In this age of electronic devices, when screens dominate our lives The appeal of tangible, printed materials hasn't diminished. Whatever the reason, whether for education for creative projects, simply adding an individual touch to your area, Nps Under 80c Or 80ccd can be an excellent source. Here, we'll dive into the sphere of "Nps Under 80c Or 80ccd," exploring the benefits of them, where to find them and ways they can help you improve many aspects of your lives.

What Are Nps Under 80c Or 80ccd?

Nps Under 80c Or 80ccd cover a large selection of printable and downloadable materials available online at no cost. These materials come in a variety of types, like worksheets, templates, coloring pages, and much more. The beauty of Nps Under 80c Or 80ccd lies in their versatility and accessibility.

Nps Under 80c Or 80ccd

Nps Under 80c Or 80ccd

Nps Under 80c Or 80ccd -

[desc-5]

[desc-1]

NPS Tax Benefit Under Sec 80CCD 1b Of Rs 50 000 Business HimSky

-50000.jpg)

NPS Tax Benefit Under Sec 80CCD 1b Of Rs 50 000 Business HimSky

[desc-4]

[desc-6]

Deduction From Gross Total Income Section 80C To 80U Graphical Table

Deduction From Gross Total Income Section 80C To 80U Graphical Table

[desc-9]

[desc-7]

How To Claim Section 80CCD 1B TaxHelpdesk

Have You Claimed These ITR Deductions On Section 80C 80CCD 80D

NPS Tax Benefits Explained I Deduction Under Section 80C 80CCD I Tax

Do 80CCC And 80CCD Come Under 80C Or They Are Extra Investment Benefits

Download Complete Tax Planning Guide In PDF For Salaried And Professionals

Do 80CCC And 80CCD Come Under 80C Or They Are Extra Investment Benefits

Do 80CCC And 80CCD Come Under 80C Or They Are Extra Investment Benefits

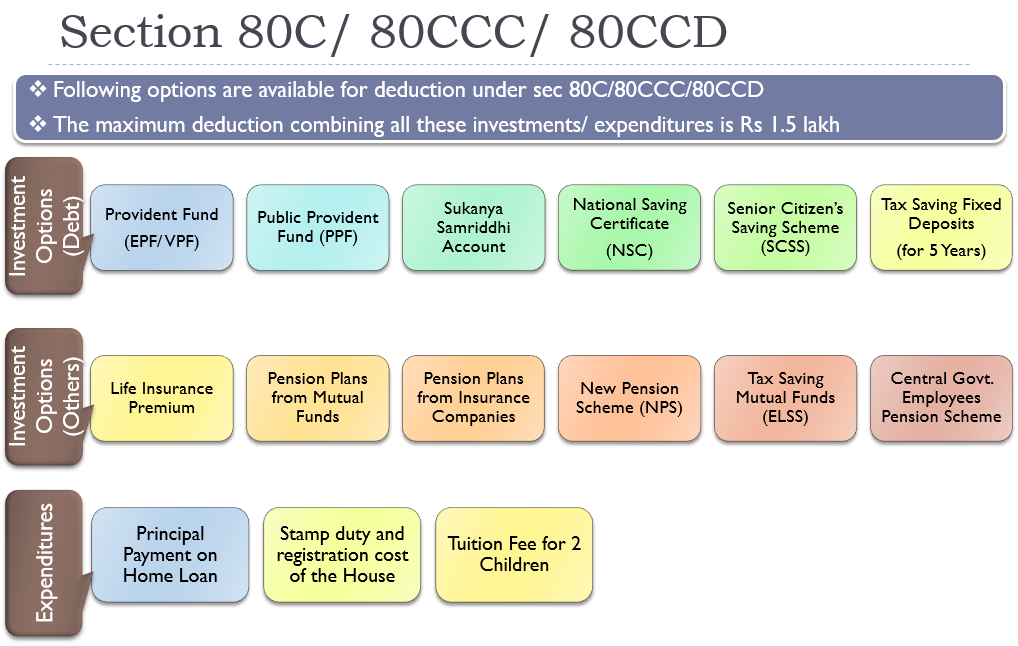

Deduction U s 80C 80CCC 80CCD 80D Income Tax 80c