In the digital age, with screens dominating our lives it's no wonder that the appeal of tangible printed material hasn't diminished. Be it for educational use such as creative projects or simply adding an element of personalization to your space, Rebate Limit In Income Tax Meaning are now a useful resource. Here, we'll take a dive deep into the realm of "Rebate Limit In Income Tax Meaning," exploring what they are, where they can be found, and what they can do to improve different aspects of your daily life.

Get Latest Rebate Limit In Income Tax Meaning Below

Rebate Limit In Income Tax Meaning

Rebate Limit In Income Tax Meaning - Rebate Limit In Income Tax Meaning, How Many Types Of Rebate In Income Tax, What Is Rebate In Income Tax, What Is 87a Rebate In Income Tax, How Is Section 87a Rebate Calculated, How Rebate Is Calculated In Income Tax

Section 87A of the Income tax Act 1961 allows an individual to claim tax rebate provided their taxable income does not increase the specified level This tax rebate effectively makes zero tax outgo of an individual

However under the new tax regime the rebate limit is Rs 25 000 for the taxpayers with an annual income up to Rs 7 lakh for FY 2023 24 and onwards TDS stands for tax deducted at source As per the Income Tax act any company or person making a payment is required to deduct tax at source if the payment exceeds certain threshold limits

Rebate Limit In Income Tax Meaning encompass a wide range of printable, free materials online, at no cost. The resources are offered in a variety kinds, including worksheets templates, coloring pages and many more. One of the advantages of Rebate Limit In Income Tax Meaning lies in their versatility and accessibility.

More of Rebate Limit In Income Tax Meaning

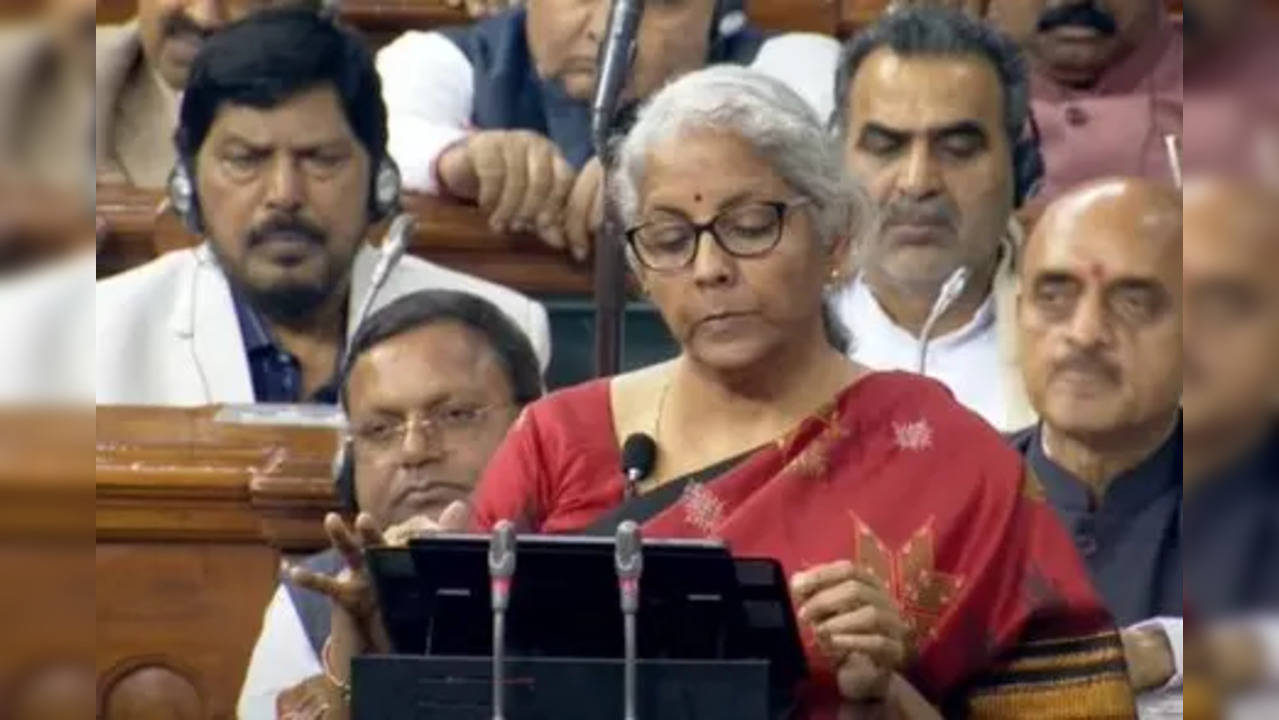

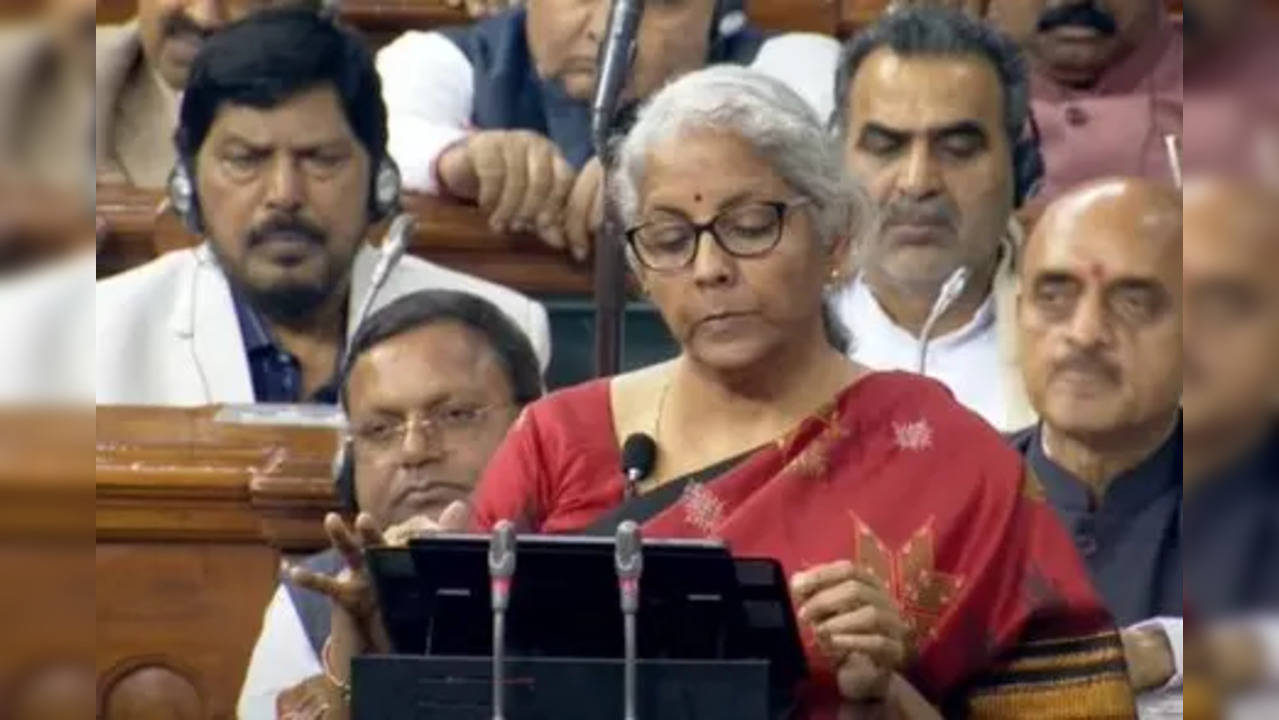

Union Budget 2023 Centre Raises Tax Rebate Limit Reduces Slabs In Key

Union Budget 2023 Centre Raises Tax Rebate Limit Reduces Slabs In Key

You can claim the income tax rebate only if you file your income tax returns within a specified period every financial year Learn more about the tax rebate meaning and the investments that help reduce your tax liability in this article

What Is Income Tax Rebate A tax rebate is getting a refund of taxes when an individual s tax liability is less than what they ve paid the government refunds it if your tax liability falls within the rebate limit you can expect a full refund of the tax amount

Rebate Limit In Income Tax Meaning have gained immense popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or costly software.

-

Modifications: Your HTML0 customization options allow you to customize the templates to meet your individual needs when it comes to designing invitations and schedules, or decorating your home.

-

Educational Value: Free educational printables can be used by students from all ages, making the perfect device for teachers and parents.

-

Affordability: Fast access a myriad of designs as well as templates reduces time and effort.

Where to Find more Rebate Limit In Income Tax Meaning

Fortune India Business News Strategy Finance And Corporate Insight

Fortune India Business News Strategy Finance And Corporate Insight

The income tax rebate under Section 87A for AY 2023 24 the rebate amount is Rs 12 500 for resident individuals with taxable income up to Rs 5 00 000

Section 87A is a legal provision which allows for tax rebates under the Income Tax Act of 1961 The section which was inserted through the Finance Act of 2013 provides tax relief for individuals earning below a specified limit

If we've already piqued your curiosity about Rebate Limit In Income Tax Meaning Let's look into where you can discover these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety with Rebate Limit In Income Tax Meaning for all needs.

- Explore categories such as design, home decor, craft, and organization.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free Flashcards, worksheets, and other educational tools.

- Perfect for teachers, parents, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates free of charge.

- These blogs cover a wide range of topics, including DIY projects to planning a party.

Maximizing Rebate Limit In Income Tax Meaning

Here are some ideas for you to get the best use of Rebate Limit In Income Tax Meaning:

1. Home Decor

- Print and frame beautiful artwork, quotes as well as seasonal decorations, to embellish your living spaces.

2. Education

- Utilize free printable worksheets to enhance your learning at home and in class.

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Rebate Limit In Income Tax Meaning are an abundance of useful and creative resources designed to meet a range of needs and pursuits. Their access and versatility makes them a great addition to both personal and professional life. Explore the world of Rebate Limit In Income Tax Meaning now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really completely free?

- Yes they are! You can print and download these materials for free.

-

Can I make use of free printing templates for commercial purposes?

- It's determined by the specific rules of usage. Always review the terms of use for the creator before utilizing printables for commercial projects.

-

Are there any copyright violations with printables that are free?

- Some printables may have restrictions in use. Be sure to read the terms and conditions provided by the designer.

-

How do I print Rebate Limit In Income Tax Meaning?

- Print them at home using a printer or visit an area print shop for top quality prints.

-

What program is required to open printables at no cost?

- The majority of printed documents are in PDF format. They is open with no cost software like Adobe Reader.

Increase In Rebate Limit Relief On Home Loan Here s What Taxpayers

Crypto Companies Are On Their Way To Dubai Find Out Why

Check more sample of Rebate Limit In Income Tax Meaning below

Interim Budget 2019 Income Tax Limit Raised No Tax For People Earning

Income Tax Return Meaning YouTube

How The Mavericks Can Lure Giannis Antetokounmpo Away From The Bucks

/cdn.vox-cdn.com/uploads/chorus_image/image/59968557/947938930.jpg.0.jpg)

Income Tax Slabs Overhauled Under New Regime Rebate Limit Up Check

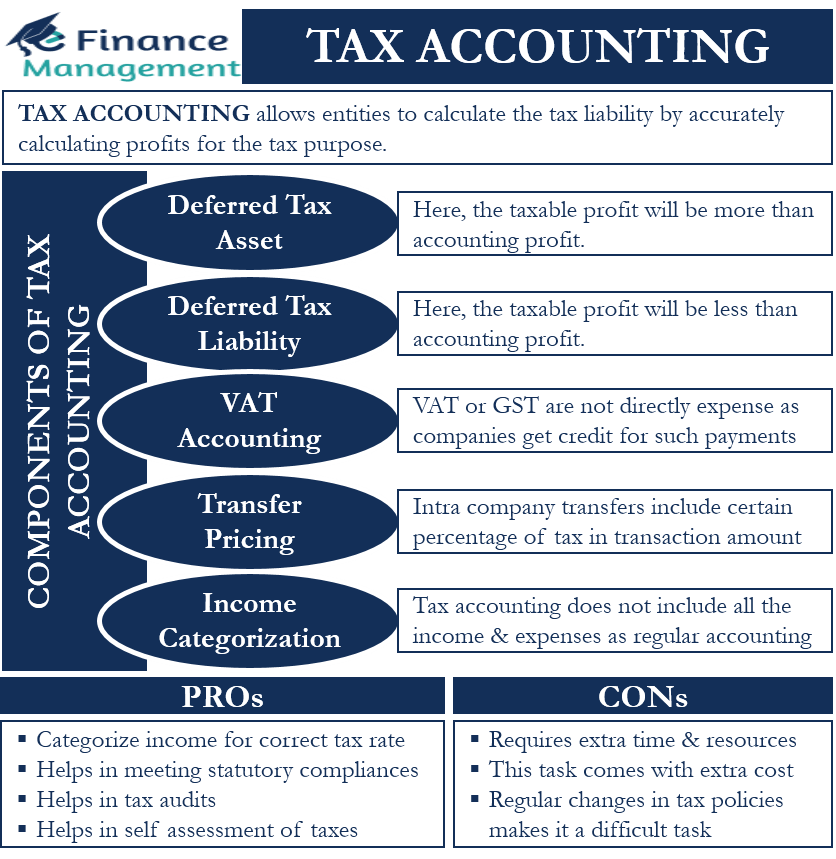

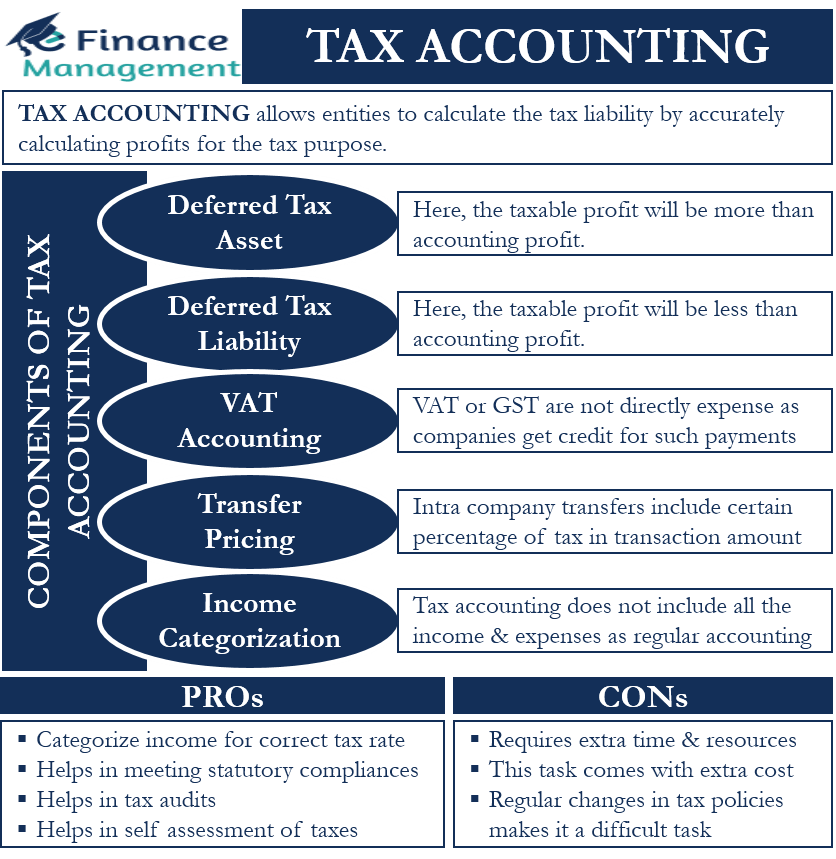

Tax Accounting Meaning Pros Components And More EFM

Indian Budget 2023 Income Tax Rebate Limit Increased No Tax On Income

https://cleartax.in/s/difference-between-tax...

However under the new tax regime the rebate limit is Rs 25 000 for the taxpayers with an annual income up to Rs 7 lakh for FY 2023 24 and onwards TDS stands for tax deducted at source As per the Income Tax act any company or person making a payment is required to deduct tax at source if the payment exceeds certain threshold limits

https://www.bajajfinserv.in/insights/income-tax-rebate

A tax rebate essentially entails a reduction in the tax amount that individuals are required to pay It serves as an incentive offered by the government to encourage savings and is specifically outlined in Section 237 of the Income Tax Act

However under the new tax regime the rebate limit is Rs 25 000 for the taxpayers with an annual income up to Rs 7 lakh for FY 2023 24 and onwards TDS stands for tax deducted at source As per the Income Tax act any company or person making a payment is required to deduct tax at source if the payment exceeds certain threshold limits

A tax rebate essentially entails a reduction in the tax amount that individuals are required to pay It serves as an incentive offered by the government to encourage savings and is specifically outlined in Section 237 of the Income Tax Act

Income Tax Slabs Overhauled Under New Regime Rebate Limit Up Check

Income Tax Return Meaning YouTube

Tax Accounting Meaning Pros Components And More EFM

Indian Budget 2023 Income Tax Rebate Limit Increased No Tax On Income

What Is Previous Year In Income Tax Under Section 3

New Income Tax Slabs Rate Updates Rebate Limit Increased To Rs 7

New Income Tax Slabs Rate Updates Rebate Limit Increased To Rs 7

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh