In this age of electronic devices, with screens dominating our lives it's no wonder that the appeal of tangible printed materials isn't diminishing. In the case of educational materials, creative projects, or just adding an individual touch to the area, Student Loan Repayment Taxable Income are a great source. With this guide, you'll dive into the world "Student Loan Repayment Taxable Income," exploring the benefits of them, where you can find them, and how they can enhance various aspects of your daily life.

Get Latest Student Loan Repayment Taxable Income Below

Student Loan Repayment Taxable Income

Student Loan Repayment Taxable Income - Student Loan Repayment Taxable Income, Student Loan Forgiveness Taxable Income California, Student Loan Forgiveness Taxable Income Or Agi, Student Loan Forgiveness Taxable Income Indiana, Student Loan Forgiveness Taxable Income Minnesota, Student Loan Forgiveness Taxable Income Federal, Student Loan Forgiveness Taxable Income States, Student Loan Forgiveness Irs Taxable Income, Ibr Student Loan Forgiveness Taxable Income, Wisconsin Student Loan Forgiveness Taxable Income

Up to 2 500 of student loan interest can be tax deductible each year Depending on the loan forgiveness program you participate in you might have to pay taxes on the amount forgiven If

Deduct student loan interest Receive tax free treatment of a canceled student loan Receive tax free student loan repayment assistance Establish and contribute to a Coverdell education savings account ESA which features tax free earnings Participate in a qualified tuition program QTP which features tax free earnings

Student Loan Repayment Taxable Income encompass a wide array of printable materials available online at no cost. These printables come in different forms, including worksheets, templates, coloring pages, and more. The attraction of printables that are free is their flexibility and accessibility.

More of Student Loan Repayment Taxable Income

Are Student Loans Taxable Income

Are Student Loans Taxable Income

Under 9675 of the American Rescue Plan Act ARPA however the forgiveness of student loan debt between 2021 and 2025 does not count toward federal taxable incomeTaxable income is the amount of income subject to tax after deductions and exemptions

The prohibition on deducting student loan interest expense when choosing to file separately affects taxpayers with student loans and modified adjusted gross income under 170 000 7 Higher taxable income taxpayers approaching the student loan phaseout range are in the 22 marginal rate For these taxpayers losing the 2 500

Student Loan Repayment Taxable Income have risen to immense popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies or expensive software.

-

Individualization We can customize designs to suit your personal needs whether it's making invitations or arranging your schedule or even decorating your house.

-

Educational Benefits: The free educational worksheets cater to learners of all ages, which makes them a vital aid for parents as well as educators.

-

An easy way to access HTML0: The instant accessibility to various designs and templates is time-saving and saves effort.

Where to Find more Student Loan Repayment Taxable Income

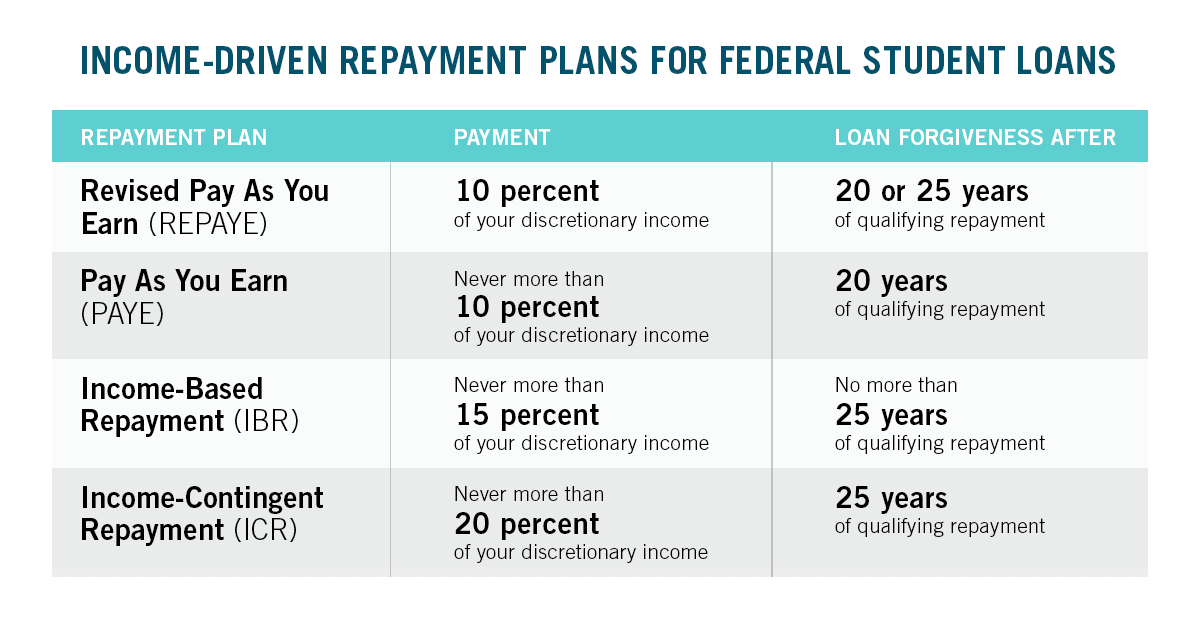

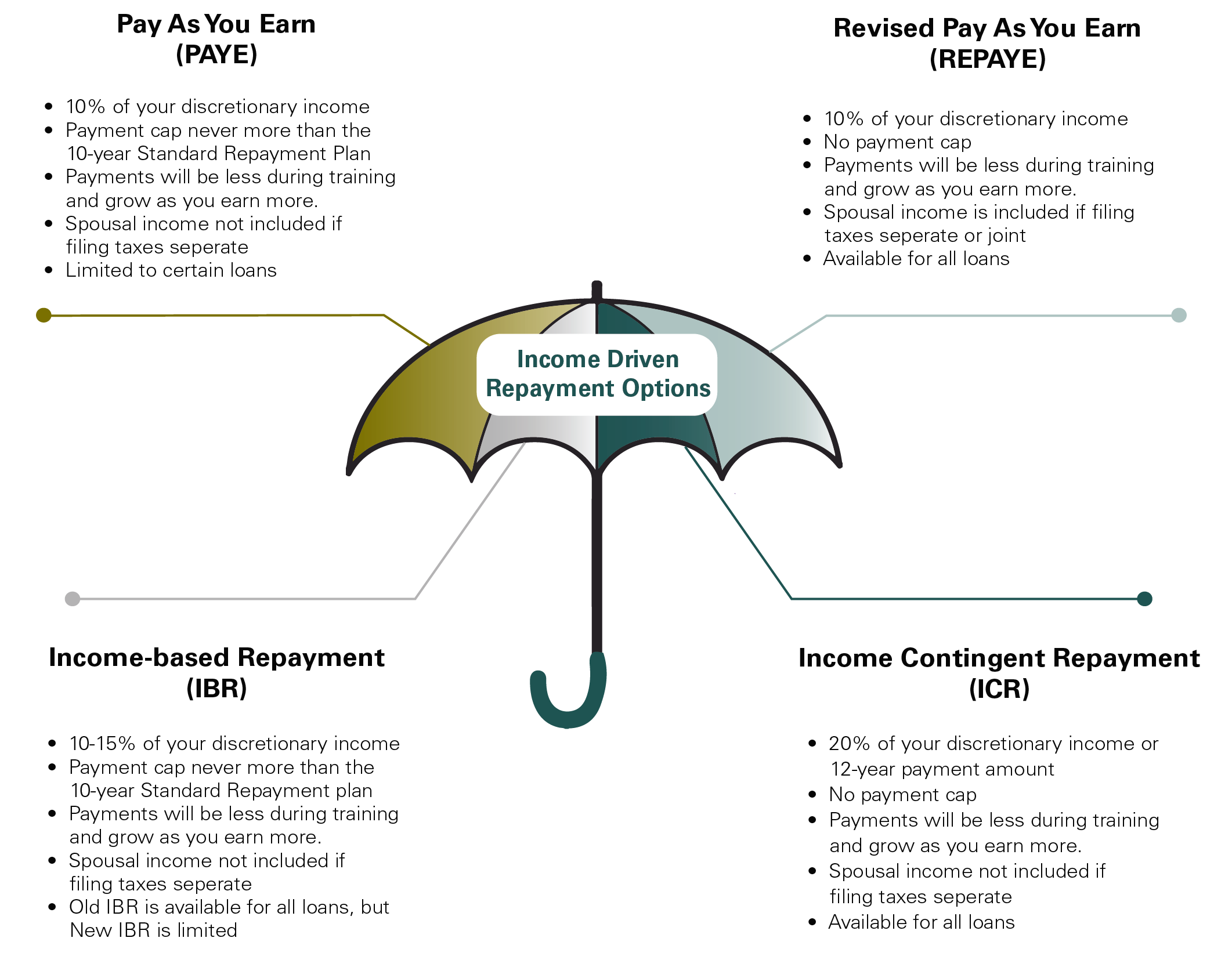

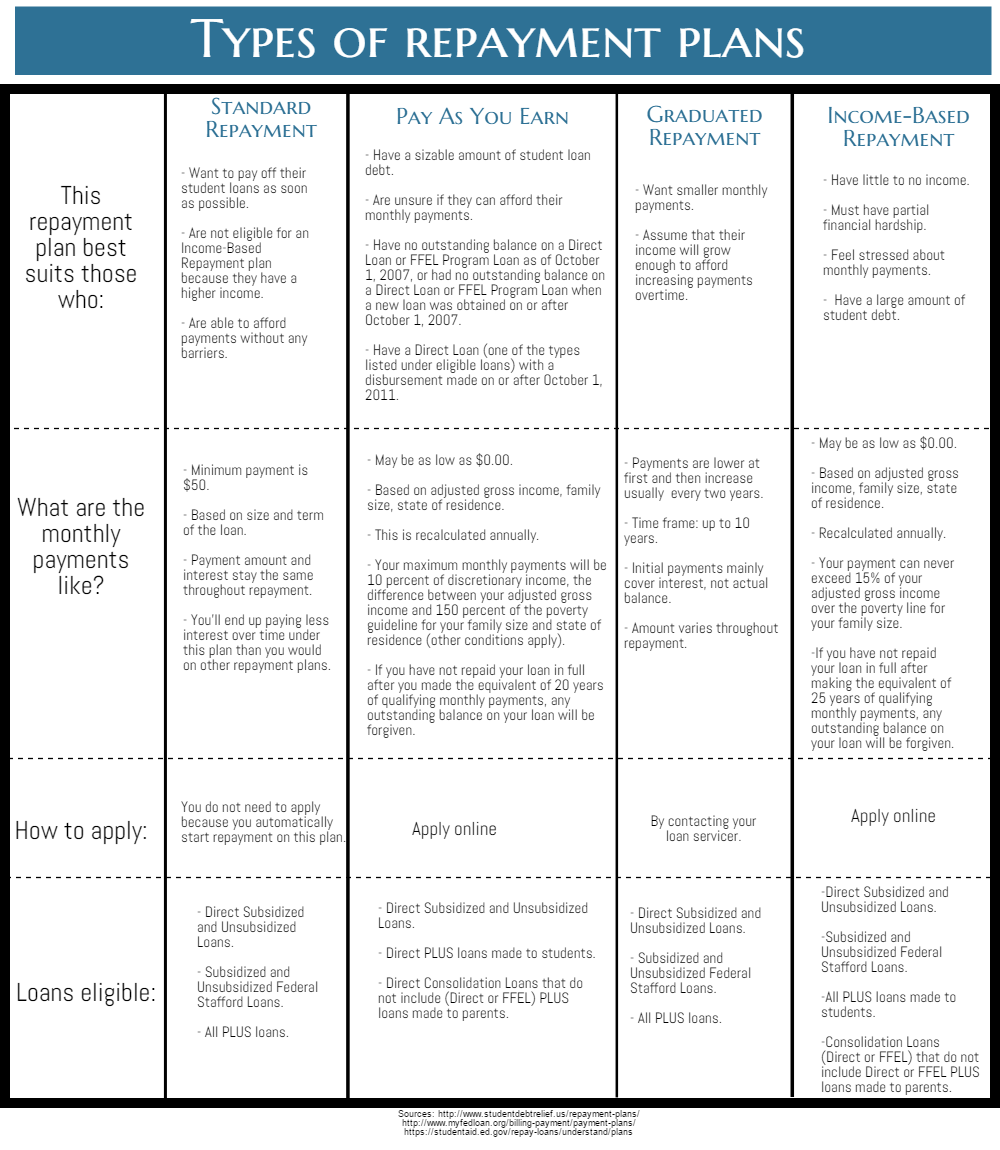

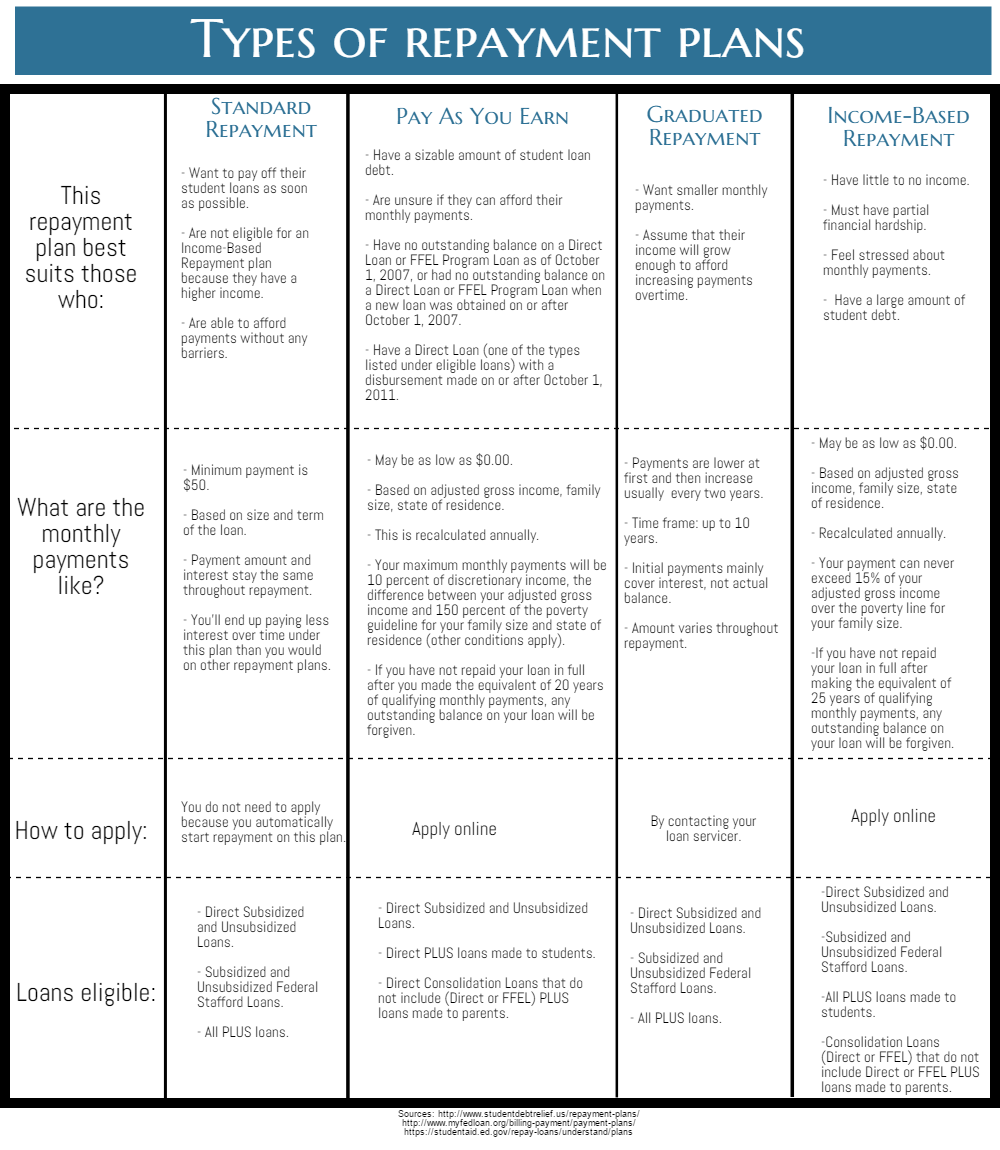

Student Loan Repayment Income Based Plans

Student Loan Repayment Income Based Plans

Student loans can impact your federal income tax return in several ways from reducing your taxable income to losing your refund depending on your situation Here s what you need to

Background Student Loan Forgiveness Can Be Taxable Whenever any kind of debt including student loan debt is forgiven cancelled reduced or discharged there could be tax

Since we've got your interest in Student Loan Repayment Taxable Income Let's take a look at where you can get these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of Student Loan Repayment Taxable Income designed for a variety purposes.

- Explore categories like decoration for your home, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets or flashcards as well as learning materials.

- Perfect for teachers, parents as well as students who require additional resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates for no cost.

- These blogs cover a wide selection of subjects, that includes DIY projects to party planning.

Maximizing Student Loan Repayment Taxable Income

Here are some ways in order to maximize the use of Student Loan Repayment Taxable Income:

1. Home Decor

- Print and frame stunning artwork, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Utilize free printable worksheets to reinforce learning at home (or in the learning environment).

3. Event Planning

- Design invitations, banners as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Student Loan Repayment Taxable Income are a treasure trove of innovative and useful resources for a variety of needs and desires. Their accessibility and flexibility make them an essential part of any professional or personal life. Explore the endless world that is Student Loan Repayment Taxable Income today, and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really absolutely free?

- Yes, they are! You can print and download these tools for free.

-

Do I have the right to use free printables for commercial use?

- It's all dependent on the terms of use. Make sure you read the guidelines for the creator before utilizing their templates for commercial projects.

-

Do you have any copyright violations with Student Loan Repayment Taxable Income?

- Some printables could have limitations on their use. Make sure to read the terms and conditions provided by the creator.

-

How do I print printables for free?

- You can print them at home with a printer or visit a print shop in your area for top quality prints.

-

What program is required to open printables free of charge?

- The majority of printed documents are in PDF format, which is open with no cost software like Adobe Reader.

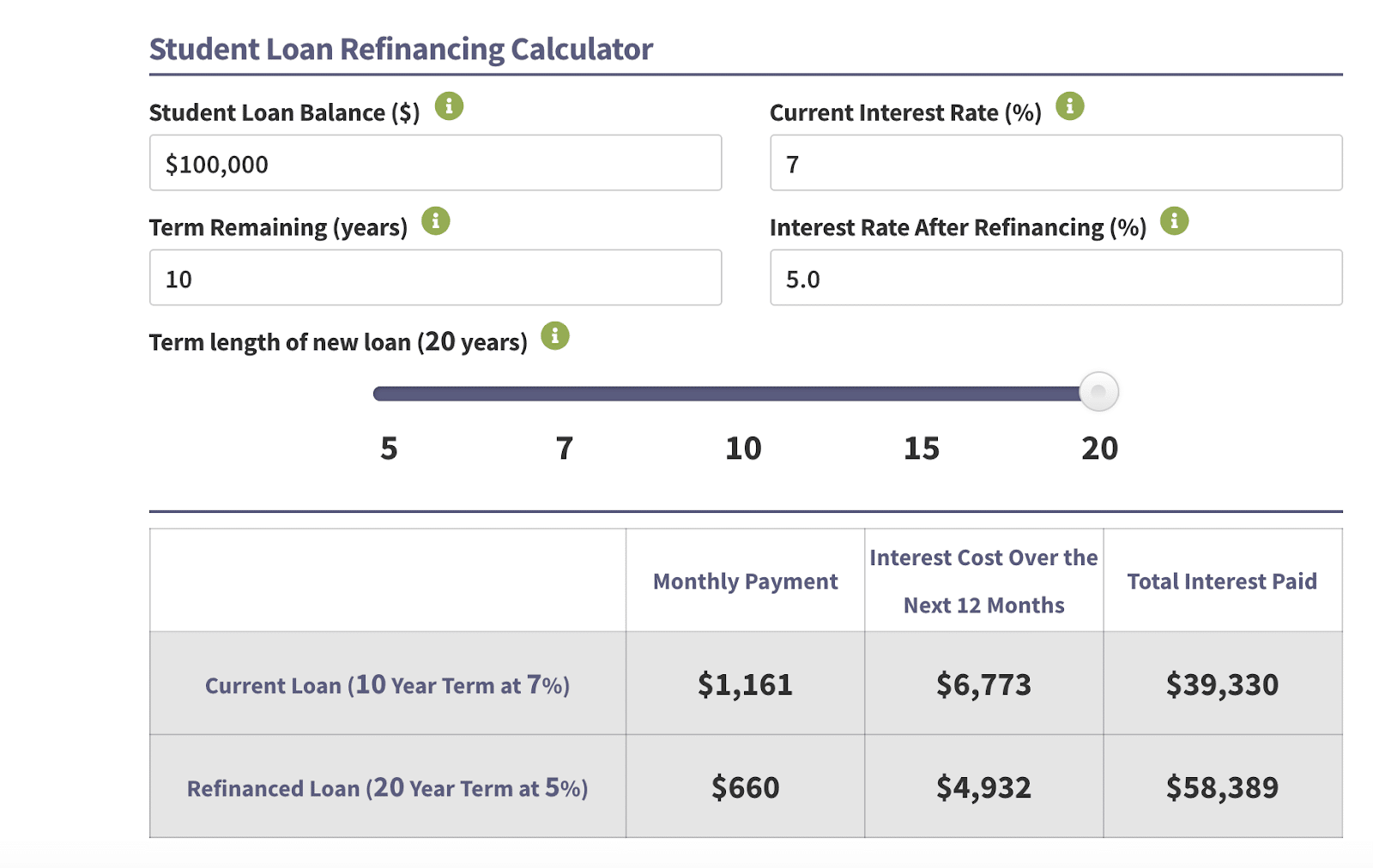

Getting Married With Student Loan Debt Here s What You Need To Know

Why Income Based Repayment Isn t The Only Student Loan Solution

Check more sample of Student Loan Repayment Taxable Income below

How To Sell On EBay Tips For Success In 2021 Student Loan Repayment

Student Loan Payments MoneyMatters101

Student Loan Income Based Repayment Calculator Navient MoiraCameron

What Is An Income based Repayment IBR Student Loan Repayment Plan

EVERYTHING YOU NEED TO KNOW ABOUT THE INCOME SENSITIVE REPAYMENT PLAN

How This 35 Year Old Scored Her Six Figure Salary Paying Off Student

https://www.irs.gov/publications/p970

Deduct student loan interest Receive tax free treatment of a canceled student loan Receive tax free student loan repayment assistance Establish and contribute to a Coverdell education savings account ESA which features tax free earnings Participate in a qualified tuition program QTP which features tax free earnings

https://www.forbes.com/advisor/taxes/student-loan-forgiveness-taxes

Student loan forgiveness is not taxable in most states because they follow federal tax rules Borrowers also won t need to worry if they live in one of the nine states that don t have an

Deduct student loan interest Receive tax free treatment of a canceled student loan Receive tax free student loan repayment assistance Establish and contribute to a Coverdell education savings account ESA which features tax free earnings Participate in a qualified tuition program QTP which features tax free earnings

Student loan forgiveness is not taxable in most states because they follow federal tax rules Borrowers also won t need to worry if they live in one of the nine states that don t have an

What Is An Income based Repayment IBR Student Loan Repayment Plan

Student Loan Payments MoneyMatters101

EVERYTHING YOU NEED TO KNOW ABOUT THE INCOME SENSITIVE REPAYMENT PLAN

How This 35 Year Old Scored Her Six Figure Salary Paying Off Student

4 Effective Student Loan Repayment Options Doctors Should Consider

Student Loan Repayment Options

Student Loan Repayment Options

/https://specials-images.forbesimg.com/imageserve/607da0772ae797a1078148de/0x0.jpg)

Why 10 000 In Student Loan Forgiveness May Not Help Borrowers In