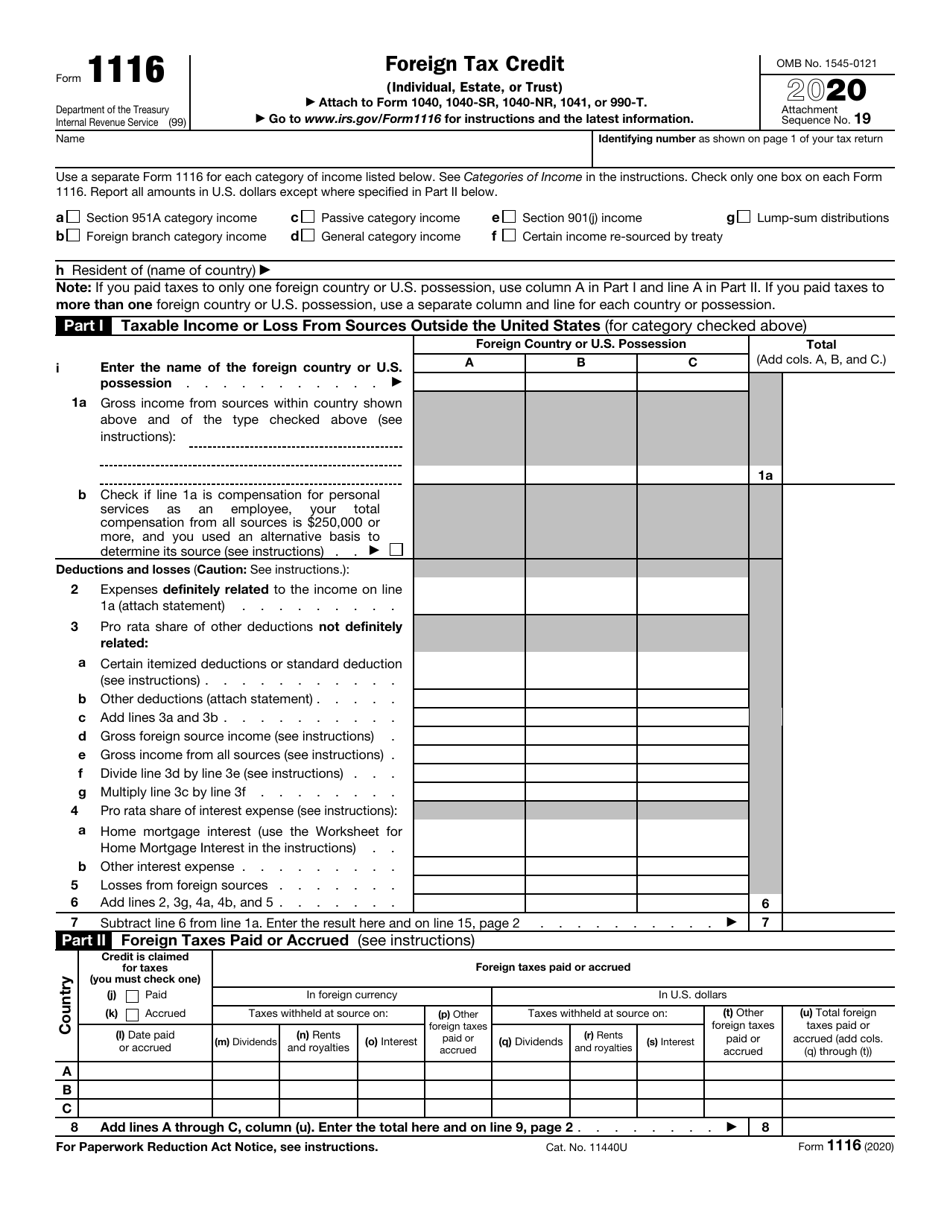

Irs Form 1116 Printable Printable Forms Free Online

For 346PRODUCTION Www directingactors

Check more sample of Irs Tax Credit Air Conditioner below

The Central Board Of Direct Tax CBDT Modified The Provisions Of The

2023 Home Energy Federal Tax Credits Rebates Explained

Income Tax 2022 Irs Latest News Update

Cost To Install A Heat Pump 2023 Cost Guide Inch Calculator

Form 5695 Instructions 2023 Printable Forms Free Online

Federal Tax Credits

https://www.irs.gov/credits-deductions/energy...

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

https://www.energystar.gov/about/federal-tax...

Central Air Conditioners Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal Tax Credits Strategies to Maximize Your Federal Tax Savings Claim the credits using the IRS Form 5695 Instructions for Form 5695

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

Central Air Conditioners Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal Tax Credits Strategies to Maximize Your Federal Tax Savings Claim the credits using the IRS Form 5695 Instructions for Form 5695

Cost To Install A Heat Pump 2023 Cost Guide Inch Calculator

2023 Home Energy Federal Tax Credits Rebates Explained

Form 5695 Instructions 2023 Printable Forms Free Online

Federal Tax Credits

Solar Tax Credit And Your Boat Updated Blog

Goodman Rebates

Goodman Rebates

Does 15 Seer AC Qualify For Tax Credit Revealed