In the digital age, where screens dominate our lives but the value of tangible printed material hasn't diminished. Be it for educational use as well as creative projects or simply to add an element of personalization to your home, printables for free have proven to be a valuable source. This article will dive to the depths of "Tax Credit For Work From Home," exploring the benefits of them, where to find them and ways they can help you improve many aspects of your life.

Get Latest Tax Credit For Work From Home Below

Tax Credit For Work From Home

Tax Credit For Work From Home - Tax Credit For Work From Home, Tax Deductions For Work From Home, Tax Deductions For Work From Home Employees, Tax Deduction For Work From Home Expenses, Tax Relief For Work From Home, Tax Relief Work From Home 2022, Tax Rebate Work From Home 2022, Tax Relief Work From Home Ireland, Tax Rebate Work From Home Covid, Work From Home Tax Deduction

Tax deductions for expenses needed to work from home are only available to taxpayers who itemize their deductions Also work from home expenses can only be written off if they exceed 2 of adjustable gross income

If you pay the 20 basic rate of tax and claim tax relief on 6 a week you would get 1 20 per week in tax relief 20 of 6 You ll usually get tax relief through a change to your tax

Printables for free cover a broad assortment of printable, downloadable resources available online for download at no cost. They are available in numerous designs, including worksheets templates, coloring pages and more. One of the advantages of Tax Credit For Work From Home lies in their versatility as well as accessibility.

More of Tax Credit For Work From Home

Mercy Microblog Diaporama

Mercy Microblog Diaporama

What are work from home tax deductions or write offs We want you to get every deduction you deserve so you ll have more cash in your pocket to get out of debt save for an emergency fund and win with money So let s dig into the deets on work from home deductions Can I claim the home office tax deduction if I ve been working

Instead of paying 20 of 50 000 which would be 10 000 the freelancer would pay 20 of 40 000 which equals 8 000 So those 10 000 in WFH expenses reduce the total tax bill by 2 000 in

Tax Credit For Work From Home have gained a lot of popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

customization The Customization feature lets you tailor printables to your specific needs whether you're designing invitations and schedules, or even decorating your home.

-

Educational Worth: Free educational printables provide for students of all ages, which makes them a vital aid for parents as well as educators.

-

Simple: immediate access a plethora of designs and templates reduces time and effort.

Where to Find more Tax Credit For Work From Home

The Federal Tax Credit For Electric Cars Is Set To Expire OsVehicle

The Federal Tax Credit For Electric Cars Is Set To Expire OsVehicle

The home office deduction may be one of the biggest work from home expenses a self employed person can take since you can take a deduction that is a portion of your home mortgage interest or rent property taxes homeowners insurance utilities and depreciation based on the square footage of space used directly and exclusively for

To claim for tax relief for working from home employees can apply directly via GOV UK for free Once their application has been approved the online portal will adjust their tax code for

After we've peaked your curiosity about Tax Credit For Work From Home Let's look into where you can get these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of Tax Credit For Work From Home designed for a variety uses.

- Explore categories such as furniture, education, organizing, and crafts.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing as well as flashcards and other learning tools.

- This is a great resource for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates at no cost.

- The blogs covered cover a wide spectrum of interests, ranging from DIY projects to planning a party.

Maximizing Tax Credit For Work From Home

Here are some ways to make the most use of printables that are free:

1. Home Decor

- Print and frame gorgeous art, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Utilize free printable worksheets to help reinforce your learning at home or in the classroom.

3. Event Planning

- Design invitations and banners and other decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized by using printable calendars as well as to-do lists and meal planners.

Conclusion

Tax Credit For Work From Home are an abundance of practical and imaginative resources which cater to a wide range of needs and preferences. Their availability and versatility make them an essential part of both personal and professional life. Explore the vast collection of Tax Credit For Work From Home now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really gratis?

- Yes they are! You can download and print the resources for free.

-

Can I utilize free printables for commercial use?

- It's contingent upon the specific rules of usage. Always review the terms of use for the creator before using their printables for commercial projects.

-

Do you have any copyright rights issues with Tax Credit For Work From Home?

- Certain printables might have limitations on usage. You should read the terms of service and conditions provided by the creator.

-

How can I print Tax Credit For Work From Home?

- You can print them at home using printing equipment or visit a print shop in your area for better quality prints.

-

What software do I require to open printables free of charge?

- Most printables come with PDF formats, which can be opened with free programs like Adobe Reader.

10 Words For Someone Who Takes Credit For Your Work

Millions Of Benefit Claimants Could Be Entitled To 1 500 If Court

Check more sample of Tax Credit For Work From Home below

Credit For Work Experience Vancouver School Of Arts And Academics

Who Qualifies For Ertc 2020

WOTC Archives MP

Dothan Industrial Park Receives Million Dollar Grant

Brad Holmes Earns Big Credit For Work Building 2022 Lions Heavy

View 27 Work From Home Memes Funny Basetrenddashjibril

https://www.gov.uk/tax-relief-for-employees/working-at-home

If you pay the 20 basic rate of tax and claim tax relief on 6 a week you would get 1 20 per week in tax relief 20 of 6 You ll usually get tax relief through a change to your tax

https://www.vero.fi/en/individuals/tax-cards-and...

The maximum credit for household expenses that you can claim is 3 500 per person The credit threshold per person is 100 which you have to pay yourself Credit is only granted for the part of the total expense that was paid for work You can claim credit for 60 of the amount that you have paid a company for their work

If you pay the 20 basic rate of tax and claim tax relief on 6 a week you would get 1 20 per week in tax relief 20 of 6 You ll usually get tax relief through a change to your tax

The maximum credit for household expenses that you can claim is 3 500 per person The credit threshold per person is 100 which you have to pay yourself Credit is only granted for the part of the total expense that was paid for work You can claim credit for 60 of the amount that you have paid a company for their work

Dothan Industrial Park Receives Million Dollar Grant

Who Qualifies For Ertc 2020

Brad Holmes Earns Big Credit For Work Building 2022 Lions Heavy

View 27 Work From Home Memes Funny Basetrenddashjibril

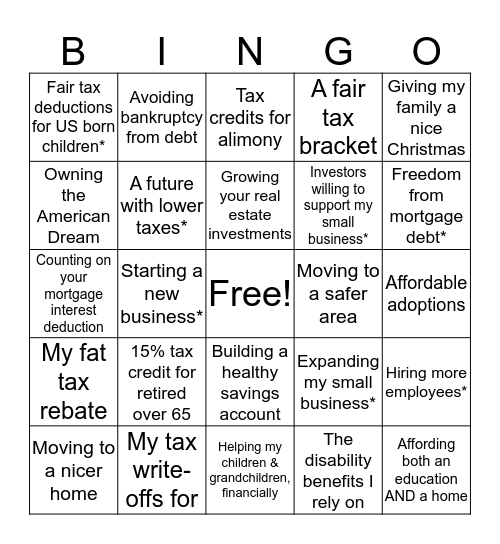

GOP Cash Slash Bingo Card

How To Take Credit For Your Work

How To Take Credit For Your Work

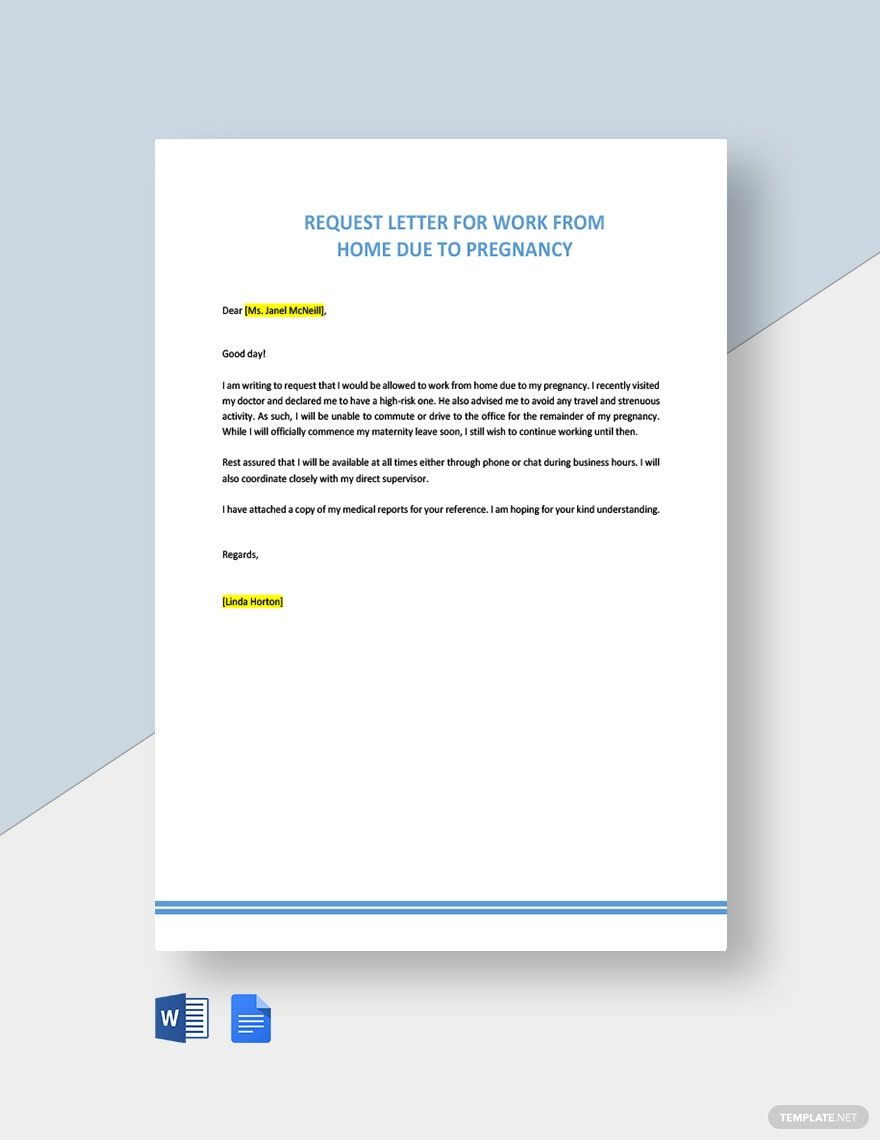

Free Request Letter For Work From Home Due To Pregnancy Google Docs