In this day and age where screens dominate our lives yet the appeal of tangible printed products hasn't decreased. No matter whether it's for educational uses for creative projects, simply to add some personal flair to your home, printables for free have proven to be a valuable resource. For this piece, we'll take a dive into the sphere of "Manitoba Personal Tax Exemption 2023," exploring their purpose, where to locate them, and how they can improve various aspects of your daily life.

Get Latest Manitoba Personal Tax Exemption 2023 Below

Manitoba Personal Tax Exemption 2023

Manitoba Personal Tax Exemption 2023 - Manitoba Personal Tax Exemption 2023, Manitoba Personal Tax Credit 2023, Federal Personal Tax Exemption 2023, Federal Personal Tax Credit 2023, Federal Income Tax Personal Exemption 2023, Manitoba Personal Income Tax Rates

Manitoba 2023 budget tax measures now law 11 April 2023 1 min read Manitoba s Bill 14 which enacts measures announced in the province s 2023 budget received Royal

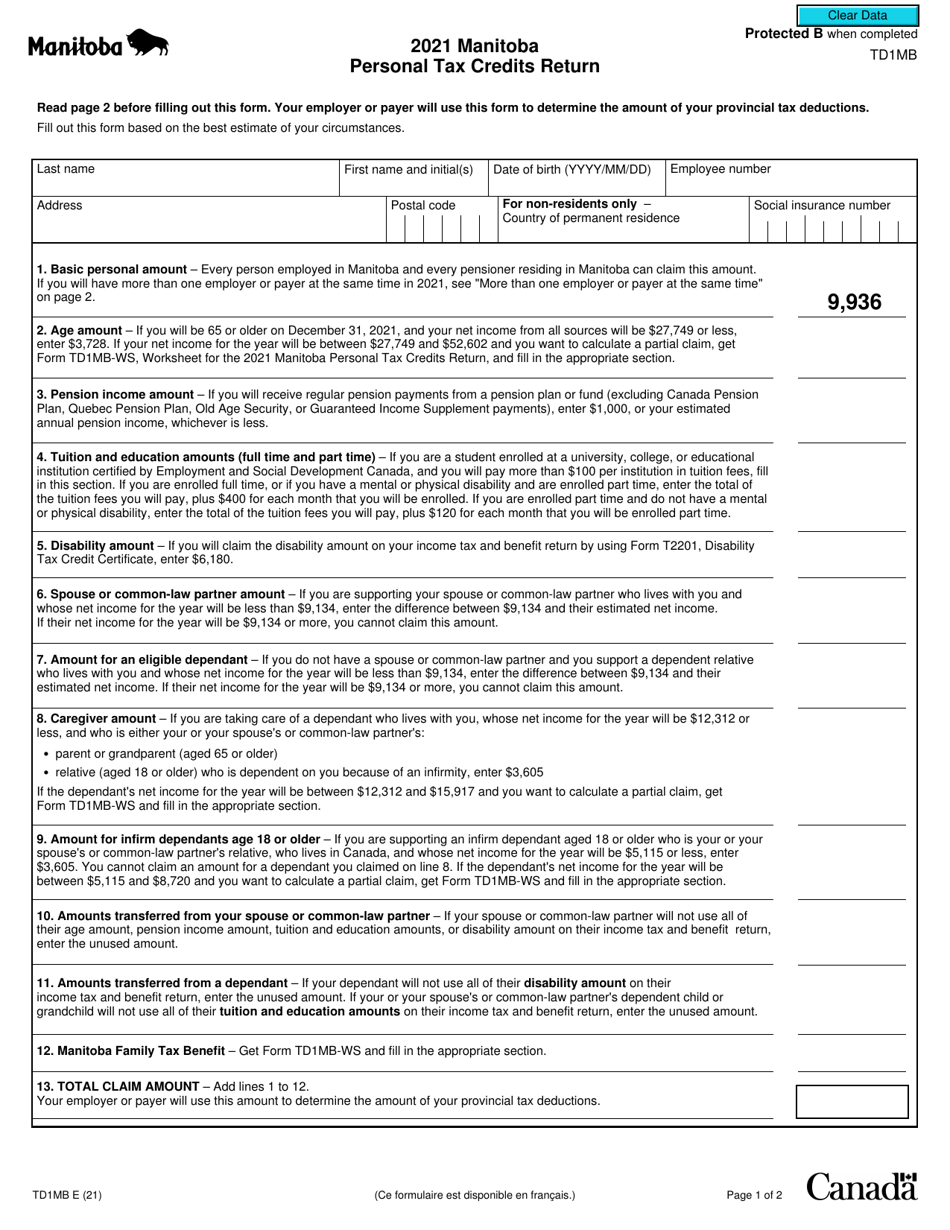

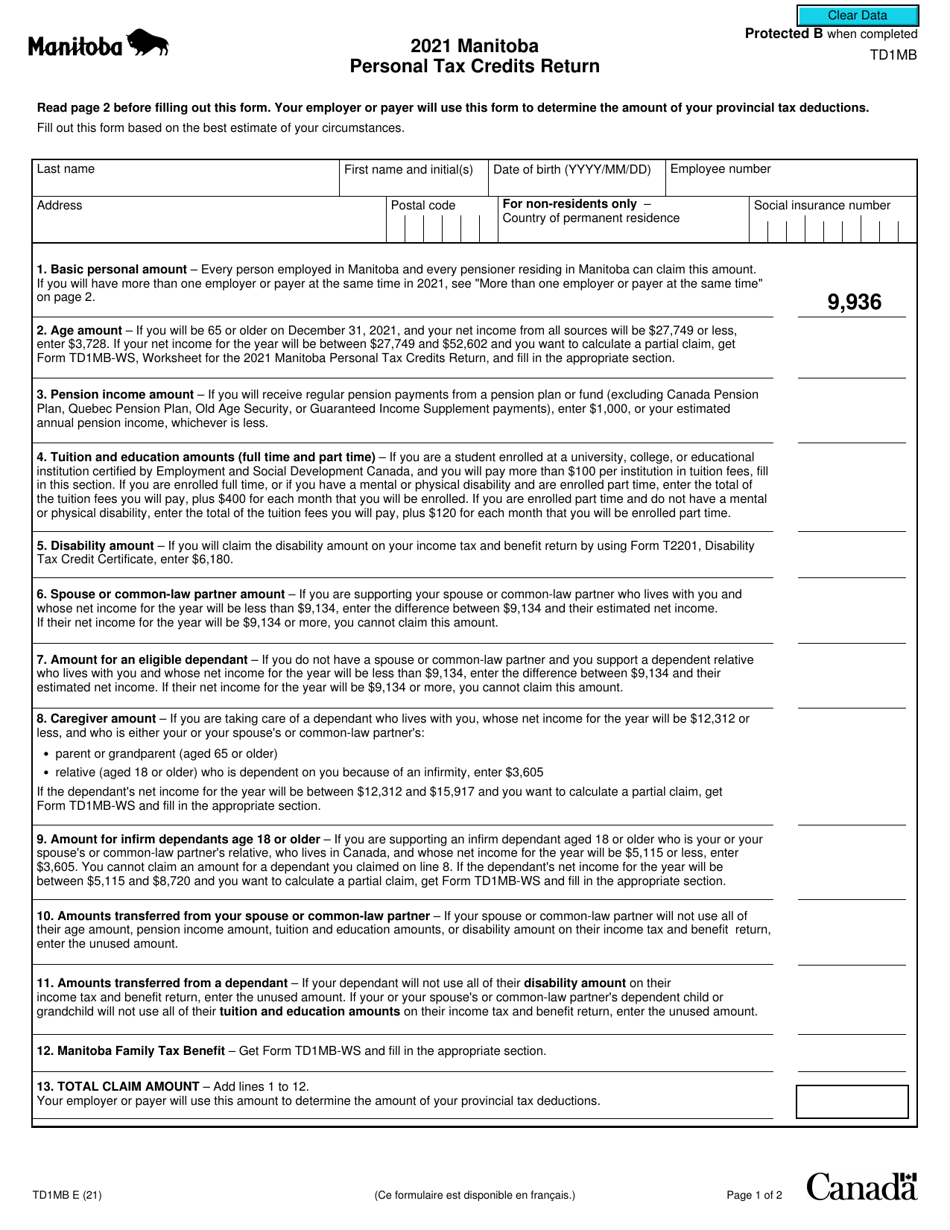

Tax Credit 2022 Amount 2023 Amount Basic personal amount 10 145 15 000 Spouse or common law partner amount 9 134 9 134 Amount for eligible dependent

Manitoba Personal Tax Exemption 2023 cover a large assortment of printable materials online, at no cost. These materials come in a variety of forms, including worksheets, templates, coloring pages, and many more. The appeal of printables for free is their flexibility and accessibility.

More of Manitoba Personal Tax Exemption 2023

2023 Tax Tables Australia IMAGESEE

2023 Tax Tables Australia IMAGESEE

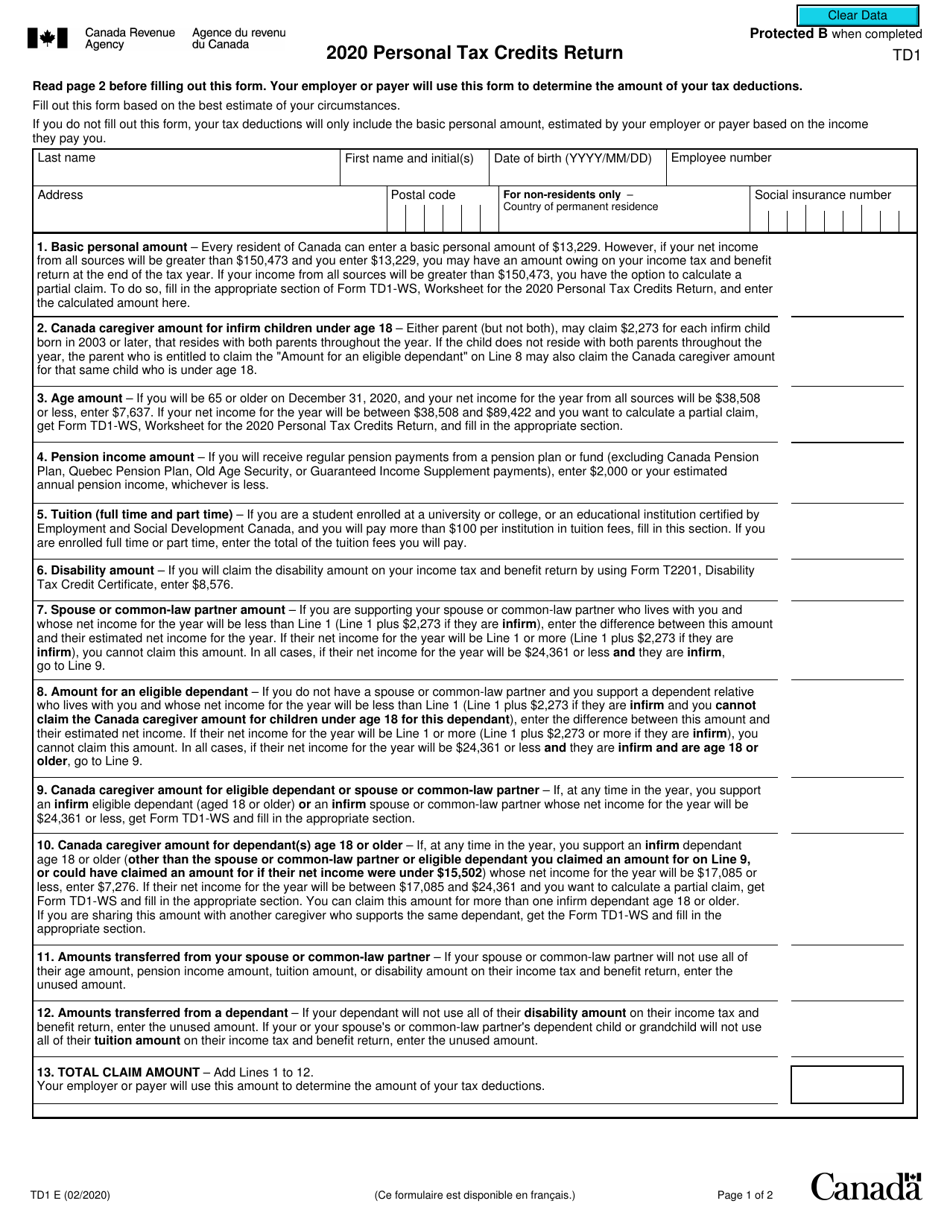

Last update 2023 12 22 Date modified 2023 12 22 As an employee you complete this form if you have a new employer or payer and will receive salary wages

Lowering income taxes by adjusting the Basic Personal Amount to 15 000 for the 2023 tax year allowing Manitobans to keep more income by adjusting

Printables for free have gained immense appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or expensive software.

-

Modifications: It is possible to tailor printing templates to your own specific requirements whether you're designing invitations or arranging your schedule or even decorating your home.

-

Educational Use: Educational printables that can be downloaded for free offer a wide range of educational content for learners of all ages, which makes them an essential tool for parents and teachers.

-

Convenience: Instant access to the vast array of design and templates is time-saving and saves effort.

Where to Find more Manitoba Personal Tax Exemption 2023

Cra Tax Forms 2023 Printable Printable Forms Free Online

Cra Tax Forms 2023 Printable Printable Forms Free Online

The Manitoba government s 2023 budget released Tuesday commits to raise the income level at which people start paying tax from the current 10 145 to 15 000 That amount the basic

Download 159 KB Tax Alert 2023 No 09 8 March 2023 From historic investments to help better serve seniors singles and families to historic tax changes that will help

We've now piqued your interest in Manitoba Personal Tax Exemption 2023 we'll explore the places the hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection in Manitoba Personal Tax Exemption 2023 for different objectives.

- Explore categories like home decor, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free along with flashcards, as well as other learning materials.

- Perfect for teachers, parents and students in need of additional sources.

3. Creative Blogs

- Many bloggers provide their inventive designs with templates and designs for free.

- The blogs covered cover a wide spectrum of interests, from DIY projects to planning a party.

Maximizing Manitoba Personal Tax Exemption 2023

Here are some ideas to make the most use of printables for free:

1. Home Decor

- Print and frame beautiful images, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Use printable worksheets from the internet to enhance learning at home also in the classes.

3. Event Planning

- Design invitations, banners and decorations for special occasions such as weddings or birthdays.

4. Organization

- Get organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Manitoba Personal Tax Exemption 2023 are a treasure trove of practical and innovative resources that meet a variety of needs and needs and. Their accessibility and versatility make them a great addition to both professional and personal lives. Explore the vast collection of Manitoba Personal Tax Exemption 2023 and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really cost-free?

- Yes you can! You can download and print these documents for free.

-

Can I use the free printables for commercial use?

- It is contingent on the specific rules of usage. Always check the creator's guidelines before utilizing printables for commercial projects.

-

Do you have any copyright issues when you download printables that are free?

- Certain printables may be subject to restrictions on use. Make sure you read the terms and conditions provided by the designer.

-

How can I print printables for free?

- Print them at home with a printer or visit any local print store for superior prints.

-

What program will I need to access Manitoba Personal Tax Exemption 2023?

- The majority are printed in PDF format. These is open with no cost software like Adobe Reader.

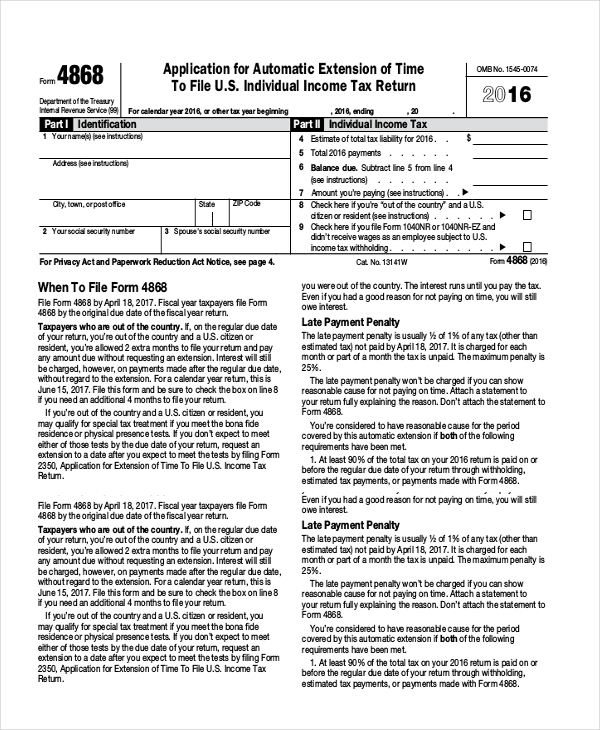

2023 Federal Tax Exemption Form ExemptForm

Manitoba Election PCs Promise To Raise Tax Brackets Basic Personal

Check more sample of Manitoba Personal Tax Exemption 2023 below

2023 Tax Exemption Form Pennsylvania ExemptForm

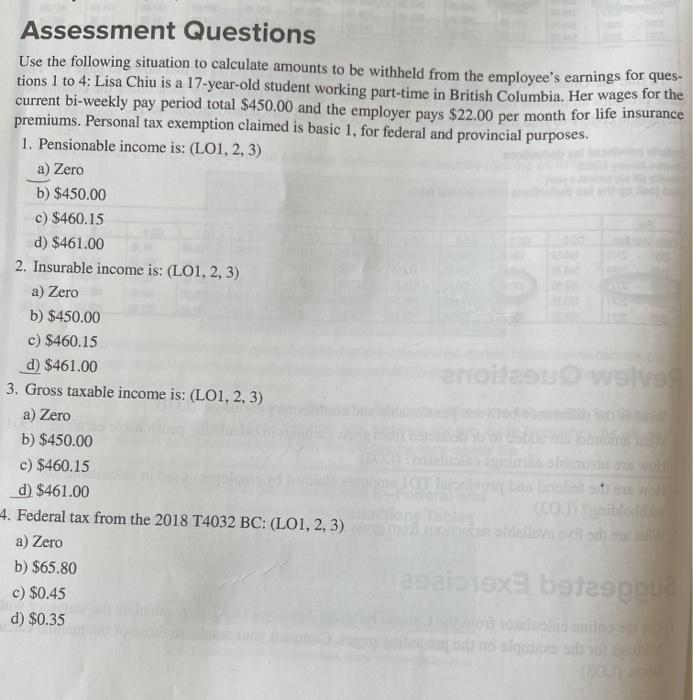

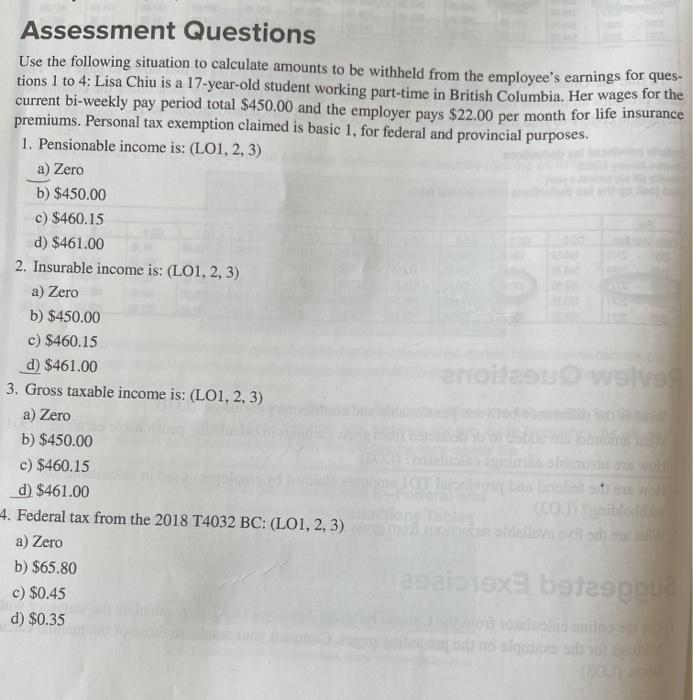

Solved Lisa Chiu Is A 17 year old Student Working Part time Chegg

Income Tax Brackets Manitoba 2020 PINCOMEQ

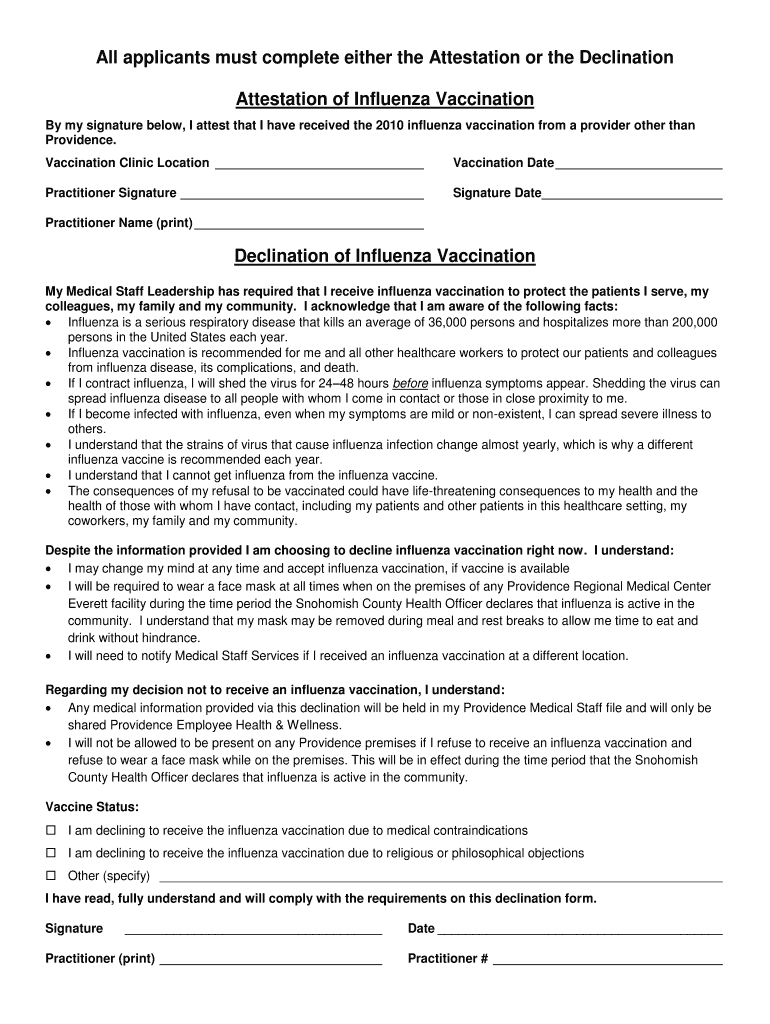

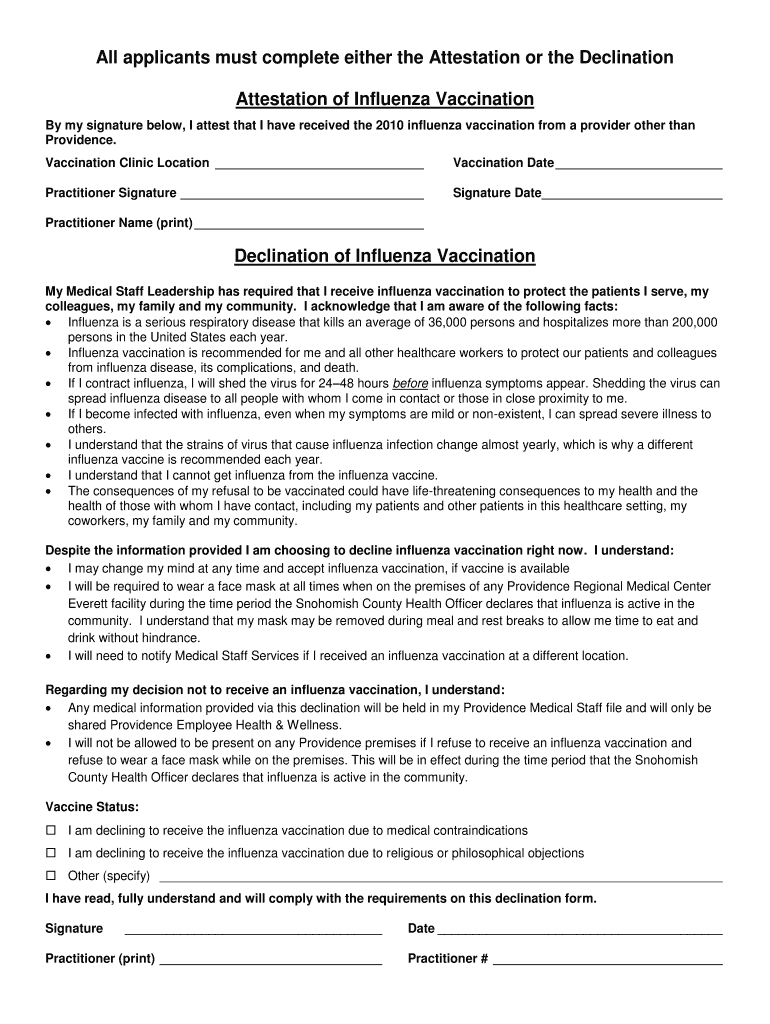

Vaccine Consent Form Template

Malaysia Personal Income Tax Relief 2020 Walang Merah

Canadian Taxes Canadian Facts Canadian Things Canada Economy

https://www.gov.mb.ca/finance/personal/pcredits.html

Tax Credit 2022 Amount 2023 Amount Basic personal amount 10 145 15 000 Spouse or common law partner amount 9 134 9 134 Amount for eligible dependent

https://www.gov.mb.ca/finance/taxation/pubs/...

Effective January 1 2024 the exemption threshold will increase from 2 million to 2 25 million of annual remuneration and the reduced rate threshold is raised from 4 million

Tax Credit 2022 Amount 2023 Amount Basic personal amount 10 145 15 000 Spouse or common law partner amount 9 134 9 134 Amount for eligible dependent

Effective January 1 2024 the exemption threshold will increase from 2 million to 2 25 million of annual remuneration and the reduced rate threshold is raised from 4 million

Vaccine Consent Form Template

Solved Lisa Chiu Is A 17 year old Student Working Part time Chegg

Malaysia Personal Income Tax Relief 2020 Walang Merah

Canadian Taxes Canadian Facts Canadian Things Canada Economy

Manitoba Care Homes Looking At Prevention After Outbreak Death In

19 Best Out Of Office Message Page 2 Free To Edit Download Print

19 Best Out Of Office Message Page 2 Free To Edit Download Print

Are You Ready Greater Fool Authored By Garth Turner The Troubled