In a world where screens have become the dominant feature of our lives but the value of tangible, printed materials hasn't diminished. In the case of educational materials and creative work, or simply adding some personal flair to your space, Personal Loan Rebate In Income Tax are now a vital resource. Here, we'll dive to the depths of "Personal Loan Rebate In Income Tax," exploring the benefits of them, where you can find them, and the ways that they can benefit different aspects of your life.

Get Latest Personal Loan Rebate In Income Tax Below

Personal Loan Rebate In Income Tax

Personal Loan Rebate In Income Tax - Personal Loan Rebate In Income Tax, Personal Loan Interest Rebate In Income Tax, Personal Loan Emi Deduction In Income Tax, Is Personal Loan Interest Tax Deductible, Does Personal Loan Comes Under 80c

Web 3 juil 2022 nbsp 0183 32 Answer No tax benefits are available for repayment of a personal loan However interest paid on a personal loan can be claimed as a deduction depending on the ultimate use of the amount

Web 25 ao 251 t 2023 nbsp 0183 32 Interest paid on personal loans is not tax deductible If you borrow to buy a car for personal use or to cover other personal

Printables for free include a vast assortment of printable, downloadable material that is available online at no cost. These resources come in many types, like worksheets, templates, coloring pages, and much more. The value of Personal Loan Rebate In Income Tax lies in their versatility and accessibility.

More of Personal Loan Rebate In Income Tax

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

Web 23 janv 2020 nbsp 0183 32 Your income tax return can include your personal loan Personal loans for tax deductible purposes like higher education home remodeling or business expansion can be deducted Sections 80C and

Web 30 sept 2020 nbsp 0183 32 No personal loans aren t considered taxable income in most situations However you will have to pay taxes if your debt is forgiven or canceled Cancellation of

Printables for free have gained immense popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

customization: You can tailor the design to meet your needs whether it's making invitations planning your schedule or decorating your home.

-

Educational Benefits: These Personal Loan Rebate In Income Tax offer a wide range of educational content for learners of all ages, making them a vital source for educators and parents.

-

An easy way to access HTML0: Instant access to an array of designs and templates cuts down on time and efforts.

Where to Find more Personal Loan Rebate In Income Tax

Income Tax Rebate On Home Loan Fy 2019 20 A design system

Income Tax Rebate On Home Loan Fy 2019 20 A design system

Web As per India s Income Tax Act 1961 personal loans are eligible for tax exemptions or deductions under section 80C depending on how you use the funds Here are some

Web Here s all that you should know about the tax benefits on personal loans Is Personal Loan Taxable Although personal loans are not defined under the Indian Income Tax

We've now piqued your interest in printables for free Let's find out where you can find these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of Personal Loan Rebate In Income Tax designed for a variety purposes.

- Explore categories such as the home, decor, organisation, as well as crafts.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing Flashcards, worksheets, and other educational materials.

- Great for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates, which are free.

- The blogs are a vast spectrum of interests, that range from DIY projects to planning a party.

Maximizing Personal Loan Rebate In Income Tax

Here are some innovative ways of making the most of Personal Loan Rebate In Income Tax:

1. Home Decor

- Print and frame stunning art, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Use printable worksheets from the internet for reinforcement of learning at home or in the classroom.

3. Event Planning

- Design invitations and banners as well as decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized by using printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Personal Loan Rebate In Income Tax are an abundance of useful and creative resources which cater to a wide range of needs and preferences. Their access and versatility makes them an invaluable addition to the professional and personal lives of both. Explore the world that is Personal Loan Rebate In Income Tax today, and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really gratis?

- Yes you can! You can download and print these files for free.

-

Are there any free printables to make commercial products?

- It depends on the specific rules of usage. Always consult the author's guidelines before using their printables for commercial projects.

-

Are there any copyright violations with Personal Loan Rebate In Income Tax?

- Certain printables might have limitations concerning their use. You should read the terms and conditions offered by the author.

-

How do I print Personal Loan Rebate In Income Tax?

- Print them at home with your printer or visit any local print store for top quality prints.

-

What software do I need to open printables for free?

- The majority of printed documents are in PDF format, which is open with no cost software like Adobe Reader.

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

Interim Budget 2019 20 The Talk Of The Town Trade Brains

Check more sample of Personal Loan Rebate In Income Tax below

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Know The Tax Amount You Can Save On Your Home Loan Under Section 24 And

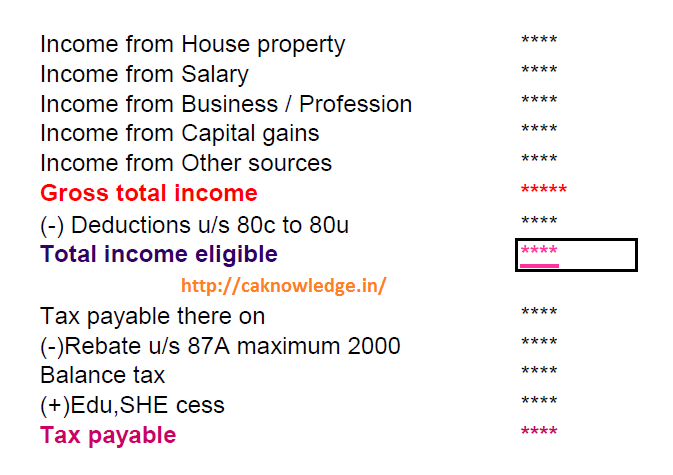

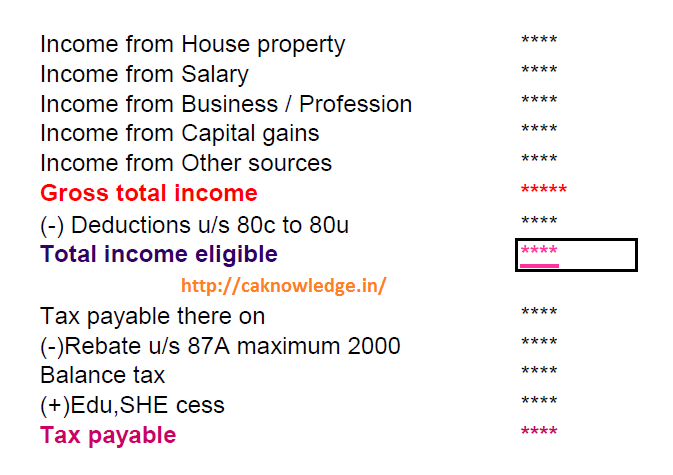

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Is Rebate U s 87A Available For Financial Year 2016 17

DEDUCTION UNDER SECTION 80C TO 80U PDF

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

https://www.investopedia.com/ask/answers/11…

Web 25 ao 251 t 2023 nbsp 0183 32 Interest paid on personal loans is not tax deductible If you borrow to buy a car for personal use or to cover other personal

https://www.forbes.com/advisor/personal-loa…

Web 29 mars 2021 nbsp 0183 32 Since personal loans are loans and not income they aren t considered taxable income and therefore you don t need to report them on your income taxes However there are some instances

Web 25 ao 251 t 2023 nbsp 0183 32 Interest paid on personal loans is not tax deductible If you borrow to buy a car for personal use or to cover other personal

Web 29 mars 2021 nbsp 0183 32 Since personal loans are loans and not income they aren t considered taxable income and therefore you don t need to report them on your income taxes However there are some instances

Is Rebate U s 87A Available For Financial Year 2016 17

Know The Tax Amount You Can Save On Your Home Loan Under Section 24 And

DEDUCTION UNDER SECTION 80C TO 80U PDF

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Section 87A Income Tax Rebate Under Section 87A For FY 2019 20

Personal Financing AEON Credit Service Malaysia

Personal Financing AEON Credit Service Malaysia

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax