In a world where screens rule our lives, the charm of tangible, printed materials hasn't diminished. Whatever the reason, whether for education and creative work, or simply adding personal touches to your space, Pension Tax Credit have become an invaluable resource. In this article, we'll dive in the world of "Pension Tax Credit," exploring what they are, where you can find them, and how they can enhance various aspects of your life.

Get Latest Pension Tax Credit Below

Pension Tax Credit

Pension Tax Credit - Pension Tax Credit, Pension Tax Credit Canada, Pension Tax Credit Calculator, Pension Tax Credits Ireland, Pension Tax Credit Phone Number, Pension Tax Credit Application, Pension Tax Credits And Savings, Pension Tax Credit Contact Number, Pension Tax Credits Uk, Pension Tax Credit Claim

Revised January 02 2024 TaxTips ca What income is eligible or qualified pension income for purposes of the pension income tax credit This is different for taxpayers under 65 vs taxpayers 65 or older

Updated October 31 2023 Fact Checked The pension income tax credit PITC is a non refundable tax credit that can be claimed on eligible pension income The tax credit allows seniors to save on taxes payable by giving them an annual tax credit on their first 2 000 of pension income

The Pension Tax Credit are a huge array of printable resources available online for download at no cost. They are available in a variety of formats, such as worksheets, coloring pages, templates and more. The great thing about Pension Tax Credit lies in their versatility and accessibility.

More of Pension Tax Credit

Do I Qualify For The Pension Tax Credit Objective Financial Partners

Do I Qualify For The Pension Tax Credit Objective Financial Partners

The Pension Income Tax credit is available to you if you are 55 years of age or older Basically it enables you to deduct from taxes payable a tax credit equal to the lesser of your pension income or 2 000 00 Depending on which province you live in this equates to 440 720 in actual tax savings each year

The pension income tax credit allows a taxpayer to claim a non refundable federal tax credit on up to 2 000 of eligible pension income Who can claim it Your clients may be able to claim up to 2 000 if they have Eligible annuity Eligible pension income Received annuity payments if they were 65 years of age or older on Dec 31 2022 or

Pension Tax Credit have gained a lot of recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the need to purchase physical copies or costly software.

-

Flexible: This allows you to modify printables to your specific needs whether you're designing invitations as well as organizing your calendar, or even decorating your home.

-

Education Value Education-related printables at no charge can be used by students of all ages, which makes them a vital aid for parents as well as educators.

-

Easy to use: You have instant access numerous designs and templates reduces time and effort.

Where to Find more Pension Tax Credit

How To Split RRIF Income With A Spouse To Get The 2 000 Tax Credit

How To Split RRIF Income With A Spouse To Get The 2 000 Tax Credit

The pension income tax credit provides a tax credit of 2 000 federally and between 1 000 to 2 000 depending on the province What Is The Pension Income Tax Credit The pension income tax credit is a non refundable tax credit that applies specifically to pension income lines 11500 11600 and 12900 on your tax return

How to claim You can start your application up to 4 months before you reach State Pension age You can apply any time after you reach State Pension age but your application can only be backdated

Since we've got your interest in Pension Tax Credit Let's find out where you can find these treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection of Pension Tax Credit for various motives.

- Explore categories like the home, decor, organization, and crafts.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free along with flashcards, as well as other learning materials.

- Perfect for teachers, parents as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for free.

- These blogs cover a broad range of interests, including DIY projects to party planning.

Maximizing Pension Tax Credit

Here are some unique ways that you can make use use of printables for free:

1. Home Decor

- Print and frame stunning images, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Utilize free printable worksheets to aid in learning at your home for the classroom.

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars or to-do lists. meal planners.

Conclusion

Pension Tax Credit are a treasure trove of useful and creative resources that satisfy a wide range of requirements and desires. Their access and versatility makes them an essential part of both professional and personal lives. Explore the vast world of Pension Tax Credit to unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really gratis?

- Yes you can! You can print and download these resources at no cost.

-

Are there any free printables for commercial uses?

- It's based on specific rules of usage. Always verify the guidelines of the creator before using printables for commercial projects.

-

Are there any copyright violations with printables that are free?

- Some printables may come with restrictions regarding their use. Make sure to read the terms and condition of use as provided by the creator.

-

How do I print printables for free?

- You can print them at home using the printer, or go to an in-store print shop to get premium prints.

-

What program do I need in order to open printables for free?

- A majority of printed materials are in the format PDF. This is open with no cost software such as Adobe Reader.

Cr dit D imp t Pour Revenu De Pension Et CIG tabli Par Une Compagnie D

What Is A Pension Tax Credit YouTube

Check more sample of Pension Tax Credit below

Money Architect Financial Planning Russell Sawatsky Using The

Are You Due A Huge Pension Tax Refund Which News

Tips For Tax Season Money Saving Strategies

How To Turn Your GIC Income Into Pension Income KBH Financial Services

Top 10 Retirement Tips

Are You Paying Too Much Tax On Your Pension Tax Banana

https://www.savvynewcanadians.com/the-pension...

Updated October 31 2023 Fact Checked The pension income tax credit PITC is a non refundable tax credit that can be claimed on eligible pension income The tax credit allows seniors to save on taxes payable by giving them an annual tax credit on their first 2 000 of pension income

https://www.gov.uk/pension-credit/eligibility

Pension Credit is extra money for pensioners to bring your weekly income up to a minimum amount what you ll get apply eligibility

Updated October 31 2023 Fact Checked The pension income tax credit PITC is a non refundable tax credit that can be claimed on eligible pension income The tax credit allows seniors to save on taxes payable by giving them an annual tax credit on their first 2 000 of pension income

Pension Credit is extra money for pensioners to bring your weekly income up to a minimum amount what you ll get apply eligibility

How To Turn Your GIC Income Into Pension Income KBH Financial Services

Are You Due A Huge Pension Tax Refund Which News

Top 10 Retirement Tips

Are You Paying Too Much Tax On Your Pension Tax Banana

How Can I Make The Most Of Pension Tax Allowances Jon Davies Accountants

Chancellor Jeremy Hunt Warned Against 10bn Tax Raid On Pensions Savings

Chancellor Jeremy Hunt Warned Against 10bn Tax Raid On Pensions Savings

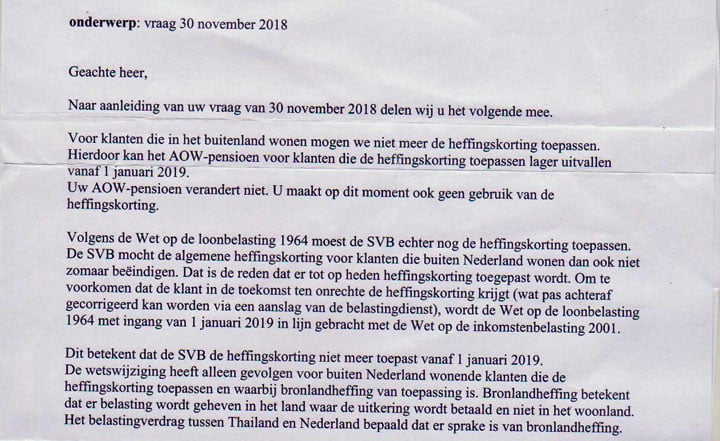

AOW Pension Tax Credit Para Sa Mga Pensiyonado Sa Thailand Thai Na Blog