In the digital age, when screens dominate our lives it's no wonder that the appeal of tangible printed products hasn't decreased. Be it for educational use such as creative projects or simply adding a personal touch to your area, Student Loan Forgiveness Taxes are now a useful resource. With this guide, you'll dive deeper into "Student Loan Forgiveness Taxes," exploring the benefits of them, where they are available, and how they can enrich various aspects of your lives.

Get Latest Student Loan Forgiveness Taxes Below

Student Loan Forgiveness Taxes

Student Loan Forgiveness Taxes - Student Loan Forgiveness Taxes, Student Loan Forgiveness Taxes By State, Student Loan Forgiveness Taxes California, Student Loan Forgiveness Taxes Wisconsin, Student Loan Forgiveness Taxes Minnesota, Student Loan Forgiveness Taxes Massachusetts, Student Loan Forgiveness Taxes 2022, Student Loan Forgiven Taxes, Student Loan Repayment Taxes, Student Loan Forgiveness Tax Calculator

Under an income tax lenders deduct the cost of the forgiven loan from their taxable income while borrowers include it in their taxable income creating symmetry in the tax system Federal student loans forgiven under

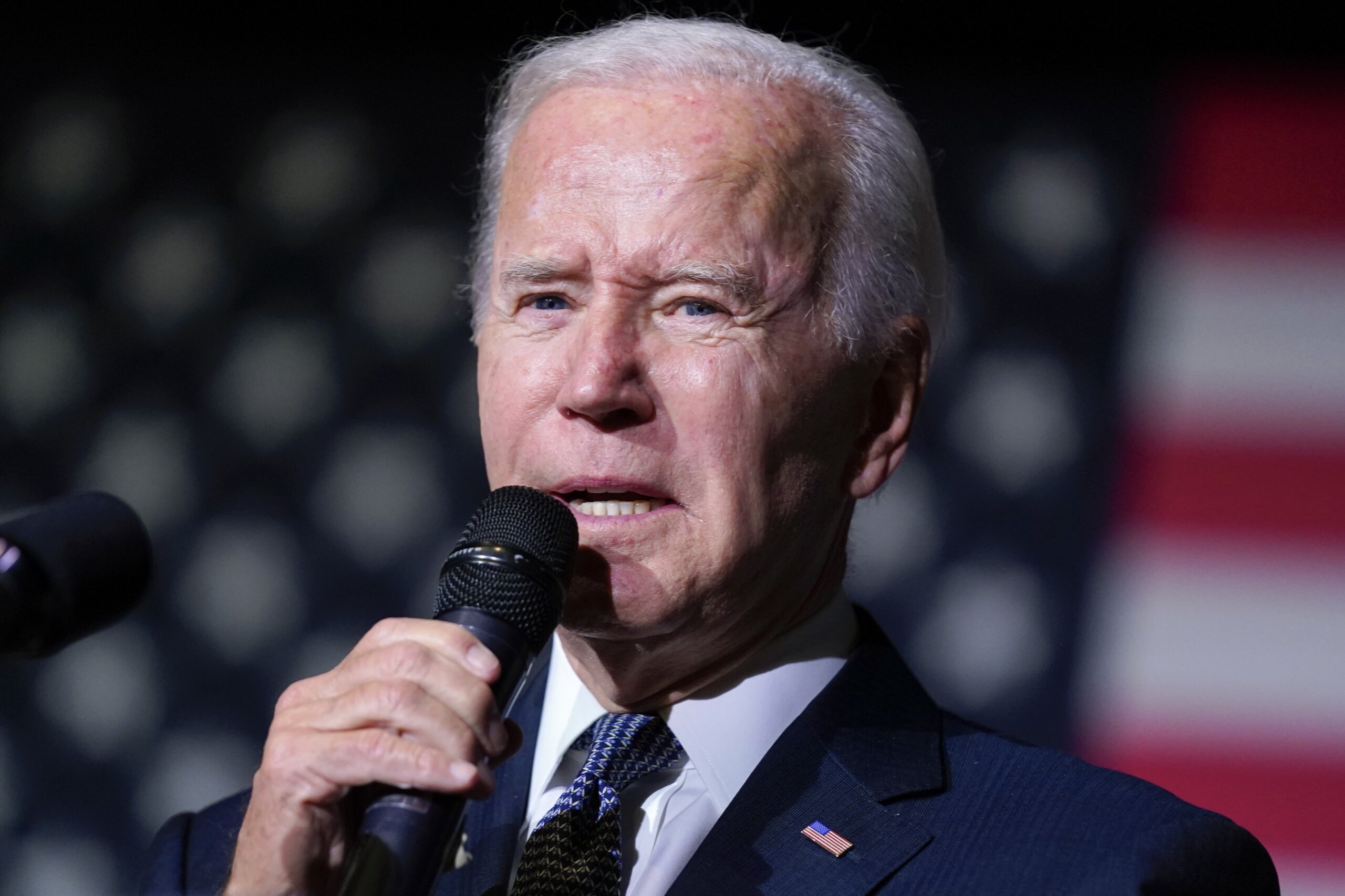

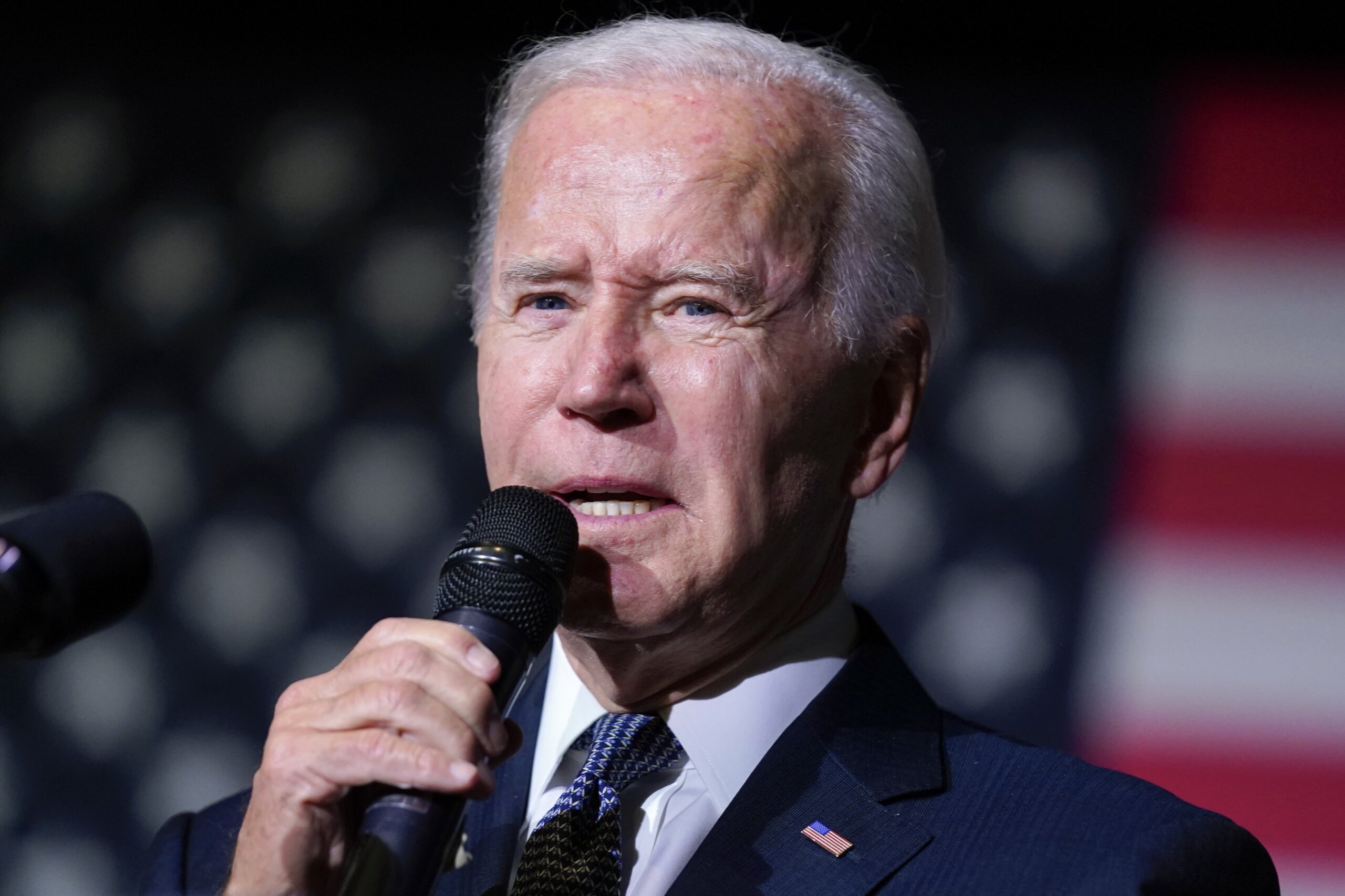

Biden s student loan forgiveness plan does not raise taxes which is something only Congress can do Here s how taxpayers pay for the debt cancellation

Student Loan Forgiveness Taxes provide a diverse array of printable materials that are accessible online for free cost. These resources come in various forms, like worksheets templates, coloring pages, and more. The benefit of Student Loan Forgiveness Taxes is their flexibility and accessibility.

More of Student Loan Forgiveness Taxes

How Student Loan Forgiveness Affects Your Taxes Optima Tax Relief

How Student Loan Forgiveness Affects Your Taxes Optima Tax Relief

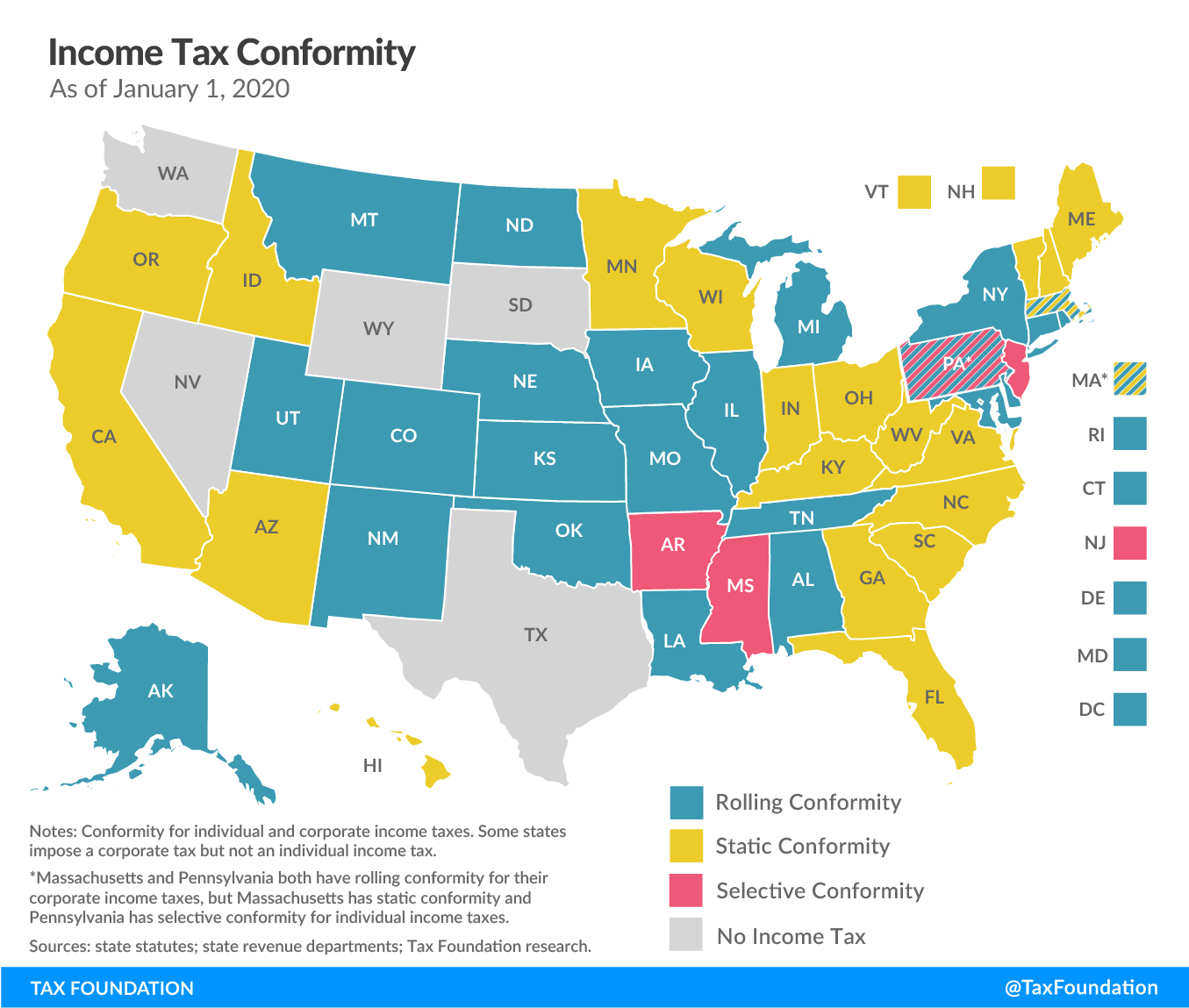

In some states the answer could be yes As a general rule a discharge of indebtedness counts as income and is taxable as my colleague Will McBride explains Under 9675 of the American Rescue Plan Act ARPA

Under current law however most forms of federal student loan forgiveness are not taxable federally through the end of 2025 Certain programs such as Public Service Loan

Student Loan Forgiveness Taxes have risen to immense popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies or costly software.

-

Flexible: Your HTML0 customization options allow you to customize printables to fit your particular needs for invitations, whether that's creating them, organizing your schedule, or even decorating your house.

-

Educational Use: Printables for education that are free offer a wide range of educational content for learners of all ages, which makes them an invaluable source for educators and parents.

-

An easy way to access HTML0: instant access a myriad of designs as well as templates, which saves time as well as effort.

Where to Find more Student Loan Forgiveness Taxes

How To Fill Out The Student Loan Forgiveness Application

How To Fill Out The Student Loan Forgiveness Application

As a general rule any kind of debt that s forgiven or reduced by the government including student loan debt is considered taxable income 4 That means in most cases you ll have to pay income taxes on the amount of

Student loan forgiveness in 2022 will not increase your federal taxable income thanks to the latest American Rescue Plan that makes all student loan forgiveness tax free

Now that we've ignited your curiosity about Student Loan Forgiveness Taxes we'll explore the places you can discover these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection and Student Loan Forgiveness Taxes for a variety motives.

- Explore categories such as design, home decor, crafting, and organization.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing, flashcards, and learning materials.

- Ideal for teachers, parents as well as students who require additional sources.

3. Creative Blogs

- Many bloggers provide their inventive designs or templates for download.

- These blogs cover a broad selection of subjects, that includes DIY projects to party planning.

Maximizing Student Loan Forgiveness Taxes

Here are some ideas of making the most of printables for free:

1. Home Decor

- Print and frame beautiful art, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Use printable worksheets for free to help reinforce your learning at home also in the classes.

3. Event Planning

- Designs invitations, banners and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Keep track of your schedule with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Student Loan Forgiveness Taxes are a treasure trove of practical and imaginative resources for a variety of needs and needs and. Their accessibility and versatility make them an invaluable addition to both professional and personal lives. Explore the plethora of Student Loan Forgiveness Taxes to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really free?

- Yes, they are! You can print and download these free resources for no cost.

-

Do I have the right to use free printables in commercial projects?

- It's contingent upon the specific rules of usage. Be sure to read the rules of the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright concerns with printables that are free?

- Certain printables could be restricted regarding their use. Always read the terms and conditions offered by the author.

-

How do I print printables for free?

- Print them at home using either a printer or go to a print shop in your area for better quality prints.

-

What program do I require to view printables at no cost?

- A majority of printed materials are in PDF format. They is open with no cost software like Adobe Reader.

Will You Owe Taxes If Your Student Loan Is Forgiven Forbes Advisor

You Can Now Submit The Student Loan Forgiveness Application Money

Check more sample of Student Loan Forgiveness Taxes below

Loan Forgiveness Under The Paycheck Protection Plan

Some Student Loan Borrowers Are Going To Be Taxed On Their Forgiveness

Small Business Loan Forgiveness Will States Tax SBA PPP Loans

What To Know If You ve Applied For Student Loan Forgiveness WTOP News

Cato Institute Files Suit Against Student Loan Forgiveness Program In

Why You Should Count On Loan Forgiveness Accumulating Money

https://www.verifythis.com/article/news/v…

Biden s student loan forgiveness plan does not raise taxes which is something only Congress can do Here s how taxpayers pay for the debt cancellation

https://www.irs.gov/taxtopics/tc431

In general if your debt is canceled forgiven or discharged for less than the amount owed the amount of the canceled debt is taxable If taxable you must report the canceled debt on your

Biden s student loan forgiveness plan does not raise taxes which is something only Congress can do Here s how taxpayers pay for the debt cancellation

In general if your debt is canceled forgiven or discharged for less than the amount owed the amount of the canceled debt is taxable If taxable you must report the canceled debt on your

What To Know If You ve Applied For Student Loan Forgiveness WTOP News

Some Student Loan Borrowers Are Going To Be Taxed On Their Forgiveness

Cato Institute Files Suit Against Student Loan Forgiveness Program In

Why You Should Count On Loan Forgiveness Accumulating Money

How Will Student Loan Forgiveness Affect Your Credit Lexington Law

Administrative Forbearance Student Loans Can You Still Apply To Put On

Administrative Forbearance Student Loans Can You Still Apply To Put On

Are You Eligible For 5 Billion In Student Loan Forgiveness