In a world when screens dominate our lives, the charm of tangible, printed materials hasn't diminished. No matter whether it's for educational uses such as creative projects or just adding an extra personal touch to your home, printables for free have become an invaluable source. The following article is a dive into the sphere of "Malta Corporate Tax Rate," exploring what they are, how to locate them, and how they can enrich various aspects of your life.

Get Latest Malta Corporate Tax Rate Below

Malta Corporate Tax Rate

Malta Corporate Tax Rate - Malta Corporate Tax Rate, Malta Corporate Tax Rate 5, Malta Corporate Tax Rate 2023, Malta Corporate Tax Rate 2022, Maltese Corporate Tax Rate, Malta Business Tax Rate, Malta Effective Corporate Tax Rate, Malta Corporate Profit Tax Rate, Malta Company Tax Rate, Malta 5 Tax Rate

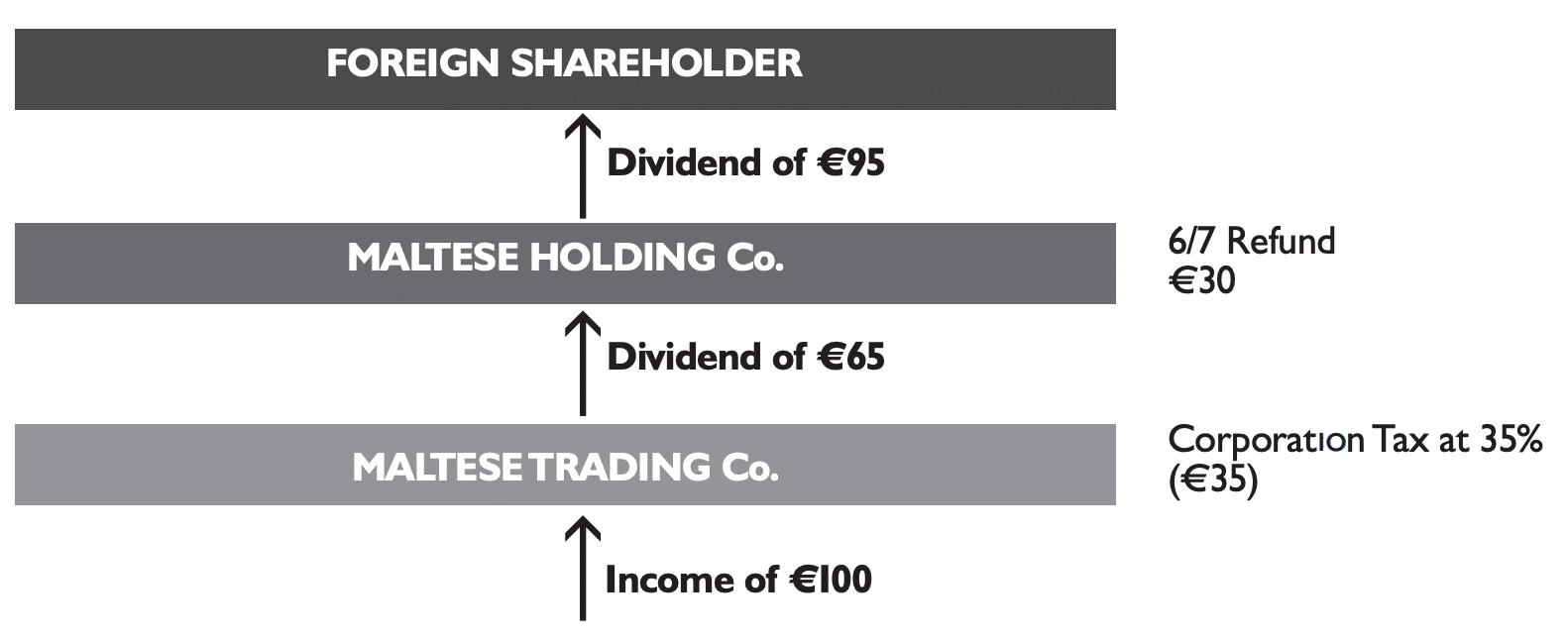

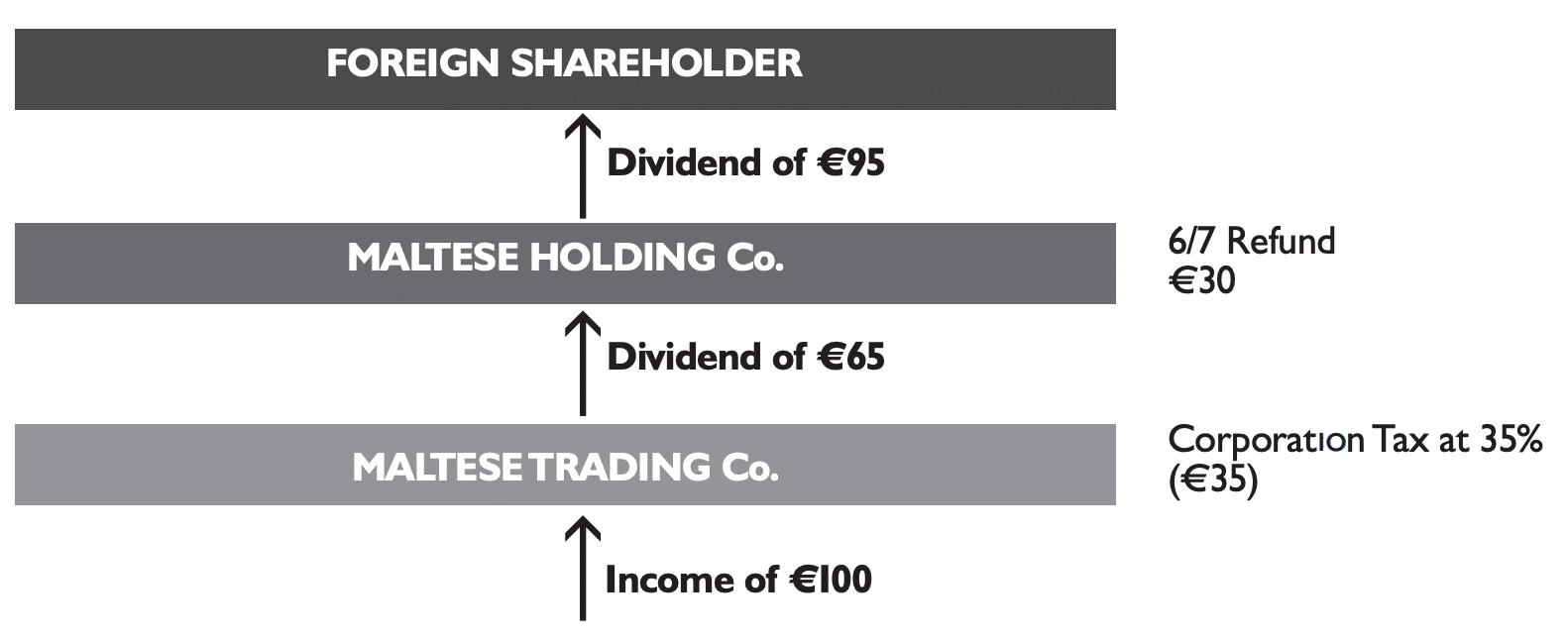

Malta has a standard 35 corporate tax rate chargeable against a company s income for each fiscal year When dividends are distributed to shareholders they then become eligible to claim a tax reimbursement on the organisation s profits However they may also apply for tax refunds where the organization operates in Malta as an overseas branch

Attractive Tax System Malta s full imputation system combined with the 6 7ths refund mechanism for non resident and non domiciled shareholders results in an effective corporate tax rate of just 5 This is one of the lowest rates in the European Union making Malta an attractive destination for businesses seeking tax efficiency

The Malta Corporate Tax Rate are a huge array of printable materials online, at no cost. These printables come in different designs, including worksheets coloring pages, templates and more. The appeal of printables for free is in their versatility and accessibility.

More of Malta Corporate Tax Rate

Plan For Global Corporate Tax Rate Unlikely To Affect Malta for Now

Plan For Global Corporate Tax Rate Unlikely To Affect Malta for Now

1 September 2018 Malta has a competitive tax system including among others full imputation tax refund participation exemption and notional interest deduction Also on kpmg

Last reviewed 27 February 2024 Taxable period The year of assessment is a calendar year but a company may obtain authorisation from the Maltese Commissioner for Tax and Customs to have a different year end i e other than 31 December Tax returns

Malta Corporate Tax Rate have gained immense popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or costly software.

-

Individualization The Customization feature lets you tailor printables to your specific needs such as designing invitations for your guests, organizing your schedule or decorating your home.

-

Educational Use: Printables for education that are free cater to learners of all ages, making them a valuable instrument for parents and teachers.

-

The convenience of Fast access many designs and templates reduces time and effort.

Where to Find more Malta Corporate Tax Rate

Malta s Corporate Tax Refund Scheme

Malta s Corporate Tax Refund Scheme

The Malta corporate tax rate is a flat rate of 35 Other taxes include VAT stamp duty and customs and excise duty Malta is the only EU member state with a full imputation system of taxation in force One of the key advantages of the Maltese company income tax system is the full imputation system that applies to the taxation of dividends

The corporate tax rate in Malta is set at 35 and companies incorporated in Malta are subjected to tax in Malta on their worldwide income This is irrespective of where the source of income is from and where it is received

After we've peaked your curiosity about Malta Corporate Tax Rate we'll explore the places you can discover these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of Malta Corporate Tax Rate suitable for many needs.

- Explore categories such as the home, decor, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free along with flashcards, as well as other learning materials.

- Great for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers post their original designs and templates at no cost.

- The blogs are a vast range of topics, ranging from DIY projects to party planning.

Maximizing Malta Corporate Tax Rate

Here are some inventive ways ensure you get the very most of Malta Corporate Tax Rate:

1. Home Decor

- Print and frame beautiful images, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Use printable worksheets for free to enhance your learning at home and in class.

3. Event Planning

- Design invitations, banners, and decorations for special occasions like birthdays and weddings.

4. Organization

- Keep track of your schedule with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Malta Corporate Tax Rate are an abundance of practical and innovative resources for a variety of needs and interest. Their accessibility and flexibility make them an invaluable addition to any professional or personal life. Explore the vast world of Malta Corporate Tax Rate and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really cost-free?

- Yes you can! You can download and print these documents for free.

-

Does it allow me to use free printing templates for commercial purposes?

- It's dependent on the particular usage guidelines. Always read the guidelines of the creator before using their printables for commercial projects.

-

Are there any copyright rights issues with Malta Corporate Tax Rate?

- Certain printables could be restricted regarding their use. Be sure to review the terms and conditions set forth by the creator.

-

How do I print Malta Corporate Tax Rate?

- You can print them at home using printing equipment or visit a local print shop to purchase superior prints.

-

What software do I require to view printables for free?

- The majority are printed in PDF format. They can be opened using free software, such as Adobe Reader.

Malta Corporate Tax Rate 2023 Take profit

Malta Let It Be Explore Malt Beer Exploring

Check more sample of Malta Corporate Tax Rate below

Passive Income Tax In Malta Papilio Services Limited

What Is Malta s Taxation System Tax Free Citizen

Malta Corporate Tax Rate 2023 Take profit

Malta Direct Corporate Taxation TBA Associates

Malta To Make Corporation Tax Proposals To The OECD

A Comprehensive Guide To Malta s 5 Effective Corporate Tax Rate Jean

https://jeangalea.com/malta-low-corporate-tax

Attractive Tax System Malta s full imputation system combined with the 6 7ths refund mechanism for non resident and non domiciled shareholders results in an effective corporate tax rate of just 5 This is one of the lowest rates in the European Union making Malta an attractive destination for businesses seeking tax efficiency

https://cfr.gov.mt/en/inlandrevenue/corporatetax/...

According to our income tax legislation Maltese companies are subject to corporate tax at the rate of 35 on their worldwide income and capital gains Foreign companies incorporated outside Malta carrying out business activities in Malta are liable to tax on income arising in Malta

Attractive Tax System Malta s full imputation system combined with the 6 7ths refund mechanism for non resident and non domiciled shareholders results in an effective corporate tax rate of just 5 This is one of the lowest rates in the European Union making Malta an attractive destination for businesses seeking tax efficiency

According to our income tax legislation Maltese companies are subject to corporate tax at the rate of 35 on their worldwide income and capital gains Foreign companies incorporated outside Malta carrying out business activities in Malta are liable to tax on income arising in Malta

Malta Direct Corporate Taxation TBA Associates

What Is Malta s Taxation System Tax Free Citizen

Malta To Make Corporation Tax Proposals To The OECD

A Comprehensive Guide To Malta s 5 Effective Corporate Tax Rate Jean

Contact Corporate Services Limited Malta CSL Malta Malta Company

Providing Corporate Service Excellence In Malta Astra Consulting Malta

Providing Corporate Service Excellence In Malta Astra Consulting Malta

Malta Maritime Flag Ranked 14th On Paris MoU Committee White List AMK