In this day and age with screens dominating our lives yet the appeal of tangible printed materials hasn't faded away. Be it for educational use such as creative projects or just adding an individual touch to the space, Hra Rebate Rules In Income Tax are a great resource. With this guide, you'll take a dive into the sphere of "Hra Rebate Rules In Income Tax," exploring what they are, how to get them, as well as how they can enrich various aspects of your life.

Get Latest Hra Rebate Rules In Income Tax Below

Hra Rebate Rules In Income Tax

Hra Rebate Rules In Income Tax - Hra Rebate Rules In Income Tax, Hra Exemption Rule In Income Tax Pdf, Hra Exemption In Income Tax, Hra Exemption In Income Tax Calculation, Hra Exemption In Income Tax With Example, Hra Exemption In Income Tax 2022-23, Hra Exemption In Income Tax Return, Hra Exemption In Income Tax Under Section, Hra Exemption In Income Tax 2023-24, Hra Exemption In Income Tax Form

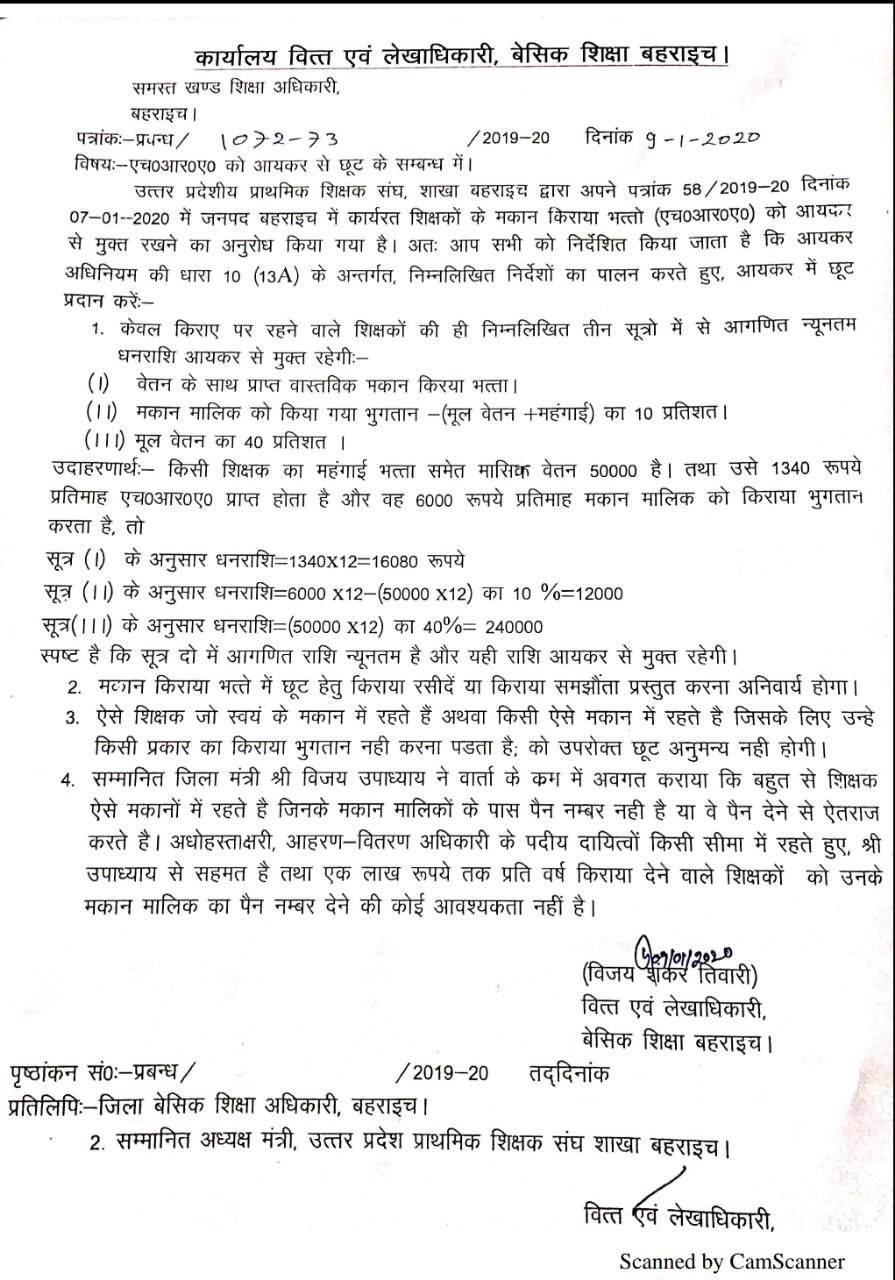

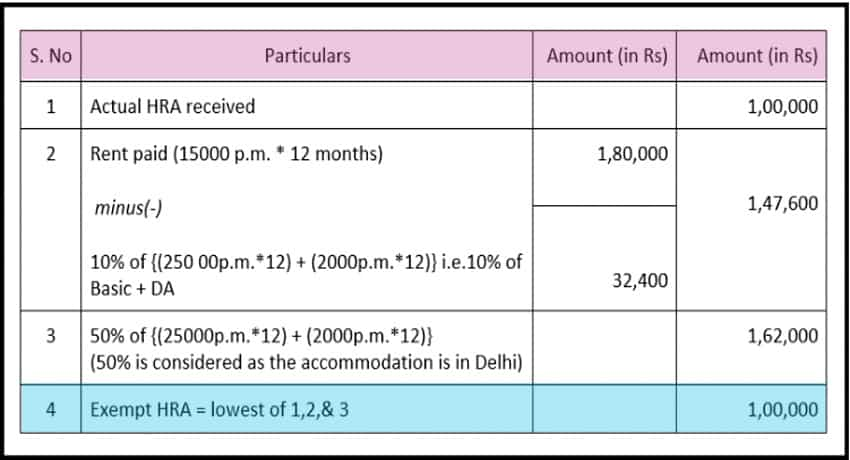

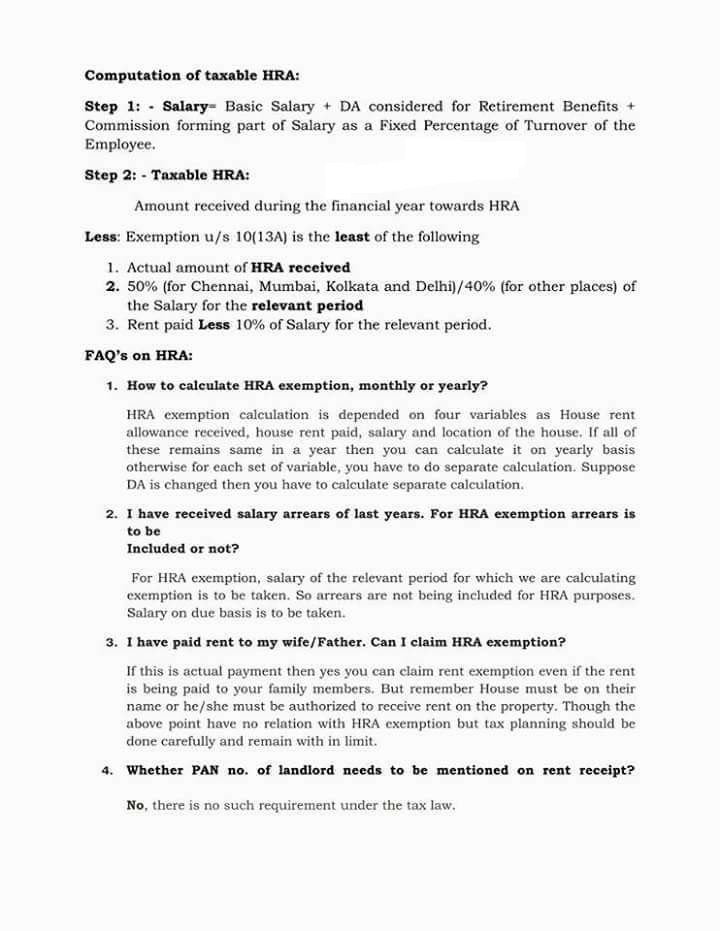

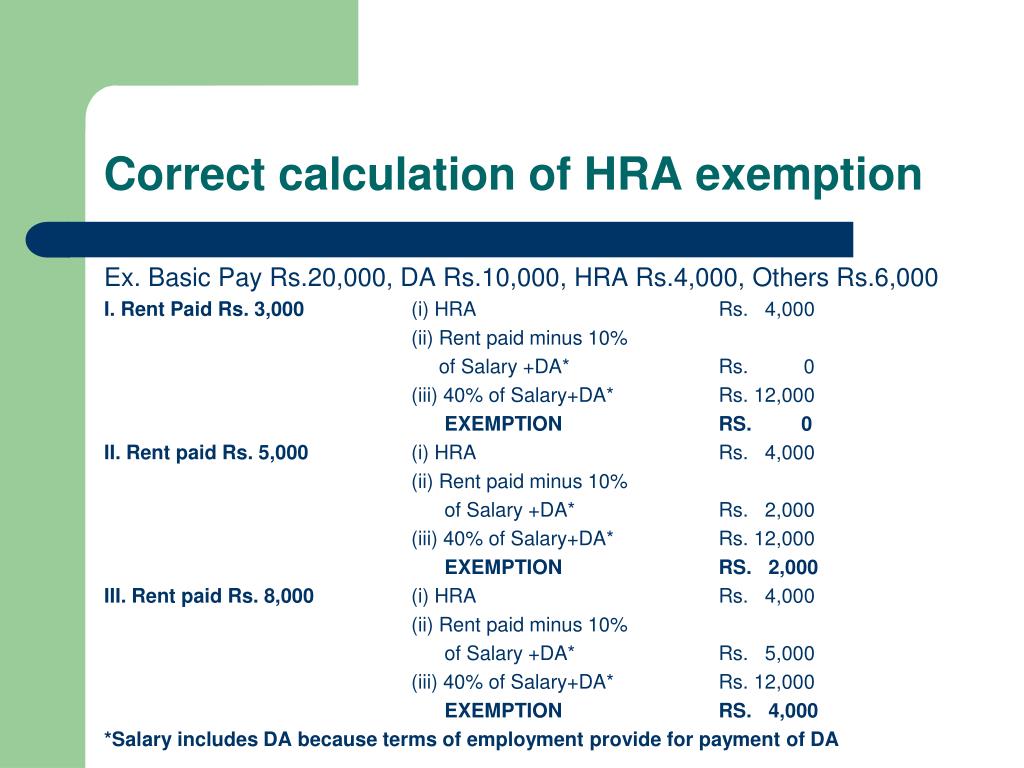

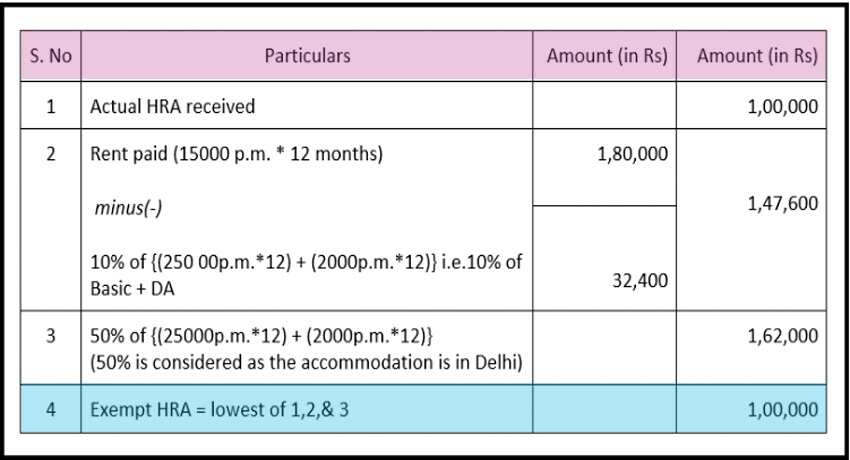

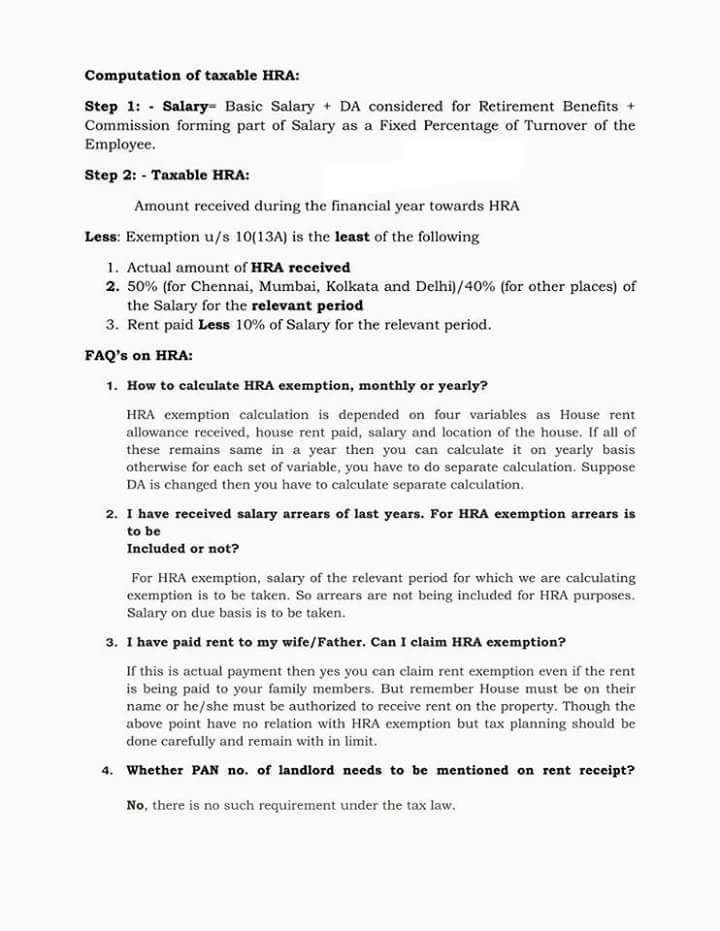

Web 28 juin 2018 nbsp 0183 32 1 Actual House Rent Allowance HRA received from your employer 2 Actual house rent paid by you minus 10 of your basic salary 3 50 of your basic salary if you live in a metro or 40 of your basic

Web 5 mai 2020 nbsp 0183 32 1 CONDITIONS FOR CLAIMING HRA EXEMPTION Salaried Individual only can claim HRA Self employed cannot claim HRA However Self Employed can also claim deduction of Rent paid under

Hra Rebate Rules In Income Tax cover a large variety of printable, downloadable content that can be downloaded from the internet at no cost. These printables come in different types, like worksheets, templates, coloring pages, and many more. The appeal of printables for free is in their variety and accessibility.

More of Hra Rebate Rules In Income Tax

HRA Income Tax Deduction Rules Teacher Haryana Education News

HRA Income Tax Deduction Rules Teacher Haryana Education News

Web 22 avr 2022 nbsp 0183 32 Listed below are the conditions All you want to know about rent receipt amp its role in saving tax Conditions for claiming HRA rebate under Section 10 13A Key

Web 19 juil 2023 nbsp 0183 32 What is HRA House Rent Allowance Eligibility Criteria to Claim Tax Deductions On HRA How much HRA exemption is available under the income tax act

Hra Rebate Rules In Income Tax have garnered immense recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

Personalization There is the possibility of tailoring printables to fit your particular needs when it comes to designing invitations, organizing your schedule, or even decorating your home.

-

Educational Benefits: Free educational printables offer a wide range of educational content for learners of all ages. This makes them a vital tool for parents and educators.

-

Easy to use: The instant accessibility to a variety of designs and templates cuts down on time and efforts.

Where to Find more Hra Rebate Rules In Income Tax

Income Tax Department Puts House Rental Allowance HRA Exemption Rules

Income Tax Department Puts House Rental Allowance HRA Exemption Rules

Web Rent paid 10 of the basic salary including Dearness Allowance For example if your basic salary including Dearness Allowance is INR 50 000 month you receive a HRA of

Web 6 janv 2018 nbsp 0183 32 Although it is a part of your salary HRA unlike basic salary is not fully taxable Subject to certain conditions a part of HRA is exempted under Section 10 13A

In the event that we've stirred your interest in printables for free Let's take a look at where you can find these elusive treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety in Hra Rebate Rules In Income Tax for different reasons.

- Explore categories like decoration for your home, education, organisation, as well as crafts.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free Flashcards, worksheets, and other educational tools.

- The perfect resource for parents, teachers and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers post their original designs and templates for no cost.

- These blogs cover a broad selection of subjects, that range from DIY projects to party planning.

Maximizing Hra Rebate Rules In Income Tax

Here are some unique ways to make the most use of Hra Rebate Rules In Income Tax:

1. Home Decor

- Print and frame gorgeous artwork, quotes or seasonal decorations to adorn your living areas.

2. Education

- Print worksheets that are free to help reinforce your learning at home, or even in the classroom.

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions such as weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars or to-do lists. meal planners.

Conclusion

Hra Rebate Rules In Income Tax are an abundance of useful and creative resources that can meet the needs of a variety of people and pursuits. Their availability and versatility make these printables a useful addition to both professional and personal lives. Explore the wide world of Hra Rebate Rules In Income Tax today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really are they free?

- Yes, they are! You can download and print these items for free.

-

Can I use the free printables for commercial use?

- It's all dependent on the usage guidelines. Always verify the guidelines provided by the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright problems with Hra Rebate Rules In Income Tax?

- Some printables may come with restrictions regarding their use. Be sure to check the terms and regulations provided by the designer.

-

How do I print printables for free?

- You can print them at home with the printer, or go to a local print shop to purchase more high-quality prints.

-

What program do I need to run printables free of charge?

- The majority of printables are in PDF format, which can be opened using free programs like Adobe Reader.

House Rent Allowance HRA Tax Exemption HRA Calculation Rules

PPT WELCOME TO THE T D S SEMINAR PowerPoint Presentation Free

Check more sample of Hra Rebate Rules In Income Tax below

How To Rebate In HRA In Income Tax 2022

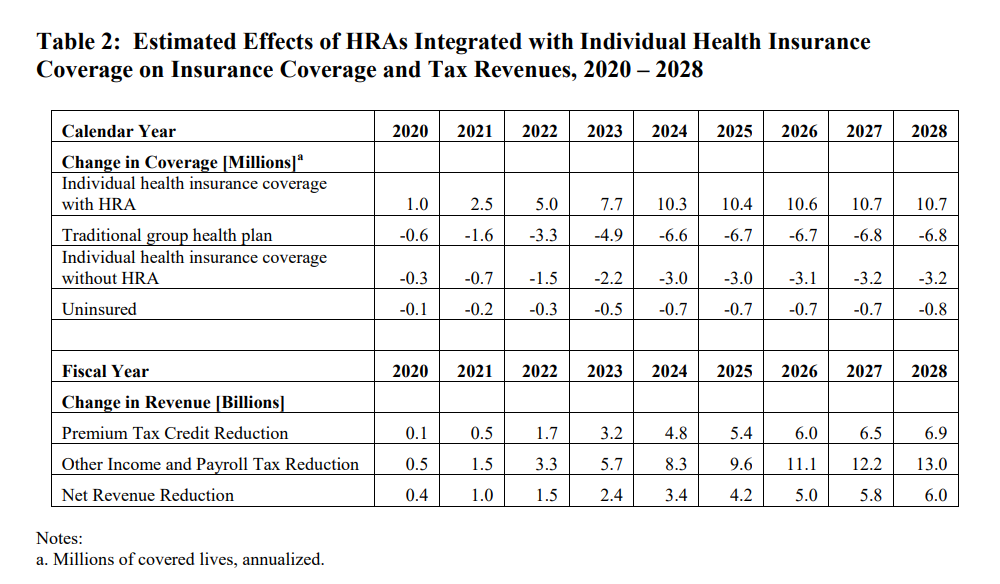

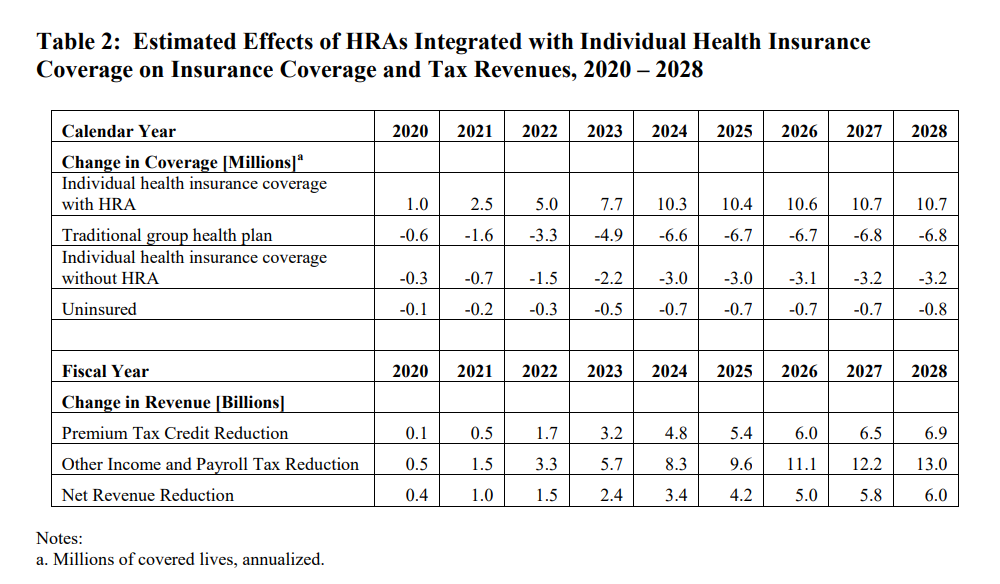

Sizing Up The Proposed HRA Rule AAF

How To Get Full Rebate On HRA In Income Tax

Danpirellodesign Income Tax Rebate On Home Loan And Hra

Salaried Person Here s All You Need To Know About HRA Tax Deduction

HRA Exemption Rules HRA Deduction HRA Calculation HRA Tax Saving

https://taxguru.in/income-tax/house-rent-all…

Web 5 mai 2020 nbsp 0183 32 1 CONDITIONS FOR CLAIMING HRA EXEMPTION Salaried Individual only can claim HRA Self employed cannot claim HRA However Self Employed can also claim deduction of Rent paid under

https://www.etmoney.com/learn/saving-schemes/house-rent-allowance

Web 22 sept 2022 nbsp 0183 32 House rent allowance is eligible for HRA deduction under Section 10 13A of the Income Tax Act if an individual meets the following criteria The person claiming

Web 5 mai 2020 nbsp 0183 32 1 CONDITIONS FOR CLAIMING HRA EXEMPTION Salaried Individual only can claim HRA Self employed cannot claim HRA However Self Employed can also claim deduction of Rent paid under

Web 22 sept 2022 nbsp 0183 32 House rent allowance is eligible for HRA deduction under Section 10 13A of the Income Tax Act if an individual meets the following criteria The person claiming

Danpirellodesign Income Tax Rebate On Home Loan And Hra

Sizing Up The Proposed HRA Rule AAF

Salaried Person Here s All You Need To Know About HRA Tax Deduction

HRA Exemption Rules HRA Deduction HRA Calculation HRA Tax Saving

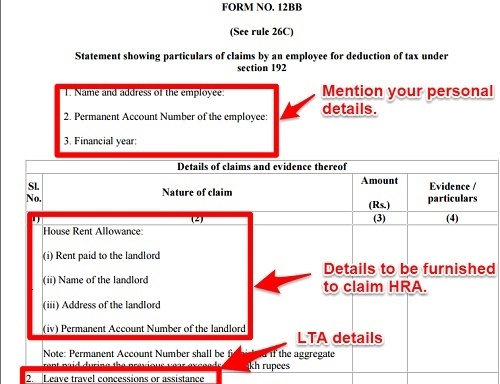

Form 12BB Changes In Declaring HRA LTA And Sec 80 Deductions

Tax Rebate On HRA

Tax Rebate On HRA

Form 12BB To Claim HRA Deduction By Salaried Employees