In the digital age, where screens have become the dominant feature of our lives and the appeal of physical printed products hasn't decreased. If it's to aid in education as well as creative projects or simply adding an individual touch to your space, Tax Benefit On Donations To Charity In India are a great source. Here, we'll dive into the world of "Tax Benefit On Donations To Charity In India," exploring what they are, how they are available, and how they can enhance various aspects of your daily life.

Get Latest Tax Benefit On Donations To Charity In India Below

Tax Benefit On Donations To Charity In India

Tax Benefit On Donations To Charity In India - Tax Benefit On Donations To Charity In India, How To Donate Money To Charity In India, Is Charity Taxable In India

Introduced and implemented in 1961 Section 80G of the Income Tax Act enables taxpayers to claim up to 50 to 100 of their charitable donations as tax deductions This act encourages donors to invest more in change and take steps towards a positive social impact with their small acts of generosity

Section 80GGA of the Income Tax Act 1961 provides a significant tax benefit for taxpayers in India It allows for a 100 deduction on donations made towards specific scientific research and rural development initiatives

Printables for free cover a broad variety of printable, downloadable items that are available online at no cost. These printables come in different forms, like worksheets coloring pages, templates and more. The appeal of printables for free is in their versatility and accessibility.

More of Tax Benefit On Donations To Charity In India

Charity Donation Flyer Free PSD PsdDaddy

Charity Donation Flyer Free PSD PsdDaddy

Contributions to charity can be an excellent way to contribute to society and also decrease your tax liability in India Here s an overview of the pertinent sections of the Income Tax Act Section

In India Section 80G of the Income Tax Act allows you to claim deductions on your income tax returns for donations made to charity This article will explore this 80G deduction tax benefits and how they can be availed

Tax Benefit On Donations To Charity In India have risen to immense popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or expensive software.

-

Flexible: They can make printed materials to meet your requirements for invitations, whether that's creating them making your schedule, or decorating your home.

-

Educational value: The free educational worksheets cater to learners of all ages. This makes them a great tool for teachers and parents.

-

Convenience: Access to a plethora of designs and templates will save you time and effort.

Where to Find more Tax Benefit On Donations To Charity In India

Avail Tax benefit On Personal Loan MY Wicked Armor

Avail Tax benefit On Personal Loan MY Wicked Armor

Donations made to help people tide over the covid 19 pandemic can help you save income tax as well Here is a look at how Section 80G of the Income tax Act can help you save tax under the old tax regime

Section 80G of the I T Act allows donations made to specified relief funds and charitable institutions as a deduction from gross total income before arriving at taxable income

We've now piqued your interest in Tax Benefit On Donations To Charity In India Let's take a look at where they are hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of printables that are free for a variety of uses.

- Explore categories such as decorating your home, education, the arts, and more.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets or flashcards as well as learning materials.

- It is ideal for teachers, parents and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for free.

- These blogs cover a wide range of topics, all the way from DIY projects to planning a party.

Maximizing Tax Benefit On Donations To Charity In India

Here are some creative ways for you to get the best of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Use printable worksheets for free for teaching at-home either in the schoolroom or at home.

3. Event Planning

- Design invitations and banners and decorations for special occasions like weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Tax Benefit On Donations To Charity In India are an abundance of creative and practical resources that satisfy a wide range of requirements and interest. Their access and versatility makes them a great addition to your professional and personal life. Explore the world of Tax Benefit On Donations To Charity In India today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Tax Benefit On Donations To Charity In India truly free?

- Yes they are! You can download and print these tools for free.

-

Can I use free printables in commercial projects?

- It is contingent on the specific rules of usage. Be sure to read the rules of the creator before using any printables on commercial projects.

-

Are there any copyright issues in Tax Benefit On Donations To Charity In India?

- Some printables could have limitations on use. Check the terms of service and conditions provided by the author.

-

How can I print printables for free?

- Print them at home using an printer, or go to a local print shop to purchase top quality prints.

-

What program do I require to open printables that are free?

- The majority of printables are in the format PDF. This is open with no cost programs like Adobe Reader.

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

Charitable Deductions For 2020

Check more sample of Tax Benefit On Donations To Charity In India below

Benefits Of Donating Money To Charity Biglifez

How Much Do You Need To Donate For Tax Deduction

How To Claim Tax Benefits On Home Loan Bleu Finance

New Life Trust Registered Charity In India

How To Avail Tax Benefits On Personal Loan Tata Capital Blog

Donation Flyer Template

https://tax2win.in/guide/80g-deduction-donations...

Section 80GGA of the Income Tax Act 1961 provides a significant tax benefit for taxpayers in India It allows for a 100 deduction on donations made towards specific scientific research and rural development initiatives

https://cleartax.in/s/charitable-trusts-ngo-income-tax-benefits

Section 80G of Indian Income Tax Act allows tax deductions for donations made to charitable trusts or NGOs Charitable institutions play a crucial role in social welfare and economic development receiving exemptions under certain conditions

Section 80GGA of the Income Tax Act 1961 provides a significant tax benefit for taxpayers in India It allows for a 100 deduction on donations made towards specific scientific research and rural development initiatives

Section 80G of Indian Income Tax Act allows tax deductions for donations made to charitable trusts or NGOs Charitable institutions play a crucial role in social welfare and economic development receiving exemptions under certain conditions

New Life Trust Registered Charity In India

How Much Do You Need To Donate For Tax Deduction

How To Avail Tax Benefits On Personal Loan Tata Capital Blog

Donation Flyer Template

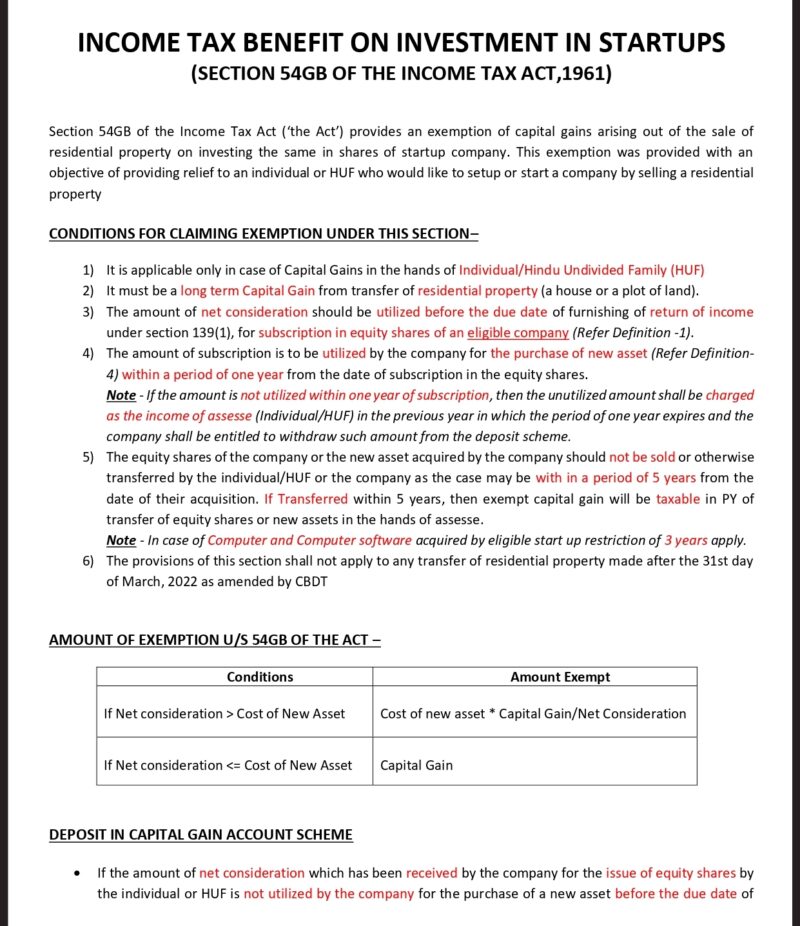

TAX BENEFIT ON INVESTMENT IN STARTUPS U S 54GB CA Rajput

Tax Benefit On Electric Vehicles Inside Narrative

Tax Benefit On Electric Vehicles Inside Narrative

Know Everything About The Tax Benefits Of ULIPs