In a world in which screens are the norm The appeal of tangible printed material hasn't diminished. No matter whether it's for educational uses or creative projects, or simply to add an element of personalization to your home, printables for free have become an invaluable source. With this guide, you'll take a dive in the world of "Rebate On Hra In Income Tax," exploring the different types of printables, where you can find them, and how they can improve various aspects of your lives.

Get Latest Rebate On Hra In Income Tax Below

Rebate On Hra In Income Tax

Rebate On Hra In Income Tax - Rebate On Hra In Income Tax, Deduction Of Hra In Income Tax, Exemption Of Hra In Income Tax Rules, Hra Rebate In Income Tax Calculator, Hra Rebate In Income Tax Section, How Much Rebate On Hra, What Is Hra Rebate, Can Hra Be Claimed In Itr, Calculate Tax Rebate On Hra

Web 19 juil 2023 nbsp 0183 32 In Income Tax HRA is defined as a house rent allowance It is the amount paid by the employer to the employees to help them meet living costs in rented

Web 22 sept 2022 nbsp 0183 32 Tax Benefits of HRA HRA deduction under Section 10 13A of the ITA has the following benefits The biggest advantage of the HRA rebate is that it reduces your

Rebate On Hra In Income Tax provide a diverse selection of printable and downloadable materials available online at no cost. They are available in a variety of styles, from worksheets to templates, coloring pages, and more. One of the advantages of Rebate On Hra In Income Tax is in their variety and accessibility.

More of Rebate On Hra In Income Tax

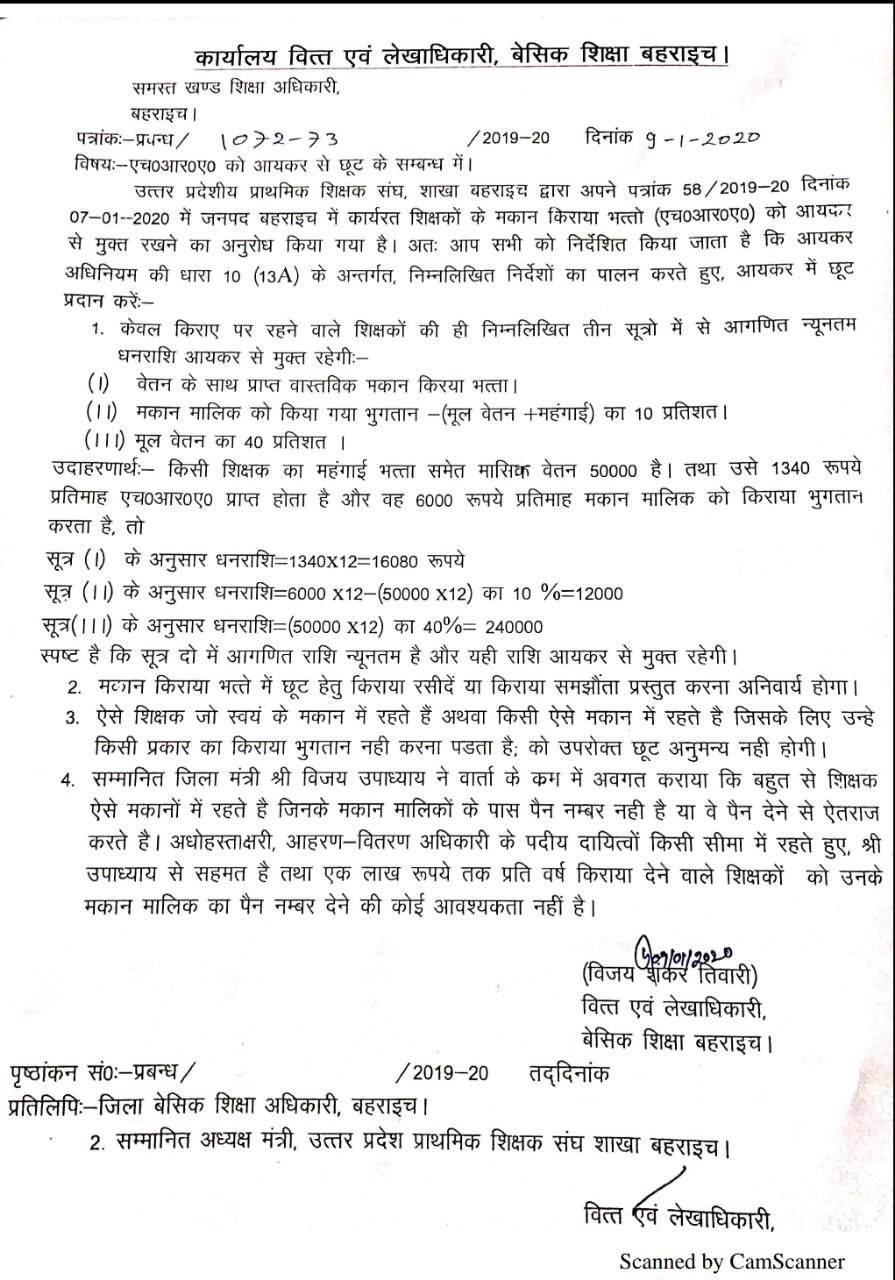

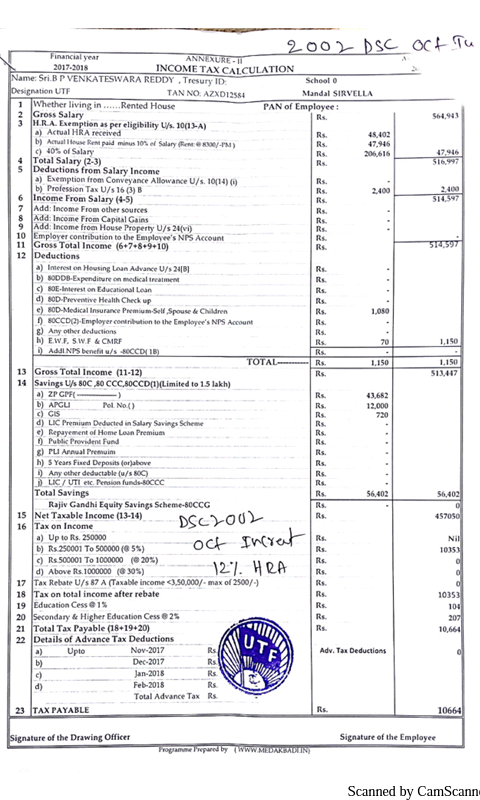

DSC 2002 All HRA Income Tax Ready Reckonar Tables 2017 18

DSC 2002 All HRA Income Tax Ready Reckonar Tables 2017 18

Web 26 janv 2022 nbsp 0183 32 The income tax rules allow deduction of the salary component received as HRA from the taxable salary income However HRA is fully taxable for an employee not living in a rented house

Web HRA exemption in income tax for self employed and other employees If you live in rented accommodation and you are A self employed individual or Salaried individual but your

Rebate On Hra In Income Tax have risen to immense appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies of the software or expensive hardware.

-

The ability to customize: They can make print-ready templates to your specific requirements such as designing invitations for your guests, organizing your schedule or decorating your home.

-

Educational Value These Rebate On Hra In Income Tax cater to learners of all ages, making them an invaluable instrument for parents and teachers.

-

Accessibility: Access to numerous designs and templates helps save time and effort.

Where to Find more Rebate On Hra In Income Tax

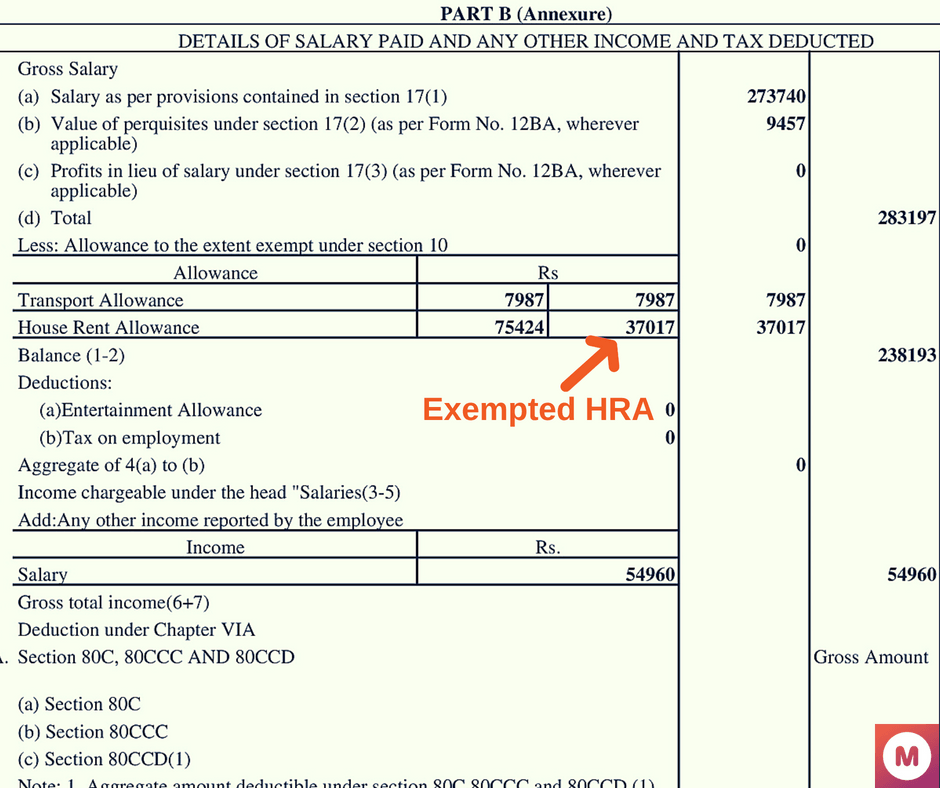

Income Tax HRA

Income Tax HRA

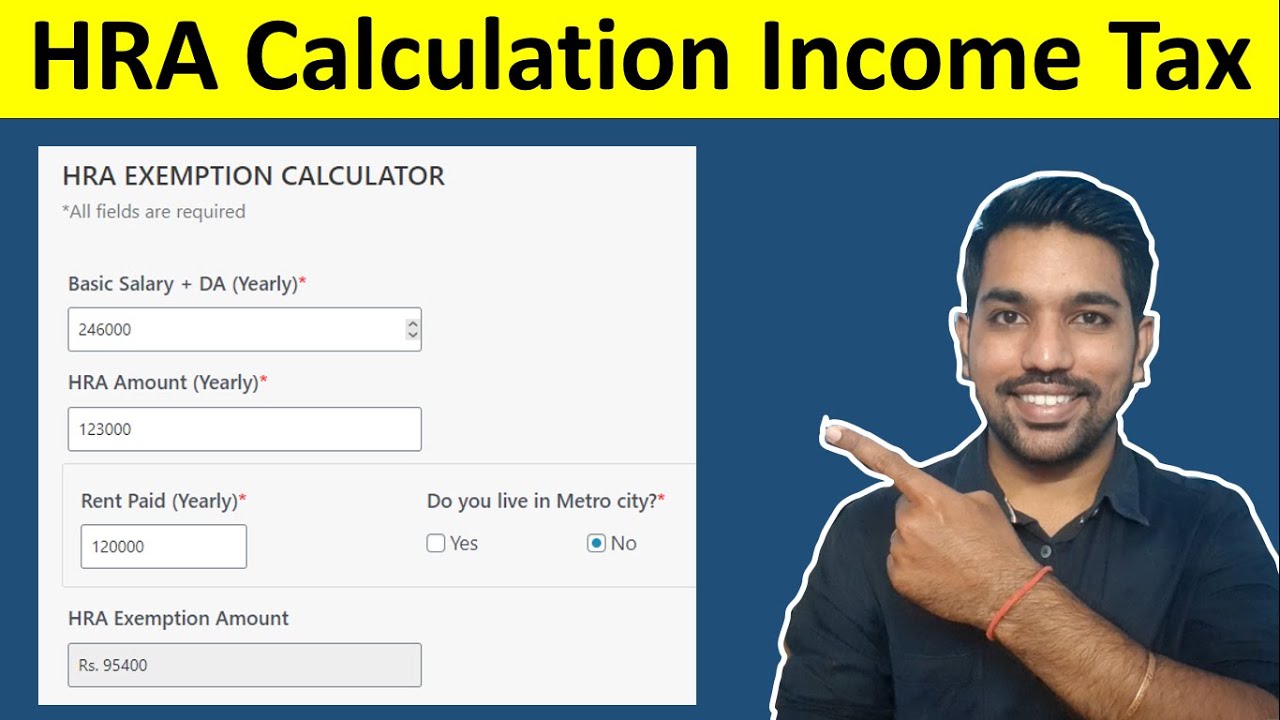

Web The exemption on your HRA benefit is the minimum of The actual HRA received rent paid annually reduced by 10 of salary 50 of your basic salary if you live in a metro city

Web HRA can be claimed as a tax deduction under the Income Tax Act The amount of HRA received depends on factors such as the employee s salary the actual rent paid and the

Since we've got your curiosity about Rebate On Hra In Income Tax we'll explore the places you can discover these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of Rebate On Hra In Income Tax suitable for many applications.

- Explore categories like decorating your home, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free or flashcards as well as learning materials.

- This is a great resource for parents, teachers as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates, which are free.

- These blogs cover a broad selection of subjects, all the way from DIY projects to party planning.

Maximizing Rebate On Hra In Income Tax

Here are some ways to make the most use of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or seasonal decorations that will adorn your living areas.

2. Education

- Use printable worksheets from the internet to reinforce learning at home, or even in the classroom.

3. Event Planning

- Design invitations for banners, invitations and decorations for special occasions such as weddings or birthdays.

4. Organization

- Be organized by using printable calendars or to-do lists. meal planners.

Conclusion

Rebate On Hra In Income Tax are a treasure trove filled with creative and practical information catering to different needs and preferences. Their accessibility and versatility make them a valuable addition to both professional and personal life. Explore the vast collection of Rebate On Hra In Income Tax right now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really available for download?

- Yes, they are! You can print and download these free resources for no cost.

-

Do I have the right to use free printables for commercial uses?

- It's determined by the specific usage guidelines. Always verify the guidelines of the creator prior to using the printables in commercial projects.

-

Do you have any copyright concerns with printables that are free?

- Some printables may contain restrictions on usage. Be sure to review the terms and conditions provided by the author.

-

How can I print Rebate On Hra In Income Tax?

- Print them at home using either a printer at home or in a local print shop for the highest quality prints.

-

What software is required to open Rebate On Hra In Income Tax?

- The majority are printed in the format PDF. This can be opened with free software, such as Adobe Reader.

HRA Calculation Income Tax HRA Deduction In Income Tax How To

HRA Tax Rebate HRA In Income Tax HRA Rebate Kasie Le HRA Rebate

Check more sample of Rebate On Hra In Income Tax below

HRA Calculation In Income Tax House Rent Allowance Calculator

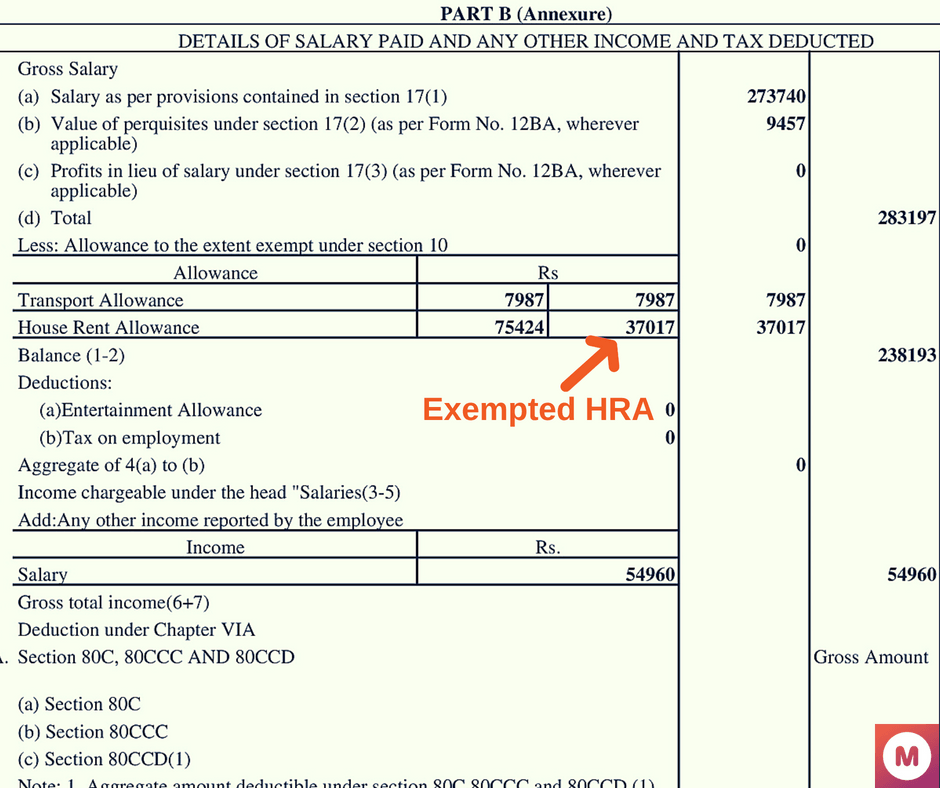

House Rent Allowance HRA Deduction Calculation AY 2019 20 Meteorio

How To Get More Out Of Your HRA Taxpayers Forum

How To Show HRA Not Accounted By The Employer In ITR

Tax Rebate On HRA

House Rent Allowance HRA Tax Exemption HRA Calculation Rules

https://www.etmoney.com/learn/saving-schemes/house-rent-allowance

Web 22 sept 2022 nbsp 0183 32 Tax Benefits of HRA HRA deduction under Section 10 13A of the ITA has the following benefits The biggest advantage of the HRA rebate is that it reduces your

https://housing.com/news/hra-house-rent-allowance-tax-exemption

Web 22 avr 2022 nbsp 0183 32 HRA exemptions are allowed under the Income Tax IT Act Section 10 13A of the Act provides that a salaried person can claim tax benefits with respect to the

Web 22 sept 2022 nbsp 0183 32 Tax Benefits of HRA HRA deduction under Section 10 13A of the ITA has the following benefits The biggest advantage of the HRA rebate is that it reduces your

Web 22 avr 2022 nbsp 0183 32 HRA exemptions are allowed under the Income Tax IT Act Section 10 13A of the Act provides that a salaried person can claim tax benefits with respect to the

How To Show HRA Not Accounted By The Employer In ITR

House Rent Allowance HRA Deduction Calculation AY 2019 20 Meteorio

Tax Rebate On HRA

House Rent Allowance HRA Tax Exemption HRA Calculation Rules

Documents Required To Claim HRA CommonFloor Groups Invoice Template

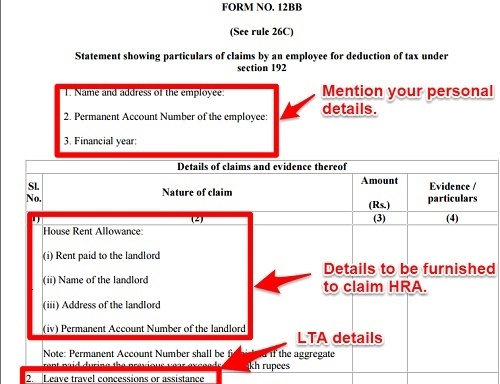

Form 12BB To Claim HRA Deduction By Salaried Employees

Form 12BB To Claim HRA Deduction By Salaried Employees

Form 12BB Changes In Declaring HRA LTA And Sec 80 Deductions