In this age of electronic devices, where screens dominate our lives however, the attraction of tangible printed materials isn't diminishing. It doesn't matter if it's for educational reasons and creative work, or simply to add an element of personalization to your space, R D Tax Offset Accounting Treatment Australia are now an essential resource. Here, we'll take a dive in the world of "R D Tax Offset Accounting Treatment Australia," exploring their purpose, where to locate them, and how they can improve various aspects of your daily life.

Get Latest R D Tax Offset Accounting Treatment Australia Below

R D Tax Offset Accounting Treatment Australia

R D Tax Offset Accounting Treatment Australia - R&d Tax Offset Accounting Treatment Australia, How Is R&d Tax Offset Calculated

The Government currently provides a tax offset for some of a company s cost of doing eligible R D activities by reducing a company s income tax liability R efundable tax offset of 43 5

The Research and Development R D tax incentive provides targeted R D offsets designed to encourage more Australian companies to engage in R D The incentive has two core

Printables for free include a vast range of printable, free content that can be downloaded from the internet at no cost. These resources come in various kinds, including worksheets templates, coloring pages and more. The appealingness of R D Tax Offset Accounting Treatment Australia is in their variety and accessibility.

More of R D Tax Offset Accounting Treatment Australia

Maximize Small Business Income Tax Offset In 2021 Australia

Maximize Small Business Income Tax Offset In 2021 Australia

R D tax incentive 1 July 2011 to 30 June 2021 Find out about the tax incentive if you re eligible and how to register for income years 1 July 2011 to 30 June 2021 Apply for the

If the asset is not used for R D purposes or if DEF Limited decides not to apply for the refundable R D incentive DEF Limited would qualify for the instant asset write off

R D Tax Offset Accounting Treatment Australia have gained immense popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

customization: This allows you to modify the design to meet your needs whether it's making invitations for your guests, organizing your schedule or even decorating your home.

-

Educational Impact: Educational printables that can be downloaded for free are designed to appeal to students of all ages, making the perfect device for teachers and parents.

-

Affordability: Quick access to numerous designs and templates helps save time and effort.

Where to Find more R D Tax Offset Accounting Treatment Australia

How To Get The 30 Digital Games Tax Offset For Game Developers

How To Get The 30 Digital Games Tax Offset For Game Developers

The accounting treatment for R DTI for financial years starting from 1 July 2021 can be summarised in Diagram 2 on the next page Learn about changes to the R D Tax

This Tax Essentials steps through the various qualifying factors for companies to register eligible R D activities and claim eligible R D expenditures as an R D tax offset as part of the company income tax return process

Now that we've piqued your interest in printables for free Let's look into where you can find these elusive gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of printables that are free for a variety of applications.

- Explore categories such as interior decor, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free, flashcards, and learning materials.

- It is ideal for teachers, parents as well as students who require additional resources.

3. Creative Blogs

- Many bloggers post their original designs and templates free of charge.

- These blogs cover a broad range of interests, everything from DIY projects to planning a party.

Maximizing R D Tax Offset Accounting Treatment Australia

Here are some inventive ways how you could make the most use of printables for free:

1. Home Decor

- Print and frame gorgeous images, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Use printable worksheets from the internet to aid in learning at your home also in the classes.

3. Event Planning

- Design invitations, banners and decorations for special occasions like weddings or birthdays.

4. Organization

- Be organized by using printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

R D Tax Offset Accounting Treatment Australia are an abundance of useful and creative resources designed to meet a range of needs and interest. Their accessibility and versatility make them a fantastic addition to every aspect of your life, both professional and personal. Explore the plethora of R D Tax Offset Accounting Treatment Australia today to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually gratis?

- Yes, they are! You can download and print these items for free.

-

Can I use the free printables to make commercial products?

- It's all dependent on the conditions of use. Always check the creator's guidelines before using printables for commercial projects.

-

Do you have any copyright rights issues with R D Tax Offset Accounting Treatment Australia?

- Some printables may come with restrictions in use. Check the terms and condition of use as provided by the designer.

-

How do I print R D Tax Offset Accounting Treatment Australia?

- You can print them at home using any printer or head to any local print store for high-quality prints.

-

What software will I need to access printables that are free?

- The majority of PDF documents are provided in PDF format. They can be opened using free software, such as Adobe Reader.

Low And Middle Income Tax Offset Free Tax Saver For 2021

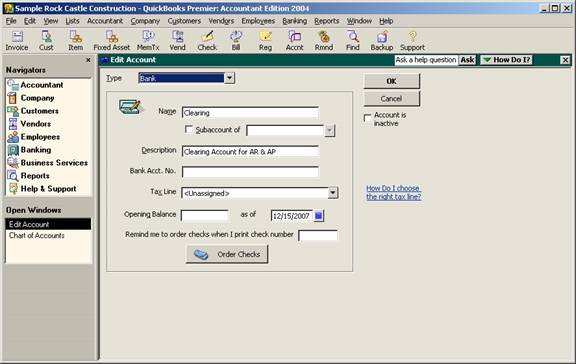

Offset A R And A P Using Journal Entries Accounting Software Secrets

Check more sample of R D Tax Offset Accounting Treatment Australia below

Microsoft Demonstrates How To Increase Green Energy In Ireland One

Substantiating R D Tax Offset Claims What Evidence Is Essential

Accounting For The R D Tax Offset Deloitte Australia Audit Assurance

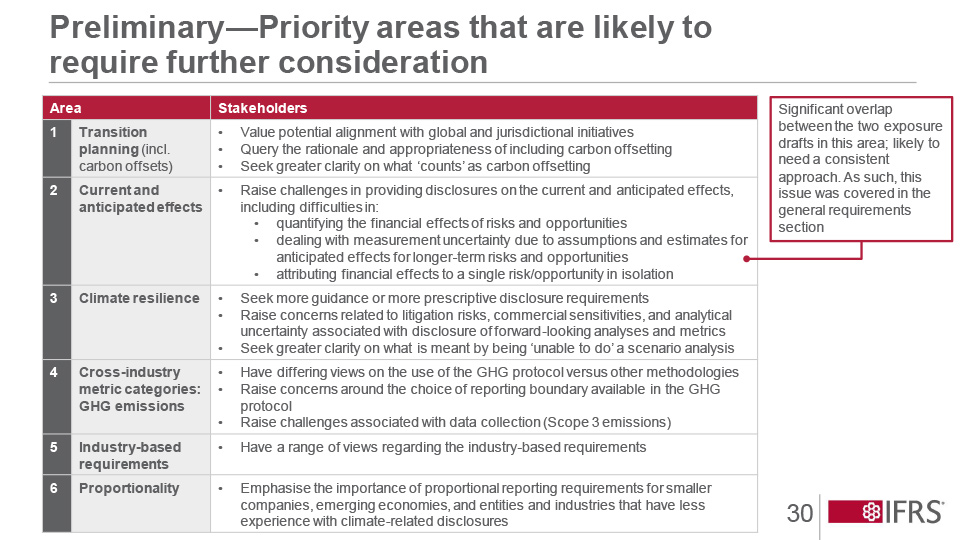

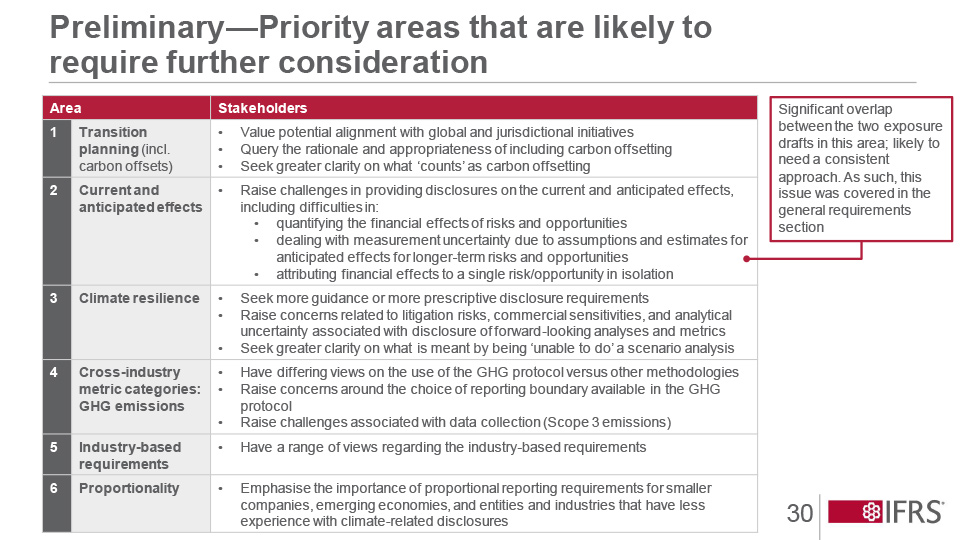

ISSB Surveys The Work Ahead Corporate Disclosures

Working And Living In A Remote Zone Tax Offset Highland Accounting

Tax Offset to Boost Computer Game Industry Accounting Times

https://www.bdo.com.au › en-au › content › accounting-news › ...

The Research and Development R D tax incentive provides targeted R D offsets designed to encourage more Australian companies to engage in R D The incentive has two core

https://www.rsm.global › ... › accountin…

Entities with an aggregated revenue of greater than 20m receive a non refundable tax offset of 38 5 of eligible R D spend which is offset against their current or future income tax liabilities The maximum amount for

The Research and Development R D tax incentive provides targeted R D offsets designed to encourage more Australian companies to engage in R D The incentive has two core

Entities with an aggregated revenue of greater than 20m receive a non refundable tax offset of 38 5 of eligible R D spend which is offset against their current or future income tax liabilities The maximum amount for

ISSB Surveys The Work Ahead Corporate Disclosures

Substantiating R D Tax Offset Claims What Evidence Is Essential

Working And Living In A Remote Zone Tax Offset Highland Accounting

Tax Offset to Boost Computer Game Industry Accounting Times

The Risk To Future Dividends When Receiving R D Tax Incentives Nine

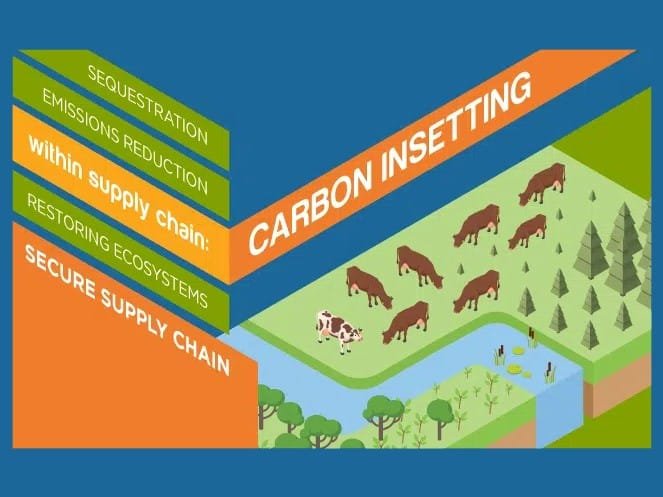

Carbon Accounting Software Carbonoffsetadvisory

Carbon Accounting Software Carbonoffsetadvisory

Carbon Insetting The Target Of Scope 3 Carbon Offset Accounting