In this day and age when screens dominate our lives it's no wonder that the appeal of tangible printed objects isn't diminished. Whether it's for educational purposes in creative or artistic projects, or just adding personal touches to your home, printables for free are now a vital source. With this guide, you'll dive into the sphere of "Singapore Corporate Income Tax Rebate," exploring their purpose, where to find them and the ways that they can benefit different aspects of your lives.

Get Latest Singapore Corporate Income Tax Rebate Below

Singapore Corporate Income Tax Rebate

Singapore Corporate Income Tax Rebate - Singapore Corporate Income Tax Rebate, Singapore Corporate Income Tax Return Due Date, Singapore Corporate Income Tax Return Form, Singapore Income Tax Rebate, Corporate Income Tax Rebate Singapore Ya 2022, Can You Claim Tax Back In Singapore, What Is A Corporate Tax Rebate

Web 16 janv 2023 nbsp 0183 32 Who is eligible for the corporate income tax rebate in Singapore As of the Singapore Budget 2023 the corporate income tax rebate is no longer available for

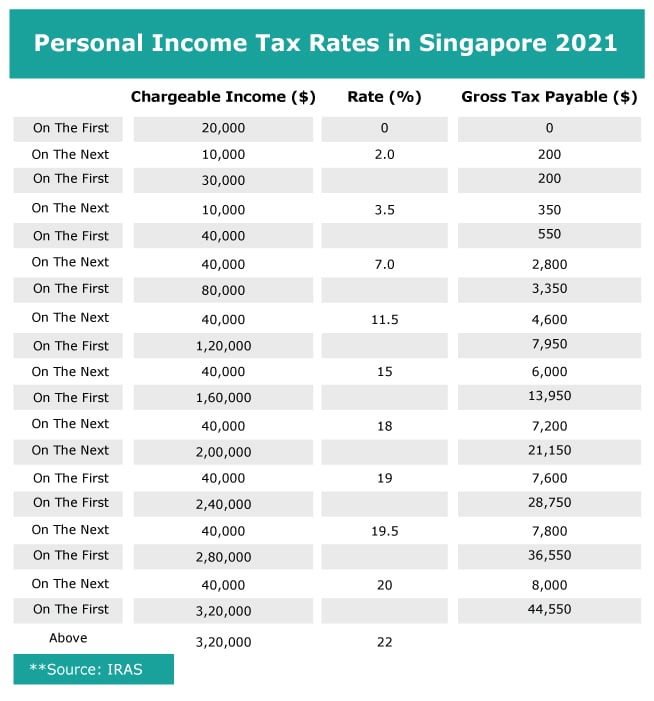

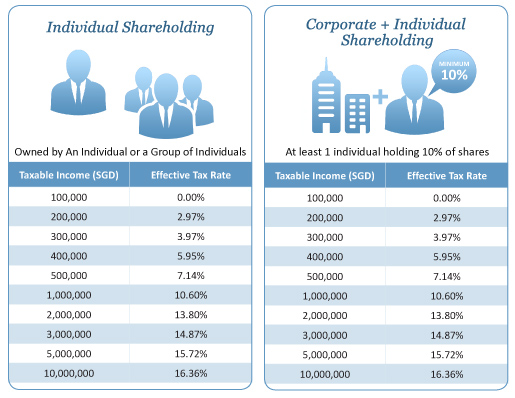

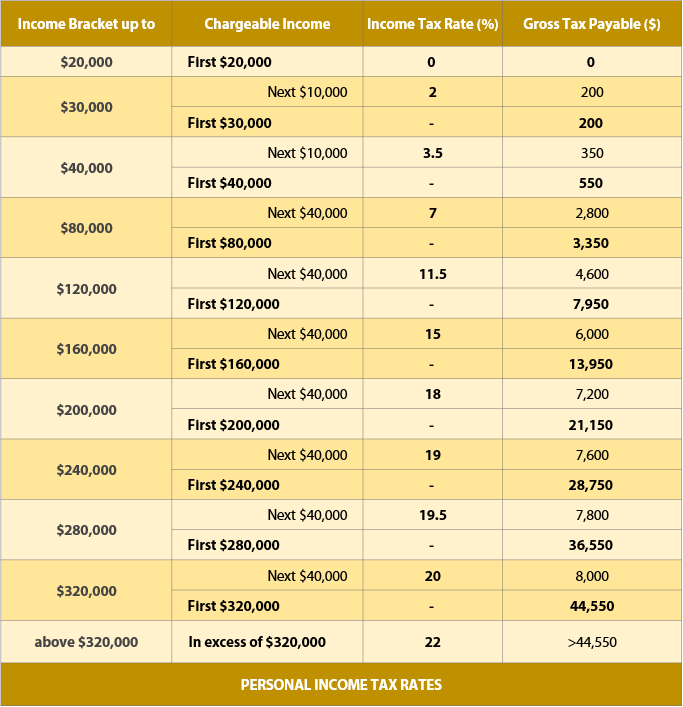

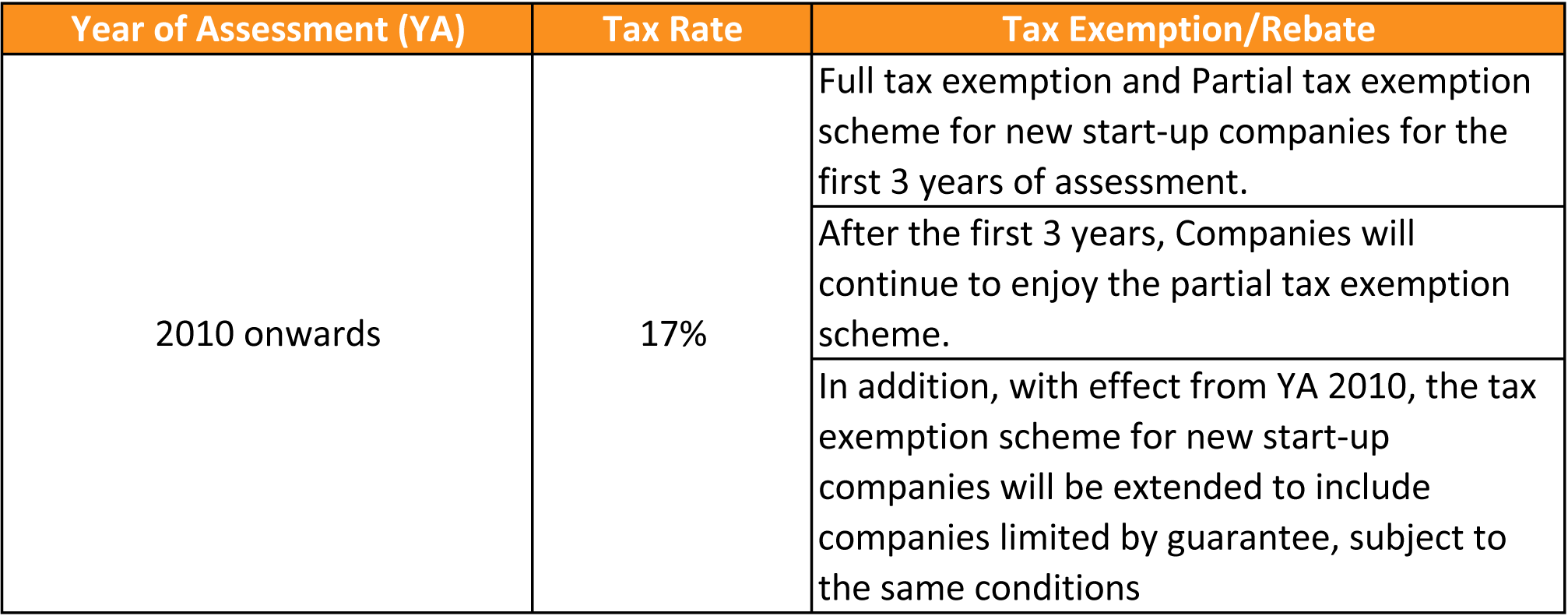

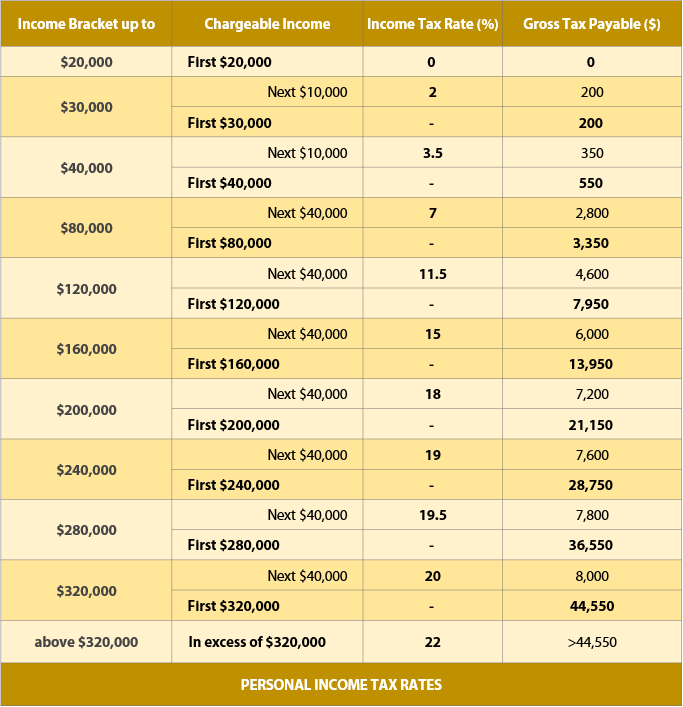

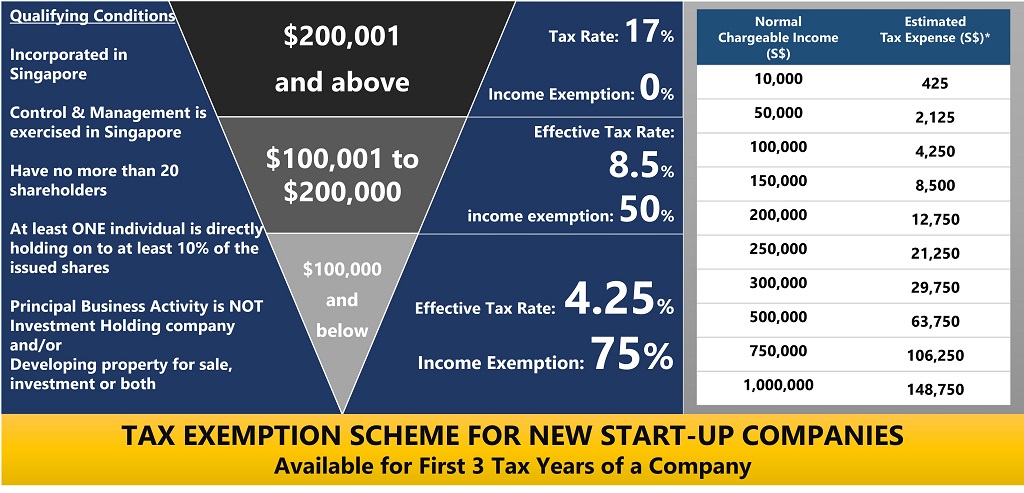

Web Singapore s Corporate Income Tax rate is 17 Expand all Definition of a Company Basis Period amp Year of Assessment Corporate Income Tax Rate Corporate Income Tax

Singapore Corporate Income Tax Rebate include a broad assortment of printable, downloadable materials that are accessible online for free cost. They are available in numerous designs, including worksheets templates, coloring pages and more. The attraction of printables that are free is in their versatility and accessibility.

More of Singapore Corporate Income Tax Rebate

Overview Of Singapore Corporate Taxation System JSE Office

Overview Of Singapore Corporate Taxation System JSE Office

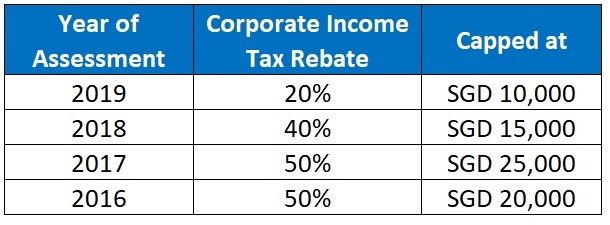

Web 15 mars 2020 nbsp 0183 32 All companies will receive a 25 CIT rebate for the Year of Assessment YA 2020 The rebate is capped at S 15 000 The CIT rebate is available to all

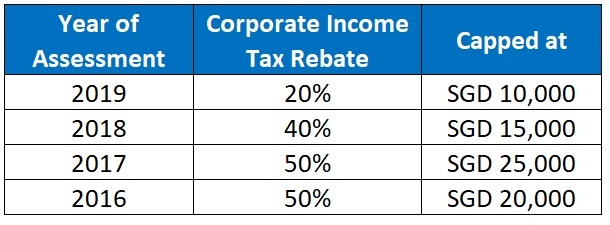

Web 18 f 233 vr 2020 nbsp 0183 32 In YA2019 companies were granted 20 Corporate Income Tax rebate which is capped at a maximum of SGD10 000 If a Singapore company s tax payable for

The Singapore Corporate Income Tax Rebate have gained huge popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the need to buy physical copies of the software or expensive hardware.

-

customization It is possible to tailor printables to fit your particular needs in designing invitations to organize your schedule or decorating your home.

-

Educational Value: The free educational worksheets provide for students of all ages. This makes them a valuable source for educators and parents.

-

Affordability: Instant access to various designs and templates helps save time and effort.

Where to Find more Singapore Corporate Income Tax Rebate

Understanding Corporate Tax In Singapore ContactOne

Understanding Corporate Tax In Singapore ContactOne

Web 23 f 233 vr 2022 nbsp 0183 32 The corporate income tax rate would remain at 17 for year of assessment 2022 with no corporate income tax rebate proposed A minimum effective tax rate

Web 3 lignes nbsp 0183 32 14 mars 2023 nbsp 0183 32 To help businesses grow Singapore offers various incentives including the Singapore Corporate

Since we've got your interest in Singapore Corporate Income Tax Rebate, let's explore where the hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection of Singapore Corporate Income Tax Rebate suitable for many uses.

- Explore categories such as design, home decor, the arts, and more.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free including flashcards, learning materials.

- It is ideal for teachers, parents and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for free.

- The blogs covered cover a wide selection of subjects, everything from DIY projects to planning a party.

Maximizing Singapore Corporate Income Tax Rebate

Here are some fresh ways to make the most of Singapore Corporate Income Tax Rebate:

1. Home Decor

- Print and frame stunning artwork, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Print out free worksheets and activities to reinforce learning at home (or in the learning environment).

3. Event Planning

- Invitations, banners and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable planners checklists for tasks, as well as meal planners.

Conclusion

Singapore Corporate Income Tax Rebate are an abundance of fun and practical tools that cater to various needs and hobbies. Their accessibility and flexibility make them a great addition to each day life. Explore the vast collection of Singapore Corporate Income Tax Rebate right now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Singapore Corporate Income Tax Rebate really completely free?

- Yes, they are! You can print and download these tools for free.

-

Do I have the right to use free printables to make commercial products?

- It depends on the specific conditions of use. Make sure you read the guidelines for the creator before utilizing their templates for commercial projects.

-

Do you have any copyright issues when you download printables that are free?

- Certain printables may be subject to restrictions concerning their use. Always read the conditions and terms of use provided by the creator.

-

How do I print printables for free?

- Print them at home with either a printer or go to a local print shop to purchase top quality prints.

-

What program do I need to open printables for free?

- Many printables are offered in the format of PDF, which can be opened using free programs like Adobe Reader.

Singapore Corporate Tax Rebate Ya 2022 Rebate2022

Why Invest In India Through A Singapore Company Rikvin Pte Ltd

Check more sample of Singapore Corporate Income Tax Rebate below

All Income Earned In Singapore Is Subject To Tax However Singapore

Tax Guide For Singapore Companies Company Tax Services Singapore

Reasons For Setting Up A Business In Singapore Registration Guide

2020 Singapore Corporate Tax Update Singapore Taxation

Singapore Tax Rates

Facts About Corporate Taxes In Singapore Singapore Taxation

https://www.iras.gov.sg/taxes/corporate-income-tax/basics-of-corporate...

Web Singapore s Corporate Income Tax rate is 17 Expand all Definition of a Company Basis Period amp Year of Assessment Corporate Income Tax Rate Corporate Income Tax

https://taxsummaries.pwc.com/singapore/corporate/taxes-on-corporate …

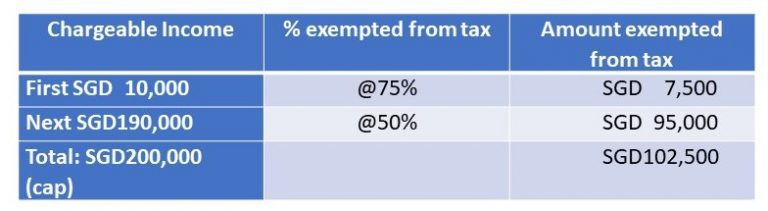

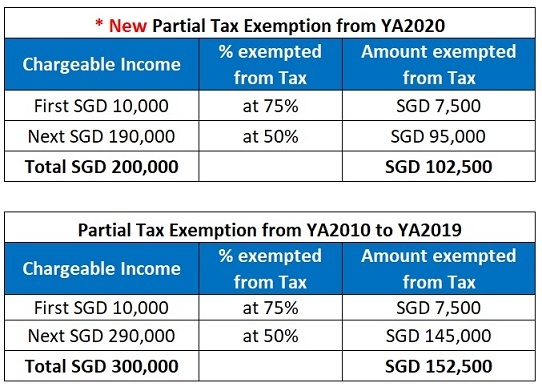

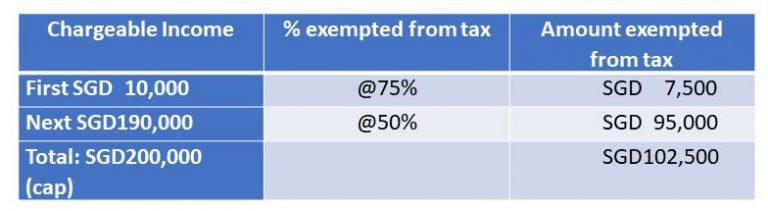

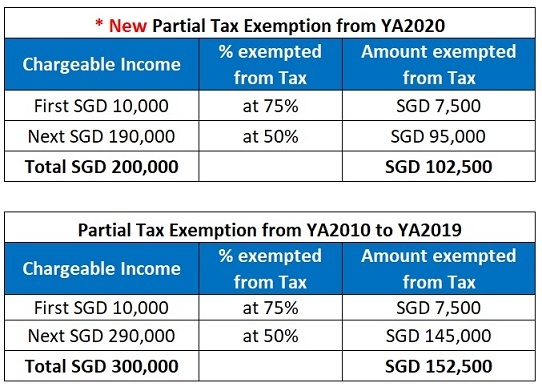

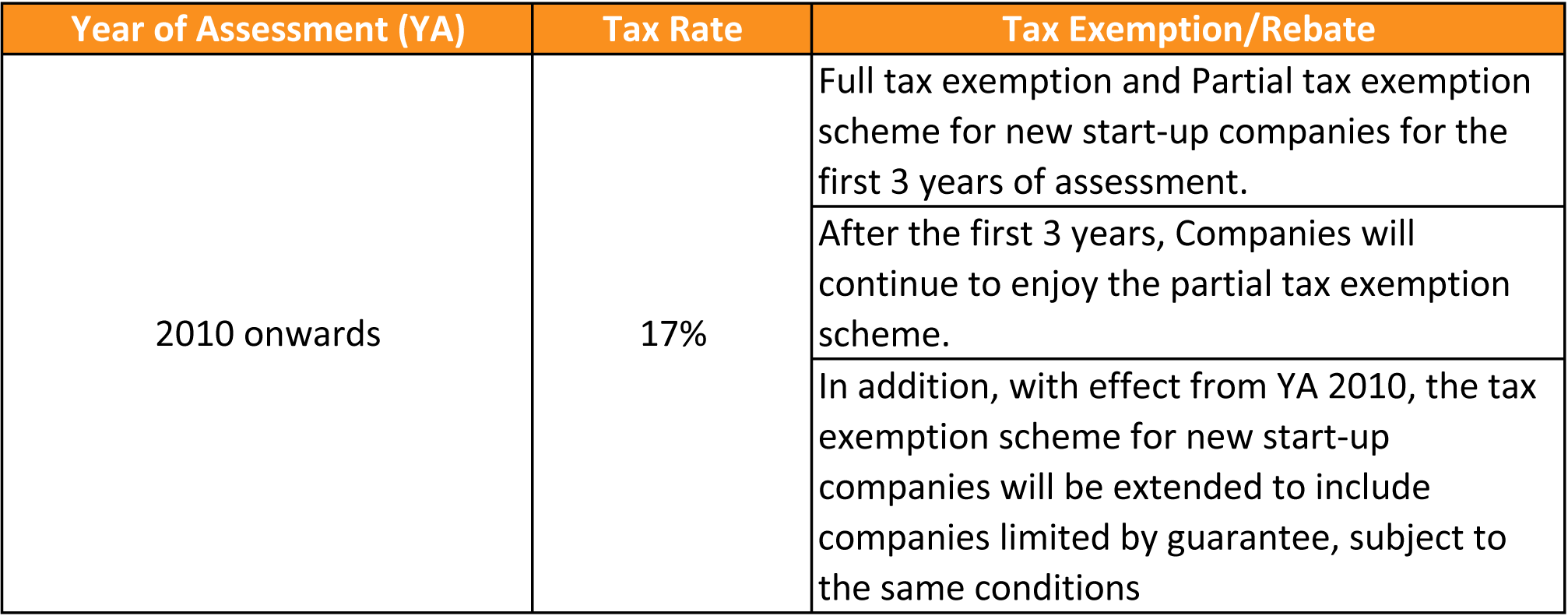

Web 4 mai 2023 nbsp 0183 32 Tax on corporate income is imposed at a flat rate of 17 A partial tax exemption and a three year start up tax exemption for qualifying start up companies are

Web Singapore s Corporate Income Tax rate is 17 Expand all Definition of a Company Basis Period amp Year of Assessment Corporate Income Tax Rate Corporate Income Tax

Web 4 mai 2023 nbsp 0183 32 Tax on corporate income is imposed at a flat rate of 17 A partial tax exemption and a three year start up tax exemption for qualifying start up companies are

2020 Singapore Corporate Tax Update Singapore Taxation

Tax Guide For Singapore Companies Company Tax Services Singapore

Singapore Tax Rates

Facts About Corporate Taxes In Singapore Singapore Taxation

Understanding Corporate Tax In Singapore ContactOne

Singapore Budget 2019 GST Vouchers More CHAS Subsidies Income Tax

Singapore Budget 2019 GST Vouchers More CHAS Subsidies Income Tax

Understanding Singapore Taxes In 5 Minutes