Today, where screens dominate our lives, the charm of tangible printed materials isn't diminishing. Whether it's for educational purposes such as creative projects or simply to add a personal touch to your home, printables for free are now a vital source. This article will dive to the depths of "Self Education Loan Exemption In Income Tax," exploring the benefits of them, where they can be found, and how they can enhance various aspects of your lives.

Get Latest Self Education Loan Exemption In Income Tax Below

Self Education Loan Exemption In Income Tax

Self Education Loan Exemption In Income Tax - Self Education Loan Exemption In Income Tax, Can Education Loan Be Used For Tax Exemption, Education Loan Tax Exemption Limit, Education Loan Tax Exemption Example

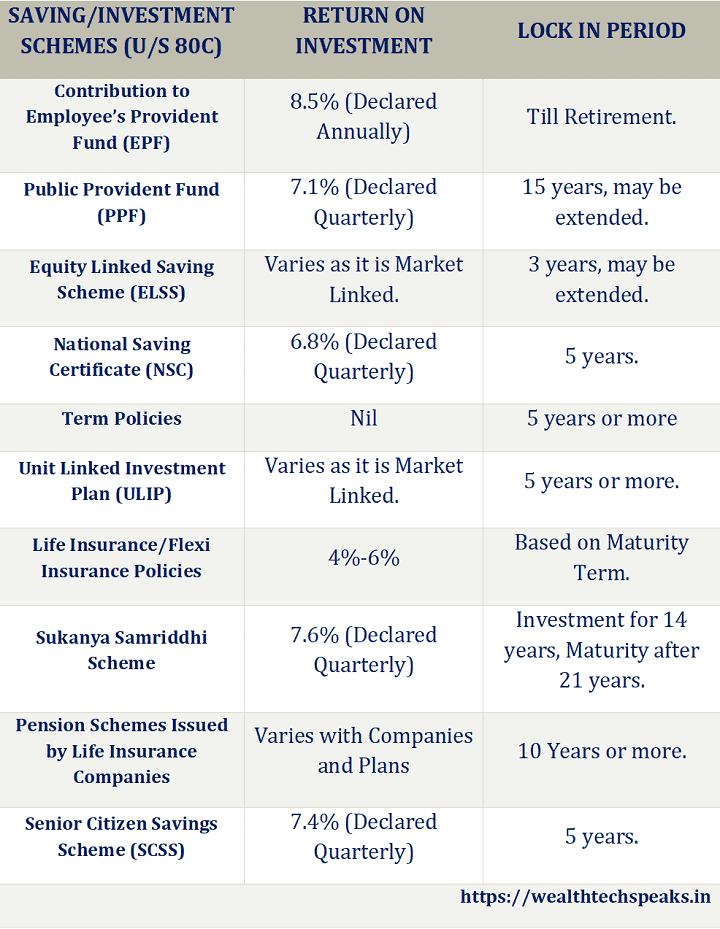

Section 80E of the Income Tax Act provides deduction towards interest paid on loan taken for higher education

Interest on loans taken for pursuing higher education including vocational studies is eligible for deduction u s 80E Understand Section 80E of the Income Tax Act which allows tax deductions for interest paid on education

Printables for free include a vast variety of printable, downloadable materials that are accessible online for free cost. These resources come in various styles, from worksheets to coloring pages, templates and more. The appealingness of Self Education Loan Exemption In Income Tax is in their versatility and accessibility.

More of Self Education Loan Exemption In Income Tax

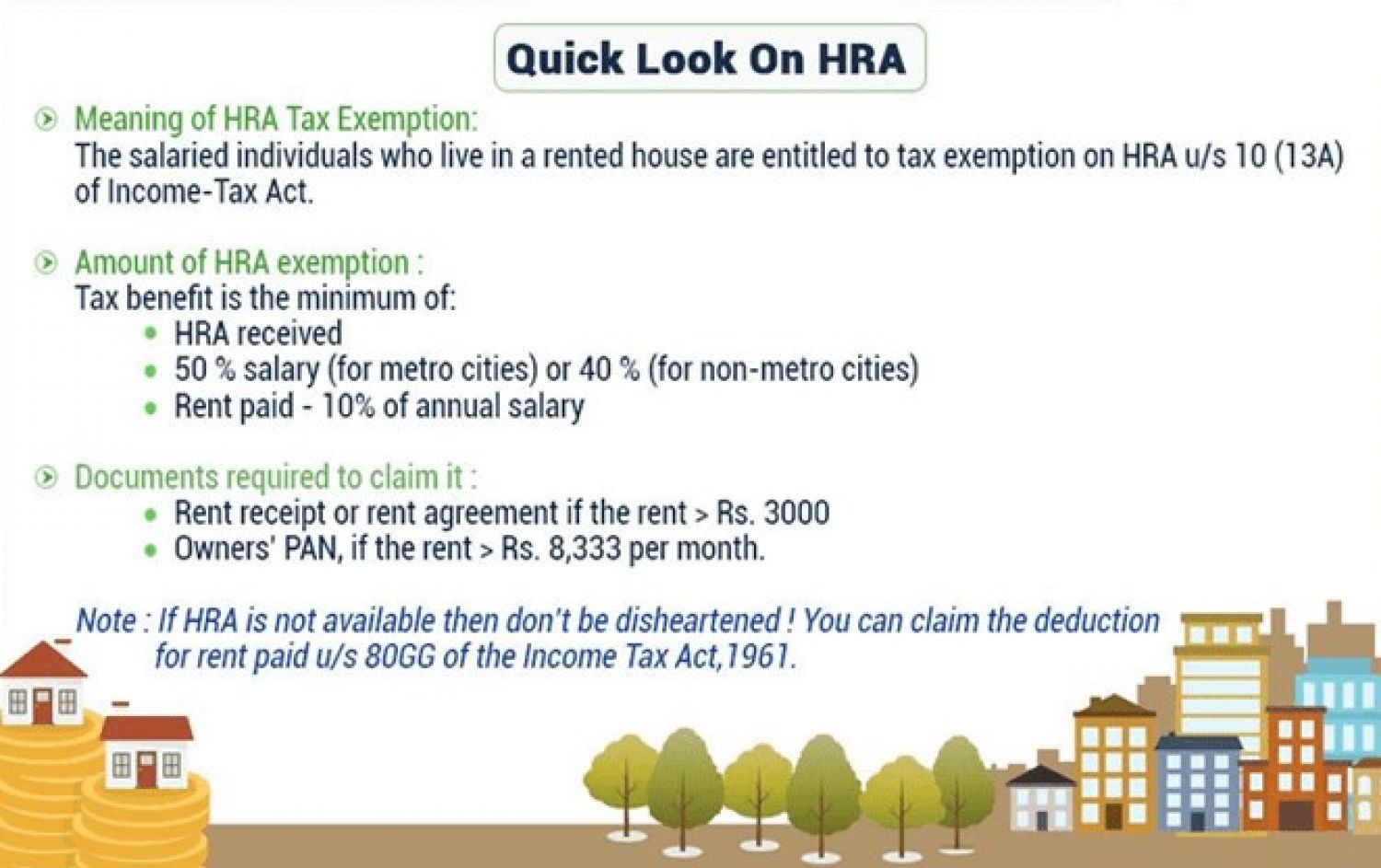

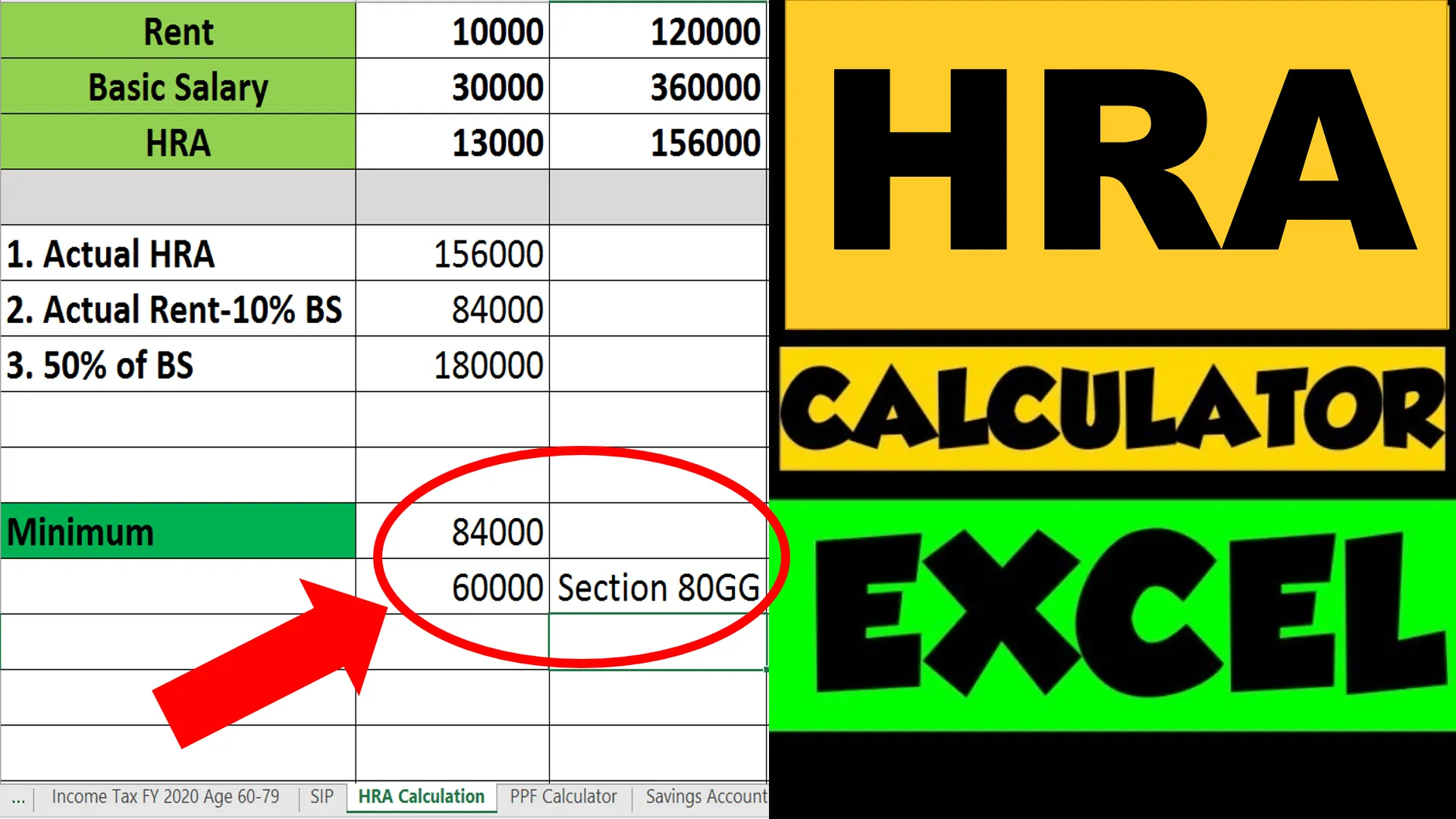

How To Claim HRA Allowance House Rent Allowance Exemption

How To Claim HRA Allowance House Rent Allowance Exemption

Section 80E of the Income Tax Act allows a tax deduction on the interest paid on education loans for higher studies Section 80E deduction helps to reduce the financial burden

If you ve taken an Education Loan and are repaying the same you can always claim deduction under Section 80E of the Income Tax Act for the Repayment of Interest on Education Loan

Self Education Loan Exemption In Income Tax have garnered immense recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

Personalization The Customization feature lets you tailor printing templates to your own specific requirements whether you're designing invitations making your schedule, or even decorating your house.

-

Educational Use: The free educational worksheets provide for students of all ages. This makes them an invaluable instrument for parents and teachers.

-

Affordability: Quick access to a variety of designs and templates saves time and effort.

Where to Find more Self Education Loan Exemption In Income Tax

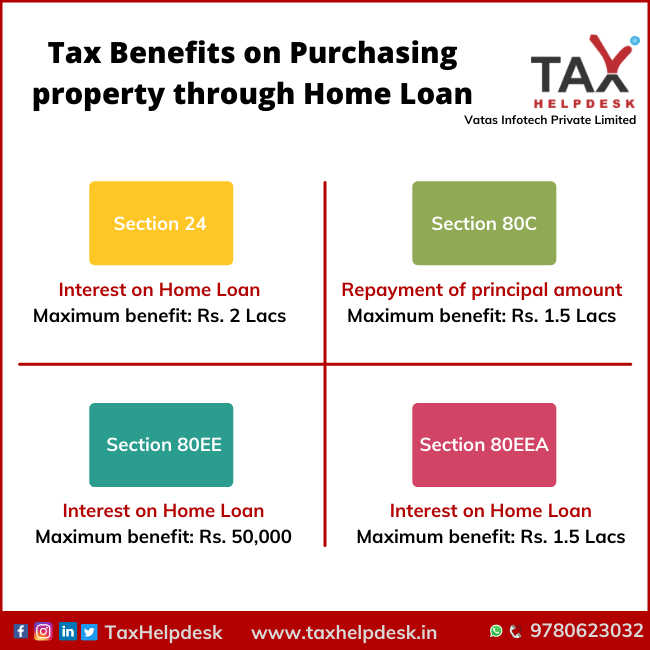

Home Loan 5 Tax Exemption Tax Planning

Home Loan 5 Tax Exemption Tax Planning

If you complete a Self Assessment tax return you must use it to tell HMRC about your student or postgraduate loan deductions

Have you taken an education loan to support higher studies of yourself or of your spouse Children or for the student of whom you are legal guardian and you are not aware of

We hope we've stimulated your curiosity about Self Education Loan Exemption In Income Tax, let's explore where they are hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of Self Education Loan Exemption In Income Tax suitable for many purposes.

- Explore categories like furniture, education, organizational, and arts and crafts.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing or flashcards as well as learning tools.

- Ideal for parents, teachers and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates, which are free.

- The blogs are a vast variety of topics, that includes DIY projects to party planning.

Maximizing Self Education Loan Exemption In Income Tax

Here are some new ways that you can make use of Self Education Loan Exemption In Income Tax:

1. Home Decor

- Print and frame stunning art, quotes, or festive decorations to decorate your living spaces.

2. Education

- Use printable worksheets for free to aid in learning at your home for the classroom.

3. Event Planning

- Design invitations, banners, and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Get organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Self Education Loan Exemption In Income Tax are a treasure trove filled with creative and practical information which cater to a wide range of needs and hobbies. Their accessibility and flexibility make them a valuable addition to every aspect of your life, both professional and personal. Explore the vast array of Self Education Loan Exemption In Income Tax today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really free?

- Yes they are! You can download and print these materials for free.

-

Can I download free printables to make commercial products?

- It's dependent on the particular usage guidelines. Always verify the guidelines provided by the creator prior to using the printables in commercial projects.

-

Are there any copyright rights issues with Self Education Loan Exemption In Income Tax?

- Certain printables might have limitations on their use. Be sure to review the terms and conditions set forth by the author.

-

How do I print printables for free?

- Print them at home using either a printer at home or in an in-store print shop to get top quality prints.

-

What software do I require to view printables for free?

- The majority of printed documents are in the format of PDF, which can be opened with free software, such as Adobe Reader.

Income Tax Slab For FY 2022 23 What You Need To Know

Tax Benefits On Home Loan Know More At Taxhelpdesk

Check more sample of Self Education Loan Exemption In Income Tax below

Home Loan Deductions And Tax Benefits AY 2022 23 Home Loan Tax

How To Apply For PTPTN Loan Repayment Exemption Pengecualian

Tax Benefits On Home Loan 2022 2023

Discover Your Favorite Brand Free Shipping Stainless Steel Flat Collar

Income Tax Exemption On Interest Of Education Loan YouTube

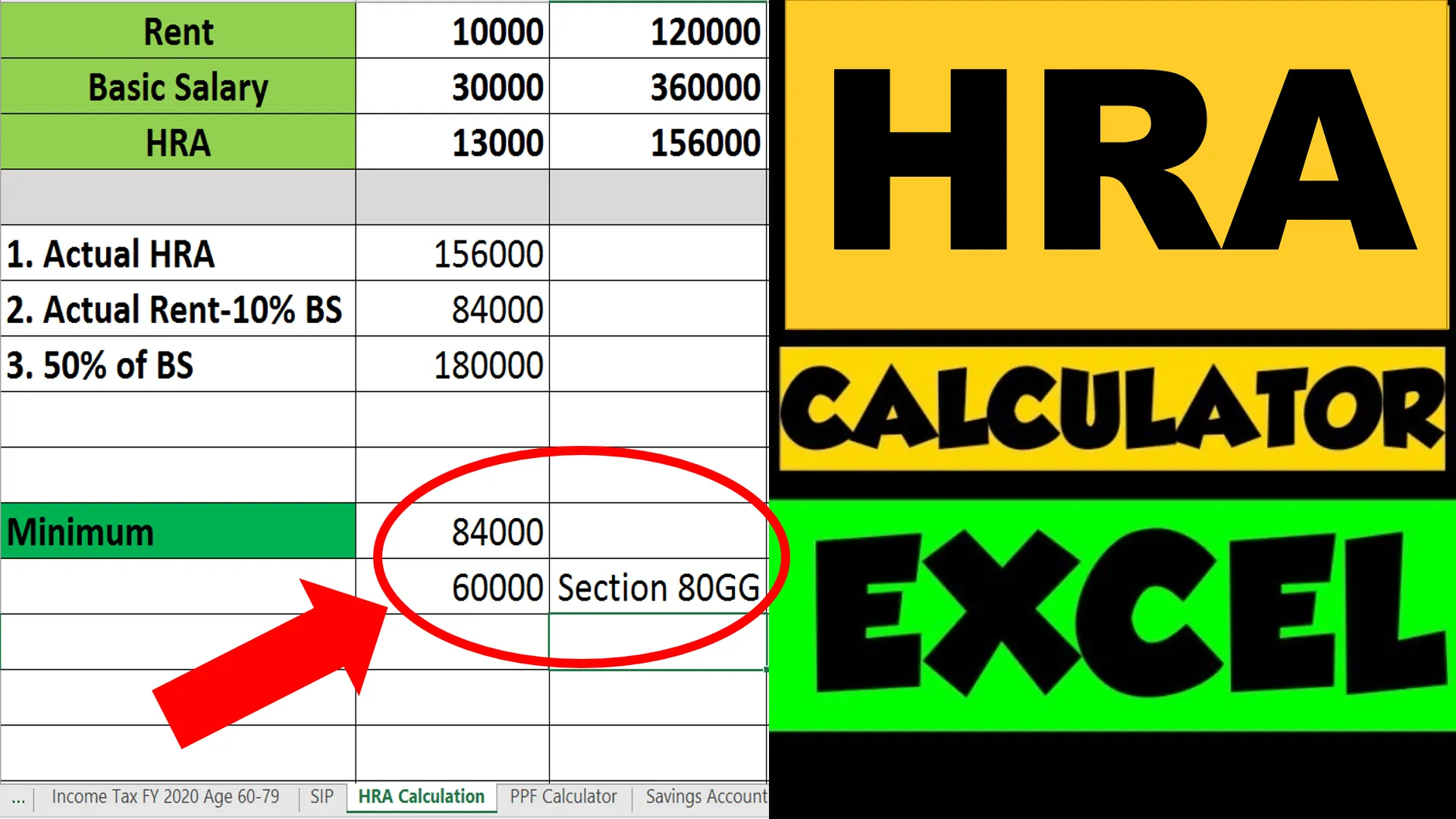

HRA Exemption Calculator In Excel House Rent Allowance Calculation

https://tax2win.in › guide

Interest on loans taken for pursuing higher education including vocational studies is eligible for deduction u s 80E Understand Section 80E of the Income Tax Act which allows tax deductions for interest paid on education

https://cleartax.in

Education loan interest is tax deductible under section 80E for individuals taking loans for higher studies limited to interest payments only Loan must be from recognized institutions No cap on deduction amount available

Interest on loans taken for pursuing higher education including vocational studies is eligible for deduction u s 80E Understand Section 80E of the Income Tax Act which allows tax deductions for interest paid on education

Education loan interest is tax deductible under section 80E for individuals taking loans for higher studies limited to interest payments only Loan must be from recognized institutions No cap on deduction amount available

Discover Your Favorite Brand Free Shipping Stainless Steel Flat Collar

How To Apply For PTPTN Loan Repayment Exemption Pengecualian

Income Tax Exemption On Interest Of Education Loan YouTube

HRA Exemption Calculator In Excel House Rent Allowance Calculation

Sharing On PTPTN Loan Payment Exemption 2022

Housing Loan Tax Exemption Revision In Fiscal 2022 PLAZA HOMES

Housing Loan Tax Exemption Revision In Fiscal 2022 PLAZA HOMES

Avoid Mistakes While Claiming HRA On The ITR Ebizfiling