In the age of digital, where screens rule our lives yet the appeal of tangible printed items hasn't gone away. Whether it's for educational purposes in creative or artistic projects, or just adding some personal flair to your area, Is Student Loan Interest Tax Deductible Canada are a great resource. We'll dive into the world of "Is Student Loan Interest Tax Deductible Canada," exploring their purpose, where to locate them, and how they can add value to various aspects of your life.

Get Latest Is Student Loan Interest Tax Deductible Canada Below

Is Student Loan Interest Tax Deductible Canada

Is Student Loan Interest Tax Deductible Canada - Is Student Loan Interest Tax Deductible Canada, Is Student Loan Interest Tax Deductible, Is Loan Interest Tax Deductible In Canada, Is Federal Student Loan Interest Tax Deductible

The most common deductions that apply to students are child care expenses moving expenses The most common non refundable tax credits that apply to students are Canada employment amount interest paid on student loans tuition education and textbook amounts Some of common refundable tax credits are Canada training credit

Are student loans tax deductible in Canada Your student loan is not tax deductible but you can claim any interest you ve paid on your loan in the preceding five years as a non refundable tax credit

Is Student Loan Interest Tax Deductible Canada include a broad array of printable materials that are accessible online for free cost. They come in many kinds, including worksheets coloring pages, templates and much more. The value of Is Student Loan Interest Tax Deductible Canada lies in their versatility as well as accessibility.

More of Is Student Loan Interest Tax Deductible Canada

Mortgage Interest Tax Deduction 2020 Calculator JunaidKaleah

Mortgage Interest Tax Deduction 2020 Calculator JunaidKaleah

Tax credits for student loans You receive a 15 tax credit on any interest you pay on your government student loans each year This credit applies to interest payments you make on both your federal and provincial or territorial student loans

You can claim the interest you paid on your student loans to lower your income tax payable However you can only claim the interest you paid in 2022 and any of the preceding 5 years if not claimed already if the loan was issued to you under The Canada Student Loans Act The Canada Student Financial Assistance Act

Is Student Loan Interest Tax Deductible Canada have garnered immense popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies or expensive software.

-

Individualization You can tailor printables to fit your particular needs be it designing invitations for your guests, organizing your schedule or even decorating your home.

-

Educational Value Free educational printables can be used by students from all ages, making the perfect aid for parents as well as educators.

-

Accessibility: instant access a myriad of designs as well as templates helps save time and effort.

Where to Find more Is Student Loan Interest Tax Deductible Canada

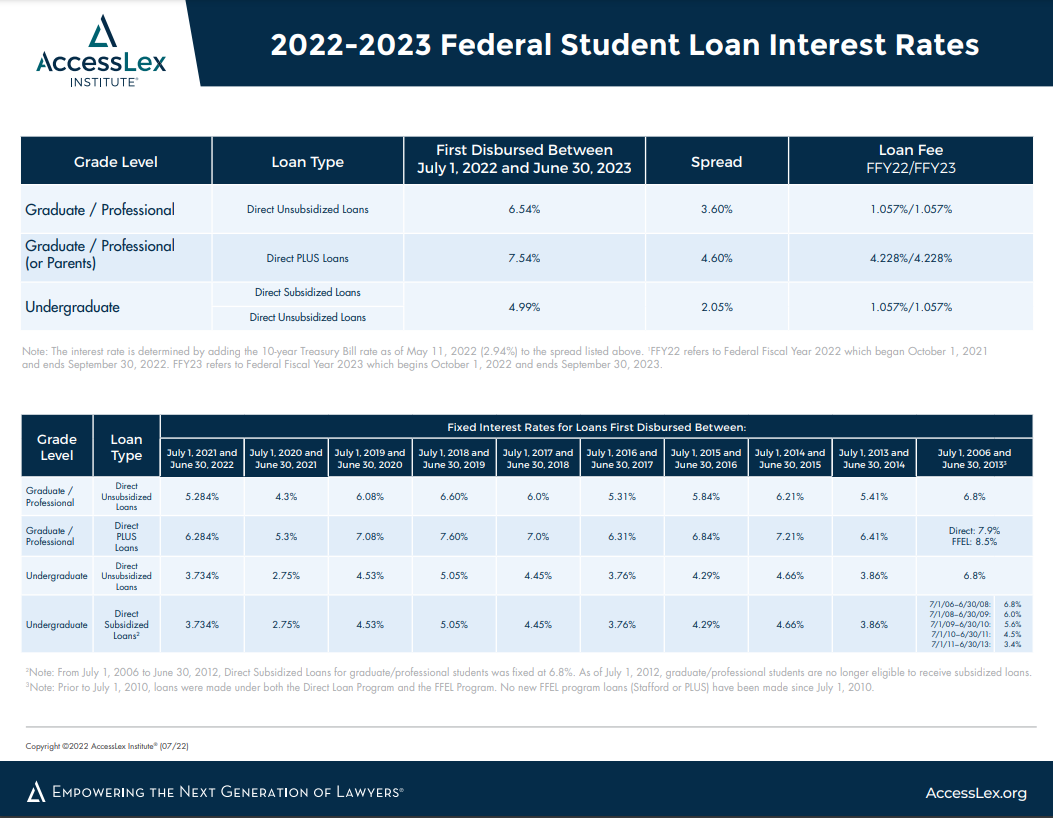

Federal Student Loan Interest Rates AccessLex

Federal Student Loan Interest Rates AccessLex

Student loan interest If you have provincial territorial or federal student loans you may be eligible to receive a tax credit based on any interest you pay on them Note that Interest paid on

The Canada Revenue Agency CRA allows you to deduct interest paid on student loans if you received them under the Canada Student Loans Act Canada Student Financial Assistance Act Apprentice Loans Act or through any similar provincial or

We've now piqued your interest in Is Student Loan Interest Tax Deductible Canada we'll explore the places you can get these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety in Is Student Loan Interest Tax Deductible Canada for different objectives.

- Explore categories such as design, home decor, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free or flashcards as well as learning materials.

- Ideal for teachers, parents and students looking for additional sources.

3. Creative Blogs

- Many bloggers provide their inventive designs or templates for download.

- The blogs are a vast selection of subjects, that range from DIY projects to planning a party.

Maximizing Is Student Loan Interest Tax Deductible Canada

Here are some ways to make the most of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Use these printable worksheets free of charge to build your knowledge at home as well as in the class.

3. Event Planning

- Invitations, banners as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable planners with to-do lists, planners, and meal planners.

Conclusion

Is Student Loan Interest Tax Deductible Canada are a treasure trove of useful and creative resources that meet a variety of needs and interests. Their accessibility and flexibility make them a wonderful addition to any professional or personal life. Explore the vast world of printables for free today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really available for download?

- Yes you can! You can download and print these items for free.

-

Can I utilize free printables for commercial use?

- It's contingent upon the specific rules of usage. Make sure you read the guidelines for the creator before utilizing printables for commercial projects.

-

Are there any copyright issues in Is Student Loan Interest Tax Deductible Canada?

- Certain printables could be restricted on use. Always read the terms and conditions offered by the creator.

-

How do I print printables for free?

- Print them at home with the printer, or go to a local print shop to purchase superior prints.

-

What program will I need to access printables for free?

- The majority of printables are with PDF formats, which can be opened with free programs like Adobe Reader.

Is Your Interest Tax Deductible ShineWing TY TEOH

How To Claim The Student Loan Interest Deduction Tomcaligist

Check more sample of Is Student Loan Interest Tax Deductible Canada below

Is Student Loan Interest Tax Deductible

Student Loan Interest Deduction 2013 PriorTax Blog

The Deduction Of Interest On Mortgages Is More Delicate With The New

Is Car Loan Interest Tax Deductible In Canada

Student Loan Interest Tax Deduction Milliken Perkins Brunelle

Are Student Loans Tax Deductible Bold

https://turbotax.intuit.ca › tips

Are student loans tax deductible in Canada Your student loan is not tax deductible but you can claim any interest you ve paid on your loan in the preceding five years as a non refundable tax credit

https://turbotax.intuit.ca › tips

Receive a 15 tax credit based on the interest you paid on your student loans in 2022 and the preceding five years To qualify for the student loan tax credit you must be a Canadian citizen permanent resident or protected person and

Are student loans tax deductible in Canada Your student loan is not tax deductible but you can claim any interest you ve paid on your loan in the preceding five years as a non refundable tax credit

Receive a 15 tax credit based on the interest you paid on your student loans in 2022 and the preceding five years To qualify for the student loan tax credit you must be a Canadian citizen permanent resident or protected person and

Is Car Loan Interest Tax Deductible In Canada

Student Loan Interest Deduction 2013 PriorTax Blog

Student Loan Interest Tax Deduction Milliken Perkins Brunelle

Are Student Loans Tax Deductible Bold

How To Get The Student Loan Interest Deduction NerdWallet

Investment Expenses What s Tax Deductible Charles Schwab

Investment Expenses What s Tax Deductible Charles Schwab

Tax Deductions You Can Deduct What Napkin Finance