In this age of technology, with screens dominating our lives it's no wonder that the appeal of tangible, printed materials hasn't diminished. Be it for educational use project ideas, artistic or simply adding an individual touch to the home, printables for free are now a vital resource. This article will dive into the world of "Is Loan Taken For Renovation Of A House Eligible Under Section 80c," exploring what they are, where to find them, and how they can enrich various aspects of your lives.

What Are Is Loan Taken For Renovation Of A House Eligible Under Section 80c?

Printables for free cover a broad range of downloadable, printable materials available online at no cost. The resources are offered in a variety types, such as worksheets coloring pages, templates and much more. The benefit of Is Loan Taken For Renovation Of A House Eligible Under Section 80c is in their variety and accessibility.

Is Loan Taken For Renovation Of A House Eligible Under Section 80c

Is Loan Taken For Renovation Of A House Eligible Under Section 80c

Is Loan Taken For Renovation Of A House Eligible Under Section 80c - Is Loan Taken For Renovation Of A House Eligible Under Section 80c

[desc-5]

[desc-1]

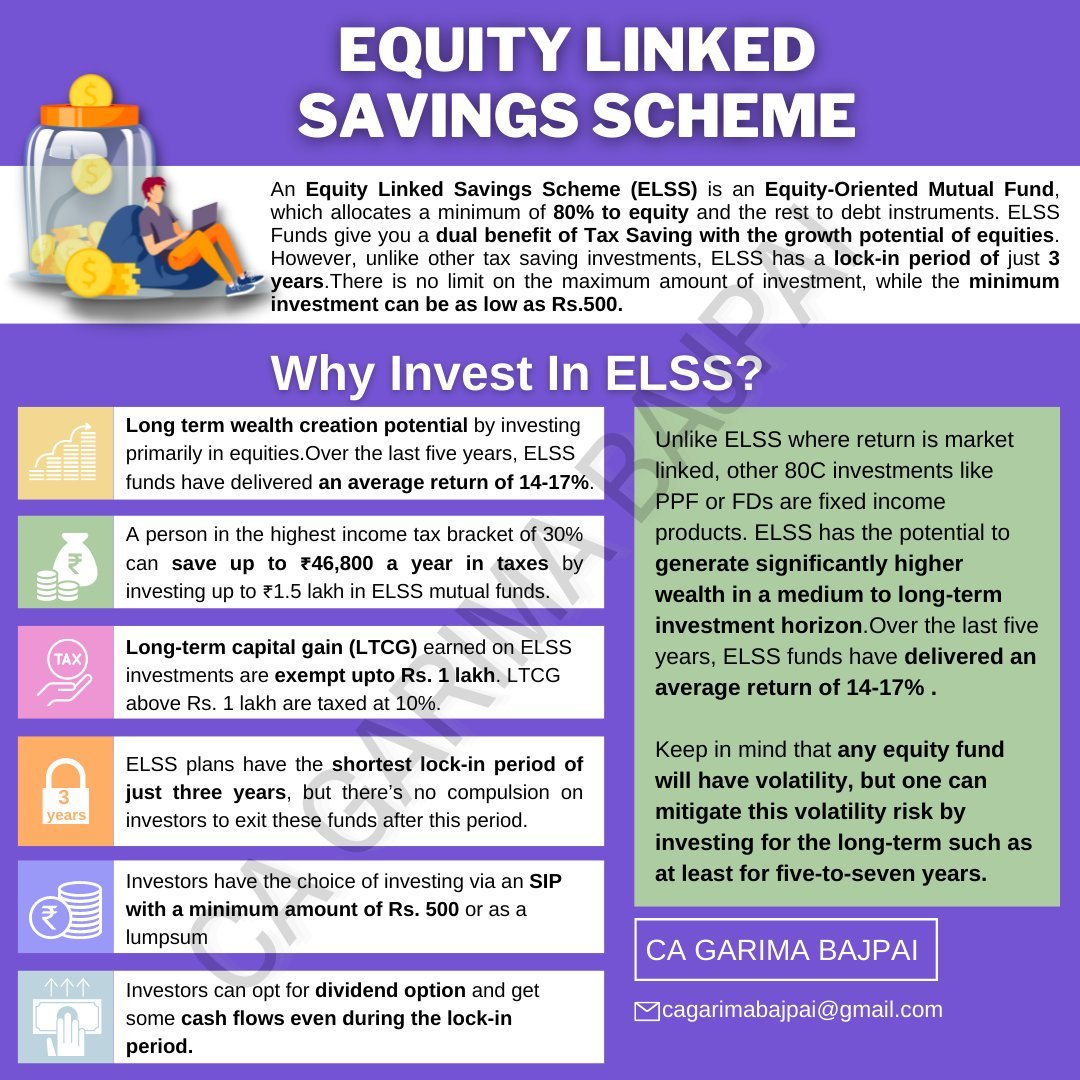

Investors Can Save Up To Rs 46 350 In Taxes Per Year By Investing Up To

Investors Can Save Up To Rs 46 350 In Taxes Per Year By Investing Up To

[desc-4]

[desc-6]

Raising The Limit Under Section 80C What Budget Can Do To Reduce Your

Raising The Limit Under Section 80C What Budget Can Do To Reduce Your

[desc-9]

[desc-7]

Attention Tax Payers ONLY 3 DAYS LEFT To Plan Your Taxes For The FY

Section 80C Deductions Income Tax Nature Of Payments U s 80C

Section 80C Life Insurance Premium Eligible Amount Deduction 2022

Section 80C Life Insurance Premium Eligible Amount Deduction 2022

Provident Fund Return Benefits Procedure And Information

Deduction Under Section 80C To 80U YouTube

Deduction Under Section 80C To 80U YouTube

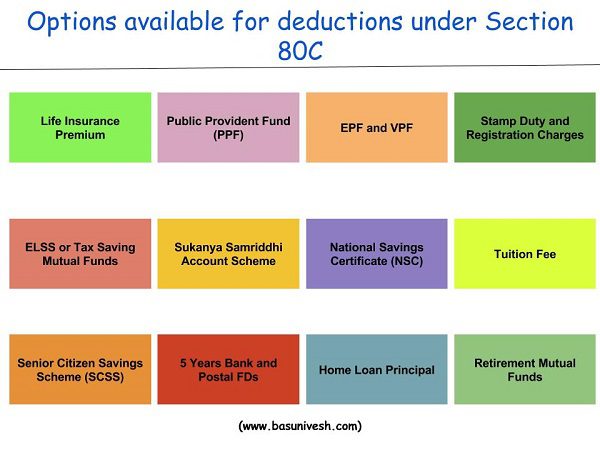

Here A List Of Types Of Deductions Covered Under Section 80C