In this age of electronic devices, when screens dominate our lives yet the appeal of tangible printed objects isn't diminished. Whether it's for educational purposes or creative projects, or simply adding some personal flair to your area, Student Loan Interest Deduction On Form 1040 Schedule 1 have proven to be a valuable source. The following article is a dive into the world "Student Loan Interest Deduction On Form 1040 Schedule 1," exploring the different types of printables, where to find them and the ways that they can benefit different aspects of your life.

Get Latest Student Loan Interest Deduction On Form 1040 Schedule 1 Below

Student Loan Interest Deduction On Form 1040 Schedule 1

Student Loan Interest Deduction On Form 1040 Schedule 1 - Student Loan Interest Deduction On Form 1040 Schedule 1, Where Do I Deduct Student Loan Interest On 1040

Enter the total interest you paid in 2018 on qualified student loans see the instructions for line 33 Don t enter more than 2 500

Enter the total interest you paid in 2022 on qualified student loans see instructions for line 21 Don t enter more than 2 500 Enter the amount from Form 1040 or 1040 SR line 9 plus any

Student Loan Interest Deduction On Form 1040 Schedule 1 include a broad assortment of printable, downloadable documents that can be downloaded online at no cost. These resources come in many designs, including worksheets templates, coloring pages, and more. The benefit of Student Loan Interest Deduction On Form 1040 Schedule 1 is their flexibility and accessibility.

More of Student Loan Interest Deduction On Form 1040 Schedule 1

Learn How The Student Loan Interest Deduction Works

Learn How The Student Loan Interest Deduction Works

Be sure you have read the Exception in the instructions for this line to see if you can use this worksheet instead of Pub 970 to figure your deduction Enter the total interest you paid in

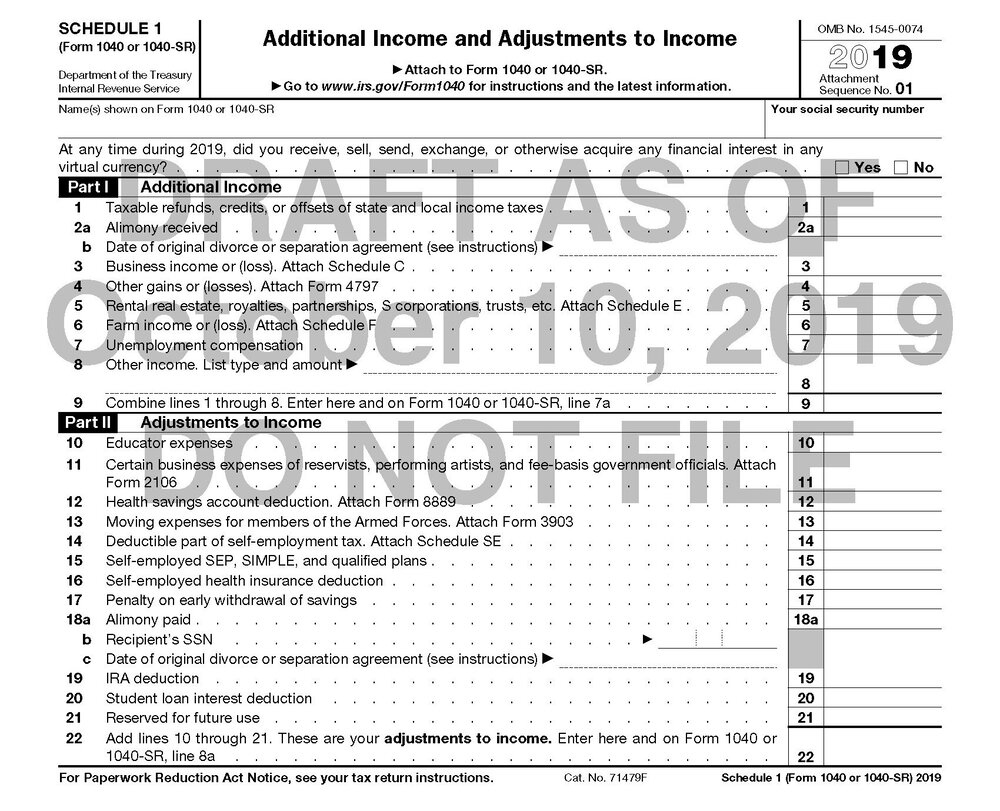

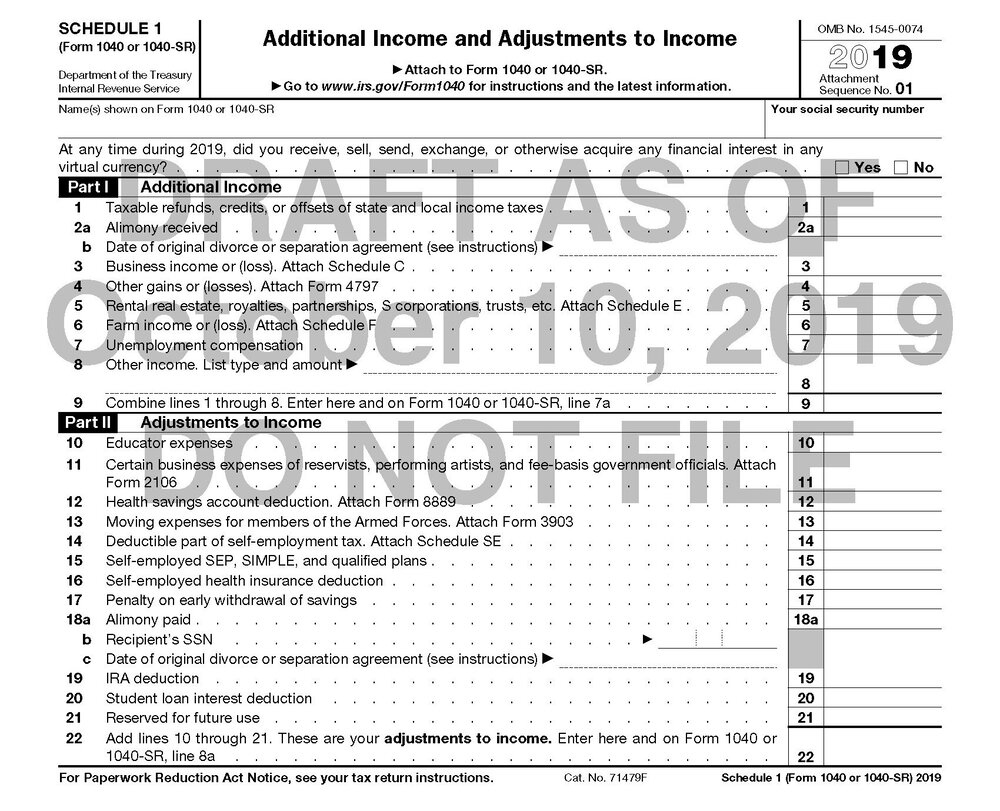

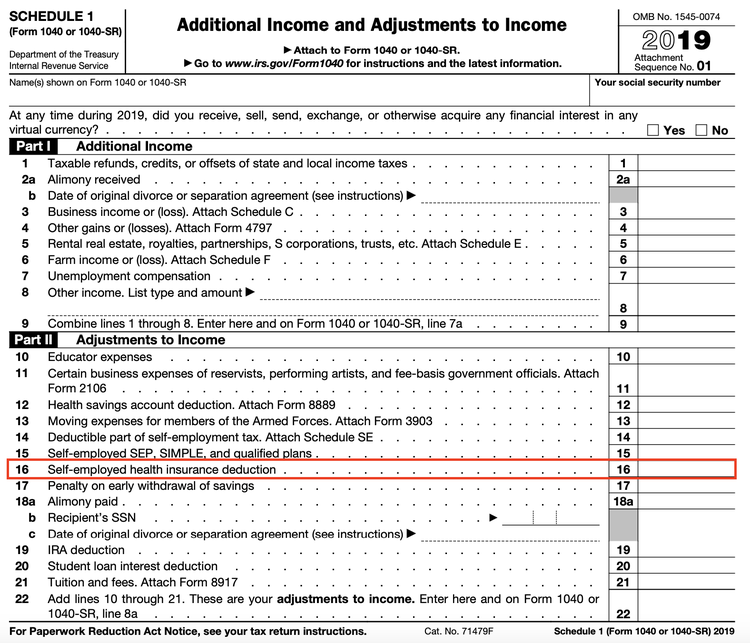

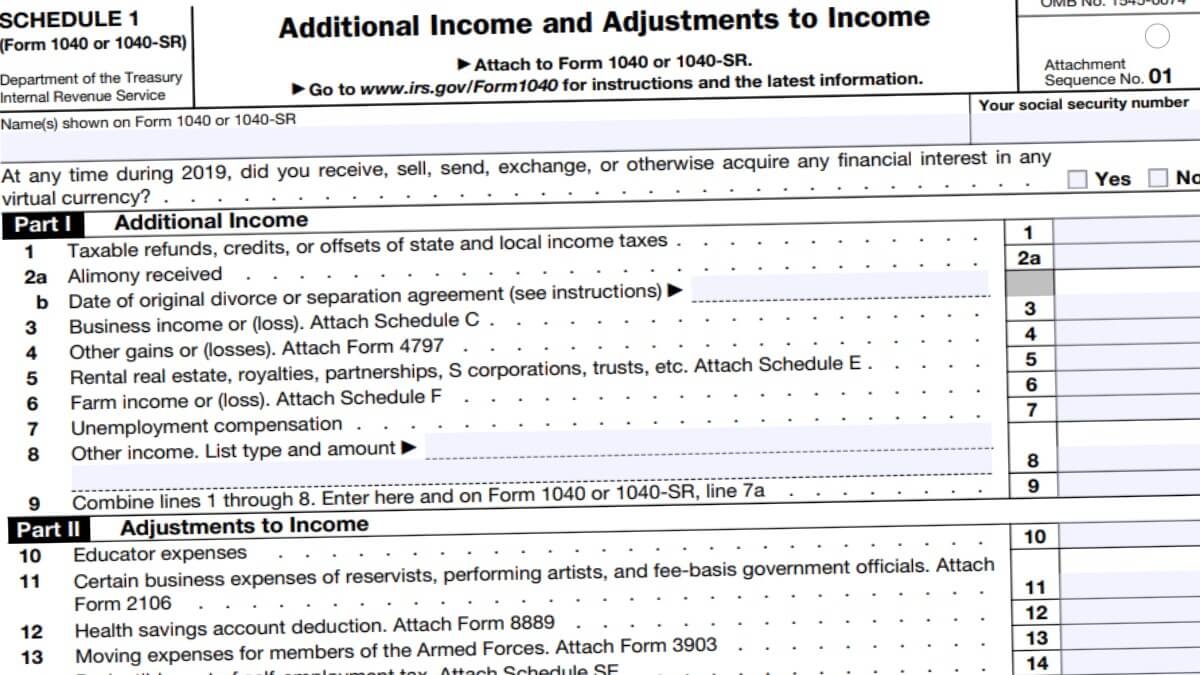

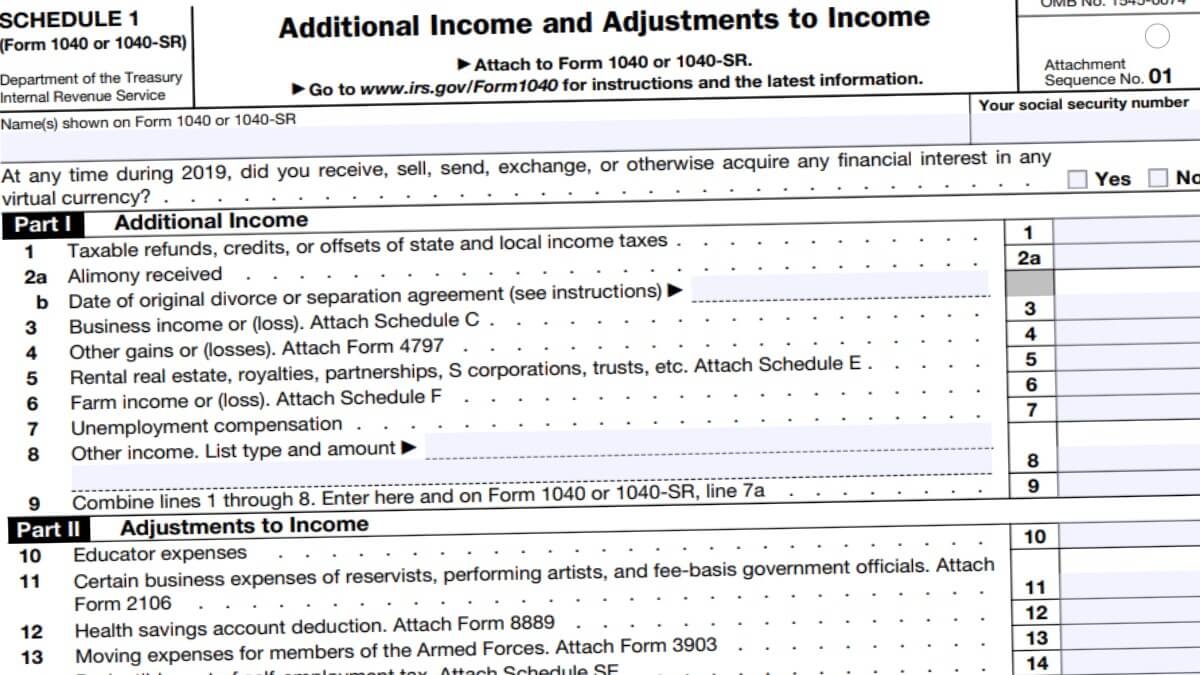

The student loan interest deduction can be claimed above the line as an adjustment to income You can take it without itemizing or take the standard deduction as well It s subtracted on Line 21 of the Adjustments to

Student Loan Interest Deduction On Form 1040 Schedule 1 have garnered immense popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

Customization: Your HTML0 customization options allow you to customize printing templates to your own specific requirements in designing invitations as well as organizing your calendar, or decorating your home.

-

Educational value: Free educational printables provide for students of all ages, which makes these printables a powerful resource for educators and parents.

-

Convenience: immediate access numerous designs and templates is time-saving and saves effort.

Where to Find more Student Loan Interest Deduction On Form 1040 Schedule 1

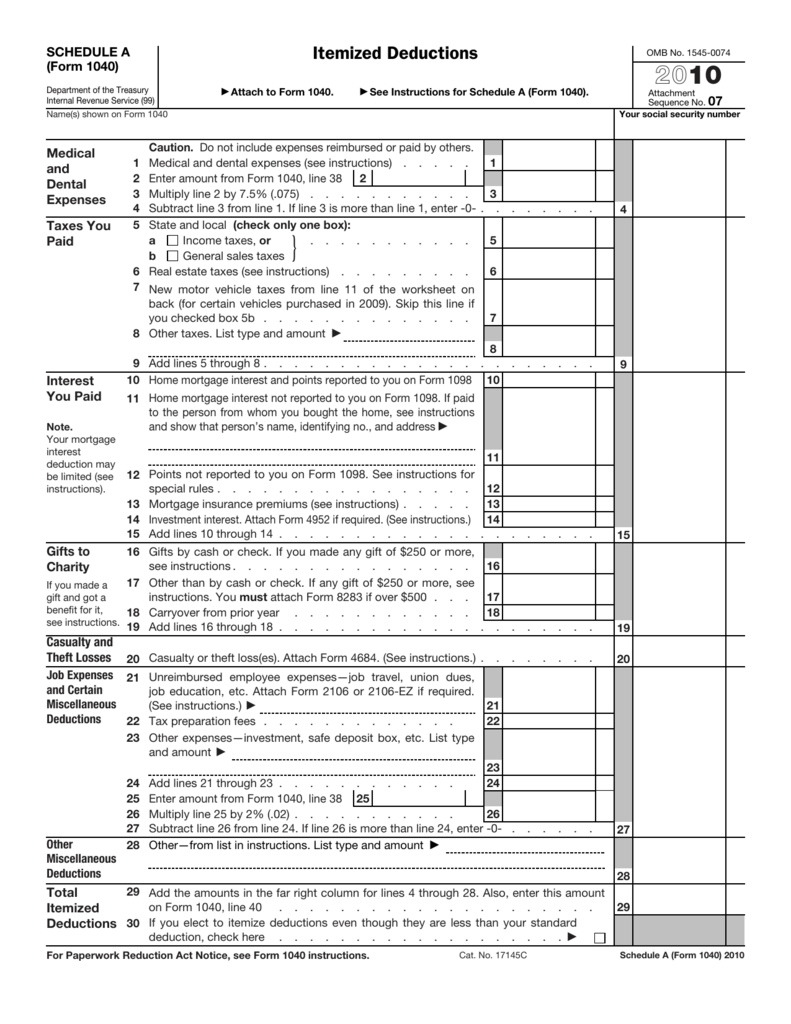

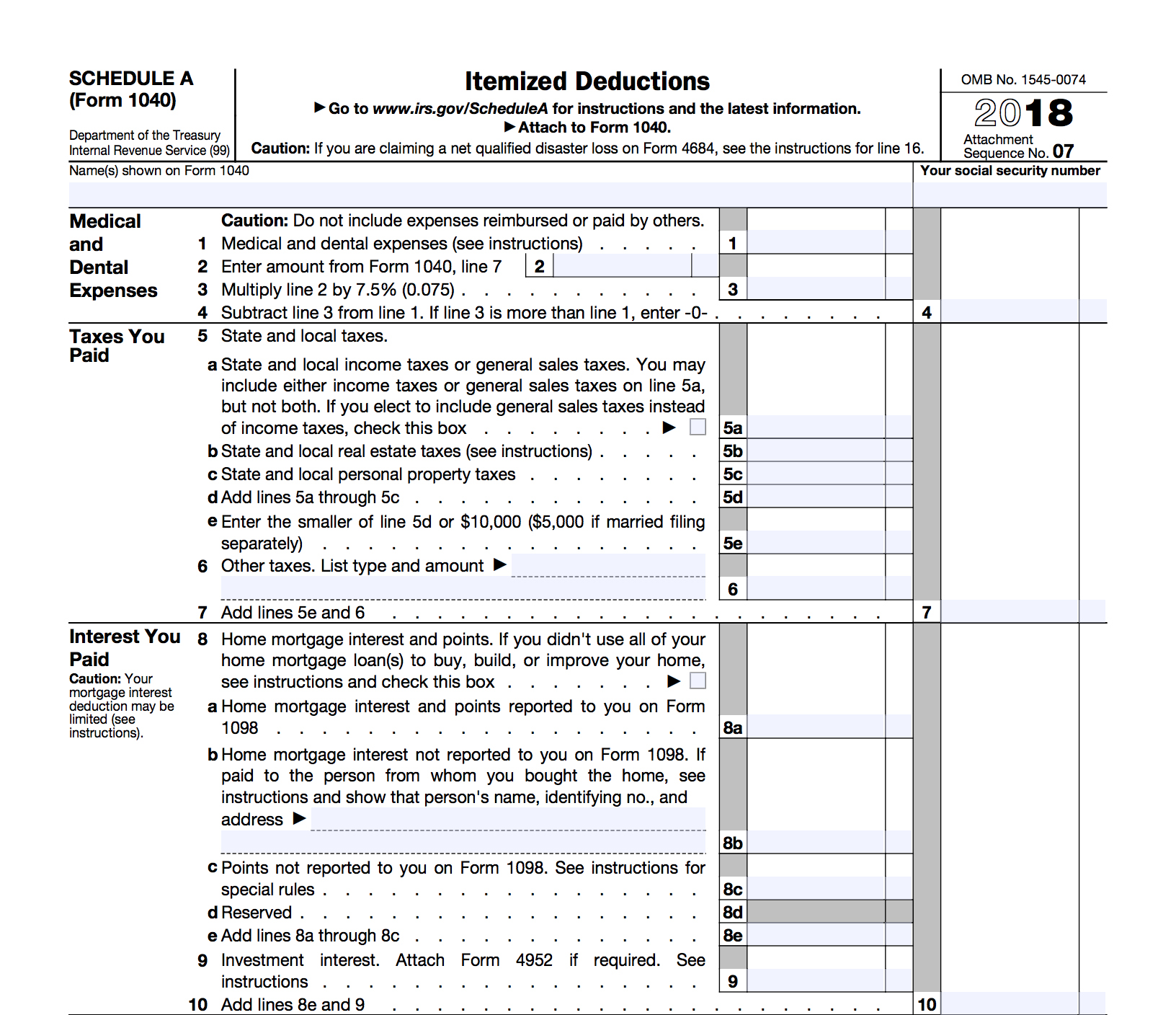

2010 Form 1040 Schedule A

2010 Form 1040 Schedule A

How do student loan interest payments lower my taxes owed Paying back your student loan won t generate any tax breaks but paying the interest on that student loan can by reducing

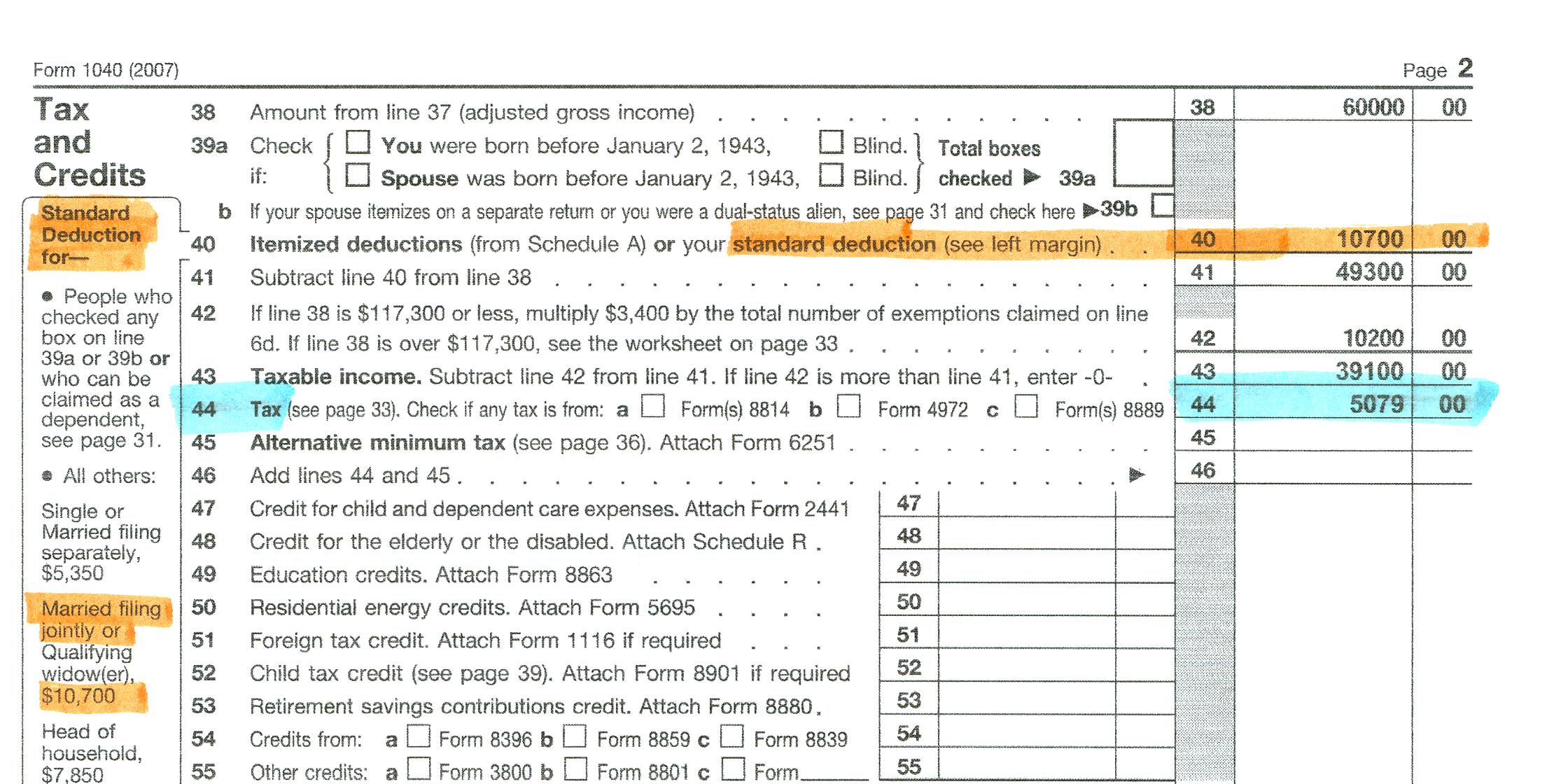

2010 Form 1040 For Paperwork Reduction Act Notice see your tax return instructions

After we've peaked your interest in printables for free Let's see where you can locate these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of Student Loan Interest Deduction On Form 1040 Schedule 1 to suit a variety of reasons.

- Explore categories such as decoration for your home, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums often provide worksheets that can be printed for free as well as flashcards and other learning tools.

- Great for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers post their original designs with templates and designs for free.

- These blogs cover a wide range of topics, ranging from DIY projects to party planning.

Maximizing Student Loan Interest Deduction On Form 1040 Schedule 1

Here are some creative ways of making the most of Student Loan Interest Deduction On Form 1040 Schedule 1:

1. Home Decor

- Print and frame beautiful artwork, quotes or seasonal decorations to adorn your living spaces.

2. Education

- Use printable worksheets for free to reinforce learning at home and in class.

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Keep track of your schedule with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Student Loan Interest Deduction On Form 1040 Schedule 1 are an abundance of practical and innovative resources for a variety of needs and needs and. Their availability and versatility make they a beneficial addition to your professional and personal life. Explore the plethora of Student Loan Interest Deduction On Form 1040 Schedule 1 right now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really for free?

- Yes you can! You can print and download these materials for free.

-

Can I use the free printables for commercial uses?

- It's based on the usage guidelines. Always read the guidelines of the creator before utilizing printables for commercial projects.

-

Are there any copyright violations with printables that are free?

- Some printables may come with restrictions regarding their use. Be sure to review the terms and regulations provided by the designer.

-

How do I print Student Loan Interest Deduction On Form 1040 Schedule 1?

- You can print them at home with either a printer or go to any local print store for higher quality prints.

-

What software do I need to run Student Loan Interest Deduction On Form 1040 Schedule 1?

- The majority are printed with PDF formats, which can be opened with free software, such as Adobe Reader.

Student Loan Interest Deduction 2013 PriorTax Blog

1040 Schedule SE Form Printable

Check more sample of Student Loan Interest Deduction On Form 1040 Schedule 1 below

How To Deduct Property Taxes On IRS Tax Forms Irs Tax Forms Mortgage

How To Enter Form 1098 E Student Loan Interest Statement In A Tax Return

Keep The Mortgage For The Home Mortgage Interest Deduction

Can I Get A Student Loan Tax Deduction The TurboTax Blog

2019 Form 1040 Schedule 1 Will Ask Taxpayers If They Have 1040 Form

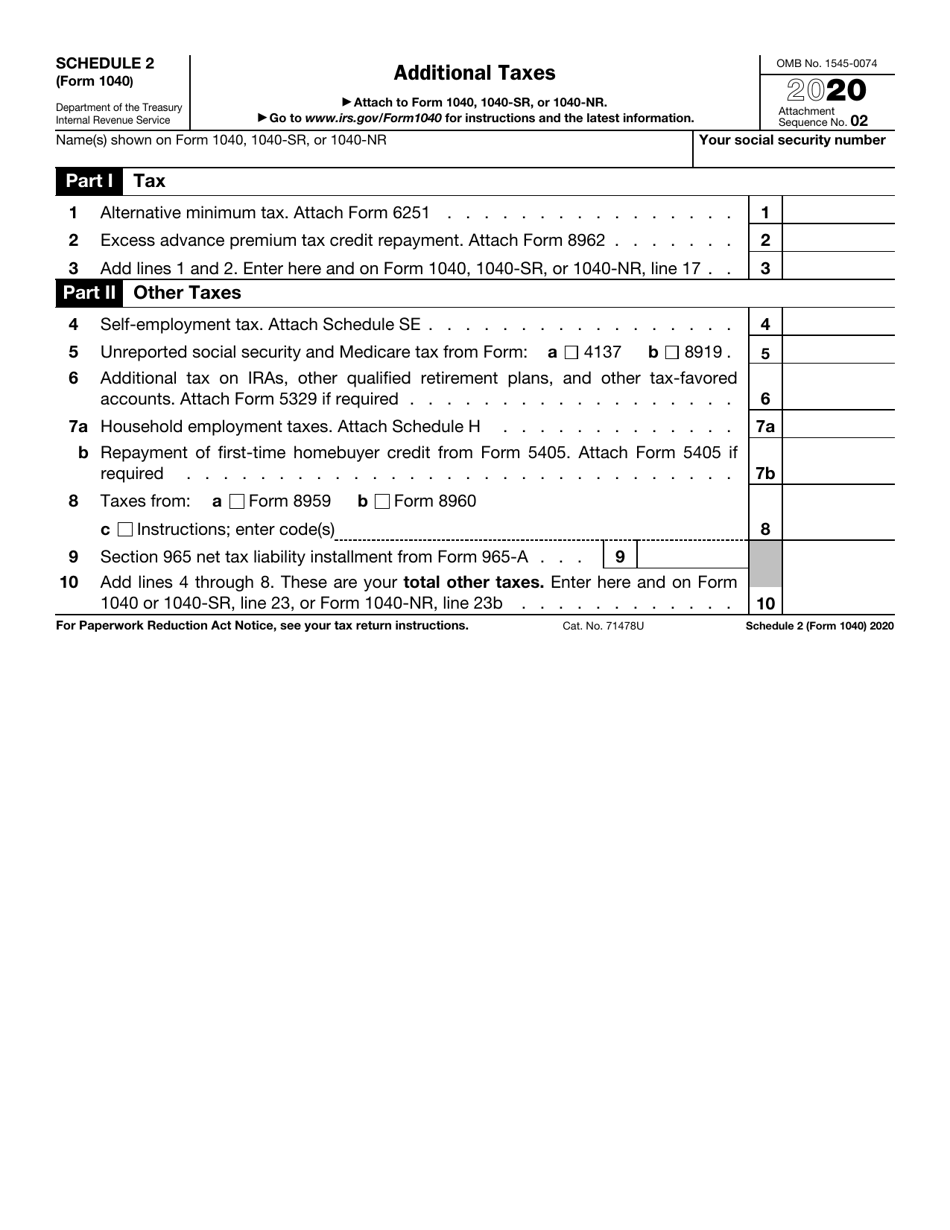

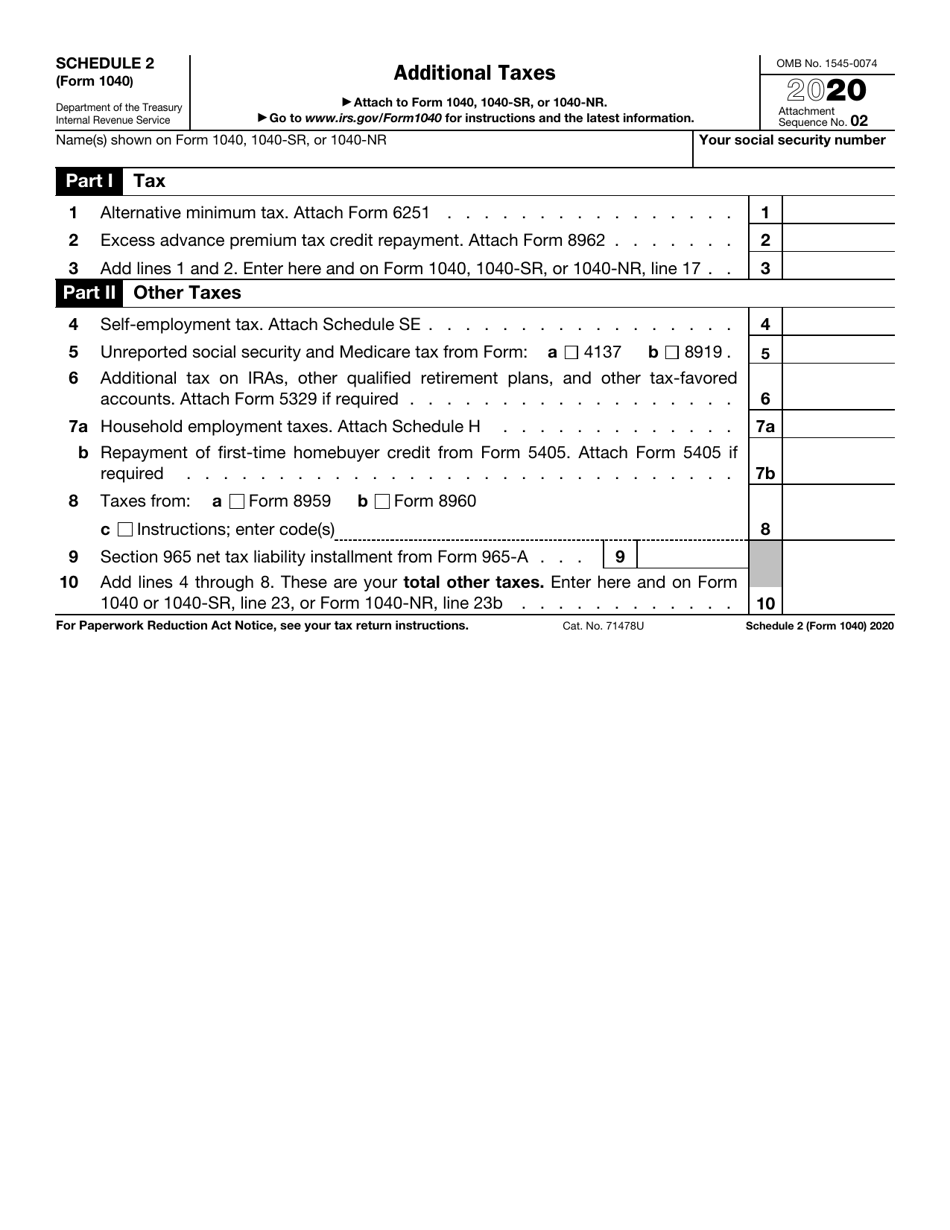

IRS Form 1040 Schedule 2 Download Fillable PDF Or Fill Online

https://media.hrblock.com › media › Knowledge...

Enter the total interest you paid in 2022 on qualified student loans see instructions for line 21 Don t enter more than 2 500 Enter the amount from Form 1040 or 1040 SR line 9 plus any

https://www.forbes.com › advisor › taxe…

Student loan interest is an adjustment to income commonly known as an above the line deduction So you claim it on Schedule 1 of your Form 1040 rather than as an itemized deduction on

Enter the total interest you paid in 2022 on qualified student loans see instructions for line 21 Don t enter more than 2 500 Enter the amount from Form 1040 or 1040 SR line 9 plus any

Student loan interest is an adjustment to income commonly known as an above the line deduction So you claim it on Schedule 1 of your Form 1040 rather than as an itemized deduction on

Can I Get A Student Loan Tax Deduction The TurboTax Blog

How To Enter Form 1098 E Student Loan Interest Statement In A Tax Return

2019 Form 1040 Schedule 1 Will Ask Taxpayers If They Have 1040 Form

IRS Form 1040 Schedule 2 Download Fillable PDF Or Fill Online

A Beginner s Guide To S Corp Health Insurance

1040 Schedule 1 2021

1040 Schedule 1 2021

Student Loan Interest Deduction Los Angeles ORT College