In this age of electronic devices, with screens dominating our lives yet the appeal of tangible printed objects hasn't waned. If it's to aid in education project ideas, artistic or simply to add an element of personalization to your space, Student Loan Tax Deduction are a great resource. The following article is a take a dive in the world of "Student Loan Tax Deduction," exploring their purpose, where they can be found, and ways they can help you improve many aspects of your life.

Get Latest Student Loan Tax Deduction Below

Student Loan Tax Deduction

Student Loan Tax Deduction - Student Loan Tax Deduction, Student Loan Tax Deduction 2023, Student Loan Tax Deduction Limit, Student Loan Tax Deduction Uk, Student Loan Tax Deduction 2022, Student Loan Tax Deduction Canada, Student Loan Tax Deduction Married Filing Separately, Student Loan Tax Deduction Australia, Student Loan Tax Deduction Germany

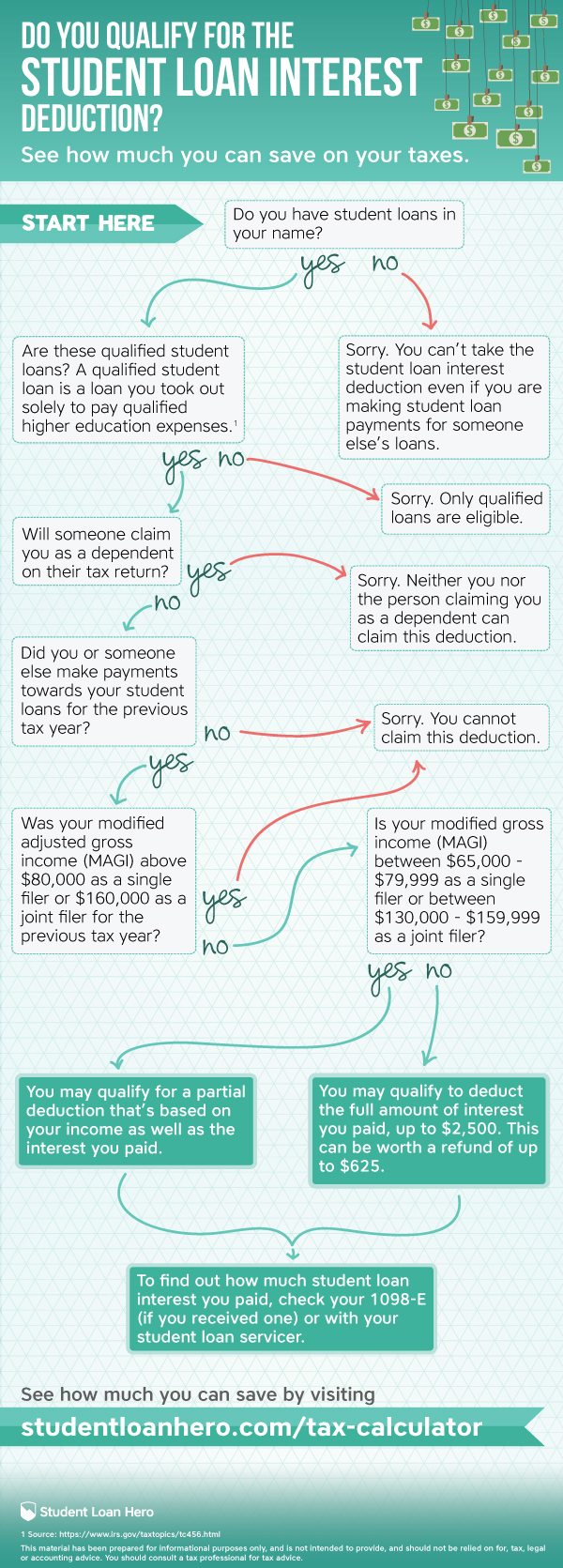

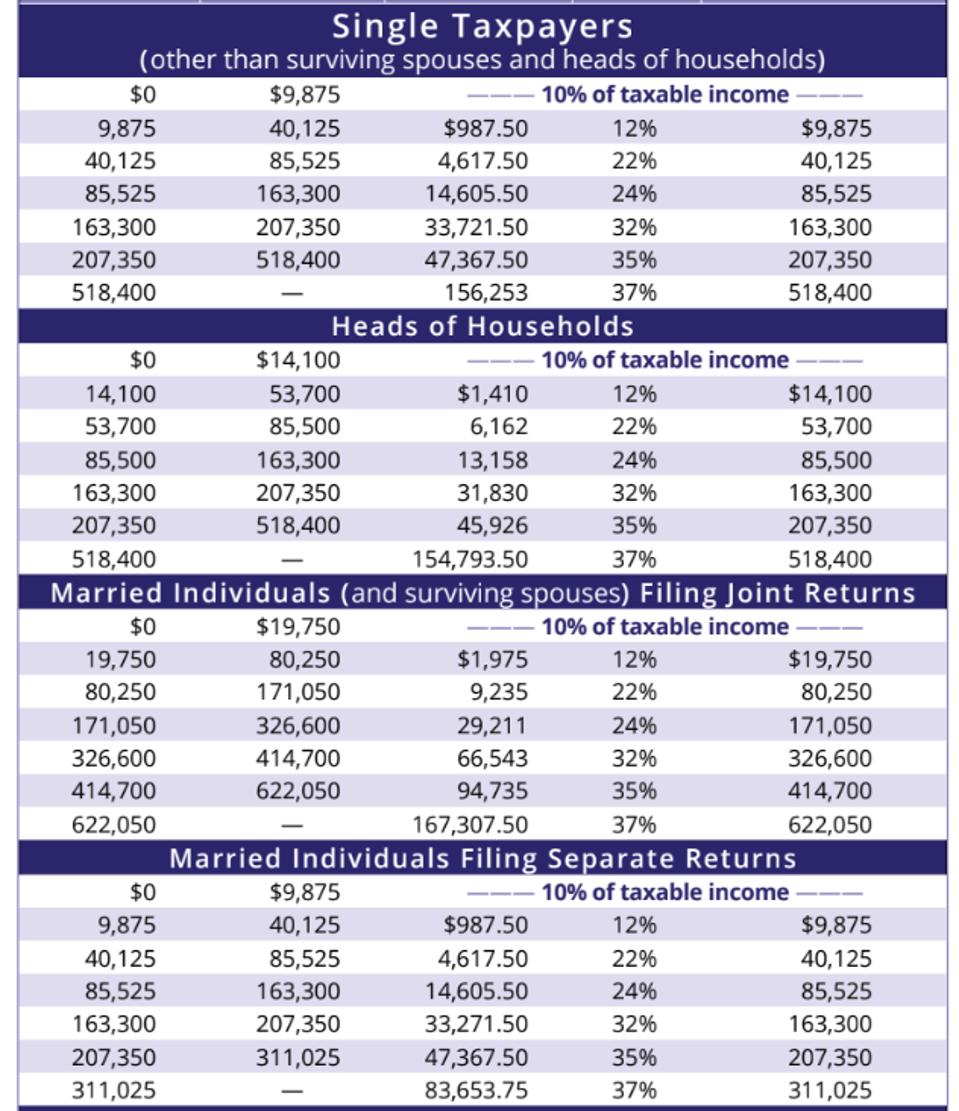

When you use student loan funds to finance your education if you are eligible the IRS allows you to claim qualifying expenses that you pay with those funds towards educational tax credits A tax deduction is also available for the interest payments you make when you start repaying your qualified education loans

The student loan interest deduction is a federal income tax deduction that allows borrowers to subtract up to 2 500 of the interest paid on qualified student loans

Student Loan Tax Deduction offer a wide collection of printable resources available online for download at no cost. These resources come in various forms, including worksheets, coloring pages, templates and much more. The benefit of Student Loan Tax Deduction lies in their versatility as well as accessibility.

More of Student Loan Tax Deduction

Student Loan Interest Deduction 2019 Tax Year Student Gen

Student Loan Interest Deduction 2019 Tax Year Student Gen

The student loan interest deduction is a federal tax deduction that lets you deduct up to 2 500 of the student loan interest you paid during the year It reduces your

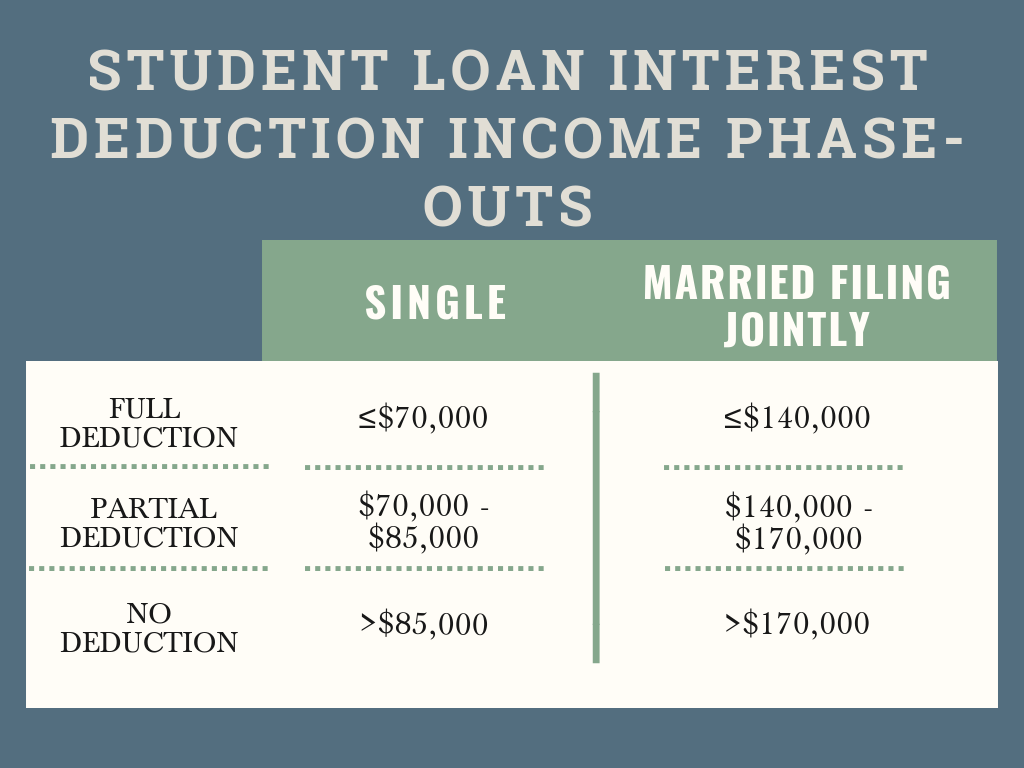

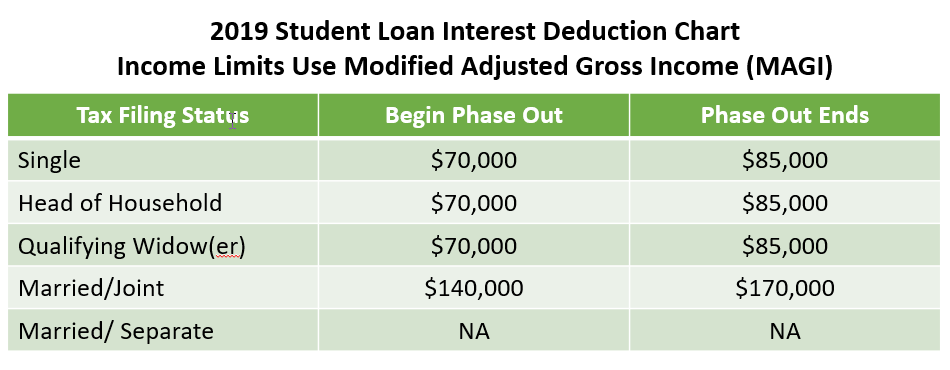

Student loan interest deduction For 2023 the amount of your student loan interest deduction is gradually reduced phased out if your MAGI is between 75 000 and 90 000 155 000 and 185 000 if you file a joint return You can t claim the deduction if your MAGI is 90 000 or more 185 000 or more if you file a joint return See chapter 4

Student Loan Tax Deduction have gained a lot of popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or costly software.

-

customization The Customization feature lets you tailor designs to suit your personal needs when it comes to designing invitations planning your schedule or even decorating your house.

-

Educational Value The free educational worksheets can be used by students from all ages, making these printables a powerful device for teachers and parents.

-

Easy to use: Access to a variety of designs and templates helps save time and effort.

Where to Find more Student Loan Tax Deduction

1098 E Tax Form Printable Printable Forms Free Online

1098 E Tax Form Printable Printable Forms Free Online

The student loan interest deduction is a tax break for college students or parents who took on debt to pay for their school It allows you to deduct up to 2 500 in interest paid from your

Key takeaways You may be able to deduct up to 2 500 of student loan interest from your taxes You may be limited or prevented from claiming the deduction entirely depending on your income level and a few other factors The deduction only applies to the portion of your payment dedicated to interest

If we've already piqued your interest in printables for free Let's look into where you can find these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of Student Loan Tax Deduction designed for a variety purposes.

- Explore categories such as the home, decor, crafting, and organization.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free with flashcards and other teaching materials.

- Ideal for teachers, parents as well as students who require additional sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates free of charge.

- These blogs cover a wide variety of topics, that range from DIY projects to planning a party.

Maximizing Student Loan Tax Deduction

Here are some new ways that you can make use use of printables that are free:

1. Home Decor

- Print and frame gorgeous art, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Use these printable worksheets free of charge to reinforce learning at home for the classroom.

3. Event Planning

- Create invitations, banners, and other decorations for special occasions such as weddings and birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars, to-do lists, and meal planners.

Conclusion

Student Loan Tax Deduction are an abundance with useful and creative ideas that can meet the needs of a variety of people and needs and. Their access and versatility makes them an essential part of both professional and personal life. Explore the vast world of Student Loan Tax Deduction today to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really for free?

- Yes, they are! You can print and download these resources at no cost.

-

Can I use the free printouts for commercial usage?

- It's dependent on the particular terms of use. Always review the terms of use for the creator before utilizing printables for commercial projects.

-

Are there any copyright issues with printables that are free?

- Certain printables may be subject to restrictions on usage. Always read these terms and conditions as set out by the author.

-

How do I print Student Loan Tax Deduction?

- Print them at home with printing equipment or visit the local print shop for top quality prints.

-

What software do I require to open Student Loan Tax Deduction?

- Many printables are offered in the format PDF. This can be opened using free programs like Adobe Reader.

Interest Loan Rumah 2017 Used Vehicle Loan A Shorter Loan Term Is

Here s Your Guide To 2020 Rates For 401k s Student Loans More

Check more sample of Student Loan Tax Deduction below

How Much Student Loan Interest Is Deductible PayForED

2024 Student Loan Interest Federal Income Tax Deduction Calculator

Student Loan Interest Deduction 2013 PriorTax Blog

Student Loan Tax Deduction How Much Can You Really Save

Student Loan Tax Deduction Milliken Perkins Brunelle

How To Qualify For A Student Loan Tax Deduction When You Least Expect

https://www. investopedia.com /terms/s/slid.asp

The student loan interest deduction is a federal income tax deduction that allows borrowers to subtract up to 2 500 of the interest paid on qualified student loans

https://www. irs.gov /taxtopics/tc456

You can claim the deduction if all of the following apply You paid interest on a qualified student loan in tax year 2023 You re legally obligated to pay interest on a qualified student loan Your filing status isn t married filing separately Your MAGI is less than a specified amount which is set annually and

The student loan interest deduction is a federal income tax deduction that allows borrowers to subtract up to 2 500 of the interest paid on qualified student loans

You can claim the deduction if all of the following apply You paid interest on a qualified student loan in tax year 2023 You re legally obligated to pay interest on a qualified student loan Your filing status isn t married filing separately Your MAGI is less than a specified amount which is set annually and

Student Loan Tax Deduction How Much Can You Really Save

2024 Student Loan Interest Federal Income Tax Deduction Calculator

Student Loan Tax Deduction Milliken Perkins Brunelle

How To Qualify For A Student Loan Tax Deduction When You Least Expect

Can I Take Advantage Of The Student Loan Interest Tax Deduction HuffPost

Student Loan Tax Deduction BarbaraPace

Student Loan Tax Deduction BarbaraPace

How To Know If You Qualify For A student Loan Tax Deduction