In this digital age, when screens dominate our lives but the value of tangible printed items hasn't gone away. No matter whether it's for educational uses or creative projects, or simply to add an individual touch to the area, Marriage Tax Benefits Canada have become a valuable resource. With this guide, you'll take a dive through the vast world of "Marriage Tax Benefits Canada," exploring their purpose, where they can be found, and how they can enhance various aspects of your life.

Get Latest Marriage Tax Benefits Canada Below

Marriage Tax Benefits Canada

Marriage Tax Benefits Canada -

Changes to your marital status could affect your benefit and credit payments To find out more go to Change your marital status Married means that you have a spouse This term only applies to a person you are legally married to Living common law means that you are living in a conjugal relationship with a person who is not your married spouse

Since your marital status has a significant impact on your return family incomes are combined for calculating income tested benefits such as the GST HST credit or the Canada Child Benefit Couples benefit from combining charitable donations and medical expenses

Marriage Tax Benefits Canada encompass a wide assortment of printable documents that can be downloaded online at no cost. They come in many forms, including worksheets, templates, coloring pages, and more. The beauty of Marriage Tax Benefits Canada lies in their versatility and accessibility.

More of Marriage Tax Benefits Canada

Maximizing Your Finances The Tax Benefits Of Marriage

Maximizing Your Finances The Tax Benefits Of Marriage

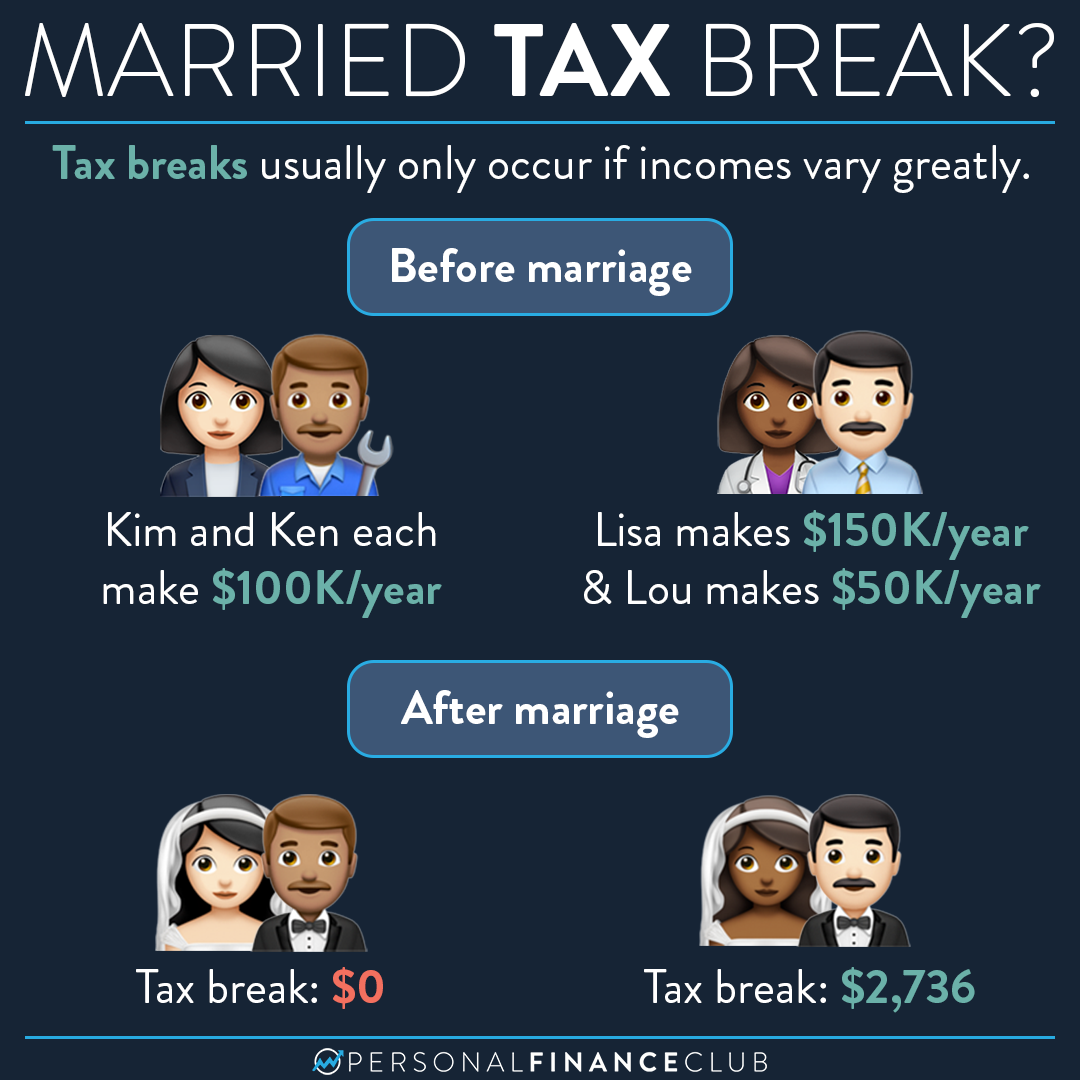

Married couples in Canada are taxed at the same rates as unmarried people There are some potential benefits that come from being married or living as common law partners that could lower your overall

Table of Contents Tax Ramifications of Married Life in Canada Exploring the Tax Landscape for Canadian Couples Tax Brackets and Marital Status Benefits and Incentives for Joint Tax Filings Tax Incentives and Parenthood To Jointly File or Not Navigating Decisions in Canada Tax Benefits Singles vs Married Couples in Canada

Print-friendly freebies have gained tremendous popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or costly software.

-

Individualization There is the possibility of tailoring printed materials to meet your requirements whether you're designing invitations, organizing your schedule, or even decorating your home.

-

Educational value: Education-related printables at no charge provide for students of all ages, making them an essential tool for teachers and parents.

-

Affordability: Fast access a variety of designs and templates can save you time and energy.

Where to Find more Marriage Tax Benefits Canada

5 Marriage Tax Benefits In The UK Money Back Helpdesk

5 Marriage Tax Benefits In The UK Money Back Helpdesk

Online Change your marital status online with My Account Sign in to My Account Register Alternative MyBenefits CRA web app or MyCRA web app By phone Change your marital status by phone By mail Change your marital status by

May 27 2021 Whether you re married or in a common law relationship keeping the Canada Revenue Agency CRA and if applicable Revenu Qu bec informed of your marital status can help you maximize your benefits while

If we've already piqued your interest in printables for free and other printables, let's discover where the hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of Marriage Tax Benefits Canada suitable for many goals.

- Explore categories such as interior decor, education, crafting, and organization.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free with flashcards and other teaching materials.

- The perfect resource for parents, teachers, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates, which are free.

- The blogs are a vast range of topics, from DIY projects to party planning.

Maximizing Marriage Tax Benefits Canada

Here are some ideas to make the most of printables that are free:

1. Home Decor

- Print and frame stunning art, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Utilize free printable worksheets to aid in learning at your home as well as in the class.

3. Event Planning

- Design invitations, banners, and other decorations for special occasions like birthdays and weddings.

4. Organization

- Keep track of your schedule with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Marriage Tax Benefits Canada are an abundance filled with creative and practical information that meet a variety of needs and interest. Their accessibility and versatility make them an essential part of every aspect of your life, both professional and personal. Explore the world of Marriage Tax Benefits Canada and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really available for download?

- Yes you can! You can print and download these files for free.

-

Are there any free printing templates for commercial purposes?

- It's based on specific terms of use. Always read the guidelines of the creator before using printables for commercial projects.

-

Are there any copyright problems with Marriage Tax Benefits Canada?

- Certain printables could be restricted concerning their use. Make sure to read the terms and condition of use as provided by the creator.

-

How do I print printables for free?

- Print them at home using either a printer or go to a local print shop for top quality prints.

-

What program do I need to run printables at no cost?

- The majority of printables are in the format PDF. This can be opened using free software such as Adobe Reader.

Tax Benefits Of Marriage Hawsons

2023 State Income Tax Rates And Brackets Tax Foundation

Check more sample of Marriage Tax Benefits Canada below

Tax Deductions Benefits For Married Couples Finance Zacks

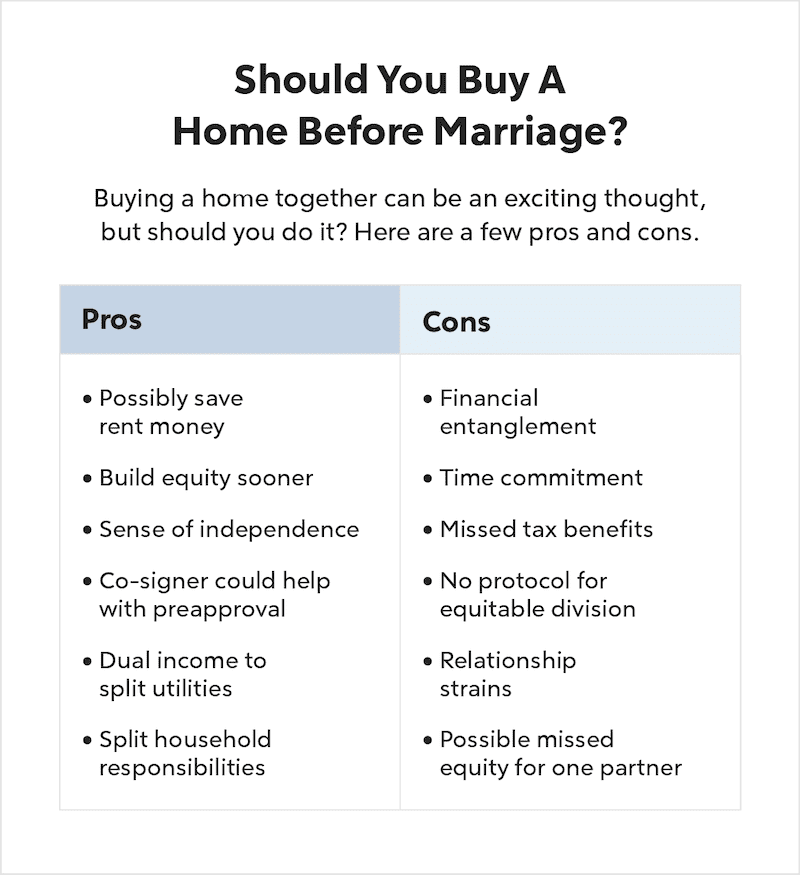

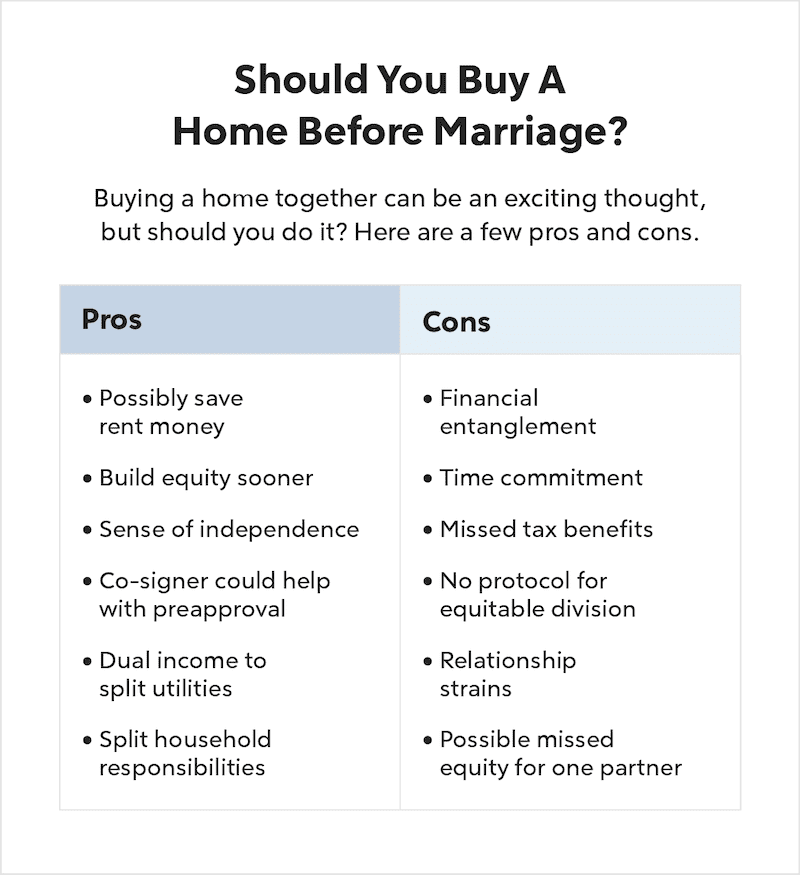

Buying A House Before Marriage Pros And Cons Quicken Loans

ADHD And Tax Disability Benefits Tax Benefits Canada

Tying The Knot Marriage Tax Benefits Penalties Explained TrendRadars

Reasons Why You Need A Marriage Certificate

Tax Benefits Of Marriage 2023 Overview Of Penalties And Bonuses

https://turbotax.intuit.ca/tips/filing-coupled-taxes-in-canada-450

Since your marital status has a significant impact on your return family incomes are combined for calculating income tested benefits such as the GST HST credit or the Canada Child Benefit Couples benefit from combining charitable donations and medical expenses

https://themarrymen.ca/blog/tax-implications-of-marriage-in-canada

In Canada the decision to tie the knot can have various effects on your financial landscape from filing taxes together to accessing certain benefits This guide explores the tax implications of marriage in Canada helping couples navigate the complexities of the Canadian tax system

Since your marital status has a significant impact on your return family incomes are combined for calculating income tested benefits such as the GST HST credit or the Canada Child Benefit Couples benefit from combining charitable donations and medical expenses

In Canada the decision to tie the knot can have various effects on your financial landscape from filing taxes together to accessing certain benefits This guide explores the tax implications of marriage in Canada helping couples navigate the complexities of the Canadian tax system

Tying The Knot Marriage Tax Benefits Penalties Explained TrendRadars

Buying A House Before Marriage Pros And Cons Quicken Loans

Reasons Why You Need A Marriage Certificate

Tax Benefits Of Marriage 2023 Overview Of Penalties And Bonuses

Will I Get A Tax Break By Getting Married Personal Finance Club

Depression And Disability Tax Benefits Tax Benefits Canada

Depression And Disability Tax Benefits Tax Benefits Canada

-1.png)

A Brief Guide To The Child Tax Benefit In Canada