In this digital age, with screens dominating our lives however, the attraction of tangible printed objects isn't diminished. No matter whether it's for educational uses for creative projects, simply adding an extra personal touch to your home, printables for free are a great resource. In this article, we'll take a dive into the sphere of "Rebate 87a Income Tax," exploring the benefits of them, where they can be found, and the ways that they can benefit different aspects of your lives.

Get Latest Rebate 87a Income Tax Below

Rebate 87a Income Tax

Rebate 87a Income Tax - Rebate 87a Income Tax, 87a Rebate In Income Tax Hindi, Rebate U/s 87a Of Income Tax Act 1961, Income Tax 87a Rebate Ay 2023-24 In Hindi, Income Tax 87a Rebate Ay 2021-22, Who Is Eligible For 87a Rebate, What Is Rebate Section 87a

Web 2 f 233 vr 2023 nbsp 0183 32 In Budget 2023 the tax rebate for individuals has been increased to INR 25 000 which means individuals having taxable income up to INR 7 00 000 can claim rebate under 87A under new tax regime which shall be applicable from FY 2023 24 AY 2024 25 onwards What are the Eligibility Criteria to Claim a Rebate u s 87A

Web 87A An assessee being an individual resident in India whose total income does not exceed 85 five hundred thousand rupees shall be entitled to a deduction from the amount of income tax as computed before allowing the deductions under this Chapter on his total income with which he is chargeable for any assessment year of an amount

Printables for free cover a broad variety of printable, downloadable documents that can be downloaded online at no cost. These resources come in many kinds, including worksheets templates, coloring pages, and many more. One of the advantages of Rebate 87a Income Tax is their flexibility and accessibility.

More of Rebate 87a Income Tax

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Web 6 lignes nbsp 0183 32 26 avr 2022 nbsp 0183 32 Eligibility Criteria for Claiming Tax Rebate Under Section 87A Tax rebate under Section 87A is

Web 6 f 233 vr 2023 nbsp 0183 32 The tax rebate u s 87A allows a taxpayer to reduce his her tax liability marginally depending on the net total income In this article we will cover the eligibility steps to claim points to keep in mind while

Print-friendly freebies have gained tremendous popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or expensive software.

-

The ability to customize: They can make the templates to meet your individual needs for invitations, whether that's creating them to organize your schedule or even decorating your house.

-

Educational value: These Rebate 87a Income Tax can be used by students of all ages, which makes them an essential tool for parents and teachers.

-

Simple: immediate access numerous designs and templates is time-saving and saves effort.

Where to Find more Rebate 87a Income Tax

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Web 3 f 233 vr 2023 nbsp 0183 32 A rebate of Rs 12 500 is available u s 87A for those under the OLD tax regime for individuals whose taxable income is Rs 5 lakh or less in a year Therefore the Section 87A Tax rebate is available under both

Web 1 f 233 vr 2023 nbsp 0183 32 Section 87A entitles a resident individual to claim tax rebate of up to Rs 12 500 against his tax liability in case his income is limited to Rs 7 lakh Once you start earning an income which is over Rs 7 lakh you will have to forgo the benefit offered by Section 87A rebate The rebate under Section 87A for AY2022 23 is Rs 12 500

We've now piqued your interest in Rebate 87a Income Tax we'll explore the places they are hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety with Rebate 87a Income Tax for all objectives.

- Explore categories such as decorations for the home, education and crafting, and organization.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing with flashcards and other teaching tools.

- This is a great resource for parents, teachers, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates at no cost.

- These blogs cover a wide array of topics, ranging that range from DIY projects to planning a party.

Maximizing Rebate 87a Income Tax

Here are some fresh ways create the maximum value use of Rebate 87a Income Tax:

1. Home Decor

- Print and frame gorgeous images, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Print out free worksheets and activities to reinforce learning at home, or even in the classroom.

3. Event Planning

- Make invitations, banners and other decorations for special occasions such as weddings or birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars along with lists of tasks, and meal planners.

Conclusion

Rebate 87a Income Tax are a treasure trove of practical and imaginative resources designed to meet a range of needs and hobbies. Their accessibility and versatility make them a valuable addition to every aspect of your life, both professional and personal. Explore the vast array of printables for free today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really available for download?

- Yes they are! You can download and print these documents for free.

-

Are there any free printables for commercial uses?

- It depends on the specific conditions of use. Always review the terms of use for the creator before utilizing their templates for commercial projects.

-

Do you have any copyright rights issues with Rebate 87a Income Tax?

- Some printables may contain restrictions in their usage. Be sure to read the terms and conditions offered by the author.

-

How can I print Rebate 87a Income Tax?

- You can print them at home using any printer or head to an area print shop for premium prints.

-

What program do I require to view Rebate 87a Income Tax?

- Many printables are offered in PDF format. They can be opened with free software, such as Adobe Reader.

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

Income Tax Rebate U s 87A For The Financial Year 2022 23

Check more sample of Rebate 87a Income Tax below

Rebate us 87A infographic Income Tax Rebate Under Section Flickr

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Rebate Of Income Tax Under Section 87A YouTube

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

All You Need To Know About Section 87A At TaxHelpdesk TaxHelpdesk

Rebate U s 87A A Y 2019 20 Section 87A Of Income Tax How To Claim

https://incometaxindia.gov.in/Acts/Income-tax Act, 1961/2021...

Web 87A An assessee being an individual resident in India whose total income does not exceed 85 five hundred thousand rupees shall be entitled to a deduction from the amount of income tax as computed before allowing the deductions under this Chapter on his total income with which he is chargeable for any assessment year of an amount

https://economictimes.indiatimes.com/wealth/tax/who-is-eligible-for...

Web 3 f 233 vr 2023 nbsp 0183 32 87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus an individual opting for the new tax regime in FY 2023 24 will pay zero taxes if their taxable income does not exceed Rs 7 lakh

Web 87A An assessee being an individual resident in India whose total income does not exceed 85 five hundred thousand rupees shall be entitled to a deduction from the amount of income tax as computed before allowing the deductions under this Chapter on his total income with which he is chargeable for any assessment year of an amount

Web 3 f 233 vr 2023 nbsp 0183 32 87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus an individual opting for the new tax regime in FY 2023 24 will pay zero taxes if their taxable income does not exceed Rs 7 lakh

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

All You Need To Know About Section 87A At TaxHelpdesk TaxHelpdesk

Rebate U s 87A A Y 2019 20 Section 87A Of Income Tax How To Claim

Rebate Of Income Tax Under Section 87A YouTube

ALL ABOUT REBATE 87A EXEMPTION OF TAX UP TO 5 LAKH SIMPLE TAX INDIA

ALL ABOUT REBATE 87A EXEMPTION OF TAX UP TO 5 LAKH SIMPLE TAX INDIA

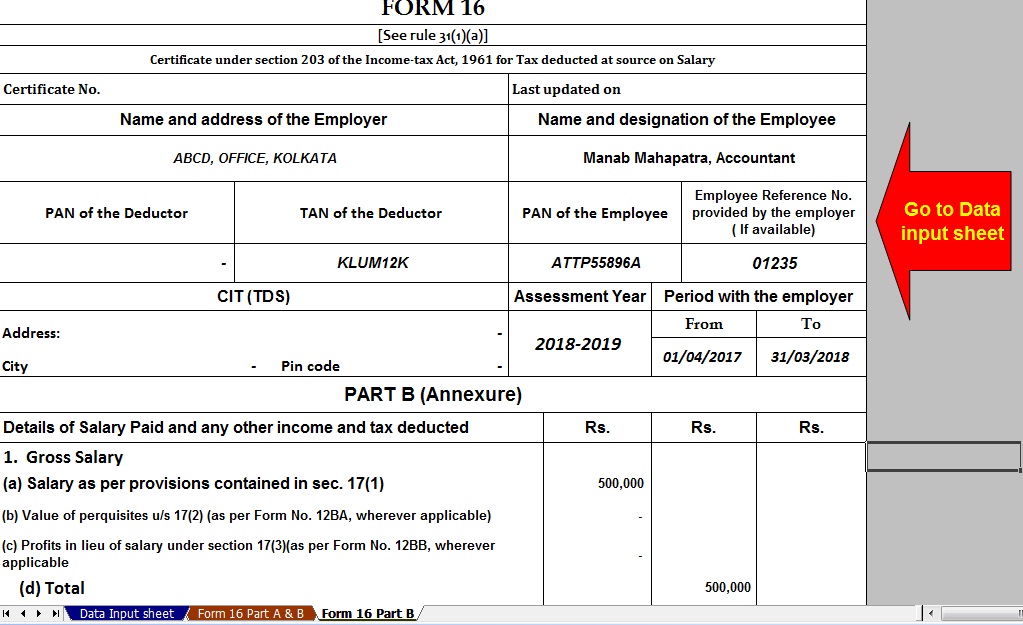

Rebate U s 87A Of The Income Tax As Per Budget 2017 Plus Automated TDS